TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Current liabilities increased to $225.5 million as of December 31, <strong>2014</strong> as compared to $154.9 million<br />

as of December 31, 2013. The increase was due primarily to higher accounts payable resulting<br />

from higher purchases to meet our production requirements. In addition, during the second quarter<br />

of <strong>2014</strong>, the assets and liabilities of certain under-funded Timken pension and postretirement plans<br />

related to our employees and retirees were transferred to pension and postretirement plans sponsored<br />

by us, which are recorded as both current and long-term liabilities. Long-term debt increased due<br />

to our borrowings of $155.0 million under our credit facility to fund capital expenditures, to pay a<br />

$50.0 million dividend to Timken in connection with the spinoff, to repurchase shares at a cost<br />

of $30.6 million, to purchase shares withheld for taxes 4.1 million, to fund cash dividends of<br />

$12.7 million paid to shareholders and to fund our operations. The decrease in our deferred income<br />

taxes related primarily to the increase of pension and postretirement liabilities. Refer to the Consolidated<br />

Statements of Changes in Equity for details of the decrease in total equity.<br />

LIQUIDITY AND CAPITAL RESOURCES<br />

Based on historical performance and current expectations, we believe our cash and cash equivalents,<br />

the cash generated from our operations, available credit facilities and our ability to access capital<br />

markets will satisfy our working capital needs, capital expenditures, quarterly dividends, share<br />

repurchases and other liquidity requirements associated with our operations for at least the next<br />

twelve months.<br />

CASH FLOWS<br />

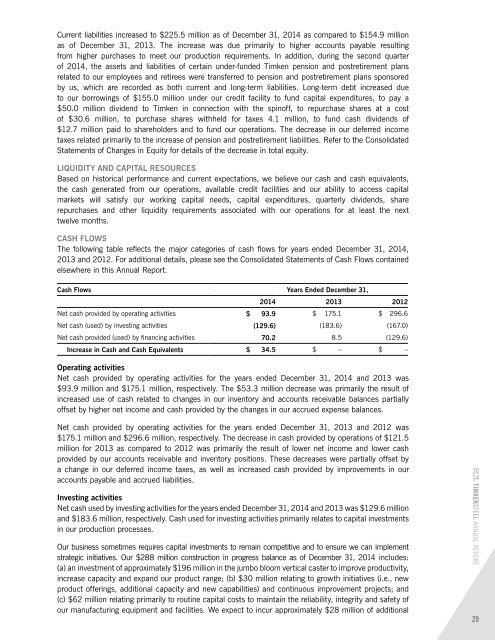

The following table reflects the major categories of cash flows for years ended December 31, <strong>2014</strong>,<br />

2013 and 2012. For additional details, please see the Consolidated Statements of Cash Flows contained<br />

elsewhere in this <strong>Annual</strong> <strong>Report</strong>.<br />

Cash Flows Years Ended December 31,<br />

<strong>2014</strong> 2013 2012<br />

Net cash provided by operating activities $ 93.9 $ 175.1 $ 296.6<br />

Net cash (used) by investing activities (129.6) (183.6) (167.0)<br />

Net cash provided (used) by financing activities 70.2 8.5 (129.6)<br />

Increase in Cash and Cash Equivalents $ 34.5 $ – $ –<br />

Operating activities<br />

Net cash provided by operating activities for the years ended December 31, <strong>2014</strong> and 2013 was<br />

$93.9 million and $175.1 million, respectively. The $53.3 million decrease was primarily the result of<br />

increased use of cash related to changes in our inventory and accounts receivable balances partially<br />

offset by higher net income and cash provided by the changes in our accrued expense balances.<br />

Net cash provided by operating activities for the years ended December 31, 2013 and 2012 was<br />

$175.1 million and $296.6 million, respectively. The decrease in cash provided by operations of $121.5<br />

million for 2013 as compared to 2012 was primarily the result of lower net income and lower cash<br />

provided by our accounts receivable and inventory positions. These decreases were partially offset by<br />

a change in our deferred income taxes, as well as increased cash provided by improvements in our<br />

accounts payable and accrued liabilities.<br />

Investing activities<br />

Net cash used by investing activities for the years ended December 31, <strong>2014</strong> and 2013 was $129.6 million<br />

and $183.6 million, respectively. Cash used for investing activities primarily relates to capital investments<br />

in our production processes.<br />

Our business sometimes requires capital investments to remain competitive and to ensure we can implement<br />

strategic initiatives. Our $288 million construction in progress balance as of December 31, <strong>2014</strong> includes:<br />

(a) an investment of approximately $196 million in the jumbo bloom vertical caster to improve productivity,<br />

increase capacity and expand our product range; (b) $30 million relating to growth initiatives (i.e., new<br />

product offerings, additional capacity and new capabilities) and continuous improvement projects; and<br />

(c) $62 million relating primarily to routine capital costs to maintain the reliability, integrity and safety of<br />

our manufacturing equipment and facilities. We expect to incur approximately $28 million of additional<br />

20<br />

14<br />

TIMKENSTEEL ANNUAL REPORT<br />

29