TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

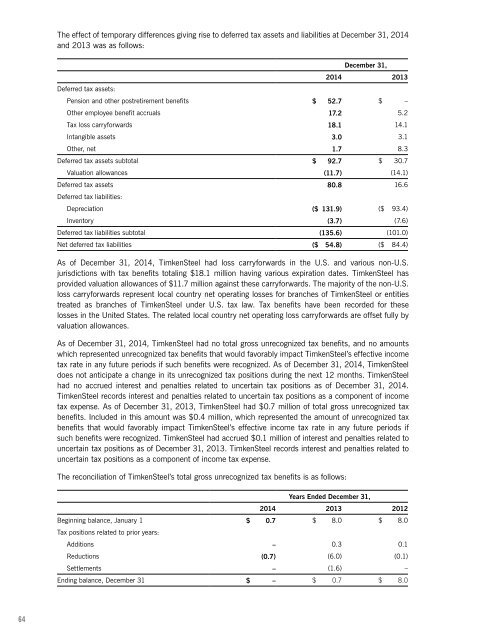

The effect of temporary differences giving rise to deferred tax assets and liabilities at December 31, <strong>2014</strong><br />

and 2013 was as follows:<br />

December 31,<br />

<strong>2014</strong> 2013<br />

Deferred tax assets:<br />

Pension and other postretirement benefits $ 52.7 $ –<br />

Other employee benefit accruals 17.2 5.2<br />

Tax loss carryforwards 18.1 14.1<br />

Intangible assets 3.0 3.1<br />

Other, net 1.7 8.3<br />

Deferred tax assets subtotal $ 92.7 $ 30.7<br />

Valuation allowances (11.7) (14.1)<br />

Deferred tax assets 80.8 16.6<br />

Deferred tax liabilities:<br />

Depreciation ($ 131.9) ($ 93.4)<br />

Inventory (3.7) (7.6)<br />

Deferred tax liabilities subtotal (135.6) (101.0)<br />

Net deferred tax liabilities ($ 54.8) ($ 84.4)<br />

As of December 31, <strong>2014</strong>, <strong>TimkenSteel</strong> had loss carryforwards in the U.S. and various non-U.S.<br />

jurisdictions with tax benefits totaling $18.1 million having various expiration dates. <strong>TimkenSteel</strong> has<br />

provided valuation allowances of $11.7 million against these carryforwards. The majority of the non-U.S.<br />

loss carryforwards represent local country net operating losses for branches of <strong>TimkenSteel</strong> or entities<br />

treated as branches of <strong>TimkenSteel</strong> under U.S. tax law. Tax benefits have been recorded for these<br />

losses in the United States. The related local country net operating loss carryforwards are offset fully by<br />

valuation allowances.<br />

As of December 31, <strong>2014</strong>, <strong>TimkenSteel</strong> had no total gross unrecognized tax benefits, and no amounts<br />

which represented unrecognized tax benefits that would favorably impact <strong>TimkenSteel</strong>’s effective income<br />

tax rate in any future periods if such benefits were recognized. As of December 31, <strong>2014</strong>, <strong>TimkenSteel</strong><br />

does not anticipate a change in its unrecognized tax positions during the next 12 months. <strong>TimkenSteel</strong><br />

had no accrued interest and penalties related to uncertain tax positions as of December 31, <strong>2014</strong>.<br />

<strong>TimkenSteel</strong> records interest and penalties related to uncertain tax positions as a component of income<br />

tax expense. As of December 31, 2013, <strong>TimkenSteel</strong> had $0.7 million of total gross unrecognized tax<br />

benefits. Included in this amount was $0.4 million, which represented the amount of unrecognized tax<br />

benefits that would favorably impact <strong>TimkenSteel</strong>’s effective income tax rate in any future periods if<br />

such benefits were recognized. <strong>TimkenSteel</strong> had accrued $0.1 million of interest and penalties related to<br />

uncertain tax positions as of December 31, 2013. <strong>TimkenSteel</strong> records interest and penalties related to<br />

uncertain tax positions as a component of income tax expense.<br />

The reconciliation of <strong>TimkenSteel</strong>’s total gross unrecognized tax benefits is as follows:<br />

Years Ended December 31,<br />

<strong>2014</strong> 2013 2012<br />

Beginning balance, January 1 $ 0.7 $ 8.0 $ 8.0<br />

Tax positions related to prior years:<br />

Additions – 0.3 0.1<br />

Reductions (0.7) (6.0) (0.1)<br />

Settlements – (1.6) –<br />

Ending balance, December 31 $ – $ 0.7 $ 8.0<br />

64