TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

TimkenSteel-2014-Annual-Report-FINAL-03112015_v001_d4t4ig

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

SUPPLEMENTAL DATA<br />

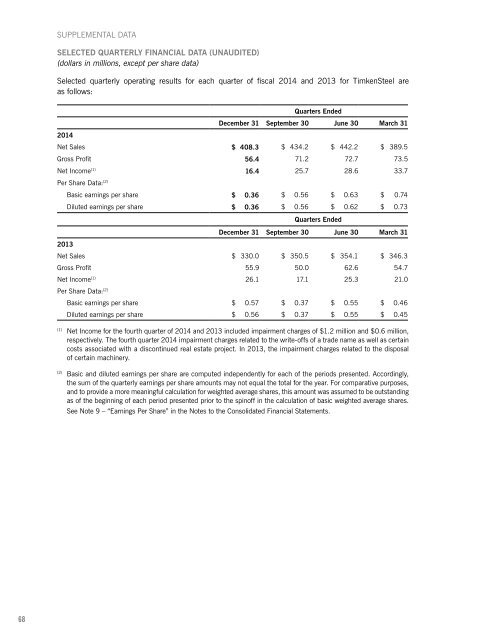

SELECTED QUARTERLY FINANCIAL DATA (UNAUDITED)<br />

(dollars in millions, except per share data)<br />

Selected quarterly operating results for each quarter of fiscal <strong>2014</strong> and 2013 for <strong>TimkenSteel</strong> are<br />

as follows:<br />

Quarters Ended<br />

December 31 September 30 June 30 March 31<br />

<strong>2014</strong><br />

Net Sales $ 408.3 $ 434.2 $ 442.2 $ 389.5<br />

Gross Profit 56.4 71.2 72.7 73.5<br />

Net Income (1) 16.4 25.7 28.6 33.7<br />

Per Share Data: (2)<br />

Basic earnings per share $ 0.36 $ 0.56 $ 0.63 $ 0.74<br />

Diluted earnings per share $ 0.36 $ 0.56 $ 0.62 $ 0.73<br />

Quarters Ended<br />

December 31 September 30 June 30 March 31<br />

2013<br />

Net Sales $ 330.0 $ 350.5 $ 354.1 $ 346.3<br />

Gross Profit 55.9 50.0 62.6 54.7<br />

Net Income (1) 26.1 17.1 25.3 21.0<br />

Per Share Data: (2)<br />

Basic earnings per share $ 0.57 $ 0.37 $ 0.55 $ 0.46<br />

Diluted earnings per share $ 0.56 $ 0.37 $ 0.55 $ 0.45<br />

(1)<br />

Net Income for the fourth quarter of <strong>2014</strong> and 2013 included impairment charges of $1.2 million and $0.6 million,<br />

respectively. The fourth quarter <strong>2014</strong> impairment charges related to the write-offs of a trade name as well as certain<br />

costs associated with a discontinued real estate project. In 2013, the impairment charges related to the disposal<br />

of certain machinery.<br />

(2)<br />

Basic and diluted earnings per share are computed independently for each of the periods presented. Accordingly,<br />

the sum of the quarterly earnings per share amounts may not equal the total for the year. For comparative purposes,<br />

and to provide a more meaningful calculation for weighted average shares, this amount was assumed to be outstanding<br />

as of the beginning of each period presented prior to the spinoff in the calculation of basic weighted average shares.<br />

See Note 9 – “Earnings Per Share” in the Notes to the Consolidated Financial Statements.<br />

68