Revving up! Ashok Leyland - Motilal Oswal

Revving up! Ashok Leyland - Motilal Oswal

Revving up! Ashok Leyland - Motilal Oswal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Ashok</strong> <strong>Leyland</strong><br />

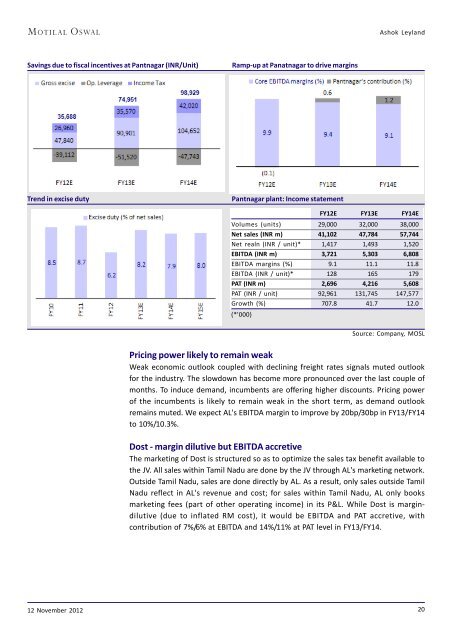

Savings due to fiscal incentives at Pantnagar (INR/Unit)<br />

Ramp-<strong>up</strong> at Panatnagar to drive margins<br />

Trend in excise duty<br />

Pantnagar plant: Income statement<br />

FY12E FY13E FY14E<br />

Volumes (units) 29,000 32,000 38,000<br />

Net sales (INR m) 41,102 47,784 57,744<br />

Net realn (INR / unit)* 1,417 1,493 1,520<br />

EBITDA (INR m) 3,721 5,303 6,808<br />

EBITDA margins (%) 9.1 11.1 11.8<br />

EBITDA (INR / unit)* 128 165 179<br />

PAT (INR m) 2,696 4,216 5,608<br />

PAT (INR / unit) 92,961 131,745 147,577<br />

Growth (%) 707.8 41.7 12.0<br />

(*'000)<br />

Source: Company, MOSL<br />

Pricing power likely to remain weak<br />

Weak economic outlook co<strong>up</strong>led with declining freight rates signals muted outlook<br />

for the industry. The slowdown has become more pronounced over the last co<strong>up</strong>le of<br />

months. To induce demand, incumbents are offering higher discounts. Pricing power<br />

of the incumbents is likely to remain weak in the short term, as demand outlook<br />

remains muted. We expect AL's EBITDA margin to improve by 20bp/30bp in FY13/FY14<br />

to 10%/10.3%.<br />

Dost - margin dilutive but EBITDA accretive<br />

The marketing of Dost is structured so as to optimize the sales tax benefit available to<br />

the JV. All sales within Tamil Nadu are done by the JV through AL's marketing network.<br />

Outside Tamil Nadu, sales are done directly by AL. As a result, only sales outside Tamil<br />

Nadu reflect in AL's revenue and cost; for sales within Tamil Nadu, AL only books<br />

marketing fees (part of other operating income) in its P&L. While Dost is margindilutive<br />

(due to inflated RM cost), it would be EBITDA and PAT accretive, with<br />

contribution of 7%/6% at EBITDA and 14%/11% at PAT level in FY13/FY14.<br />

12 November 2012<br />

20

![Electronic Contract Note [ECN] â DECLARATION (VOLUNTARY) To ...](https://img.yumpu.com/48604692/1/158x260/electronic-contract-note-ecn-a-declaration-voluntary-to-.jpg?quality=85)