director's report - woolworths holdings limited

director's report - woolworths holdings limited

director's report - woolworths holdings limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

finance<br />

director’s <strong>report</strong><br />

financial framework<br />

From a financial perspective, Woolworths is<br />

managed within a framework that optimises<br />

the use of its financial resources.<br />

Primary buying margins are strictly managed,<br />

underpinning the value proposition of our<br />

quality merchandise. We have embarked on a<br />

programme to simplify our business by<br />

removing non-value adding activities, which will<br />

reduce operating costs and increase flexibility.<br />

In addition, a clear focus on productivity is<br />

aimed at leveraging growth in operating profit<br />

until optimal operating margins are achieved.<br />

On the balance sheet, our major asset is our<br />

debtors book, consisting of the Woolworths<br />

Card, personal loan and Visa card products,<br />

which, apart from the Woolworths Visa card, all<br />

earn interest at the usury rate. Sophisticated<br />

credit vetting and risk management processes<br />

and systems ensure the maintenance of a high<br />

quality book. Investment in inventory is<br />

relatively low due to the high stock velocity of<br />

our business model and tight control by our<br />

merchandise groups.<br />

w oolwor t hs<br />

44<br />

annual <strong>report</strong>

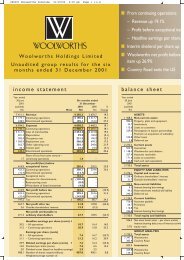

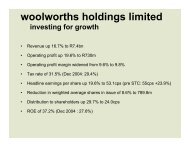

Group turnover from continuing operations rose by 24.2% to R8 421,4m. Woolworths grew sales<br />

22.6% in the 53 weeks to June to R7 302,0m, compared to a 52 week period last year, with the impact<br />

of the additional week adding approximately 2.3%. Sales on a comparable store basis increased 15.5%<br />

against last year. Consumer spending in South Africa was positive throughout the period with Textiles<br />

sales for the 53 weeks increasing by 17.7% against last year (12.2% on a comparable store basis) and<br />

Food sales by 28.7% against last year (18.7% on a comparable store basis).<br />

Total trading area in Woolworths grew 4.2% to 333 692m 2 as a result of 13 new store openings, which<br />

added 8 800m 2 . Eight stores, totalling 7 150m 2 ,were converted to the franchise format, which now<br />

accounts for 65 002m 2 of the total trading space.Textiles footage now totals 266 635 m 2 (62 119 m 2<br />

franchise) and Foods footage 67 057m 2 (2 883m 2 franchise).<br />

Country Road’s revenue from continuing operations grew by 3% in Australian dollar terms to<br />

A$207m, but translated into 36% growth in rand terms, to R1 125m. After the closure of the USA<br />

operations, Country Road now trades from 44 stores with a total footage of 23 560m 2 .<br />

Gross profit margin in Woolworths, increased marginally to 31.4%, but fell from 52% to 50% in<br />

Country Road due to increased promotional activity to counter significant discounting among<br />

competitors and an unusually warm winter.<br />

Interest received increased 20.6% to R355,5m. R341,7m was earned by Woolworths Financial<br />

Services, with the Woolworths Card growing in line with sales and the personal loan offering showing<br />

strong growth. Growth in income was constrained by the usury rate, which, for several months in the<br />

second half, failed to keep pace with increases in the prime lending rate.<br />

Operating expenses were well managed during the year growing 17.5% in Woolworths, as a result of<br />

increased trading activity, whilst Country Road’s costs in their continuing operations were 5.9% lower<br />

in Australian dollar terms as a result of head office rationalisation following the closure of the USA<br />

operations. Costs were 22.6% up in rand terms.A large portion of the operating costs in Woolworths<br />

are variable, particularly in the Foods business, and move in line with the increase in<br />

sales volumes.<br />

w oolwor t hs<br />

45<br />

annual <strong>report</strong>

Operating profit from continuing operations increased by 45.8% to R685,2m, Woolworths<br />

contributing R663,1m and Country Road R22,1m, although the latter benefited from second quarter<br />

A$ profits being translated at an exchange rate significantly weaker than the rate at which first quarter<br />

A$ losses were sustained.<br />

Finance costs increased 8% in Woolworths as a result of strict working capital management during<br />

the year and a higher level of cash resources for a large part of the year as a result of property<br />

disposals in December 2001. In Country Road, borrowing costs increased A$0,8m to A$1,1m due to<br />

higher cash flow requirements experienced in the first half of the year.<br />

Net profit before tax and exceptional items, from continuing operations, increased 47.7% to<br />

R599,2m.The exceptional items relate to a R17,2m impairment of the Claremont store property after<br />

having taken the decision to relocate into Cavendish Square; goodwill amortisation of R12,1m arising<br />

mainly from the acquisition of inthebag from Wooltru; a loss of R4,8m on the disposal of a listed<br />

investment and a provision of R7,4m in respect of an indemnity given by the company.<br />

The effective tax rate, from continuing operations before exceptional items, was down from the<br />

previous year at 32.1% (2001: 33.9%) reflecting the benefit of the assessed loss in Country Road,<br />

enhanced by the translation benefit of the rand’s sharp decline.<br />

Discontinued Operations: Country Road’s exit from the USA market resulted in a write off of net<br />

assets amounting to A$18,9m and other costs and provisions of A$5,0m, which translated to R122,6m<br />

after minority interests.<br />

Capital expenditure amounted to R335,0m offset by proceeds on disposals of R146,7m, R108,0m of<br />

which related to the sale of certain non-strategic properties for which long term leases have been<br />

entered into.<br />

Shares issued under the share purchase scheme raised R41,3m, whilst shares totalling R134,7m,<br />

repurchased by a subsidiary company as treasury stock under the shareholders’ authority granted at<br />

last year’s annual general meeting, were repurchased at an average price of R4,05 per share.<br />

finance direc<br />

w oolwor t hs<br />

46<br />

annual <strong>report</strong>

Total assets increased by 8.9% to R4 063,8m,<br />

mainly attributable to the growth in the<br />

debtors book, whilst net capital expenditure<br />

was largely in line with the depreciation charge.<br />

The R131,6m write-off resulting from the<br />

closure of Country Road’s USA operations was<br />

substantially offset by the R87,4m increase in<br />

the value of the remaining assets of Country<br />

Road on translation.<br />

The debtors book, comprising card and<br />

personal loan products, and including our<br />

funding of the Woolworths Visa Card Joint<br />

Venture with Mercantile Bank grew by<br />

R364,8m and now totals R1 800,5m. Bad debt<br />

levels continued to be well managed during the<br />

year and improved recoveries led to a net bad<br />

debt level of 2.7%.The doubtful debt provision<br />

remains conservatively calculated.<br />

the state in taxes, 2.1% to lenders, 7% to<br />

shareholders, and 22.0% was retained in the<br />

business.<br />

The debt:equity ratio of 15.8%, which was<br />

exaggerated as a result of the 53rd week net<br />

cash outflows, reflects the strong balance sheet<br />

position of the group. Return on equity, based<br />

on attributable earnings from continuing<br />

operations, improved to 17.2% from 13.5% last<br />

year, indicating the effect of the improved<br />

trading result on a leaner balance sheet.<br />

Looking forward our goal is to continually<br />

improve the return on our shareholders’ funds<br />

within the group’s financial framework.<br />

Banking facilities totalling R1 549,3m, are<br />

available to the group which greatly exceeds<br />

our estimated peak funding requirements.<br />

Interest rates and foreign exchange exposures<br />

are managed within strict treasury policy<br />

guidelines. At the end of the year, R150m of<br />

short-term borrowings were hedged until April<br />

2003, and all foreign exchange liabilities were<br />

covered by FEC contracts.<br />

Value of R2 093,8m was added during the year<br />

under review from continuing operations.<br />

59.2% was allocated to employees, 9.7% to<br />

tor’s <strong>report</strong><br />

w oolwor t hs<br />

47<br />

annual <strong>report</strong>