director's report - woolworths holdings limited

director's report - woolworths holdings limited

director's report - woolworths holdings limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

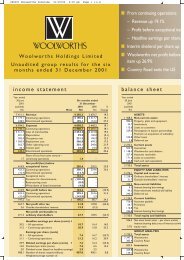

Total assets increased by 8.9% to R4 063,8m,<br />

mainly attributable to the growth in the<br />

debtors book, whilst net capital expenditure<br />

was largely in line with the depreciation charge.<br />

The R131,6m write-off resulting from the<br />

closure of Country Road’s USA operations was<br />

substantially offset by the R87,4m increase in<br />

the value of the remaining assets of Country<br />

Road on translation.<br />

The debtors book, comprising card and<br />

personal loan products, and including our<br />

funding of the Woolworths Visa Card Joint<br />

Venture with Mercantile Bank grew by<br />

R364,8m and now totals R1 800,5m. Bad debt<br />

levels continued to be well managed during the<br />

year and improved recoveries led to a net bad<br />

debt level of 2.7%.The doubtful debt provision<br />

remains conservatively calculated.<br />

the state in taxes, 2.1% to lenders, 7% to<br />

shareholders, and 22.0% was retained in the<br />

business.<br />

The debt:equity ratio of 15.8%, which was<br />

exaggerated as a result of the 53rd week net<br />

cash outflows, reflects the strong balance sheet<br />

position of the group. Return on equity, based<br />

on attributable earnings from continuing<br />

operations, improved to 17.2% from 13.5% last<br />

year, indicating the effect of the improved<br />

trading result on a leaner balance sheet.<br />

Looking forward our goal is to continually<br />

improve the return on our shareholders’ funds<br />

within the group’s financial framework.<br />

Banking facilities totalling R1 549,3m, are<br />

available to the group which greatly exceeds<br />

our estimated peak funding requirements.<br />

Interest rates and foreign exchange exposures<br />

are managed within strict treasury policy<br />

guidelines. At the end of the year, R150m of<br />

short-term borrowings were hedged until April<br />

2003, and all foreign exchange liabilities were<br />

covered by FEC contracts.<br />

Value of R2 093,8m was added during the year<br />

under review from continuing operations.<br />

59.2% was allocated to employees, 9.7% to<br />

tor’s <strong>report</strong><br />

w oolwor t hs<br />

47<br />

annual <strong>report</strong>