director's report - woolworths holdings limited

director's report - woolworths holdings limited

director's report - woolworths holdings limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

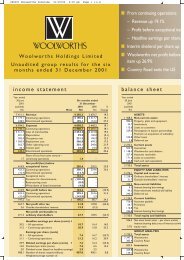

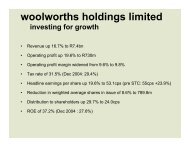

Operating profit from continuing operations increased by 45.8% to R685,2m, Woolworths<br />

contributing R663,1m and Country Road R22,1m, although the latter benefited from second quarter<br />

A$ profits being translated at an exchange rate significantly weaker than the rate at which first quarter<br />

A$ losses were sustained.<br />

Finance costs increased 8% in Woolworths as a result of strict working capital management during<br />

the year and a higher level of cash resources for a large part of the year as a result of property<br />

disposals in December 2001. In Country Road, borrowing costs increased A$0,8m to A$1,1m due to<br />

higher cash flow requirements experienced in the first half of the year.<br />

Net profit before tax and exceptional items, from continuing operations, increased 47.7% to<br />

R599,2m.The exceptional items relate to a R17,2m impairment of the Claremont store property after<br />

having taken the decision to relocate into Cavendish Square; goodwill amortisation of R12,1m arising<br />

mainly from the acquisition of inthebag from Wooltru; a loss of R4,8m on the disposal of a listed<br />

investment and a provision of R7,4m in respect of an indemnity given by the company.<br />

The effective tax rate, from continuing operations before exceptional items, was down from the<br />

previous year at 32.1% (2001: 33.9%) reflecting the benefit of the assessed loss in Country Road,<br />

enhanced by the translation benefit of the rand’s sharp decline.<br />

Discontinued Operations: Country Road’s exit from the USA market resulted in a write off of net<br />

assets amounting to A$18,9m and other costs and provisions of A$5,0m, which translated to R122,6m<br />

after minority interests.<br />

Capital expenditure amounted to R335,0m offset by proceeds on disposals of R146,7m, R108,0m of<br />

which related to the sale of certain non-strategic properties for which long term leases have been<br />

entered into.<br />

Shares issued under the share purchase scheme raised R41,3m, whilst shares totalling R134,7m,<br />

repurchased by a subsidiary company as treasury stock under the shareholders’ authority granted at<br />

last year’s annual general meeting, were repurchased at an average price of R4,05 per share.<br />

finance direc<br />

w oolwor t hs<br />

46<br />

annual <strong>report</strong>