Doing business in Iran - Dayarayan.net

Doing business in Iran - Dayarayan.net

Doing business in Iran - Dayarayan.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DOING BUSINESS IN IRAN<br />

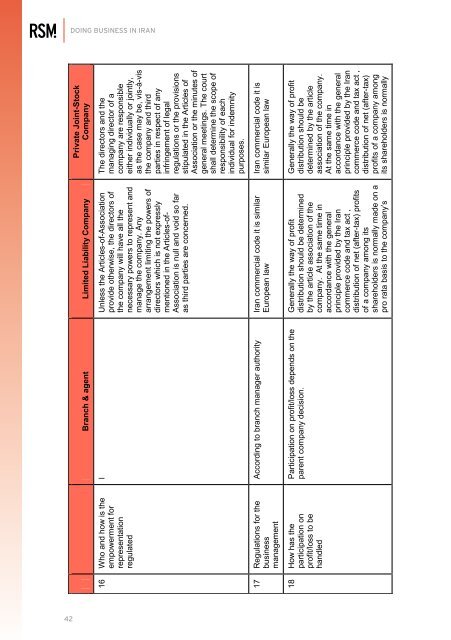

16 Who and how is the<br />

empowerment for<br />

representation<br />

regulated<br />

17 Regulations for the<br />

<strong>bus<strong>in</strong>ess</strong><br />

management<br />

18 How has the<br />

participation on<br />

profit/loss to be<br />

handled<br />

Branch & agent Limited Liability Company<br />

l Unless the Articles-of-Association<br />

provide otherwise, the directors of<br />

the company will have all the<br />

necessary powers to represent and<br />

manage the company. Any<br />

arrangement limit<strong>in</strong>g the powers of<br />

directors which is not expressly<br />

mentioned <strong>in</strong> the Articles-of-<br />

Association is null and void so far<br />

as third parties are concerned.<br />

Accord<strong>in</strong>g to branch manager authority <strong>Iran</strong> commercial code it is similar<br />

European law<br />

Participation on profit/loss depends on the<br />

parent company decision.<br />

Generally the way of profit<br />

distribution should be determ<strong>in</strong>ed<br />

by the article association of the<br />

company. At the same time <strong>in</strong><br />

accordance with the general<br />

pr<strong>in</strong>ciple provided by the <strong>Iran</strong><br />

commerce code and tax act ,<br />

distribution of <strong>net</strong> (after-tax) profits<br />

of a company among its<br />

shareholders is normally made on a<br />

pro rata basis to the company’s<br />

Private Jo<strong>in</strong>t-Stock<br />

Company<br />

The directors and the<br />

manag<strong>in</strong>g director of a<br />

company are responsible<br />

either <strong>in</strong>dividually or jo<strong>in</strong>tly,<br />

as the case may be, vis-à-vis<br />

the company and third<br />

parties <strong>in</strong> respect of any<br />

<strong>in</strong>fr<strong>in</strong>gement of legal<br />

regulations or the provisions<br />

stipulated <strong>in</strong> the Articles of<br />

Association or the m<strong>in</strong>utes of<br />

general meet<strong>in</strong>gs. The court<br />

shall determ<strong>in</strong>e the scope of<br />

responsibility of each<br />

<strong>in</strong>dividual for <strong>in</strong>demnity<br />

purposes.<br />

<strong>Iran</strong> commercial code it is<br />

similar European law<br />

Generally the way of profit<br />

distribution should be<br />

determ<strong>in</strong>ed by the article<br />

association of the company.<br />

At the same time <strong>in</strong><br />

accordance with the general<br />

pr<strong>in</strong>ciple provided by the <strong>Iran</strong><br />

commerce code and tax act ,<br />

distribution of <strong>net</strong> (after-tax)<br />

profits of a company among<br />

its shareholders is normally<br />

42