Doing business in Iran - Dayarayan.net

Doing business in Iran - Dayarayan.net

Doing business in Iran - Dayarayan.net

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DOING BUSINESS IN IRAN<br />

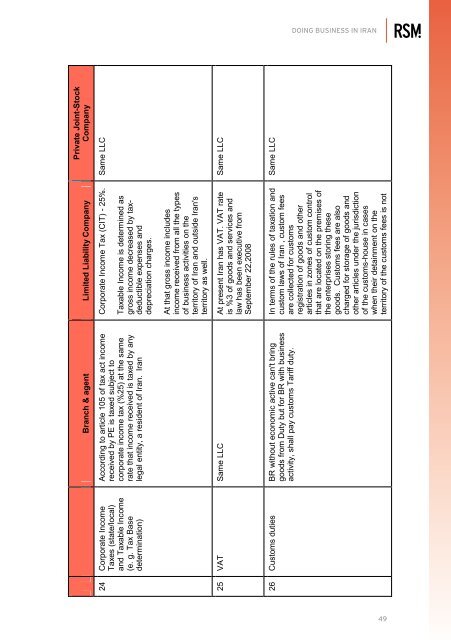

Branch & agent Limited Liability Company<br />

24 Corporate Income<br />

Taxes (state/local)<br />

and Taxable Income<br />

(e. g. Tax Base<br />

determ<strong>in</strong>ation)<br />

Accord<strong>in</strong>g to article 105 of tax act <strong>in</strong>come<br />

received by PE is taxed subject to<br />

corporate <strong>in</strong>come tax (%25) at the same<br />

rate that <strong>in</strong>come received is taxed by any<br />

legal entity, a resident of <strong>Iran</strong>. <strong>Iran</strong><br />

Corporate Income Tax (CIT) - 25%.<br />

Taxable Income is determ<strong>in</strong>ed as<br />

gross <strong>in</strong>come decreased by taxdeductible<br />

expenses and<br />

depreciation charges.<br />

At that gross <strong>in</strong>come <strong>in</strong>cludes<br />

<strong>in</strong>come received from all the types<br />

of <strong>bus<strong>in</strong>ess</strong> activities on the<br />

territory of <strong>Iran</strong> and outside <strong>Iran</strong>'s<br />

territory as well.<br />

25 VAT Same LLC At present <strong>Iran</strong> has VAT. VAT rate<br />

is %3 of goods and services and<br />

law has been executive from<br />

September 22,2008<br />

26 Customs duties BR without economic active can't br<strong>in</strong>g<br />

goods from Duty but for BR with <strong>bus<strong>in</strong>ess</strong><br />

activity, shall pay customs Tariff duty.<br />

In terms of the rules of taxation and<br />

custom laws of <strong>Iran</strong> , custom fees<br />

are collected for customs<br />

registration of goods and other<br />

articles <strong>in</strong> zones of custom control<br />

that are located on the premises of<br />

the enterprises stor<strong>in</strong>g these<br />

goods. Customs fees are also<br />

charged for storage of goods and<br />

other articles under the jurisdiction<br />

of the customs-house <strong>in</strong> cases<br />

when their deta<strong>in</strong>ment on the<br />

territory of the customs fees is not<br />

Private Jo<strong>in</strong>t-Stock<br />

Company<br />

Same LLC<br />

Same LLC<br />

Same LLC<br />

49