2009 Comprehensive Annual Financial Report - Apex Park and ...

2009 Comprehensive Annual Financial Report - Apex Park and ...

2009 Comprehensive Annual Financial Report - Apex Park and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

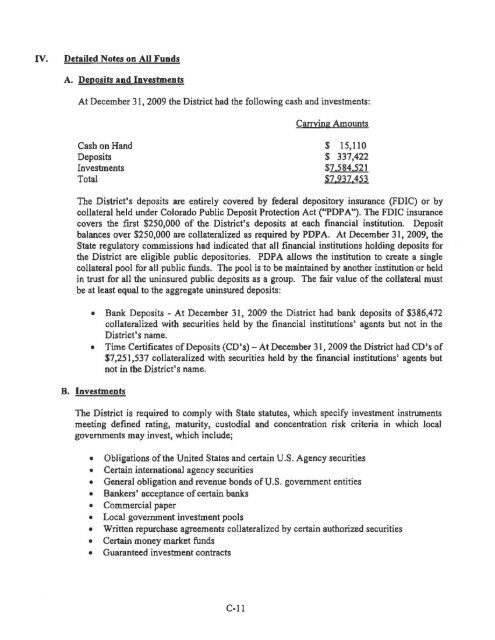

IV.<br />

Detailed Notes on AU Funds<br />

A. Deposits <strong>and</strong> Investments<br />

At December 31, <strong>2009</strong> the District had the following cash <strong>and</strong> investments:<br />

Carrying Amounts<br />

Cash on H<strong>and</strong><br />

Deposits<br />

Investments<br />

Total<br />

$ 15,110<br />

$ 337,422<br />

$7.584.521<br />

$7937.453<br />

The District's deposits are entirely covered by federal depository insurance (FDIC) or by<br />

collateral held under Colorado Public Deposit Protection Act ("PDP A"). The FDIC insurance<br />

covers the first $250,000 of the District's deposits at each fmancial institution. Deposit<br />

balances over $250,000 are collateralized as required by PDPA. At December 31, <strong>2009</strong>, the<br />

State regulatory commissions had indicated that all financial institutions holding deposits for<br />

the District are eligible public depositories. PDP A allows the institution to create a single<br />

collateral pool for all public funds. The pool is to be maintained by another institution or held<br />

in trust for all the uninsured public deposits as a group. The fair value of the collateral must<br />

be at least equal to the aggregate uninsured deposits:<br />

• Bank Deposits - At December 31, <strong>2009</strong> the District had bank deposits of $386,472<br />

collateralized with securities held by the financial institutions' agents but not in the<br />

District's name.<br />

• Time Certificates of Deposits (CD's) - At December 31, <strong>2009</strong> the District had CD's of<br />

$7,251,537 collateralized with securities held by the financial institutions' agents but<br />

not in the District's name.<br />

B. Investments<br />

The District is required to comply with State statutes, which specify investment instruments<br />

meeting defined rating, maturity, custodial <strong>and</strong> concentration risk criteria in which local<br />

governments may invest, which include;<br />

• Obligations of the United States <strong>and</strong> certain U.S. Agency securities<br />

• Certain international agency securities<br />

• General obligation <strong>and</strong> revenue bonds of U.S. government entities<br />

• Bankers' acceptance of certain banks<br />

• Commercial paper<br />

• Local government investment pools<br />

• Written repurchase agreements collateralized by certain authorized securities<br />

• Certain money market funds<br />

• Guaranteed investment contracts<br />

C-ll