2009 Comprehensive Annual Financial Report - Apex Park and ...

2009 Comprehensive Annual Financial Report - Apex Park and ...

2009 Comprehensive Annual Financial Report - Apex Park and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

IV.<br />

Detailed Notes on AU Funds (continued)<br />

The investment policy adopted by the Board of Directors of the District establishes additional<br />

restrictions to the requirements specified by the state statutes.<br />

Interest Rate Risk<br />

In accordance with its investment policy, the District manages its exposure to declines in fair<br />

values by investing operating funds in short-term securities, money market mutual funds, or<br />

similar investment pools <strong>and</strong> limiting the weighted average maturity to one year or less.<br />

Credit Risk<br />

In accordance with its investment policy, the District will minimize credit risk by limiting<br />

investments to only the types of securities defIDed within the Colorado Revised Statutes, prequalifying<br />

the financial institutions, <strong>and</strong> diversifying the investment portfolio by the types of<br />

investment securities. The District's general investment procedure is to apply the prudentperson<br />

rule: Investments are made as a prudent person would be expected to act, with<br />

discretion <strong>and</strong> intelligence, to seek reasonable income, preserve capital, <strong>and</strong> in general, avoid<br />

speculative investments.<br />

Concentration of Credit Risk<br />

Colorado Revised Statutes <strong>and</strong> the District's investment policy do not limit the amount of<br />

investments in anyone issuer. At December 31, <strong>2009</strong> the District's investment in the<br />

Colorado Business Bank Certificates of Deposits was 40%, U.S. Bank certificates of deposit<br />

was 20%, Certificate of Deposit Account Registry Service (CDARS®) was 36% <strong>and</strong><br />

Colorado Local Government Liquid Asset Trust (COLOTRUST) 4% of the District's total<br />

investments.<br />

Local Government Investment Pool<br />

At December 31, <strong>2009</strong>, the District had invested $332,983 in the Colorado Local Government<br />

Liquid Asset Trust (Colo trust), an investment vehicle established for local government entities<br />

in Colorado to pool sUIplus funds. The State Securities Commissioner administers <strong>and</strong> enforces<br />

the requirements of creating <strong>and</strong> operating Colotrust. ColOlrust operates similarly to a money<br />

market fund with each share equal in value to $1.00. Investments of Colotrust are limited to<br />

those allowed by State statutes. A designated custodial bank provides safekeeping <strong>and</strong><br />

depository services in connection with the direct investment <strong>and</strong> withdrawal functions.<br />

Substantially all securities owned are held by the Federal Reserve Bank in the account<br />

maintained for the custodial banks. The custodian's internal records identify the investments<br />

owned by the participating governments.<br />

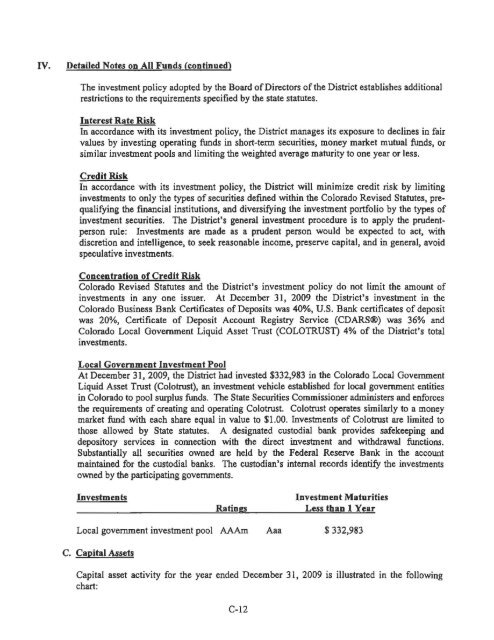

Investments<br />

Ratings<br />

Investment Maturities<br />

Less than 1 Year<br />

Local government investment pool AAAm<br />

C. Capital Assets<br />

Aaa<br />

$ 332,983<br />

Capital asset activity for the year ended December 31, <strong>2009</strong> is illustrated in the following<br />

chart:<br />

C-12