Economic Development Data Analysis and Assessment

Economic Development Data Analysis and Assessment

Economic Development Data Analysis and Assessment

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

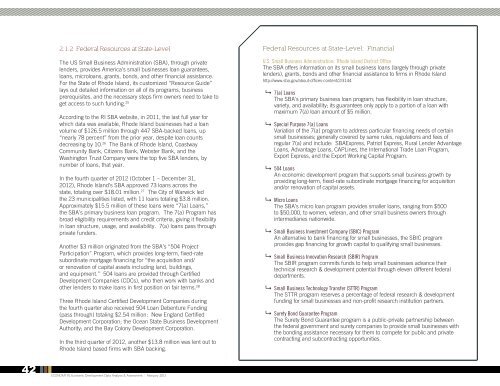

2.1.2 Federal Resources at State-Level<br />

The US Small Business Administration (SBA), through private<br />

lenders, provides America’s small businesses loan guarantees,<br />

loans, microloans, grants, bonds, <strong>and</strong> other financial assistance.<br />

For the State of Rhode Isl<strong>and</strong>, its customized “Resource Guide”<br />

lays out detailed information on all of its programs, business<br />

prerequisites, <strong>and</strong> the necessary steps firm owners need to take to<br />

get access to such funding. 25<br />

According to the RI SBA website, in 2011, the last full year for<br />

which data was available, Rhode Isl<strong>and</strong> businesses had a loan<br />

volume of $126.5 million through 447 SBA-backed loans, up<br />

“nearly 78 percent” from the prior year, despite loan counts<br />

decreasing by 10. 26 The Bank of Rhode Isl<strong>and</strong>, Coastway<br />

Community Bank, Citizens Bank, Webster Bank, <strong>and</strong> the<br />

Washington Trust Company were the top five SBA lenders, by<br />

number of loans, that year.<br />

In the fourth quarter of 2012 (October 1 – December 31,<br />

2012), Rhode Isl<strong>and</strong>’s SBA approved 73 loans across the<br />

state, totaling over $18.01 million. 27 The City of Warwick led<br />

the 23 municipalities listed, with 11 loans totaling $3.8 million.<br />

Approximately $15.5 million of these loans were “7(a) Loans,”<br />

the SBA’s primary business loan program. The 7(a) Program has<br />

broad eligibility requirements <strong>and</strong> credit criteria, giving it flexibility<br />

in loan structure, usage, <strong>and</strong> availability. 7(a) loans pass through<br />

private funders.<br />

Another $3 million originated from the SBA’s “504 Project<br />

Participation” Program, which provides long-term, fixed-rate<br />

subordinate mortgage financing for “the acquisition <strong>and</strong>/<br />

or renovation of capital assets including l<strong>and</strong>, buildings,<br />

<strong>and</strong> equipment.” 504 loans are provided through Certified<br />

<strong>Development</strong> Companies (CDCs), who then work with banks <strong>and</strong><br />

other lenders to make loans in first position on fair terms. 28<br />

Three Rhode Isl<strong>and</strong> Certified <strong>Development</strong> Companies during<br />

the fourth quarter also received 504 Loan Debenture Funding<br />

(pass through) totaling $2.54 million: New Engl<strong>and</strong> Certified<br />

<strong>Development</strong> Corporation; the Ocean State Business <strong>Development</strong><br />

Authority; <strong>and</strong> the Bay Colony <strong>Development</strong> Corporation.<br />

In the third quarter of 2012, another $13.8 million was lent out to<br />

Rhode Isl<strong>and</strong> based firms with SBA backing.<br />

Federal Resources at State-Level: Financial<br />

U.S. Small Business Administration: Rhode Isl<strong>and</strong> District Office<br />

The SBA offers information on its small business loans (largely through private<br />

lenders), grants, bonds <strong>and</strong> other financial assistance to firms in Rhode Isl<strong>and</strong><br />

http://www.sba.gov/about-offices-content/2/3144<br />

:<br />

:<br />

:<br />

:<br />

:<br />

:<br />

:<br />

:<br />

7(a) Loans<br />

The SBA’s primary business loan program; has flexibility in loan structure,<br />

variety, <strong>and</strong> availability; its guarantees only apply to a portion of a loan with<br />

maximum 7(a) loan amount of $5 million.<br />

Special Purpose 7(a) Loans<br />

Variation of the 7(a) program to address particular financing needs of certain<br />

small businesses; generally covered by same rules, regulations <strong>and</strong> fees of<br />

regular 7(a) <strong>and</strong> include: SBAExpress, Patriot Express, Rural Lender Advantage<br />

Loans, Advantage Loans, CAPLines, the International Trade Loan Program,<br />

Export Express, <strong>and</strong> the Export Working Capital Program.<br />

504 Loans<br />

An economic development program that supports small business growth by<br />

providing long-term, fixed-rate subordinate mortgage financing for acquisition<br />

<strong>and</strong>/or renovation of capital assets.<br />

Micro Loans<br />

The SBA’s micro loan program provides smaller loans, ranging from $500<br />

to $50,000, to women, veteran, <strong>and</strong> other small business owners through<br />

intermediaries nationwide.<br />

Small Business Investment Company (SBIC) Program<br />

An alternative to bank financing for small businesses, the SBIC program<br />

provides gap financing for growth capital to qualifying small businesses.<br />

Small Business Innovation Research (SBIR) Program<br />

The SBIR program commits funds to help small businesses advance their<br />

technical research & development potential through eleven different federal<br />

departments.<br />

Small Business Technology Transfer (STTR) Program<br />

The STTR program reserves a percentage of federal research & development<br />

funding for small businesses <strong>and</strong> non-profit research institution partners.<br />

Surety Bond Guarantee Program<br />

The Surety Bond Guarantee program is a public-private partnership between<br />

the federal government <strong>and</strong> surety companies to provide small businesses with<br />

the bonding assistance necessary for them to compete for public <strong>and</strong> private<br />

contracting <strong>and</strong> subcontracting opportunities.<br />

42<br />

ECONOMY RI: <strong>Economic</strong> <strong>Development</strong> <strong>Data</strong> <strong>Analysis</strong> & <strong>Assessment</strong> | February 2013