annual report 2009 - Fiskars Corporation

annual report 2009 - Fiskars Corporation

annual report 2009 - Fiskars Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

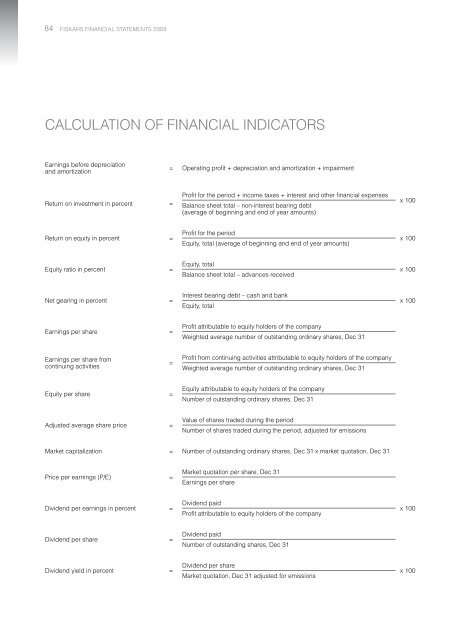

84 FISKARS Financial statements <strong>2009</strong><br />

Calculation of FINANCIAL INDICATORS<br />

Earnings before depreciation<br />

and amortization<br />

= Operating profit + depreciation and amortization + impairment<br />

Return on investment in percent =<br />

Profit for the period + income taxes + interest and other financial expenses<br />

Balance sheet total – non-interest bearing debt<br />

(average of beginning and end of year amounts)<br />

x 100<br />

Return on equity in percent =<br />

Profit for the period<br />

Equity, total (average of beginning and end of year amounts)<br />

x 100<br />

Equity ratio in percent =<br />

Equity, total<br />

Balance sheet total – advances received<br />

x 100<br />

Net gearing in percent =<br />

Interest bearing debt – cash and bank<br />

Equity, total<br />

x 100<br />

Earnings per share =<br />

Profit attributable to equity holders of the company<br />

Weighted average number of outstanding ordinary shares, Dec 31<br />

Earnings per share from<br />

continuing activities<br />

=<br />

Profit from continuing activities attributable to equity holders of the company<br />

Weighted average number of outstanding ordinary shares, Dec 31<br />

Equity per share =<br />

Equity attributable to equity holders of the company<br />

Number of outstanding ordinary shares, Dec 31<br />

Adjusted average share price =<br />

Value of shares traded during the period<br />

Number of shares traded during the period, adjusted for emissions<br />

Market capitalization = Number of outstanding ordinary shares, Dec 31 x market quotation, Dec 31<br />

Price per earnings (P/E) =<br />

Market quotation per share, Dec 31<br />

Earnings per share<br />

Dividend per earnings in percent =<br />

Dividend paid<br />

Profit attributable to equity holders of the company<br />

x 100<br />

Dividend per share =<br />

Dividend paid<br />

Number of outstanding shares, Dec 31<br />

Dividend yield in percent =<br />

Dividend per share<br />

Market quotation, Dec 31 adjusted for emissions<br />

x 100