Annual Report & Accounts 2004 - Harvey Nash

Annual Report & Accounts 2004 - Harvey Nash

Annual Report & Accounts 2004 - Harvey Nash

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

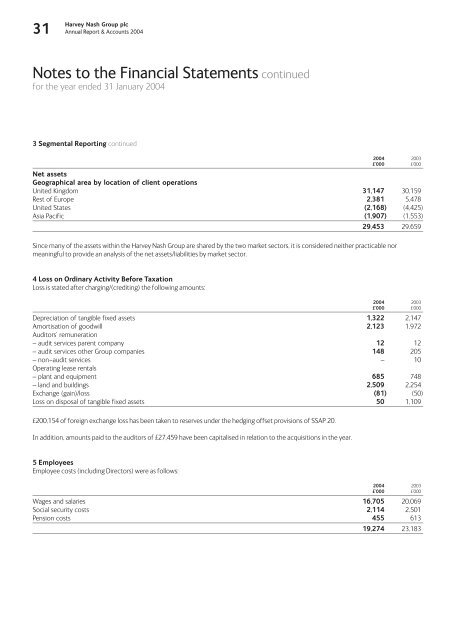

31<br />

<strong>Harvey</strong> <strong>Nash</strong> Group plc<br />

<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2004</strong><br />

Notes to the Financial Statements continued<br />

for the year ended 31 January <strong>2004</strong><br />

3 Segmental <strong>Report</strong>ing continued<br />

<strong>2004</strong> 2003<br />

£’000 £’000<br />

Net assets<br />

Geographical area by location of client operations<br />

United Kingdom 31,147 30,159<br />

Rest of Europe 2,381 5,478<br />

United States (2,168) (4,425)<br />

Asia Pacific (1,907) (1,553)<br />

29,453 29,659<br />

Since many of the assets within the <strong>Harvey</strong> <strong>Nash</strong> Group are shared by the two market sectors, it is considered neither practicable nor<br />

meaningful to provide an analysis of the net assets/liabilities by market sector.<br />

4 Loss on Ordinary Activity Before Taxation<br />

Loss is stated after charging/(crediting) the following amounts:<br />

<strong>2004</strong> 2003<br />

£’000 £’000<br />

Depreciation of tangible fixed assets 1,322 2,147<br />

Amortisation of goodwill 2,123 1,972<br />

Auditors’ remuneration<br />

– audit services parent company 12 12<br />

– audit services other Group companies 148 205<br />

– non-audit services – 10<br />

Operating lease rentals<br />

– plant and equipment 685 748<br />

– land and buildings 2,509 2,254<br />

Exchange (gain)/loss (81) (50)<br />

Loss on disposal of tangible fixed assets 50 1,109<br />

£200,154 of foreign exchange loss has been taken to reserves under the hedging offset provisions of SSAP 20.<br />

In addition, amounts paid to the auditors of £27,459 have been capitalised in relation to the acquisitions in the year.<br />

5 Employees<br />

Employee costs (including Directors) were as follows:<br />

<strong>2004</strong> 2003<br />

£’000 £’000<br />

Wages and salaries 16,705 20,069<br />

Social security costs 2,114 2,501<br />

Pension costs 455 613<br />

19,274 23,183