Annual Report & Accounts 2004 - Harvey Nash

Annual Report & Accounts 2004 - Harvey Nash

Annual Report & Accounts 2004 - Harvey Nash

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

34<br />

<strong>Harvey</strong> <strong>Nash</strong> Group plc<br />

<strong>Annual</strong> <strong>Report</strong> & <strong>Accounts</strong> <strong>2004</strong><br />

Notes to the Financial Statements continued<br />

for the year ended 31 January <strong>2004</strong><br />

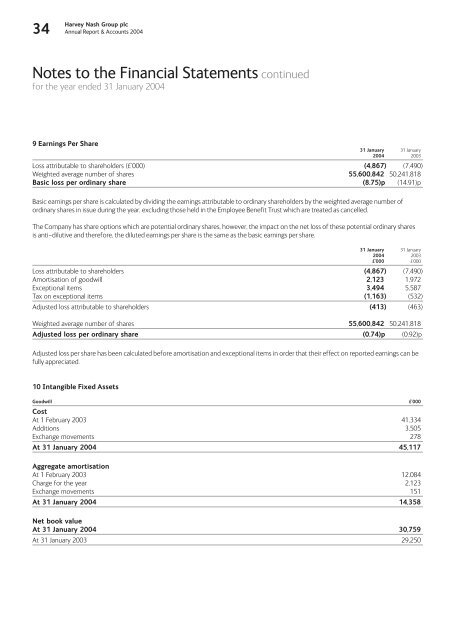

9 Earnings Per Share<br />

31 January 31 January<br />

<strong>2004</strong> 2003<br />

Loss attributable to shareholders (£’000) (4,867) (7,490)<br />

Weighted average number of shares 55,600,842 50,241,818<br />

Basic loss per ordinary share (8.75)p (14.91)p<br />

Basic earnings per share is calculated by dividing the earnings attributable to ordinary shareholders by the weighted average number of<br />

ordinary shares in issue during the year, excluding those held in the Employee Benefit Trust which are treated as cancelled.<br />

The Company has share options which are potential ordinary shares, however, the impact on the net loss of these potential ordinary shares<br />

is anti-dilutive and therefore, the diluted earnings per share is the same as the basic earnings per share.<br />

31 January 31 January<br />

<strong>2004</strong> 2003<br />

£’000 £’000<br />

Loss attributable to shareholders (4,867) (7,490)<br />

Amortisation of goodwill 2,123 1,972<br />

Exceptional items 3,494 5,587<br />

Tax on exceptional items (1,163) (532)<br />

Adjusted loss attributable to shareholders (413) (463)<br />

Weighted average number of shares 55,600,842 50,241,818<br />

Adjusted loss per ordinary share (0.74)p (0.92)p<br />

Adjusted loss per share has been calculated before amortisation and exceptional items in order that their effect on reported earnings can be<br />

fully appreciated.<br />

10 Intangible Fixed Assets<br />

Goodwill £’000<br />

Cost<br />

At 1 February 2003 41,334<br />

Additions 3,505<br />

Exchange movements 278<br />

At 31 January <strong>2004</strong> 45,117<br />

Aggregate amortisation<br />

At 1 February 2003 12,084<br />

Charge for the year 2,123<br />

Exchange movements 151<br />

At 31 January <strong>2004</strong> 14,358<br />

Net book value<br />

At 31 January <strong>2004</strong> 30,759<br />

At 31 January 2003 29,250