PDF, 4MB - Panalpina Annual Report 2012

PDF, 4MB - Panalpina Annual Report 2012

PDF, 4MB - Panalpina Annual Report 2012

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial <strong>Report</strong><br />

Consolidated Financial Statements<br />

121<br />

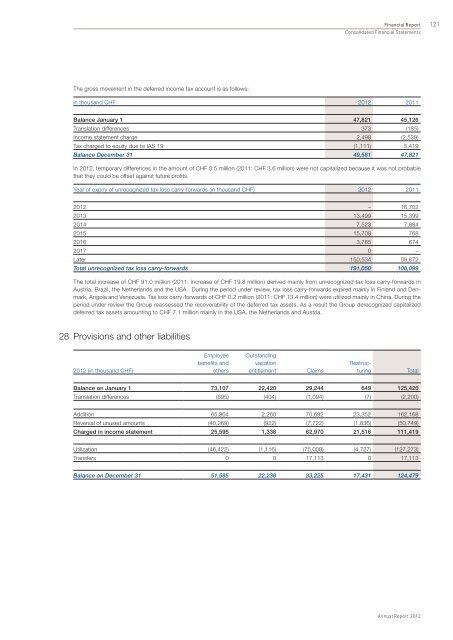

The gross movement in the deferred income tax account is as follows:<br />

in thousand CHF <strong>2012</strong> 2011<br />

Balance January 1 47,821 45,126<br />

Translation differences 373 (185)<br />

Income statement charge 2,498 (2,539)<br />

Tax charged to equity due to IAS 19 (1,111) 5,419<br />

Balance December 31 49,581 47,821<br />

In <strong>2012</strong>, temporary differences in the amount of CHF 0.5 million (2011: CHF 3.6 million) were not capitalized because it was not probable<br />

that they could be offset against future profits.<br />

Year of expiry of unrecognized tax loss carry-forwards (in thousand CHF) <strong>2012</strong> 2011<br />

<strong>2012</strong> – 16,702<br />

2013 13,499 15,399<br />

2014 7,523 7,884<br />

2015 15,709 768<br />

2016 3,785 674<br />

2017 0 –<br />

Later 150,534 58,672<br />

Total unrecognized tax loss carry-forwards 191,050 100,099<br />

The total increase of CHF 91.0 million (2011: increase of CHF 19.8 million) derived mainly from unrecognized tax loss carry-forwards in<br />

Austria, Brazil, the Netherlands and the USA . During the period under review, tax loss carry-forwards expired mainly in Finland and Denmark,<br />

Angola and Venezuela. Tax loss carry-forwards of CHF 0.2 million (2011: CHF 13.4 million) were utilized mainly in China. During the<br />

period under review the Group reassessed the recoverability of the deferred tax assets. As a result the Group derecognized capitalized<br />

deferred tax assets amounting to CHF 7.1 million mainly in the USA, the Netherlands and Austria.<br />

28<br />

Provisions and other liabilities<br />

<strong>2012</strong> (in thousand CHF)<br />

Employee<br />

benefits and<br />

others<br />

Outstanding<br />

vacation<br />

entitlement<br />

Claims<br />

Restructuring<br />

Total<br />

Balance on January 1 73,107 22,420 29,244 649 125,420<br />

Translation differences (695) (404) (1,094) (7) (2,200)<br />

Addition 65,864 2,260 70,692 23,352 162,168<br />

Reversal of unused amounts (40,269) (922) (7,722) (1,836) (50,749)<br />

Charged in income statement 25,595 1,338 62,970 21,516 111,419<br />

Utilization (46,422) (1,116) (75,008) (4,727) (127,273)<br />

Transfers 0 0 17,113 0 17,113<br />

Balance on December 31 51,585 22,238 33,225 17,431 124,479<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong>