2007 - Ceylon Petroleum Corporation

2007 - Ceylon Petroleum Corporation

2007 - Ceylon Petroleum Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

24<br />

Pricing Policy<br />

The Government withdrew subsidies<br />

on domestic petroleum processing on<br />

1st July 2006, following which CPC was<br />

obliged to set domestic fuel prices with the<br />

concurrence of the Ministry of <strong>Petroleum</strong><br />

and <strong>Petroleum</strong> Resources Development.<br />

For political reasons, it is difficult<br />

for CPC, a State-owned entity, to<br />

cover the ever increasing cost of<br />

production and distribution by retail<br />

sales. In cognisance of this, CPC has<br />

maintained stable domestic price levels,<br />

even during the second half of <strong>2007</strong>,<br />

when oil experienced its highest-ever<br />

international price surge (from 29th<br />

July <strong>2007</strong> to 13th January 2008). In thus<br />

taking CPC the brunt of these increases,<br />

shielding consumers from them, the<br />

<strong>Corporation</strong> has been forced to absorb<br />

considerable financial loss.<br />

CPC’s pricing policy is to achieve<br />

break-even profitability while shielding<br />

consumers to the best extent possible.<br />

Liquidity<br />

Working-capital management plays a<br />

vital role in the business of refining and<br />

marketing petroleum products.<br />

CPC’s stock position and receivables<br />

increased by Rs. 26 Bn, financed by<br />

increased supplier’s credit and the<br />

renegotiation of importing loans. CPC<br />

understands that the country cannot<br />

afford to run out of petroleum product<br />

stocks. The <strong>Corporation</strong> recognises<br />

and accepts its basic responsibility to<br />

guarantee the energy security of the<br />

country. However, Government debts<br />

to the <strong>Corporation</strong> have now risen to<br />

a level that seriously threatens CPC’s<br />

liquidity position and thus its ability to<br />

maintain sufficient product stocks to<br />

maintain energy security.<br />

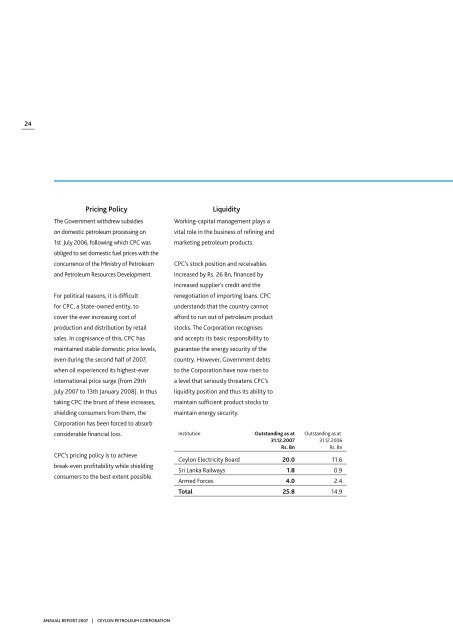

Institution Outstanding as at Outstanding as at<br />

31.12.<strong>2007</strong> 31.12.2006<br />

Rs. Bn<br />

Rs. Bn<br />

<strong>Ceylon</strong> Electricity Board 20.0 11.6<br />

Sri Lanka Railways 1.8 0.9<br />

Armed Forces 4.0 2.4<br />

Total 25.8 14.9<br />

ANNUAL REPORT <strong>2007</strong> | CEYLON PETROLEUM CORPORATION