2007 - Ceylon Petroleum Corporation

2007 - Ceylon Petroleum Corporation

2007 - Ceylon Petroleum Corporation

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

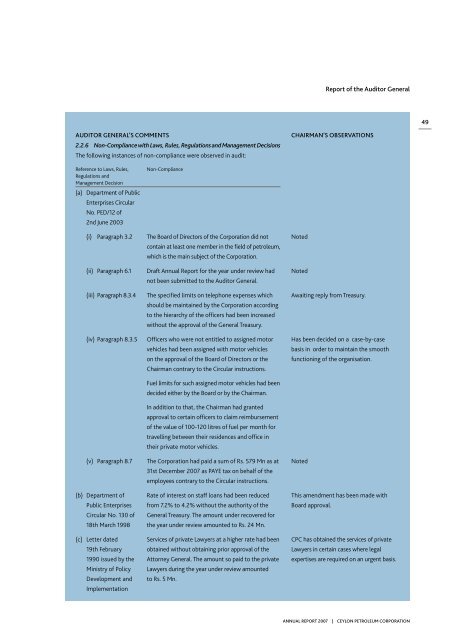

Report of the Auditor General<br />

49<br />

Auditor General’s Comments<br />

2.2.6 Non-Compliance with Laws, Rules, Regulations and Management Decisions<br />

The following instances of non-compliance were observed in audit:<br />

Chairman’s Observations<br />

Reference to Laws, Rules,<br />

Regulations and<br />

Management Decision<br />

(a) Department of Public<br />

Enterprises Circular<br />

No. PED/12 of<br />

2nd June 2003<br />

(i) Paragraph 3.2<br />

(ii) Paragraph 6.1<br />

(iii) Paragraph 8.3.4<br />

(iv) Paragraph 8.3.5<br />

(v) Paragraph 8.7<br />

(b) Department of<br />

Public Enterprises<br />

Circular No. 130 of<br />

18th March 1998<br />

(c) Letter dated<br />

19th February<br />

1990 issued by the<br />

Ministry of Policy<br />

Development and<br />

Implementation<br />

Non-Compliance<br />

The Board of Directors of the <strong>Corporation</strong> did not<br />

contain at least one member in the field of petroleum,<br />

which is the main subject of the <strong>Corporation</strong>.<br />

Draft Annual Report for the year under review had<br />

not been submitted to the Auditor General.<br />

The specified limits on telephone expenses which<br />

should be maintained by the <strong>Corporation</strong> according<br />

to the hierarchy of the officers had been increased<br />

without the approval of the General Treasury.<br />

Officers who were not entitled to assigned motor<br />

vehicles had been assigned with motor vehicles<br />

on the approval of the Board of Directors or the<br />

Chairman contrary to the Circular instructions.<br />

Fuel limits for such assigned motor vehicles had been<br />

decided either by the Board or by the Chairman.<br />

In addition to that, the Chairman had granted<br />

approval to certain officers to claim reimbursement<br />

of the value of 100-120 litres of fuel per month for<br />

travelling between their residences and office in<br />

their private motor vehicles.<br />

The <strong>Corporation</strong> had paid a sum of Rs. 579 Mn as at<br />

31st December <strong>2007</strong> as PAYE tax on behalf of the<br />

employees contrary to the Circular instructions.<br />

Rate of interest on staff loans had been reduced<br />

from 7.2% to 4.2% without the authority of the<br />

General Treasury. The amount under recovered for<br />

the year under review amounted to Rs. 24 Mn.<br />

Services of private Lawyers at a higher rate had been<br />

obtained without obtaining prior approval of the<br />

Attorney General. The amount so paid to the private<br />

Lawyers during the year under review amounted<br />

to Rs. 5 Mn.<br />

Noted<br />

Noted<br />

Awaiting reply from Treasury.<br />

Has been decided on a case-by-case<br />

basis in order to maintain the smooth<br />

functioning of the organisation.<br />

Noted<br />

This amendment has been made with<br />

Board approval.<br />

CPC has obtained the services of private<br />

Lawyers in certain cases where legal<br />

expertises are required on an urgent basis.<br />

ANNUAL REPORT <strong>2007</strong> | CEYLON PETROLEUM CORPORATION