NGA_AR_13-14

NGA_AR_13-14

NGA_AR_13-14

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NATIONAL GALLERY OF AUSTRALIA AND CONTROLLED ENTITIES<br />

NOTES TO AND FORMING P<strong>AR</strong>T OF THE FINANCIAL STATEMENTS<br />

For the year ended 30 June 20<strong>14</strong><br />

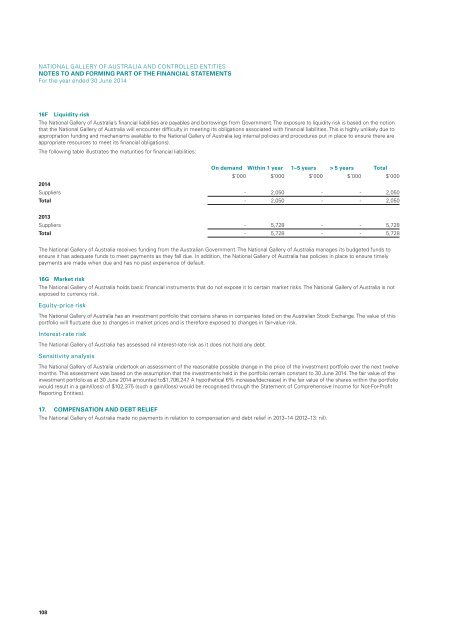

16F Liquidity risk<br />

The National Gallery of Australia’s financial liabilities are payables and borrowings from Government. The exposure to liquidity risk is based on the notion<br />

that the National Gallery of Australia will encounter difficulty in meeting its obligations associated with financial liabilities. This is highly unlikely due to<br />

appropriation funding and mechanisms available to the National Gallery of Australia (eg internal policies and procedures put in place to ensure there are<br />

appropriate resources to meet its financial obligations).<br />

The following table illustrates the maturities for financial liabilities:<br />

On demand Within 1 year 1–5 years > 5 years Total<br />

$’000 $’000 $’000 $’000 $’000<br />

20<strong>14</strong><br />

Suppliers - 2,050 - - 2,050<br />

Total - 2,050 - - 2,050<br />

20<strong>13</strong><br />

Suppliers - 5,728 - - 5,728<br />

Total - 5,728 - - 5,728<br />

The National Gallery of Australia receives funding from the Australian Government. The National Gallery of Australia manages its budgeted funds to<br />

ensure it has adequate funds to meet payments as they fall due. In addition, the National Gallery of Australia has policies in place to ensure timely<br />

payments are made when due and has no past experience of default.<br />

16G Market risk<br />

The National Gallery of Australia holds basic financial instruments that do not expose it to certain market risks. The National Gallery of Australia is not<br />

exposed to currency risk.<br />

Equity-price risk<br />

The National Gallery of Australia has an investment portfolio that contains shares in companies listed on the Australian Stock Exchange. The value of this<br />

portfolio will fluctuate due to changes in market prices and is therefore exposed to changes in fair-value risk.<br />

Interest-rate risk<br />

The National Gallery of Australia has assessed nil interest-rate risk as it does not hold any debt.<br />

Sensitivity analysis<br />

The National Gallery of Australia undertook an assessment of the reasonable possible change in the price of the investment portfolio over the next twelve<br />

months. This assessment was based on the assumption that the investments held in the portfolio remain constant to 30 June 20<strong>14</strong>. The fair value of the<br />

investment portfolio as at 30 June 20<strong>14</strong> amounted to$1,706,247. A hypothetical 6% increase/(decrease) in the fair value of the shares within the portfolio<br />

would result in a gain/(loss) of $102,375 (such a gain/(loss) would be recognised through the Statement of Comprehensive Income for Not-For-Profit<br />

Reporting Entities).<br />

17. COMPENSATION and DEBT RELIEF<br />

The National Gallery of Australia made no payments in relation to compensation and debt relief in 20<strong>13</strong>–<strong>14</strong> (2012–<strong>13</strong>: nil).<br />

108