Key Differences Between LTG Ultra and AIG Select-a-Term - AIG.com

Key Differences Between LTG Ultra and AIG Select-a-Term - AIG.com

Key Differences Between LTG Ultra and AIG Select-a-Term - AIG.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

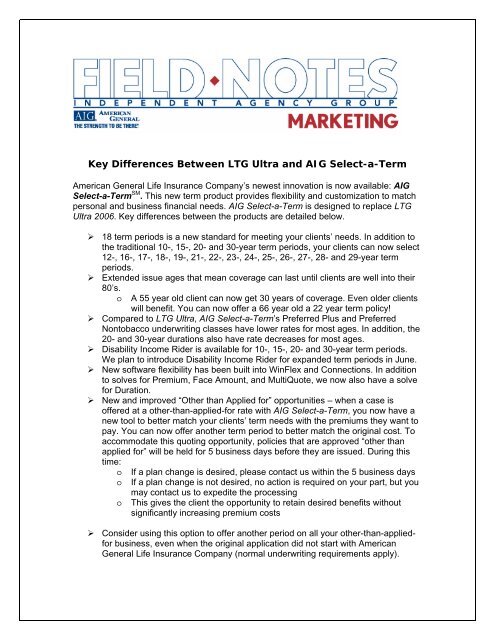

<strong>Key</strong> <strong>Differences</strong> <strong>Between</strong> <strong>LTG</strong> <strong>Ultra</strong> <strong>and</strong> <strong>AIG</strong> <strong>Select</strong>-a-<strong>Term</strong><br />

American General Life Insurance Company’s newest innovation is now available: <strong>AIG</strong><br />

<strong>Select</strong>-a-<strong>Term</strong> SM . This new term product provides flexibility <strong>and</strong> customization to match<br />

personal <strong>and</strong> business financial needs. <strong>AIG</strong> <strong>Select</strong>-a-<strong>Term</strong> is designed to replace <strong>LTG</strong><br />

<strong>Ultra</strong> 2006. <strong>Key</strong> differences between the products are detailed below.<br />

‣ 18 term periods is a new st<strong>and</strong>ard for meeting your clients’ needs. In addition to<br />

the traditional 10-, 15-, 20- <strong>and</strong> 30-year term periods, your clients can now select<br />

12-, 16-, 17-, 18-, 19-, 21-, 22-, 23-, 24-, 25-, 26-, 27-, 28- <strong>and</strong> 29-year term<br />

periods.<br />

‣ Extended issue ages that mean coverage can last until clients are well into their<br />

80’s.<br />

o<br />

A 55 year old client can now get 30 years of coverage. Even older clients<br />

will benefit. You can now offer a 66 year old a 22 year term policy!<br />

‣ Compared to <strong>LTG</strong> <strong>Ultra</strong>, <strong>AIG</strong> <strong>Select</strong>-a-<strong>Term</strong>’s Preferred Plus <strong>and</strong> Preferred<br />

Nontobacco underwriting classes have lower rates for most ages. In addition, the<br />

20- <strong>and</strong> 30-year durations also have rate decreases for most ages.<br />

‣ Disability In<strong>com</strong>e Rider is available for 10-, 15-, 20- <strong>and</strong> 30-year term periods.<br />

We plan to introduce Disability In<strong>com</strong>e Rider for exp<strong>and</strong>ed term periods in June.<br />

‣ New software flexibility has been built into WinFlex <strong>and</strong> Connections. In addition<br />

to solves for Premium, Face Amount, <strong>and</strong> MultiQuote, we now also have a solve<br />

for Duration.<br />

‣ New <strong>and</strong> improved “Other than Applied for” opportunities – when a case is<br />

offered at a other-than-applied-for rate with <strong>AIG</strong> <strong>Select</strong>-a-<strong>Term</strong>, you now have a<br />

new tool to better match your clients’ term needs with the premiums they want to<br />

pay. You can now offer another term period to better match the original cost. To<br />

ac<strong>com</strong>modate this quoting opportunity, policies that are approved “other than<br />

applied for” will be held for 5 business days before they are issued. During this<br />

time:<br />

o<br />

o<br />

o<br />

If a plan change is desired, please contact us within the 5 business days<br />

If a plan change is not desired, no action is required on your part, but you<br />

may contact us to expedite the processing<br />

This gives the client the opportunity to retain desired benefits without<br />

significantly increasing premium costs<br />

‣ Consider using this option to offer another period on all your other-than-appliedfor<br />

business, even when the original application did not start with American<br />

General Life Insurance Company (normal underwriting requirements apply).

Policy issued by:<br />

American General Life Insurance Company<br />

A member <strong>com</strong>pany of American International Group, Inc.<br />

2727-A Allen Parkway, Houston, Texas 77019<br />

<strong>AIG</strong> <strong>Select</strong>-a-<strong>Term</strong> Policy Form Number 07007<br />

Accidental Death Benefit Rider Form Number 79002<br />

Child Rider Form Number 79410<br />

<strong>Term</strong>inal Illness Rider Form Number 91401<br />

Waiver of Premium Rider Form Number 79001<br />

<strong>Select</strong>-a-<strong>Term</strong> Disability In<strong>com</strong>e Rider Form Number 06305<br />

The underwriting risks, financial obligations <strong>and</strong> support functions associated with the products issued by<br />

American General Life Insurance Company (American General Life) are its responsibility. American General<br />

Life is responsible for its own financial condition <strong>and</strong> contractual obligations.<br />

American General Life does not solicit business in the state of New York. Policies <strong>and</strong> riders not available in<br />

all states.<br />

© 2007 American International Group, Inc. All rights reserved.