2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

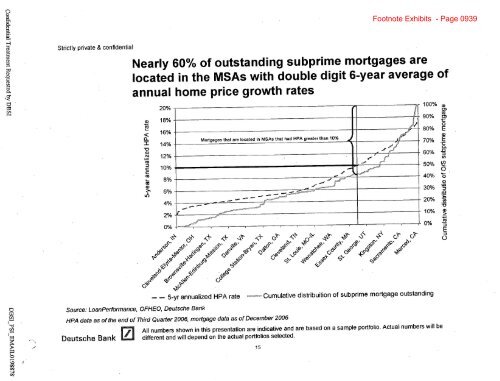

Footnote Exhibits - Page 0939<br />

Strictly private & confidential<br />

Nearly 60% of outstanding subprime mortgages are<br />

located in the MSAs with double digit 6-year average of<br />

annual home price growth rates<br />

20%--<br />

18%--<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%--<br />

4%--<br />

2%-<br />

0%-I<br />

100%<br />

90%<br />

80%<br />

70%<br />

60%<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

0%<br />

- - 5-yr annualized HPA rate - Cumulative distribuition of subprime mortgage outstanding<br />

Source: LoanPerformance, OFHEO, Deutsche Bank<br />

HPA data as of the end of Third Quarter 2006, mortgage data as of December 2006<br />

All numbers shown in this presentation are indicative and are based on a sample portfolio. Actual numbers will be<br />

different and will depend on the actual portfolios selected.<br />

Deutsche Banik<br />

15