2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Footnote Exhibits - Page 0956<br />

Strictly private & confidential<br />

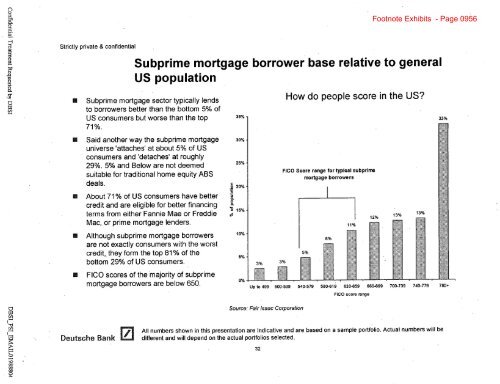

<strong>Subprime</strong> mortgage borrower base relative to general<br />

US population<br />

* <strong>Subprime</strong> mortgage sector typically lends<br />

to borrowers better than the bottom 5% of<br />

US consumers but worse than the top<br />

71%.<br />

* Said another way the subprime mortgage<br />

universe 'attaches' at about 5% of US<br />

consumers and 'detaches' at roughly<br />

29%. 5% and Below are not deemed<br />

suitable for traditional home equity ABS<br />

deals.<br />

" About 71% of US consumers have better<br />

credit and are eligible for better financing<br />

terms from either Fannie Mae or Freddie<br />

Mac, or prime mortgage lenders.<br />

" Although subprime mortgage borrowers<br />

are not exactly consumers with the worst<br />

credit, they form the top 81 % of the<br />

bottom 29% of US consumers.<br />

" FICO scores of the majority of subprime<br />

mortgage borrowers are below 650.<br />

3%3%<br />

Source: Fair Isaac Corporation<br />

How do people score in the US?<br />

FICO Score range for typical subprime<br />

mortgage borrowers<br />

11%<br />

12% 13%<br />

FICO score range<br />

780+<br />

Deutsche Bank<br />

All numbers shown in this presentation are indicative and are based on a sample portfolio. Actual numbers will be<br />

different and will depend on the actual portfolios selected.<br />

32