2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

2007_Subprime_Shorting-Home-Equity-Mezzanine-Tranches-1

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Footnote Exhibits - Page 0960<br />

Strictly private & confidential.<br />

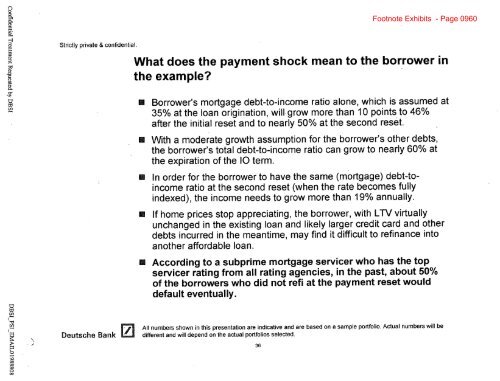

What does the payment shock mean to the borrower in<br />

the example?<br />

U<br />

Borrower's mortgage debt-to-income ratio alone, which is assumed at<br />

35% at the loan origination, will grow more than 10 points to 46%<br />

after the initial reset and to nearly 50% at the second reset.<br />

M With a moderate growth assumption for the borrower's other debts,<br />

the borrower's total debt-to-income ratio can grow to nearly 60% at<br />

the expiration of the 10 term.<br />

E In order for the borrower to have the same (mortgage) debt-toincome<br />

ratio at the second reset (when the rate becomes fully<br />

indexed), the income needs to grow more than 19% annually.<br />

E If home prices stop appreciating, the borrower, with LTV virtually<br />

unchanged in the existing loan and likely larger credit card and other<br />

debts incurred in the meantime, may find it difficult to refinance into<br />

another affordable loan.<br />

M According to a subprime mortgage servicer who has the top<br />

servicer rating from all rating agencies, in the past, about 50%<br />

of the borrowers who did not refi at the payment reset would<br />

default eventually.<br />

Deutsche Bank<br />

All numbers shown in this presentation are indicative and are based on a sample portfolio. Actual numbers will be<br />

different and will depend on the actual portfolios selected.<br />

36<br />

00<br />

00 00<br />

00