URANIUM CORPORATION OF INDIA LIMITED - (UCIL).....

URANIUM CORPORATION OF INDIA LIMITED - (UCIL).....

URANIUM CORPORATION OF INDIA LIMITED - (UCIL).....

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

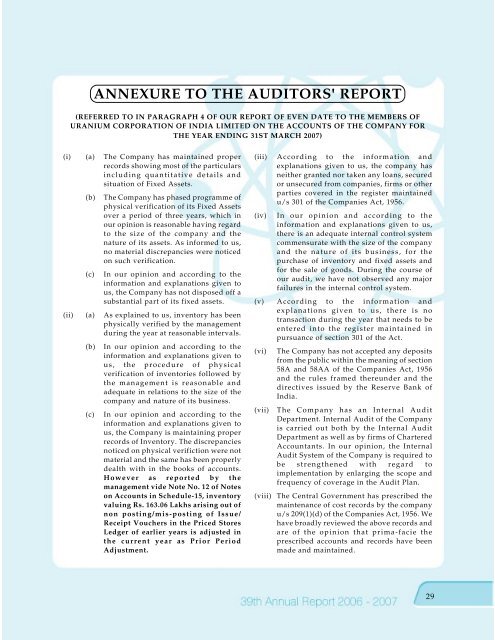

ANNEXURE TO THE AUDITORS' REPORT<br />

(REFERRED TO IN PARAGRAPH 4 <strong>OF</strong> OUR REPORT <strong>OF</strong> EVEN DATE TO THE MEMBERS <strong>OF</strong><br />

<strong>URANIUM</strong> <strong>CORPORATION</strong> <strong>OF</strong> <strong>INDIA</strong> <strong>LIMITED</strong> ON THE ACCOUNTS <strong>OF</strong> THE COMPANY FOR<br />

THE YEAR ENDING 31ST MARCH 2007)<br />

(i) (a) The Company has maintained proper<br />

records showing most of the particulars<br />

including quantitative details and<br />

situation of Fixed Assets.<br />

(b)<br />

(c)<br />

The Company has phased programme of<br />

physical verification of its Fixed Assets<br />

over a period of three years, which in<br />

our opinion is reasonable having regard<br />

to the size of the company and the<br />

nature of its assets. As informed to us,<br />

no material discrepancies were noticed<br />

on such verification.<br />

In our opinion and according to the<br />

information and explanations given to<br />

us, the Company has not disposed off a<br />

substantial part of its fixed assets.<br />

(ii) (a) As explained to us, inventory has been<br />

physically verified by the management<br />

during the year at reasonable intervals.<br />

(b)<br />

(c)<br />

In our opinion and according to the<br />

information and explanations given to<br />

us, the procedure of physical<br />

verification of inventories followed by<br />

the management is reasonable and<br />

adequate in relations to the size of the<br />

company and nature of its business.<br />

In our opinion and according to the<br />

information and explanations given to<br />

us, the Company is maintaining proper<br />

records of Inventory. The discrepancies<br />

noticed on physical verifiction were not<br />

material and the same has been properly<br />

dealth with in the books of accounts.<br />

However as reported by the<br />

management vide Note No. 12 of Notes<br />

on Accounts in Schedule-15, inventory<br />

valuing Rs. 163.06 Lakhs arising out of<br />

non posting/mis-posting of Issue/<br />

Receipt Vouchers in the Priced Stores<br />

Ledger of earlier years is adjusted in<br />

the current year as Prior Period<br />

Adjustment.<br />

(iii) According to the information and<br />

explanations given to us, the company has<br />

neither granted nor taken any loans, secured<br />

or unsecured from companies, firms or other<br />

parties covered in the register maintained<br />

u/s 301 of the Companies Act, 1956.<br />

(iv)<br />

In our opinion and according to the<br />

information and explanations given to us,<br />

there is an adequate internal control system<br />

commensurate with the size of the company<br />

and the nature of its business, for the<br />

purchase of inventory and fixed assets and<br />

for the sale of goods. During the course of<br />

our audit, we have not observed any major<br />

failures in the internal control system.<br />

(v) According to the information and<br />

explanations given to us, there is no<br />

transaction during the year that needs to be<br />

entered into the register maintained in<br />

pursuance of section 301 of the Act.<br />

(vi)<br />

(vii)<br />

(viii)<br />

The Company has not accepted any deposits<br />

from the public within the meaning of section<br />

58A and 58AA of the Companies Act, 1956<br />

and the rules framed thereunder and the<br />

directives issued by the Reserve Bank of<br />

India.<br />

The Company has an Internal Audit<br />

Department. Internal Audit of the Company<br />

is carried out both by the Internal Audit<br />

Department as well as by firms of Chartered<br />

Accountants. In our opinion, the Internal<br />

Audit System of the Company is required to<br />

be strengthened with regard to<br />

implementation by enlarging the scope and<br />

frequency of coverage in the Audit Plan.<br />

The Central Government has prescribed the<br />

maintenance of cost records by the company<br />

u/s 209(1)(d) of the Companies Act, 1956. We<br />

have broadly reviewed the above records and<br />

are of the opinion that prima-facie the<br />

prescribed accounts and records have been<br />

made and maintained.<br />

29