URANIUM CORPORATION OF INDIA LIMITED - (UCIL).....

URANIUM CORPORATION OF INDIA LIMITED - (UCIL).....

URANIUM CORPORATION OF INDIA LIMITED - (UCIL).....

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

6. The balances of Debtors, Creditors and Advances are subject to confirmation by the concerned parties<br />

and reconciliation on confirmation is under process.<br />

7. Arising out of change in the Accounting Policy on prior period adjustments and pre-paid expenses, current<br />

year adjustment/expenses are increased by Rs. NIL lakh and Rs. 4.11 lakh respectively.<br />

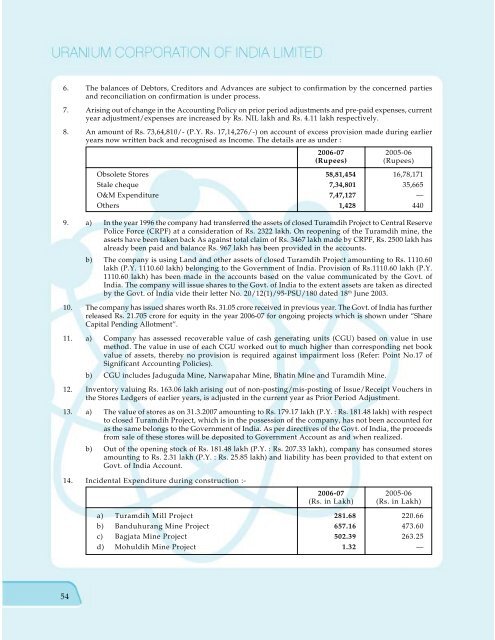

8. An amount of Rs. 73,64,810/- (P.Y. Rs. 17,14,276/-) on account of excess provision made during earlier<br />

years now written back and recognised as Income. The details are as under :<br />

2006-07 2005-06<br />

(Rupees)<br />

(Rupees)<br />

Obsolete Stores 58,81,454 16,78,171<br />

Stale cheque 7,34,801 35,665<br />

O&M Expenditure 7,47,127 —<br />

Others 1,428 440<br />

9. a) In the year 1996 the company had transferred the assets of closed Turamdih Project to Central Reserve<br />

Police Force (CRPF) at a consideration of Rs. 2322 lakh. On reopening of the Turamdih mine, the<br />

assets have been taken back As against total claim of Rs. 3467 lakh made by CRPF, Rs. 2500 lakh has<br />

already been paid and balance Rs. 967 lakh has been provided in the accounts.<br />

b) The company is using Land and other assets of closed Turamdih Project amounting to Rs. 1110.60<br />

lakh (P.Y. 1110.60 lakh) belonging to the Government of India. Provision of Rs.1110.60 lakh (P.Y.<br />

1110.60 lakh) has been made in the accounts based on the value communicated by the Govt. of<br />

India. The company will issue shares to the Govt. of India to the extent assets are taken as directed<br />

by the Govt. of India vide their letter No. 20/12(1)/95-PSU/180 dated 18 th June 2003.<br />

10. The company has issued shares worth Rs. 31.05 crore received in previous year. The Govt. of India has further<br />

released Rs. 21.705 crore for equity in the year 2006-07 for ongoing projects which is shown under “Share<br />

Capital Pending Allotment”.<br />

11. a) Company has assessed recoverable value of cash generating units (CGU) based on value in use<br />

method. The value in use of each CGU worked out to much higher than corresponding net book<br />

value of assets, thereby no provision is required against impairment loss (Refer: Point No.17 of<br />

Significant Accounting Policies).<br />

b) CGU includes Jaduguda Mine, Narwapahar Mine, Bhatin Mine and Turamdih Mine.<br />

12. Inventory valuing Rs. 163.06 lakh arising out of non-posting/mis-posting of Issue/Receipt Vouchers in<br />

the Stores Ledgers of earlier years, is adjusted in the current year as Prior Period Adjustment.<br />

13. a) The value of stores as on 31.3.2007 amounting to Rs. 179.17 lakh (P.Y. : Rs. 181.48 lakh) with respect<br />

to closed Turamdih Project, which is in the possession of the company, has not been accounted for<br />

as the same belongs to the Government of India. As per directives of the Govt. of India, the proceeds<br />

from sale of these stores will be deposited to Government Account as and when realized.<br />

b) Out of the opening stock of Rs. 181.48 lakh (P.Y. : Rs. 207.33 lakh), company has consumed stores<br />

amounting to Rs. 2.31 lakh (P.Y. : Rs. 25.85 lakh) and liability has been provided to that extent on<br />

Govt. of India Account.<br />

14. Incidental Expenditure during construction :-<br />

2006-07 2005-06<br />

(Rs. in Lakh) (Rs. in Lakh)<br />

a) Turamdih Mill Project 281.68 220.66<br />

b) Banduhurang Mine Project 657.16 473.60<br />

c) Bagjata Mine Project 502.39 263.25<br />

d) Mohuldih Mine Project 1.32 —<br />

54