You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET UPDATE – AFRICA | <strong>February</strong> <strong>2015</strong><br />

The Consumer<br />

Price Index<br />

continues to<br />

trend downwards<br />

further giving<br />

impetus to<br />

subdued yields<br />

in the T-Bill<br />

market. The near<br />

term outlook is<br />

bound to remain<br />

favourable for<br />

investors as<br />

inflation risk<br />

is mitigated by<br />

depressed oil<br />

prices.<br />

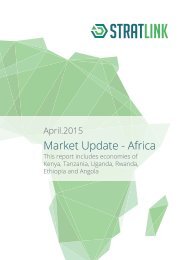

Service Sector Growth<br />

Source: Bank of Rwanda, StratLink <strong>Africa</strong><br />

Rising income levels have served to make<br />

the wholesale and retail segment buoyant,<br />

driving growth in the service sector. Investors<br />

are bound to maintain keen interest<br />

on this segment of the sector with a view to<br />

cashing in on growing consumption in the<br />

market.<br />

Per Capita Income (USD)<br />

Bids Accepted (USD Mln)<br />

Source: Bank of Rwanda, StratLink <strong>Africa</strong><br />

The 91 Day paper closed January <strong>2015</strong> at<br />

4.10% while the 182 Day closed the month<br />

at 5.0%, representing very marginal changes<br />

on each from December 2014. The 364<br />

Day, on the other hand, closed January <strong>2015</strong><br />

at 6.0%, twenty five bps lower than it did December<br />

2014.<br />

T-Bill Yields<br />

Source: Bank of Rwanda, StratLink <strong>Africa</strong><br />

Source: BMI 2014, StratLink <strong>Africa</strong><br />

DEBT MARKET UPDATE<br />

Yields have been largely stable in the T-Bill<br />

market reporting marginal movement in<br />

January <strong>2015</strong>. This is consistent with government<br />

appetite for domestic borrowing<br />

which has registered marginal changes in<br />

the last three months. In the latter part of<br />

2014, we witnessed volatility in yields in<br />

what we believe was occasioned by hiccups<br />

in disbursement of public funds that could<br />

have seen the government reach for domestic<br />

borrowing.<br />

The Consumer Price Index continues to<br />

trend downwards further giving impetus to<br />

subdued yields in the T-Bill market. The near<br />

term outlook is bound to remain favourable<br />

for investors as inflation risk is mitigated by<br />

depressed oil prices.<br />

Consumer Price Index<br />

Source: National Bureau of Statistics, StratLink <strong>Africa</strong><br />

20 | StratLink <strong>Africa</strong> Ltd.<br />

www.stratlinkglobal.com