Annual Report 2012 - TodayIR.com

Annual Report 2012 - TodayIR.com

Annual Report 2012 - TodayIR.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Lonking Holdings Limited<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Notes to the Consolidated Financial Statements<br />

For the year ended 31 December <strong>2012</strong><br />

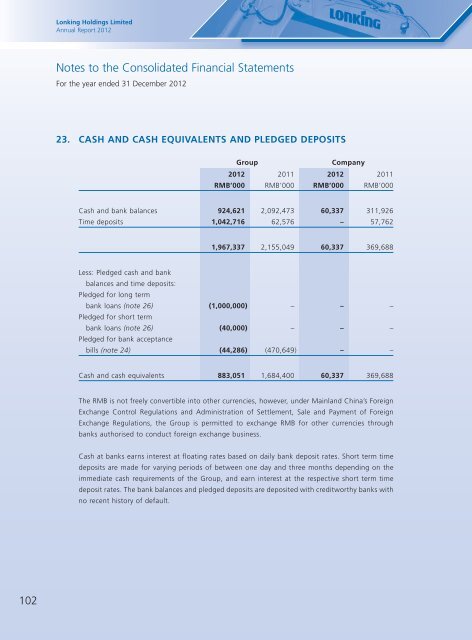

23. CASH AND CASH EQUIVALENTS AND PLEDGED DEPOSITS<br />

Group<br />

Company<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

RMB’000 RMB’000 RMB’000 RMB’000<br />

Cash and bank balances 924,621 2,092,473 60,337 311,926<br />

Time deposits 1,042,716 62,576 – 57,762<br />

1,967,337 2,155,049 60,337 369,688<br />

Less: Pledged cash and bank<br />

balances and time deposits:<br />

Pledged for long term<br />

bank loans (note 26) (1,000,000) – – –<br />

Pledged for short term<br />

bank loans (note 26) (40,000) – – –<br />

Pledged for bank acceptance<br />

bills (note 24) (44,286) (470,649) – –<br />

Cash and cash equivalents 883,051 1,684,400 60,337 369,688<br />

The RMB is not freely convertible into other currencies, however, under Mainland China’s Foreign<br />

Exchange Control Regulations and Administration of Settlement, Sale and Payment of Foreign<br />

Exchange Regulations, the Group is permitted to exchange RMB for other currencies through<br />

banks authorised to conduct foreign exchange business.<br />

Cash at banks earns interest at floating rates based on daily bank deposit rates. Short term time<br />

deposits are made for varying periods of between one day and three months depending on the<br />

immediate cash requirements of the Group, and earn interest at the respective short term time<br />

deposit rates. The bank balances and pledged deposits are deposited with creditworthy banks with<br />

no recent history of default.<br />

102