Annual Report 2012 - TodayIR.com

Annual Report 2012 - TodayIR.com

Annual Report 2012 - TodayIR.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Lonking Holdings Limited<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2012</strong><br />

Notes to the Consolidated Financial Statements<br />

For the year ended 31 December <strong>2012</strong><br />

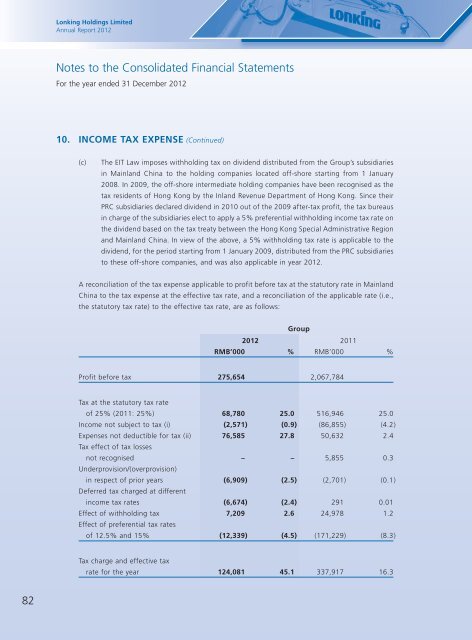

10. INCOME TAX EXPENSE (Continued)<br />

(c)<br />

The EIT Law imposes withholding tax on dividend distributed from the Group’s subsidiaries<br />

in Mainland China to the holding <strong>com</strong>panies located off-shore starting from 1 January<br />

2008. In 2009, the off-shore intermediate holding <strong>com</strong>panies have been recognised as the<br />

tax residents of Hong Kong by the Inland Revenue Department of Hong Kong. Since their<br />

PRC subsidiaries declared dividend in 2010 out of the 2009 after-tax profit, the tax bureaus<br />

in charge of the subsidiaries elect to apply a 5% preferential withholding in<strong>com</strong>e tax rate on<br />

the dividend based on the tax treaty between the Hong Kong Special Administrative Region<br />

and Mainland China. In view of the above, a 5% withholding tax rate is applicable to the<br />

dividend, for the period starting from 1 January 2009, distributed from the PRC subsidiaries<br />

to these off-shore <strong>com</strong>panies, and was also applicable in year <strong>2012</strong>.<br />

A reconciliation of the tax expense applicable to profit before tax at the statutory rate in Mainland<br />

China to the tax expense at the effective tax rate, and a reconciliation of the applicable rate (i.e.,<br />

the statutory tax rate) to the effective tax rate, are as follows:<br />

Group<br />

<strong>2012</strong> 2011<br />

RMB’000 % RMB’000 %<br />

Profit before tax 275,654 2,067,784<br />

Tax at the statutory tax rate<br />

of 25% (2011: 25%) 68,780 25.0 516,946 25.0<br />

In<strong>com</strong>e not subject to tax (i) (2,571) (0.9) (86,855) (4.2)<br />

Expenses not deductible for tax (ii) 76,585 27.8 50,632 2.4<br />

Tax effect of tax losses<br />

not recognised – – 5,855 0.3<br />

Underprovision/(overprovision)<br />

in respect of prior years (6,909) (2.5) (2,701) (0.1)<br />

Deferred tax charged at different<br />

in<strong>com</strong>e tax rates (6,674) (2.4) 291 0.01<br />

Effect of withholding tax 7,209 2.6 24,978 1.2<br />

Effect of preferential tax rates<br />

of 12.5% and 15% (12,339) (4.5) (171,229) (8.3)<br />

Tax charge and effective tax<br />

rate for the year 124,081 45.1 337,917 16.3<br />

82