COIF Charities Property Fund - CCLA

COIF Charities Property Fund - CCLA

COIF Charities Property Fund - CCLA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Report of the <strong>Fund</strong> Manager<br />

for the half year ended 30 June 2012<br />

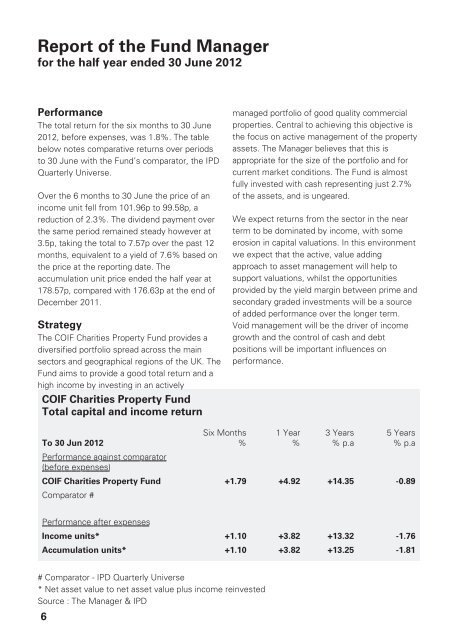

Performance<br />

The total return for the six months to 30 June<br />

2012, before expenses, was 1.8%. The table<br />

below notes comparative returns over periods<br />

to 30 June with the <strong>Fund</strong>’s comparator, the IPD<br />

Quarterly Universe.<br />

Over the 6 months to 30 June the price of an<br />

income unit fell from 101.96p to 99.58p, a<br />

reduction of 2.3%. The dividend payment over<br />

the same period remained steady however at<br />

3.5p, taking the total to 7.57p over the past 12<br />

months, equivalent to a yield of 7.6% based on<br />

the price at the reporting date. The<br />

accumulation unit price ended the half year at<br />

178.57p, compared with 176.63p at the end of<br />

December 2011.<br />

Strategy<br />

The <strong>COIF</strong> <strong>Charities</strong> <strong>Property</strong> <strong>Fund</strong> provides a<br />

diversified portfolio spread across the main<br />

sectors and geographical regions of the UK. The<br />

<strong>Fund</strong> aims to provide a good total return and a<br />

high income by investing in an actively<br />

<strong>COIF</strong> <strong>Charities</strong> <strong>Property</strong> <strong>Fund</strong><br />

Total capital and income return<br />

managed portfolio of good quality commercial<br />

properties. Central to achieving this objective is<br />

the focus on active management of the property<br />

assets. The Manager believes that this is<br />

appropriate for the size of the portfolio and for<br />

current market conditions. The <strong>Fund</strong> is almost<br />

fully invested with cash representing just 2.7%<br />

of the assets, and is ungeared.<br />

We expect returns from the sector in the near<br />

term to be dominated by income, with some<br />

erosion in capital valuations. In this environment<br />

we expect that the active, value adding<br />

approach to asset management will help to<br />

support valuations, whilst the opportunities<br />

provided by the yield margin between prime and<br />

secondary graded investments will be a source<br />

of added performance over the longer term.<br />

Void management will be the driver of income<br />

growth and the control of cash and debt<br />

positions will be important influences on<br />

performance.<br />

To 30 Jun 2012<br />

Six Months<br />

%<br />

1 Year<br />

%<br />

3 Years<br />

% p.a<br />

5 Years<br />

% p.a<br />

Performance against comparator<br />

(before expenses)<br />

<strong>COIF</strong> <strong>Charities</strong> <strong>Property</strong> <strong>Fund</strong> +1.79 +4.92 +14.35 -0.89<br />

Comparator #<br />

Performance after expenses<br />

Income units* +1.10 +3.82 +13.32 -1.76<br />

Accumulation units* +1.10 +3.82 +13.25 -1.81<br />

# Comparator - IPD Quarterly Universe<br />

* Net asset value to net asset value plus income reinvested<br />

Source : The Manager & IPD<br />

6