Market & Competition - Deutsche Bahn AG

Market & Competition - Deutsche Bahn AG

Market & Competition - Deutsche Bahn AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

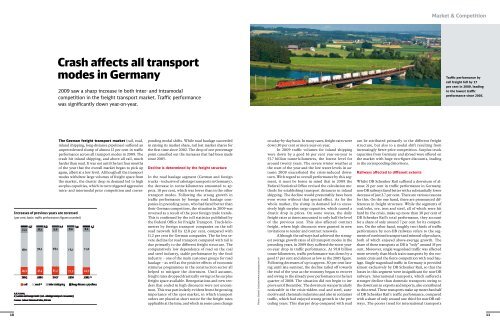

Increases of previous years are reversed<br />

(per cent; basis: traffic performance; figures rounded)<br />

Crash affects all transport<br />

modes in Germany<br />

2009 saw a sharp increase in both inter- and intramodal<br />

competition in the freight transport market. Traffic performance<br />

was significantly down year-on-year.<br />

The German freight transport market (rail, road,<br />

inland shipping, long-distance pipelines) suffered an<br />

unprecedented slump of almost 12 per cent in traffic<br />

performance across all transport modes in 2009. The<br />

crash hit inland shipping, and above all rail, much<br />

harder than road. It was not until the last four months<br />

of the year that the overall market began to pick up<br />

again, albeit at a low level. Although all the transport<br />

modes withdrew large volumes of freight space from<br />

the market, the drastic drop in demand led to high<br />

surplus capacities, which in turn triggered aggressive<br />

intra- and intermodal price competition and corres-<br />

ponding modal shifts. While road haulage succeeded<br />

in raising its market share, rail lost market shares for<br />

the first time since 2002. The drop of one percentage<br />

point cancelled out the increases that had been made<br />

since 2005.<br />

Decline is determined by the freight structure<br />

In the road haulage segment (German and foreign<br />

trucks – inclusive of cabotage transports in Germany),<br />

the decrease in tonne-kilometres amounted to approx.<br />

10 per cent, which was lower than in the other<br />

transport modes. Following the strong growth in<br />

traffic performance by foreign road haulage companies<br />

in preceding years, who had fared better than<br />

their German competitors, the situation in 2009 was<br />

reversed as a result of the poor foreign trade trends.<br />

This is confirmed by the toll statistics published by<br />

the Federal Office for Freight Transport. Truck-kilometres<br />

by foreign transport companies on the toll<br />

road network fell by 12.8 per cent, compared with<br />

11.2 per cent for German companies. The far less severe<br />

decline for road transport compared with rail is<br />

due primarily to the different freight structure. The<br />

comparatively low dependence of road on the coal<br />

and steel industry, stable performance by the food<br />

industry – one of the main customer groups for road<br />

haulage – as well as the positive effects of economic<br />

stimulus programmes in the construction sector all<br />

helped to mitigate the downturn. Until autumn,<br />

freight rates dropped drastically owing to the surplus<br />

freight space available. Renegotiations and new tenders<br />

that ended in high discounts were not uncommon.<br />

This was particularly evident from the growing<br />

importance of the spot market, in which transport<br />

orders are placed at short notice for the freight rates<br />

applicable at the time, and which in some cases change<br />

on a day-by-day basis. In many cases, freight rates were<br />

down 30 per cent or more year-on-year.<br />

In 2009 traffic volumes for inland shipping<br />

were down by a good 16 per cent year-on-year to<br />

53.7 billion tonne-kilometres, the lowest level for<br />

around twenty years. The severe winter weather at<br />

the start of the year and the low water levels in autumn<br />

2009 exacer bated the crisis-induced downturn.<br />

With regard to overall performance by this segment,<br />

it must be borne in mind that in 2009 the<br />

Federal Sta tistical Office re vised the calculation methods<br />

for establishing transport distances in inland<br />

shipping. The decline would presumably have been<br />

even worse without that special effect. As for the<br />

whole market, the slump in demand led to excessively<br />

high surplus cargo capacities, which caused a<br />

drastic drop in prices. On some routes, the daily<br />

freight rates at times amounted to only half the level<br />

of the previous year. This also affected contract<br />

freight, where high discounts were granted in new<br />

invitations to tender and contract renewals.<br />

Although the railways had achieved the strongest<br />

average growth rates of all transport modes in the<br />

preceding years, in 2009 they suffered the worst yearon-year<br />

drop in traffic performance. At 95.8 billion<br />

tonne-kilometres, traffic performance was down by a<br />

good 17 per cent and almost as low as the 2005 figure.<br />

Following decreases of up to approx. 30 per cent lasting<br />

until late summer, the decline tailed off towards<br />

the end of the year as the economy began to recover<br />

and owing to the already poor performance in the last<br />

quarter of 2008. The situation did not begin to improve<br />

until December. The downturn was particularly<br />

noticeable in the crisis-ridden coal and steel, automotive<br />

and chemicals industries and also in container<br />

traffic, which had enjoyed strong growth in the preceding<br />

years. This sharper drop compared with road<br />

can be attributed primarily to the different freight<br />

structure, but also to a modal shift resulting from<br />

increasingly fierce price competition. Surplus truck<br />

capacities from Germany and abroad were offered on<br />

the market with huge two-figure discounts, leading<br />

to the corresponding distortions.<br />

Railways affected to different extents<br />

Whilst DB Schenker Rail suffered a downturn of almost<br />

21 per cent in traffic performance in Germany,<br />

non-DB railways fared better with a substantially lower<br />

decrease of just 3.7 per cent. There are various reasons<br />

for this. On the one hand, there are pronounced differences<br />

in freight structure. While the segments of<br />

coal/coke, ore, iron and steel, all of which were hit<br />

hard by the crisis, make up more than 30 per cent of<br />

DB Schenker Rail’s total performance, they account<br />

for a share of only around 7 per cent for its competitors.<br />

On the other hand, roughly two thirds of traffic<br />

performance by non-DB railways refers to the segments<br />

of combined transport and mineral oil products,<br />

both of which enjoyed above-average growth. The<br />

share of these transports at DB is “only” around 35 per<br />

cent. Moreover, single wagonload traffic was affected<br />

more severely than block train transports by the economic<br />

crisis and the fierce competition with road haulage.<br />

Single wagonload traffic in Germany is provided<br />

almost exclusively by DB Schenker Rail, so that the<br />

losses in this segment were insignificant for non-DB<br />

railways. International transports, which suffered a<br />

stronger decline than domestic transports owing to<br />

the downturn in exports and imports, also contributed<br />

to this trend. These transports make up more than half<br />

of DB Schenker Rail’s traffic performance, compared<br />

with a share of only around one third for non-DB railways.<br />

The poorer trend for international transports<br />

Traffic performance by<br />

rail freight fell by 17<br />

per cent in 2009, leading<br />

to the lowest traffic<br />

performance since 2005.<br />

10 11<br />

Photo: Daniel Schärer/www.trainpassion.ch<br />

<strong>Market</strong> & <strong>Competition</strong>