Investment Views - VP Bank

Investment Views - VP Bank

Investment Views - VP Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

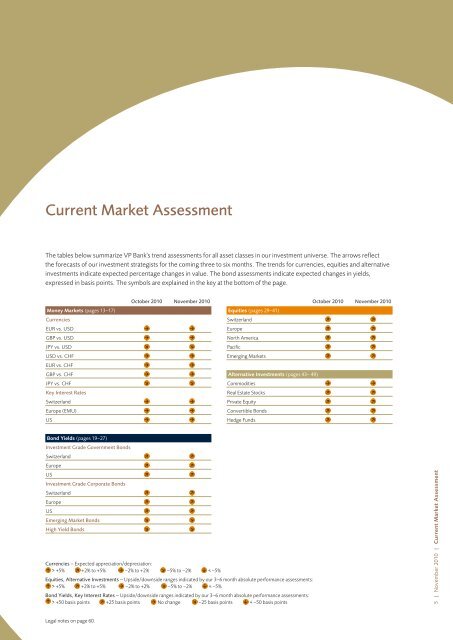

Current Market Assessment<br />

The tables below summarize <strong>VP</strong> <strong>Bank</strong>'s trend assessments for all asset classes in our investment universe. The arrows reflect<br />

the forecasts of our investment strategists for the coming three to six months. The trends for currencies, equities and alternative<br />

investments indicate expected percentage changes in value. The bond assessments indicate expected changes in yields,<br />

expressed in basis points. The symbols are explained in the key at the bottom of the page.<br />

Money Markets (pages 13–17)<br />

Currencies<br />

EUR vs. USD<br />

GBP vs. USD<br />

JPY vs. USD<br />

USD vs. CHF<br />

EUR vs. CHF<br />

GBP vs. CHF<br />

JPY vs. CHF<br />

Key Interest Rates<br />

Switzerland<br />

Europe (EMU)<br />

US<br />

Bond Yields (pages 19–27)<br />

<strong>Investment</strong> Grade Government Bonds<br />

Switzerland<br />

Europe<br />

US<br />

<strong>Investment</strong> Grade Corporate Bonds<br />

Switzerland<br />

Europe<br />

US<br />

Emerging Market Bonds<br />

High Yield Bonds<br />

October 2010 November 2010<br />

Equities (pages 29–41)<br />

Switzerland<br />

Europe<br />

North America<br />

Pacific<br />

Emerging Markets<br />

Alternative <strong>Investment</strong>s (pages 43– 49)<br />

Commodities<br />

Real Estate Stocks<br />

Private Equity<br />

Convertible Bonds<br />

Hedge Funds<br />

Currencies – Expected appreciation/depreciation:<br />

> +5% +2% to +5% –2% to +2% –5% to –2% < –5%<br />

Equities, Alternative <strong>Investment</strong>s – Upside/downside ranges indicated by our 3–6 month absolute performance assessments:<br />

> +5% +2% to +5% –2% to +2% –5% to –2% < –5%<br />

Bond Yields, Key Interest Rates – Upside/downside ranges indicated by our 3–6 month absolute performance assessments:<br />

> +50 basis points +25 basis points No change –25 basis points < –50 basis points<br />

Legal notes on page 60.<br />

October 2010 November 2010<br />

5 | November 2010 | Current Market Assessment