Download Financial Statements - Ports of Auckland

Download Financial Statements - Ports of Auckland

Download Financial Statements - Ports of Auckland

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Ports</strong> <strong>of</strong> <strong>Auckland</strong> Limited & Subsidiaries financial report 09<br />

NOTES TO THE FINANCIAL STATEMENTS (continued)<br />

30 June 2009<br />

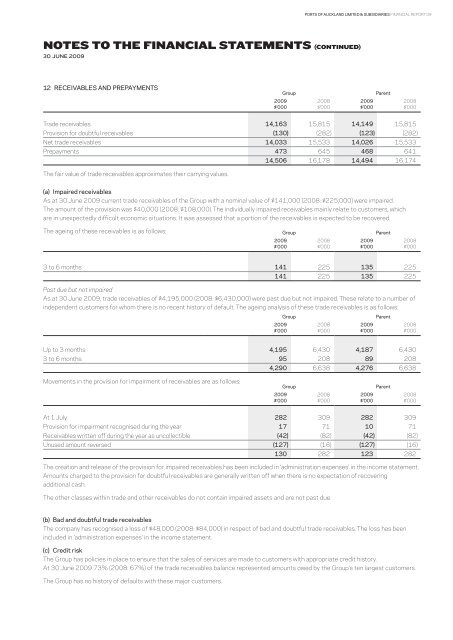

12 Receivables and prepayments<br />

Group<br />

Parent<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

Trade receivables 14,163 15,815 14,149 15,815<br />

Provision for doubtful receivables (130) (282) (123) (282)<br />

Net trade receivables 14,033 15,533 14,026 15,533<br />

Prepayments 473 645 468 641<br />

14,506 16,178 14,494 16,174<br />

The fair value <strong>of</strong> trade receivables approximates their carrying values.<br />

(a) Impaired receivables<br />

As at 30 June 2009 current trade receivables <strong>of</strong> the Group with a nominal value <strong>of</strong> $141,000 (2008: $225,000) were impaired.<br />

The amount <strong>of</strong> the provision was $40,000 (2008: $108,000). The individually impaired receivables mainly relate to customers, which<br />

are in unexpectedly difficult economic situations. It was assessed that a portion <strong>of</strong> the receivables is expected to be recovered.<br />

The ageing <strong>of</strong> these receivables is as follows:<br />

Group<br />

Parent<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

3 to 6 months 141 225 135 225<br />

141 225 135 225<br />

Past due but not impaired<br />

As at 30 June 2009, trade receivables <strong>of</strong> $4,195,000 (2008: $6,430,000) were past due but not impaired. These relate to a number <strong>of</strong><br />

independent customers for whom there is no recent history <strong>of</strong> default. The ageing analysis <strong>of</strong> these trade receivables is as follows:<br />

2009<br />

$’000<br />

Group<br />

2008<br />

$’000<br />

2009<br />

$’000<br />

Parent<br />

2008<br />

$’000<br />

Up to 3 months 4,195 6,430 4,187 6,430<br />

3 to 6 months 95 208 89 208<br />

4,290 6,638 4,276 6,638<br />

Movements in the provision for impairment <strong>of</strong> receivables are as follows:<br />

Group<br />

Parent<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

At 1 July 282 309 282 309<br />

Provision for impairment recognised during the year 17 71 10 71<br />

Receivables written <strong>of</strong>f during the year as uncollectible (42) (82) (42) (82)<br />

Unused amount reversed (127) (16) (127) (16)<br />

130 282 123 282<br />

The creation and release <strong>of</strong> the provision for impaired receivables has been included in ‘administration expenses’ in the income statement.<br />

Amounts charged to the provision for doubtful receivables are generally written <strong>of</strong>f when there is no expectation <strong>of</strong> recovering<br />

additional cash.<br />

The other classes within trade and other receivables do not contain impaired assets and are not past due.<br />

(b) Bad and doubtful trade receivables<br />

The company has recognised a loss <strong>of</strong> $48,000 (2008: $84,000) in respect <strong>of</strong> bad and doubtful trade receivables. The loss has been<br />

included in ‘administration expenses’ in the income statement.<br />

(c) Credit risk<br />

The Group has policies in place to ensure that the sales <strong>of</strong> services are made to customers with appropriate credit history.<br />

At 30 June 2009 73% (2008: 67%) <strong>of</strong> the trade receivables balance represented amounts owed by the Group’s ten largest customers.<br />

The Group has no history <strong>of</strong> defaults with these major customers.