Download Financial Statements - Ports of Auckland

Download Financial Statements - Ports of Auckland

Download Financial Statements - Ports of Auckland

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

02<br />

04<br />

06<br />

08<br />

10<br />

12<br />

14<br />

16<br />

18<br />

20<br />

22<br />

24<br />

26<br />

28<br />

30<br />

32<br />

34<br />

36<br />

38<br />

40<br />

42<br />

44<br />

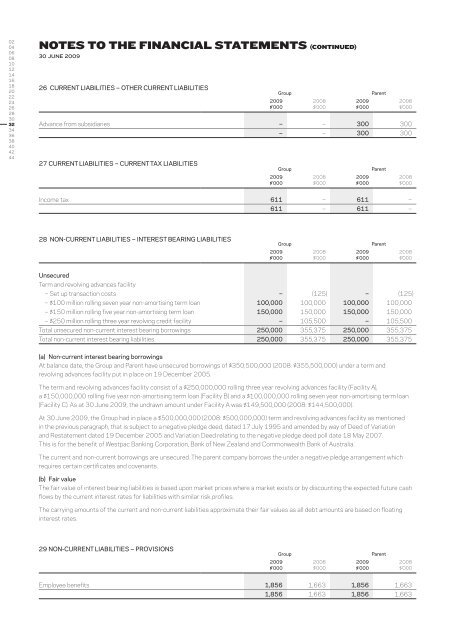

NOTES TO THE FINANCIAL STATEMENTS (continued)<br />

30 June 2009<br />

26 Current liabilities – Other current liabilities<br />

Advance from subsidiaries – – 300 300<br />

27 Current liabilities – Current tax liabilities<br />

2009<br />

$’000<br />

2009<br />

$’000<br />

Group<br />

Group<br />

2008<br />

$’000<br />

2008<br />

$’000<br />

2009<br />

$’000<br />

2009<br />

$’000<br />

Parent<br />

Parent<br />

2008<br />

$’000<br />

– – 300 300<br />

2008<br />

$’000<br />

Income tax 611 – 611 –<br />

611 – 611 –<br />

28 Non-current liabilities – Interest bearing liabilities<br />

Group<br />

Parent<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

Unsecured<br />

Term and revolving advances facility<br />

– Set up transaction costs – (125) – (125)<br />

– $100 million rolling seven year non-amortising term loan 100,000 100,000 100,000 100,000<br />

– $150 million rolling five year non-amortising term loan 150,000 150,000 150,000 150,000<br />

– $250 million rolling three year revolving credit facility – 105,500 – 105,500<br />

Total unsecured non-current interest bearing borrowings 250,000 355,375 250,000 355,375<br />

Total non-current interest bearing liabilities 250,000 355,375 250,000 355,375<br />

(a) Non-current interest bearing borrowings<br />

At balance date, the Group and Parent have unsecured borrowings <strong>of</strong> $350,500,000 (2008: $355,500,000) under a term and<br />

revolving advances facility put in place on 19 December 2005.<br />

The term and revolving advances facility consist <strong>of</strong> a $250,000,000 rolling three year revolving advances facility (Facility A),<br />

a $150,000,000 rolling five year non-amortising term loan (Facility B) and a $100,000,000 rolling seven year non-amortising term loan<br />

(Facility C). As at 30 June 2009, the undrawn amount under Facility A was $149,500,000 (2008: $144,500,000).<br />

At 30 June 2009, the Group had in place a $500,000,000 (2008: $500,000,000) term and revolving advances facility as mentioned<br />

in the previous paragraph, that is subject to a negative pledge deed, dated 17 July 1995 and amended by way <strong>of</strong> Deed <strong>of</strong> Variation<br />

and Restatement dated 19 December 2005 and Variation Deed relating to the negative pledge deed poll date 18 May 2007.<br />

This is for the benefit <strong>of</strong> Westpac Banking Corporation, Bank <strong>of</strong> New Zealand and Commonwealth Bank <strong>of</strong> Australia.<br />

The current and non-current borrowings are unsecured. The parent company borrows the under a negative pledge arrangement which<br />

requires certain certificates and covenants.<br />

(b) Fair value<br />

The fair value <strong>of</strong> interest bearing liabilities is based upon market prices where a market exists or by discounting the expected future cash<br />

flows by the current interest rates for liabilities with similar risk pr<strong>of</strong>iles.<br />

The carrying amounts <strong>of</strong> the current and non-current liabilities approximate their fair values as all debt amounts are based on floating<br />

interest rates.<br />

29 Non-current liabilities – Provisions<br />

Group<br />

Parent<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

2009<br />

$’000<br />

2008<br />

$’000<br />

Employee benefits 1,856 1,663 1,856 1,663<br />

1,856 1,663 1,856 1,663