Disclosure Document - Karvy

Disclosure Document - Karvy

Disclosure Document - Karvy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KARVY STOCK BROKING LTD<br />

PORTFOLIO MANAGEMENT SERVICES<br />

DISCLOSURE DOCUMENT<br />

[As required under Regulation 14 of SEBI (Portfolio Managers) Regulation, 1993]<br />

1. This document supercedes the <strong>Disclosure</strong> document dated July 31, 2012 filed with<br />

Securities and Exchange Board of India (SEBI) on August 6, 2012.<br />

2. This <strong>Disclosure</strong> <strong>Document</strong> has been filed with SEBI along with the certificate from<br />

independent chartered accountant in the prescribed format in terms of Regulation<br />

14 of the SEBI (Portfolio Managers) Regulations, 1993.<br />

3. The purpose of this <strong>Disclosure</strong> <strong>Document</strong> is to provide essential information about<br />

the portfolio management services in such manner as to assist and enable the<br />

investors in making informed decision for engaging <strong>Karvy</strong> Stock Broking Limited as a<br />

Portfolio Manager.<br />

4. This document contains the necessary information about the Portfolio Manager<br />

required by an investor<br />

5. Investors should carefully read this entire document before making a decision and<br />

retain it for future reference.<br />

6. No person has been authorized to give any information or to make any<br />

representations not confirmed in this <strong>Disclosure</strong> <strong>Document</strong> in connection with the<br />

services proposed to be provided by the Portfolio Manager, and any information or<br />

representations not contained herein must not be relied upon as having been<br />

authorized by the Portfolio Manager.<br />

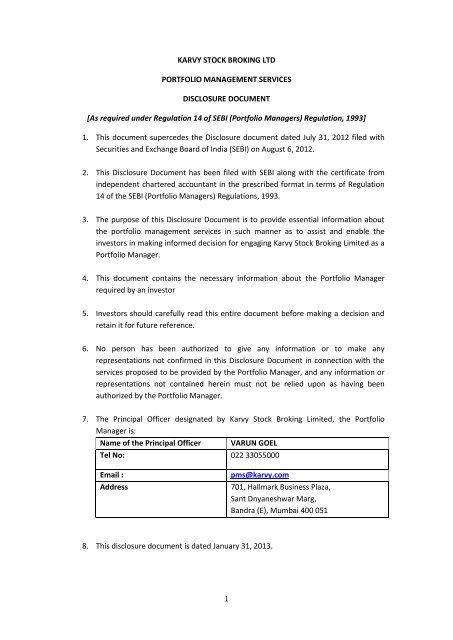

7. The Principal Officer designated by <strong>Karvy</strong> Stock Broking Limited, the Portfolio<br />

Manager is:<br />

Name of the Principal Officer<br />

VARUN GOEL<br />

Tel No: 022 33055000<br />

Email :<br />

Address<br />

pms@karvy.com<br />

701, Hallmark Business Plaza,<br />

Sant Dnyaneshwar Marg,<br />

Bandra (E), Mumbai 400 051<br />

8. This disclosure document is dated January 31, 2013.<br />

1

Portfolio Management Services<br />

KARVY STOCK BROKING LIMITED<br />

SEBI Registration No. INP000001512<br />

INDEX<br />

Sr No Contents Page Number<br />

1 Disclaimer Clause 3<br />

2 Definitions 4 - 7<br />

3 Description - The Portfolio Manager<br />

i<br />

ii<br />

History, Present Business and background of the Portfolio<br />

Manager.<br />

Promoters of the Portfolio Manager, Directors and their<br />

background.<br />

8<br />

9 - 10<br />

iii<br />

Details of the top 10 group companies of the Portfolio<br />

manager based on turnover as on March 31, 2012<br />

11<br />

iv Details of Services being offered. 11<br />

4 Penalties/Pending Litigations/Proceedings etc 12 - 13<br />

5 Services offered 13 - 18<br />

6 Risk Factors 18 - 22<br />

7 Client Representation<br />

i Category of clients as on December 31, 2012 22 -23<br />

ii<br />

Complete disclosure in respect of transactions with related<br />

parties as per the standards specified by the Institute of<br />

Chartered Accountants of India (as on March 31, 2012)<br />

23 -28<br />

8 Financial Performance of Portfolio Manager, <strong>Karvy</strong> Stock<br />

Broking Limited<br />

9 Portfolio Management Performance of the Portfolio<br />

Manager for last 3 years<br />

28 - 29<br />

29 - 32<br />

10 Nature of Expenses 32 - 34<br />

11 Taxation 34 - 37<br />

12 Accounting Policies 37 - 39<br />

13 Investor Services 39<br />

14 Grievances Redressal 39<br />

15 Dispute Settlement Mechanism 39 - 40<br />

2

16 General 40<br />

1)Disclaimer clause<br />

This document has been prepared in accordance with the Securities Exchange Board of India<br />

(Portfolio Managers) Regulations, 1993, as amended from time to time and other circulars<br />

issued by SEBI from time to time and have been filed with SEBI. This <strong>Document</strong> has neither<br />

been approved nor disapproved by SEBI nor has SEBI certified the accuracy or adequacy of<br />

the contents of this <strong>Document</strong>.<br />

This information is not for public distribution and has been furnished to you solely for your<br />

information and may not be reproduced or redistributed to any other person.<br />

2) Definitions<br />

In this Agreement, unless otherwise clearly indicated by or inconsistent with the context, the<br />

following expressions shall have the meaning assigned to them hereunder respectively:<br />

“Act” – means the Securities and Exchange Board of India Act, 1992.<br />

“Agreement” includes agreement entered between <strong>Karvy</strong> Stock Broking Limited, the<br />

portfolio manager and the client for the management of funds or securities of the client in<br />

terms of Regulation 14 of the SEBI (Portfolio Managers) Regulations, 1993 and SEBI<br />

(Portfolio Managers) Amendment Regulations, 2002 issued by the Securities and Exchange<br />

Board of India and as may be modified from time to time.<br />

“Board” means the Securities and Exchange Board of India.<br />

“ Bank Account” means one or more bank accounts opened, maintained and operated by<br />

the Portfolio Manager in the name of clients or a pool account in the name of the Portfolio<br />

Manager in which the funds handed over by the client shall be held by the Portfolio Manager<br />

on behalf of the Client.<br />

“Chartered Accountant” means a chartered accountant as defined in clause (b) of subsection<br />

(1) of section 2 of the Chartered Accountants Act, 1949 (38 of 1949) and who has<br />

obtained a certificate of practice under sub-section (1) of section 6 of that Act.<br />

3

“Client” means any body corporate, partnership firm, individual, HUF, association of person,<br />

body of individuals, trust, statutory authority, or any other person who enters into<br />

agreement with the Portfolio Manager for the managing of his/ her/ its portfolio.<br />

“Custodian” means any person who carries on or proposes to carry on the business of<br />

providing custodial services in accordance with the regulations issued by SEBI from time to<br />

time.<br />

“Depository” means Depository as defined in the Depositories Act, 1996 (22 of 1996) and<br />

currently includes National Securities Depository Limited (NSDL) and Central Depository<br />

Services (India) Limited (CDSL) .<br />

“Depository Account” means any account of the client or for the client with an entity<br />

registered as depository participant under sub-section 1A of Section 12 of the Act or any<br />

other law for the time being relating to registration of depository participants.<br />

“Discretionary Portfolio Manager” means a portfolio manager who exercises or may, under<br />

a contract relating to portfolio management, exercises any degree of discretion as to the<br />

investments or management of the portfolio of securities or the funds of the client, as the<br />

case may be.<br />

“<strong>Disclosure</strong> <strong>Document</strong>” means this disclosure document dated January 31, 2013 for offering<br />

Portfolio Management Services.<br />

“Financial year” means the period of twelve months commencing on 1 st April every year an<br />

ending on 31 st march of the next year.<br />

“Funds” means the monies placed by the Client with the Portfolio Manager and any<br />

accretions thereto.<br />

“Funds managed” means the market value of the Portfolio of the Client as on date.<br />

“Fund Manager” (FM) means the individual/s appointed by the portfolio manager who<br />

manages, advises or directs or undertakes on behalf of the client (whether as a discretionary<br />

4

portfolio manager or otherwise) the management or administration of a portfolio of<br />

securities or funds of the client, as the case may be.<br />

“Initial Corpus” means the value of the funds and the market value of securities brought in<br />

by the client and accepted by the Portfolio Manager at the time of registering with the<br />

Portfolio Manager for the portfolio management services.<br />

“Investment Advisory Services” means the services, where the Portfolio Manager advises<br />

Clients on investments in general or gives specific advice required by the Clients and agreed<br />

upon in the Agreement.<br />

“Non Discretionary Portfolio Manager” means a portfolio manager who manages the funds<br />

in accordance with the directions of the client.<br />

“Person directly or indirectly connected” means any person being an associate, subsidiary,<br />

inter connected company or a company under the same management within the meaning of<br />

section 370(1B) of the Companies Act, 1956 or in the same group.<br />

“Portfolio” means the total holdings of securities and / or funds belonging to the client.<br />

“Portfolio Manager” (PM) means <strong>Karvy</strong> Stock Broking Ltd., a company Registered under the<br />

Companies Act, 1956 and having its Registered Office at <strong>Karvy</strong> House, 46, Avenue 4, Road<br />

No.10, Banjara Hills, Hyderabad and its PMS dealing office at 701, Hallmark Business Plaza,<br />

Sant Dnyaneshwar Marg, Bandra (E), Mumbai 400 051[ but may add more dealing offices in<br />

future] <strong>Karvy</strong> Stock Broking Limited has obtained a certificate from SEBI dated 1 st<br />

November, 2005 to act as Portfolio Manager under SEBI Registration No.INP000001512.<br />

“Portfolio Value” means the aggregate of the Portfolio Funds and Value of Portfolio<br />

Securities.<br />

“Principal Officer” means a director/an employee of the portfolio manager who is<br />

responsible for the activities of portfolio management and has been designated as principal<br />

officer by the portfolio manager.<br />

5

“Regulations” – means the Securities and Exchange Board of India (Portfolio Managers)<br />

Regulations, 1993, as amended by Securities and Exchange Board of India (Portfolio<br />

Managers) Amendment Regulations, 2002, and as may be amended by SEBI from time to<br />

time including rules, guidelines or circulars issued in relation thereto from time to time.<br />

“Strategy” means any of the Portfolio Investment categories mentioned here or that may be<br />

introduced by the Portfolio Manager from time to time. The Term Strategy may be<br />

interchanged with Plans/Products/Options.<br />

“SEBI” means the Securities and Exchange Board of India established under sub-section (1)<br />

of Section 3 of the Securities and Exchange Board of India Act, 1992.<br />

“Securities” means shares (whether dematerialized or otherwise), derivatives (futures and<br />

options), scrip, stocks, bonds, warrants, convertible debentures, non-convertible<br />

debentures, fixed return investments, floating rate instruments linked to MIBOR/call money<br />

etc., equity shares and equity linked instruments or other marketable securities of a like<br />

nature in or of any incorporated company or other body corporate, negotiable instruments,<br />

including usage bills of exchange, trade bills, deposits or other money market instruments,<br />

derivatives, commercial paper, certificates of deposits, units issued by Unit Trust of India and<br />

units issued by Mutual Funds, mortgage backed or other asset backed securities issued by<br />

any institution or corporate, cumulative convertible preference shares issued by any<br />

incorporated Company and securities issued by the Central Government or a State<br />

Government or any other securities that may be issued from time to time and other rights or<br />

interests in securities .<br />

“Securities lending” means the securities lending as per the Securities Lending Scheme,<br />

1997 and related guidelines specified by SEBI.<br />

“Structured Products” means products returns on which may be linked to Equity Index, Debt<br />

instruments, Non Convertible Debentures and may also be based on Basket of stock, index<br />

or stock futures with pre-defined capital protection. These are normally third party<br />

products.<br />

The terms that are used herein and not defined herein, except where the context otherwise<br />

so requires, shall have the same meanings as are assigned to them under the Act, the<br />

Regulations or the Rules.<br />

6

3) Description<br />

i. History, Present Business and Background of the Portfolio Manager<br />

KARVY, is a premier integrated financial services provider, and ranked amongst the leading<br />

corporate in the country in all its business segments, servicing over millions of individual<br />

investors in various capacities, and provides investor services to many corporates,<br />

comprising the who’s who of Corporate India. KARVY covers the entire spectrum of financial<br />

services such as Stock Broking, Depository Participants, Distribution of financial products –<br />

mutual funds, bonds, fixed deposit, equities, Insurance Broking, Commodities Broking,<br />

Personal Finance, Advisory Services, Merchant Banking & Corporate Finance, placement of<br />

equity, IPOs, among others. <strong>Karvy</strong> has a professional management team and ranks among<br />

the best in technology and operations.<br />

<strong>Karvy</strong> Stock Broking Limited was incorporated on 30 th March 1995 having Registered Office<br />

at <strong>Karvy</strong> House 46, Avenue 4, Street No.-1, Banjara Hills, Hyderabad – 500 034. <strong>Karvy</strong> Stock<br />

Broking Limited (KSBL) is a member of – National Stock Exchange Limited, Bombay Stock<br />

Exchange Limited and MCX Stock Exchange Limited. <strong>Karvy</strong> Stock Broking Limited has been<br />

registered as a Depository Participant with National Securities Depository Ltd (NSDL) since<br />

December 1997 and with Central Depository Securities Ltd (CDSL) since October 1999 and<br />

offers these services across the network. <strong>Karvy</strong> has a large number of offices across the<br />

length and breadth of the country, thus making financial services accessible to urban, semiurban<br />

and rural investors. We offer broking services across the entire network on a robust<br />

platform with sound technological support and risk and surveillance mechanism which are of<br />

a high order. The broking services are backed by a strong research desk and a<br />

communication cell which is very proactive to market feed back and analyses information<br />

that flows into the capital markets which enables us to provide quality advice to our<br />

customers. The research team comprises of technical analysts who cover market trends and<br />

stock specific movements and fundamental specialists who track various segments of<br />

industry and corporate. In addition, our specific industry reports give comprehensive<br />

information on various industries. Besides this, we also provide customized advisory<br />

services to help in making the right financial moves that are specifically suited to portfolio<br />

requirements of the clients.<br />

Offering a wide trading platform with a dual membership both as a stock broker registered<br />

with NSE, BSE and MCX as well as a Depository Participant registered with both NSDL and<br />

CDSL, we are a powerful medium for trading and settlement of dematerialized shares. We<br />

have established live DPMs, Internet access to accounts and an easier transaction process in<br />

order to offer more convenience to individual and corporate investors.<br />

ii. Details of Promoters, directors and their background<br />

Mr. C. Parthasarathy, Promoter, Chairman and Managing Director, aged about 57 years; a<br />

leader in the financial services industry in India is responsible for building KARVY as one of<br />

India’s truly integrated Financial Service provider. He is a Fellow Member of the Institute of<br />

7

Company Secretaries of India, a Fellow Member of the Institute of Chartered Accountants of<br />

India and a graduate in Law. As Chairman, he oversees the group’s operations and renders<br />

vision and business direction. His passion and vision for achieving leadership in various<br />

segments of the business have transformed KARVY into a leading financial intermediary<br />

ranking amongst the top in the Registrar, Share Transfer and IPO Distribution businesses. He<br />

has about 35 years of experience in the financial services arena. He also holds directorships<br />

in various companies of the group.<br />

Mr. M. Yugandhar, Promoter cum Director, aged about 61 years, is founder of <strong>Karvy</strong> group<br />

has varied experience in the field of financial services spanning about 35 years. He is a<br />

Fellow Member of the Institute of Chartered Accountants. He also holds directorships in<br />

various companies of the group.<br />

Mr. M.S. Ramakrishna, Promoter cum Director, aged about 59 years, founder of <strong>Karvy</strong><br />

group is orchestrator of technology initiatives such as the call center in the service of the<br />

customers. Mr.M.S Ramakrishna holds directorships in <strong>Karvy</strong> group and various other<br />

companies. He has about 32 years of experience in the financial services arena. He also<br />

holds directorships in various companies of the group.<br />

Mr. B.D. Narang, Non Promoter Director, aged about 67 years is a post graduate in Science,<br />

M.Sc. (Agr. Eco) He has held senior positions in various banks before superannuation and<br />

retiring as the Chairman and Managing Director of Oriental Bank of Commerce in the year<br />

2005. During his illustrious career, he has handled several special assignments viz, Alternate<br />

Chairman of the Committee on Banking Procedures set up by Indian banks’ Association for<br />

the year 1997-98, Chaired a panel on Serious Financial Frauds appointed by the RBI, Chaired<br />

a Panel on Financing Construction Industry appointed by Indian Banks’ Association,<br />

Appointed as Chairman of Governing Council of National Institute of Banking Studies &<br />

Corporate Management, Elected member of the Management Committee of India Banks’<br />

Association, Member of the Advisory Council of Banker Training College (RBI), Mumbai, etc.<br />

Since retirement he has handled several assignments viz, Member- Expert group formed for<br />

examining problems of distressed farmers, member- Committee to Oversee the Working of<br />

National Education & Investor Fund (Nominated by the Ministry of Co. Affairs GOL),<br />

Technical Expert for Co-option in the Audit Board for Performance Audit/Reviews in respect<br />

of Housing Finance PSUs & Hudco, Advisor- DSP Merrill Lynch, Mumbai (Dec 2003 to Sept<br />

2007).<br />

Mr. Ashish Agrawal, Non Promoter Director, aged about 39 years, holds a Bachelor’s degree<br />

in Electronics Engineering from the SGS Institute of Technology & Science, Indore. He is also<br />

a Chartered Financial Analyst and an MBA from the Indian Institute of Management,<br />

Ahmadabad. Mr. Ashish Agarwal is presently serving as the Vice President of Baring Private<br />

Equity Asia- Mumbai and is responsible for its investments in India. Prior to the current<br />

assignment with Baring, Mr. Ashish was associated with Lehman Brothers- Mumbai as a<br />

Senior Vice President. He has about 18 years of experience and has been also associated<br />

8

with the Bank of America, JM Morgan Stanley- Mumbai, ICICI Securities and CMC Limited in<br />

his various prior assignments.<br />

Ms. Vishakha Mulye, Non Promoter Director, aged about 43 years, holds a Bachelor’s<br />

degree in commerce from the University of Bombay. She is also a Chartered Accountant fom<br />

the Institute of Chartered Accountants of India. Ms. Vishakha joined the ICICI Group in 1993<br />

and has vast experience in the areas of strategy, treasury & markets, proprietary equity<br />

investing and management of long term equity investments, structured finance and<br />

corporate & project finance. From 2002 to 2005, she was responsible for the Bank’s<br />

structured finance and global markets businesses, and its financial Institutions relationships.<br />

From 2005-2007, she was the CFO of ICICI Bank. In October 2007, she was elevated to the<br />

Board of ICICI Bank’s general insurance subsidiary. ICICI Lombard General Insurance<br />

Company. In April 2009, she took over as Managing Director & CEO of ICICI Venture Funds<br />

Management Co. Ltd. She was selected as ‘Young Global Leader’ for the year 2007 by World<br />

Economic Forum. She has also been conferred the award for “Most Powerful Women in<br />

Indian Business” thrice (2007, 2009 & 2010) by Business Today.<br />

(iii) Details of the Top 10 Group companies/firms based on turnover as on March 31, 2012<br />

Name of the Company Nature of Business Status<br />

<strong>Karvy</strong> Computershare<br />

Pvt. Ltd.<br />

SEBI Registered Registrar and<br />

Share Transfer Agent<br />

Group company<br />

<strong>Karvy</strong> Consultants Ltd SEBI Registered OTCEI member Group company<br />

<strong>Karvy</strong> Comtrade Ltd. FMC/ NCDEX /MCX/NMCE/ACE /<br />

ICEX/ NCDEX Spot Exchange /<br />

National Spot Exchange<br />

registered commodity broker<br />

wholly owned subsidiary<br />

company<br />

<strong>Karvy</strong> Realty (India) Ltd. Realty Services wholly owned subsidiary<br />

company<br />

<strong>Karvy</strong> Investor Services<br />

Ltd.<br />

<strong>Karvy</strong> Insurance Broking<br />

Ltd.<br />

<strong>Karvy</strong><br />

Management<br />

Ltd.<br />

Data<br />

services<br />

<strong>Karvy</strong> Financial Services<br />

Ltd.<br />

SEBI Registered Merchant Banker<br />

and Underwriter.<br />

IRDA Registered Insurance Broker<br />

Transaction Processing<br />

Financial Services-NBFC<br />

Wholly owned subsidiary<br />

company<br />

wholly owned subsidiary<br />

company<br />

wholly owned subsidiary<br />

company<br />

wholly owned subsidiary<br />

company<br />

<strong>Karvy</strong> Capital Limited Financial Services-NBFC wholly owned subsidiary<br />

company<br />

<strong>Karvy</strong> Inc- USA Advisory Services Wholly owned subsidiary<br />

9

(iv )Details of the services being offered:<br />

Portfolio Manager offers Discretionary, Non discretionary & Advisory services as per the<br />

preference and agreement with the individual client (For more details kindly refer Annexure<br />

A).<br />

4.Penalties, pending litigation or proceedings, findings of inspection or investigations for<br />

which action may have been taken or initiated by any regulatory authority.<br />

I<br />

All cases of penalties imposed by<br />

the Board or the directions issued<br />

by Board under the Act or Rules or<br />

Regulations made there under<br />

The Whole Time Member of Securities<br />

and Exchange Board of India<br />

(“SEBI”) had passed a common final<br />

order dated June 22, 2007 (“Order”)<br />

against the KSBL – Stock Broker, KSBL<br />

– Depository participant and <strong>Karvy</strong><br />

Computershare Private Limited (KCPL)<br />

in the matter of IPO irregularities.<br />

Against the appeal made by KSBL and<br />

KCPL, Hon’ble SAT set aside the order<br />

and remanded the cases to SEBI with a<br />

direction to pass three separate<br />

orders on the three show causes<br />

issued by the learned whole time<br />

member. The Whole Time Member of<br />

SEBI has granted a personal hearing as<br />

per the order of Hon’ble SAT which<br />

and the matter is yet to conclude.<br />

Pending<br />

Ii The nature of penalty/direction As above<br />

SEBI has initiated proceedings against<br />

the company and its directors before<br />

the additional chief metropolitan<br />

magistrate, Mumbai, with respect to<br />

the investigation conducted by SEBI in<br />

various IPOs.<br />

Iii Penalties imposed for any<br />

economic offence and/or for<br />

violation of any securities laws<br />

Iv Any pending material<br />

litigation/legal proceedings against<br />

the Portfolio Manager/key<br />

personnel with separate disclosure<br />

regarding pending criminal cases, if<br />

any<br />

None<br />

SEBI has initiated proceedings against<br />

KSBL and its directors before the<br />

additional chief metropolitan<br />

magistrate, Mumbai, with respect to<br />

the investigation conducted by SEBI in<br />

10<br />

Pending

various IPOs.<br />

v<br />

Any deficiency in the systems and<br />

operations of the Portfolio<br />

Manager observed by the Board or<br />

any regulatory agency<br />

Vi Any enquiry/adjudication<br />

proceedings initiated against the<br />

Portfolio Manager or its directors,<br />

principal officer or employee or<br />

any person directly or indirectly<br />

connected with the Portfolio<br />

Manager or its directors, principal<br />

officer or employee, under the Act<br />

or Rules or Regulations made there<br />

under<br />

Not Applicable<br />

Not Applicable<br />

5) Services Offered<br />

5.1 The Portfolio Manager offers the following three types of Services<br />

a. Discretionary<br />

The Portfolio account of the client is managed at the full Discretion and liberty of Portfolio<br />

Manager.<br />

Under these services, the choice as well as the timings of the investment decisions rest<br />

solely with the Portfolio Manager. The Portfolio Manager may at times and at its own<br />

discretion, adhere to the views of the Client pertaining to the investment /disinvestment in<br />

the Client’s Portfolio. The Portfolio Manager shall have the sole and absolute discretion to<br />

invest in respect of the Client’s account in any type of security as per the Agreement and<br />

make such changes in the investments and invest some or all of funds in the Client’s account<br />

in such manner and in such markets as it deems fit. The Client may give informal guidance to<br />

customize the portfolio strategies; however, the final decision rests with the Portfolio<br />

Manager. The securities invested / disinvested by the Portfolio Manager for Clients in the<br />

same Strategy may differ from one Client to another Client. The Portfolio Managers’ decision<br />

(taken in good faith) in deployment of the Clients’ account is absolute and final and can<br />

never be called in question or be open to review at any time during the currency of the<br />

agreement or any time thereafter except on the ground of malafide, fraud, conflict of<br />

interest or gross negligence. This right of the Portfolio Manager shall be exercised strictly in<br />

accordance with the relevant Acts, Rules, and Regulations, guidelines and notifications in<br />

force from time to time.<br />

11

Under these services, the Clients may authorize the Portfolio Manager to invest their Funds<br />

in specific financial instruments or a mix of specific financial instruments or restrict the<br />

Portfolio Manager from investing in specific financial instruments or securities. Periodical<br />

statements in respect of Client’s Portfolio shall be sent to the respective Clients.<br />

Portfolio Strategy:<br />

1. K-Sensible Portfolio – this is a long term oriented strategy with a low churn rate and<br />

ideal for investors with a two to three year investment objective<br />

2. K-Aggressive Portfolio – this strategy provides a balance between growth and safety<br />

by employing a strategy of systematic profit booking. This strategy has a medium<br />

churn rate and is ideal for investors with a one to two year investment objective.<br />

3. K-Energetic Portfolio – this strategy provides returns by following an aggressive<br />

style of investing which entails higher risks. This strategy has a high churn rate and is<br />

ideal for investors with a 12 to 15 month investment objective.<br />

4. Alpha Portfolio – this is designed for those investors who seek long-term capital<br />

appreciation from their asset allocation to equities. The portfolio manager will invest<br />

in stocks across sectors, market capitalization categories and investment themes.<br />

5. Delta Portfolio – This is designed for those investors who seek long-term capital<br />

appreciation from their asset allocation to equities and debt. The portfolio will<br />

invest in mutual funds across sectors, market capitalization categories and<br />

investment themes.<br />

6. Omega Portfolio – This is designed for those investors who seek long-term capital<br />

appreciation from their asset allocation to equities, debt, gold and other asset<br />

classes which are available through either exchange traded products or through<br />

mutual funds.<br />

7. Theta Portfolio – This is designed for those investors who seek income and longterm<br />

capital appreciation from their asset allocation to debt.<br />

8. Alpha Plus Portfolio – This is a diversified portfolio with investments in stocks across<br />

sectors, market capitalizations and investment themes.<br />

9. Gamma Portfolio – Gamma Portfolio aims to generate Capital appreciation in the<br />

medium term through investments in equities. It would aim to invest in high growth<br />

companies with sustainable business models backed by strong management<br />

capabilities.<br />

10. PSI Portfolio – This is designed for those investors who seek long-term capital<br />

appreciation from their asset allocation to equities and other investment vehicles,<br />

and to outperform the market in the long run. The portfolio will invest in equity,<br />

equity related instruments and other alternative asset classes.<br />

12

11. Aurous portfolio - This is designed for those investors who seek long-term capital<br />

appreciation from their asset allocation primarily to debt and gold and other<br />

investment vehicles as may be required.<br />

Note: The Aurous Portfolio shall be introduced with effect from February 15, 2013<br />

12. Zeta portfolio - This is designed for those investors who seek long-term capital<br />

appreciation from their asset allocation to equities, debt, gold, stock futures and<br />

options and other asset classes which are available through either exchange traded<br />

products, Over the counter products or through mutual funds<br />

Note: The Zeta Portfolio shall be introduced with effect from February 15, 2013<br />

b. Non Discretionary<br />

Non-Discretionary Portfolio is the Portfolio which Portfolio Manager manages in<br />

consultation with and as per the directions or consent of the client. Under these services,<br />

the Clients decide their own investments with the Portfolio Manager only facilitating the<br />

execution of transactions. The .Portfolio Manager’s role would include but not limited to<br />

providing research, structuring of clients’ portfolios, investment advice and guidance and<br />

trade execution at the Client’s request. The Portfolio Manager shall execute orders as per<br />

the mandate received or consent obtained from the Client. The deployment of the Client’s<br />

Funds by the Portfolio Manager shall be as per the instructions or consent of the Client. The<br />

rights and obligations of the Portfolio Manager shall be exercised strictly in accordance with<br />

the Act, Rules and/or Regulations, guidelines and notifications in force from time to time.<br />

Periodical statements in respect of Client’s Portfolio shall be sent to the respective Clients.<br />

The following are illustrative, but not exhaustive, investment strategies available for client<br />

availing Non-Discretionary Portfolio Management Services.<br />

1. Equity Portfolio: Equity Portfolio (Non discretionary) are designed for those<br />

investors who seek long-term capital appreciation from their asset allocation to<br />

equities. The portfolio manager will invest in stocks across sectors, market<br />

capitalization categories and investment themes, in consultation with and as per<br />

directions or consent of the client.<br />

2. Non Convertible Debentures: The Non Convertible Debentures are debentures<br />

which do not get converted into equity and normally attract a fixed rate of return.<br />

The Non-convertible Debentures may be listed or unlisted.<br />

Investments will be made in the Non Convertible Debentures in consultation with<br />

and as per directions or the consent of the client.<br />

13

3. Structured product: The Structured products are designed for those investors who<br />

want returns linked to price movement of any Equity index, basket of stocks,<br />

commodities, precious metals, etc., with a predefined level of capital protection.<br />

Structured Products may be principal or non principal protected or may not have<br />

any protection at all. Investments will be made in the structured products in<br />

consultation with and as per directions or the consent of the client.<br />

4. Non Convertible Debentures as part of Structured Products<br />

Non convertible Debentures are normally issued with a fixed rate of Interest. In case<br />

of Non convertible Debentures issued as part of a structured product, the returns on<br />

Non-convertible debentures may be linked to the price movement of an underlying<br />

or derivative thereof. Investments will be made in such products in consultation with<br />

and as per directions or consent of the client.<br />

5. Omega Portfolio<br />

It is designed for those investors who seek long-term capital appreciation from their<br />

asset allocation to equities, debt, gold and other asset classes which are available<br />

through either exchange traded products or through mutual funds.<br />

6. Optima Portfolio<br />

It is designed for those investors who seek capital appreciation from their asset<br />

allocation to Equities, debt and gold.<br />

7. Alpha Portfolio<br />

It is designed for those investors who seek aggressive capital appreciation from their<br />

equity asset allocation. The portfolio will invest in stocks across sectors, market<br />

capitalization categories and investment themes.<br />

Note: The Alpha Portfolio has been introduced with effect from 1/02/2012.<br />

c. Advisory<br />

Portfolio Manager will provide advisory services, as per the Regulations, which shall be in<br />

the nature of investment advice and shall include the responsibility of advising on the<br />

portfolio strategy, investment, disinvestment of the various stocks in the client’s portfolio,<br />

for an agreed fee, entirely at the client’s risk. This service will be purely of advisory in nature<br />

under an agreed fee structure with the client. It is up to the client to accept the<br />

14

ecommendations/advice of Portfolio Manager and Portfolio Manager will not be held<br />

responsible for any consequence arising out of acceptance of Portfolio Manager’s advice<br />

under this service.<br />

“Equity Advisory Portfolio (Advisory) product” has been designed for those investors who<br />

seek long-term capital appreciation from their asset allocation to equities. The portfolio<br />

manager will provide the advice to invest in stocks across sectors; market capitalization<br />

categories and investment themes but the decision to invest will be of the client.<br />

5.2 Present Investment Objective<br />

The General Objective is to formulate and device the investment philosophy to<br />

achieve long term growth of capital by investing in assets, which generate<br />

reasonable return and to ensure liquidity. The actual portfolio management style<br />

will vary in line with profile of each client with regards to his risk tolerance levels and<br />

specific preferences or concerns. (The specific objective will be as mentioned in the<br />

agreement with the client).<br />

5.3 Types of securities<br />

The Portfolio Manager/Fund Manager shall invest in all such types of Securities as<br />

defined (kindly refer to the definition) and in all such Securities as permissible from<br />

time to time.<br />

5.4 Investment in Group / associate companies<br />

The Portfolio Manager/Fund Manager may invest in Securities of the<br />

associate/group companies subject to the applicable laws/ regulations/ guidelines.<br />

These investments will be carried out to achieve the investment objectives and<br />

strategies and in the normal course of investment activity subject to the applicable<br />

laws/regulations.<br />

The Portfolio Manager / Fund Manager shall not make any investments in any<br />

unlisted securities of associate/group companies of the Portfolio Manager/<br />

promoter. The Portfolio Manager / Fund Manager will also not make investment in<br />

privately placed securities issued by Associate/Group companies of the promoter.<br />

The Portfolio Manager may invest not more than 25% of the portfolio of an<br />

individual client in the listed securities of the Group companies.<br />

5.5 Minimum Investment Amount<br />

The Portfolio Manager shall not accept funds / securities from the new clients,<br />

cumulative value of which is less than Rupees TwentyFive Lakhs or as specified in<br />

the agreement with the Portfolio Manager or as amended/specified in the SEBI<br />

(portfolio managers) regulations, 1993. The Portfolio Manager shall make necessary<br />

15

6) Risk factors<br />

amendments on Minimum Investment Amount and shall be applicable on<br />

prospective basis.<br />

1. Investments in securities are subject to market risks including price volatility and<br />

liquidity risk and there is no assurance or guarantee that the objectives of the strategy<br />

will be achieved. The investment may not be suited for all categories of investors. The<br />

past or present performance of these strategies does not indicate the future<br />

performance of the same strategy or any other future strategies launched subsequently<br />

by Portfolio Manager. With reference to appreciation on the portfolio, the investors are<br />

not being offered any guaranteed or indicative returns through any of the strategies.<br />

The Portfolio Manager also does not guarantee any capital protection for any strategy.<br />

2. There are inherent risks arising out of investment objectives, investment strategy, asset<br />

allocation and non-diversification of portfolio. The investment objective, investment<br />

strategy and asset allocation may differ from client to client. However, generally, highly<br />

concentrated portfolios with lesser number of stocks will be more volatile than a<br />

portfolio with a larger number of stocks. Portfolios with higher allocation to equities will<br />

be subject to higher volatility that portfolios with low allocation to equities. Diversified<br />

portfolios (allocated across companies and broad sectors) generally tend to be less<br />

volatile than non diversified portfolios. The names of the various strategies do not in any<br />

manner indicate their prospects or returns.<br />

3. Investment decisions made by the Portfolio Manager may not always be profitable since<br />

actual market movement may be at variance with anticipated trends.<br />

4. ETF may trade above or below their NAV. The NAV of ETF will fluctuate with changes in<br />

market value of scheme’s holdings of underlying stocks. However, given that ETF can be<br />

created and redeemed only in creation units directly with the Mutual Fund, it is<br />

expected that large discounts or premiums to the NAVs of ETFs will not sustain due to<br />

availability of arbitrage possibility. Any changes in trading regulations by the Exchange<br />

(s) or SEBI may affect the ability of market maker to arbitrage resulting into wider<br />

premium / discount to NAV for ETFs.<br />

5. The performances of the strategies depend on the performance of the market and the<br />

individual companies in which investment have been made under strategies relative to<br />

industry specific and macro economic factors. The Portfolio Manager does not assure or<br />

guarantee that Performance of Portfolio of the Investor shall better the Performance of<br />

any Benchmark Index.<br />

6. The tax benefits described in this <strong>Disclosure</strong> <strong>Document</strong> are as available under the<br />

present taxation laws and are available subject to conditions. The information given is<br />

included for general purpose only and is based on advice received by the Portfolio<br />

Manager regarding the law and practice in force in India and the investors should be<br />

aware that the relevant fiscal rules or their interpretation may change. As is the case<br />

with any investment, there can be no guarantee that the current tax position or the<br />

proposed tax position prevailing at the time of an investment in the Portfolio will endure<br />

indefinitely. In view of the individual nature of tax consequences, each investor is<br />

16

advised to consult his/her own professional tax advisor regarding the taxation aspects of<br />

his/ her portfolio investments.<br />

7. Prospective investors should review/ study this <strong>Disclosure</strong> <strong>Document</strong> carefully and in its<br />

entirety and shall not construe the contents hereof or regard the summaries contained<br />

herein as advice relating to legal, taxation, or financial/investment matters. Prospective<br />

investors are advised to consult their own professional advisor(s) as to the legal, tax,<br />

financial or any other requirements or restrictions relating to the subscription, gifting,<br />

acquisition, holding, disposal (sale or conversion into money) of Portfolio and to the<br />

treatment of income(if any), capitalization, capital gains, any distribution, and other tax<br />

consequences relevant to their portfolio, acquisition, holding, capitalization, disposal<br />

(sale, transfer or conversion into money) of portfolio within their jurisdiction of<br />

nationality, residence, incorporation, domicile etc. or under the laws of any jurisdiction<br />

to which they or any managed funds to be used to purchase/gift portfolio of securities<br />

are subject, and also to determine possible legal, tax, financial or other consequences of<br />

subscribing/gifting, purchasing or holding portfolio of securities before making an<br />

investment.<br />

8. The debt investments and other fixed income securities may be subject to interest rate<br />

risk, liquidity risk, credit risk and reinvestment risk. Liquidity in these investments may<br />

be affected by trading volume, settlement period and transfer procedures. Issuer of<br />

fixed income security may default or may be unable to make timely payments of<br />

principal and interest. Net Asset Value of portfolio may be affected due to perceived<br />

level of credit risk as well as actual event of default.<br />

9. The corporate debt market is relatively illiquid vis-à-vis the government securities<br />

market. There could therefore be difficulties in exiting from corporate bonds in times of<br />

uncertainties. Further, liquidity may occur only in specific lot sizes. Liquidity in a security<br />

can therefore suffer. Even though the Government securities market is more liquid<br />

compared to that of other debt instruments, on occasions, there could be difficulties in<br />

transacting in the market due to extreme volatility or unusual constriction in market<br />

volumes or on occasions when an unusually large transaction has to be put through.<br />

There can be no assurance that the requirements of the securities market necessary to<br />

maintain the listing of specified debt security will continue to be met or will remain<br />

unchanged.<br />

10. Exposure to select Sector(s) carries the performance risk of the relevant sector, which<br />

could outperform or underperform the market and/or various indices.<br />

11. Technology and pharmaceutical stocks and some of the investments in niche sectors run<br />

the risk of volatility, high valuation, obsolescence and low liquidity.<br />

12. Frequent rebalancing of portfolio may result in higher brokerage / transaction cost. Also<br />

the allocation to different securities can vary from 0 to 100 %, hence there can be a vast<br />

difference between the performance of the products and returns generated by<br />

underlying securities.<br />

13. Information available on some companies in which the Portfolio manager has made<br />

investments may be limited.<br />

17

14. The performance of the strategies may be affected by change in Government Policies<br />

including taxation, and certain unforeseen developments in political or general areas at<br />

the national or international level. Also, the investments are subject to external risks<br />

such as war, natural calamities and policy changes of local / international markets which<br />

affect stock markets.<br />

15. The performance of the strategies may also be affected and investor could lose money<br />

over short periods due to fluctuation in NAV of Portfolio arising out of fluctuations of<br />

interest rates, credit risk, political and geopolitical risk, currency risk, foreign exchange<br />

risks, foreign investments, risks arising from changing business dynamics, risk associated<br />

with investment in securities debt, risk due to movement in Futures and options<br />

markets, changes in the general market conditions, forces affecting the capital markets,<br />

closure of stock exchange due to circuit filter rules or otherwise and risks associated<br />

with trading volumes, settlement periods, transfer procedures, liquidity and settlement<br />

systems in equity and debt markets.<br />

16. There is a possibility that loss may be sustained by the Portfolio as a result of the failure<br />

of another party (usually referred as the “Counter party”) to comply with the terms of<br />

the derivative contract.<br />

17. Portfolio Manager, subject to authorization in writing by the client, may participate in<br />

securities lending. Engaging in securities lending is subject to risks related to fluctuations<br />

in collateral value/settlement/liquidity/default from counter party, including corporate<br />

benefits accrued thereon. This may lead to the risk of Approved Intermediary unable to<br />

deliver back the securities. Portfolio Manager cannot be held liable for any loss arising<br />

out of operation of such strategies.<br />

The portfolio manager may in the course of its activities, avail the services of persons /<br />

bodies who are not employees of the portfolio manager. The portfolio manager would<br />

exercise due diligence when employing such persons, however there may be losses<br />

incurred on account of any act or omission on part of such persons or bodies. The<br />

portfolio manager disclaims liability for any loss in the portfolio on this account.<br />

All portfolios under portfolio management are subject to change at anytime at the<br />

discretion of the Portfolio Manager.<br />

18. In the case of stock lending, risks relate to the defaults from counterparties with regard<br />

to securities lent and the corporate benefits accruing thereon, inadequacy of the<br />

collateral and settlement risks. The Portfolio Manager is not responsible or liable for any<br />

loss resulting from the operations of the strategies/options.<br />

19. Investments in the Market Linked Debentures (MLDs) are also subject to model risk. The<br />

MLDs are created on the basis of complex mathematical models involving multiple<br />

derivative exposures which may or may not be hedged and the actual behavior of the<br />

securities selected for hedging may significantly differ from the returns predicted by the<br />

mathematical models.<br />

20. Strategies may use derivative instrument like futures and options (index as well as<br />

individual securities), warrants, convertible securities, swap agreements, etc. for the<br />

18

purpose of hedging and/or portfolio balancing, as permitted under the<br />

Regulations/guidelines. Strategies using such derivative products may be affected by<br />

risks different from those associated with stock and bonds. Such derivative products are<br />

highly leveraged instruments and their use requires a high degree of skill, expertise and<br />

diligence. Small price movements in the underlying security may have a large impact on<br />

the value of the derivatives and futures and options and may also result in loss. Some of<br />

the risks relate to mis-pricing or the improper valuation of the derivatives/futures and<br />

option and the inability to correlate the positions with the underlying assets, rates and<br />

indices. The risk of loss associated with futures contracts is potentially unlimited due to<br />

the low margin deposits required and the extremely high degree of leverage involved in<br />

futures pricing. Also, the derivatives/future and options market is nascent in India.<br />

The liquidity of the investments is guided by trading volumes in the securities in which it<br />

invests. Although securities may be listed on the Exchange(s), there can be no assurance<br />

that an active secondary market will develop or be maintained. This may limit the<br />

Portfolio Manager’s ability to freely deal with securities in the Portfolio and may lead to<br />

incurring of losses till the security is finally sold. Different segments of the financial<br />

markets have different settlement periods and such periods may be extended<br />

significantly due to unforeseen circumstances. The inability of a Portfolio to make<br />

intended securities purchase due to settlement problems could cause the portfolio to<br />

miss certain investment opportunities. Similarly, the inability to sell securities held in the<br />

portfolio due to absence of a well developed and liquid secondary market would at<br />

times result in potential losses in the Portfolio, in case of a subsequent decline in the<br />

value of securities held in the Portfolio.<br />

21. The Portfolio Manager may invest in non-publicly offered debt securities and unlisted<br />

securities. This may expose client’s portfolio to liquidity risks.<br />

22. Securities, which are not listed on the Stock Exchanges, are inherently illiquid in nature<br />

and carry a larger amount of liquidity risk, in comparison to securities that are listed on<br />

the Exchanges or offer other exit options to the investor, including a PUT option. The<br />

Portfolio Manager may, considering the overall level of risk of the Portfolio, invest in<br />

lower rated/unrated securities that offer attractive yield, which may increase the risk of<br />

the Portfolio. Such investments shall be subject to the scope of investments laid down<br />

in the executed agreement.<br />

23. The Portfolio Manager may seek to create value by investing in stocks that trade below<br />

the estimated fair value of the Company, which shall be judged by various quantitative<br />

valuation parameters. But due to various reasons, it may so happen that such stocks<br />

continue to languish and are not able to attain the price discovery. Accordingly, this may<br />

have material adverse impact on the performance of the portfolio.<br />

24. After accepting the corpus for management, the Portfolio Manager may not get an<br />

opportunity to deploy the same or there may be delay in deployment. In such situation<br />

the clients may suffer opportunity loss.<br />

19

7) Client Representation<br />

i. Category of clients as on December 31 ,2012.<br />

Category of Clients No of Clients Funds<br />

Managed<br />

(Rs. In Crs)<br />

Associate/Group companies<br />

As on 31 st December, 2012. - -<br />

As on 31 st March 2012. - -<br />

As on 31 st March, 2011. - -<br />

As on 31 st March, 2010. - -<br />

Others<br />

Remarks<br />

As on 31 st December, 2012. 409 100.14 Discretionary, Nondiscretionary<br />

As on 31 st March 2012. 467 67.58 Discretionary, Nondiscretionary<br />

As on 31 st March, 2011. 309 25.96 Discretionary, Nondiscretionary<br />

As on 31 st March, 2010. 49 7.94 Discretionary & Nondiscretionary<br />

Total<br />

As on 31 st December,2012. 409 100.14 Discretionary, Nondiscretionary<br />

As on 31 st March 2012. 467 67.58 Discretionary, Nondiscretionary<br />

As on 31 st March, 2011. 309 25.96 Discretionary, Nondiscretionary<br />

As on 31 st March , 2010. 49 7.94 Discretionary & Nondiscretionary<br />

Sr.<br />

No<br />

ii.Complete disclosure in respect of transactions with related parties as per the standards<br />

specified by the Institute of Chartered Accountants of India (as on 31 st March 2012)<br />

Name of the related party<br />

Nature of Transaction<br />

Amount<br />

2011-12 2010-11<br />

1<br />

<strong>Karvy</strong> Consultants Limited<br />

Loans and advances<br />

given/(repaid),net<br />

13,12,867<br />

(3,99,93,432)<br />

(Group Company) Balance at year end 4,17,39,076<br />

4,04,26,209<br />

20

2<br />

<strong>Karvy</strong> Computershare Pvt.<br />

Limited<br />

Trading in securities<br />

15,29,614 5,31,85,299<br />

(Group Company) Rent (paid) / received 13,89,727 13,32,075<br />

Reimbursement of expenses 35,55,672 -<br />

3 <strong>Karvy</strong> Investor Services Limited<br />

(Subsidiary company)<br />

Interest on advances received<br />

/ (paid), net (16,22,083) (1,65,71,604)<br />

Loans and advances given /<br />

(repaid), net# (44,79,497)<br />

14,57,31,059<br />

Reimbursement of expenses 1,67,20,534<br />

75,14,301<br />

Balance at year end 2,58,947 47,38,444<br />

4 <strong>Karvy</strong> Comtrade Limited<br />

(Subsidiary company) Trading in securities 1,658 29,79,482<br />

Interest on advances received<br />

/ (paid), net (14,78,438)<br />

Loans and advances given /<br />

(repaid), net (12,02,38,033)<br />

(14,18,219)<br />

10,50,00,000<br />

Reimbursement of expenses 13,75,06,936<br />

4,23,25,075<br />

Balance at year end 5,399 12,02,43,432<br />

5<br />

<strong>Karvy</strong> Insurance Broking<br />

Limited<br />

(Subsidiary company)<br />

Interest on advances received<br />

/ (paid), net<br />

36,62,121 13,50,177<br />

Loans and advances given /<br />

(repaid), net (90,18,812)<br />

2,87,15,159<br />

21

Reimbursement of expenses 50,85,278 1,08,16,752<br />

Balance at year end 3,87,37,348<br />

4,77,56,160<br />

6<br />

<strong>Karvy</strong> Data Management<br />

Services Limited<br />

(Subsidiary company)<br />

Interest on advances received<br />

/ (paid), net<br />

74,30,110 8,81,712<br />

Rent (paid) / received 55,21,464 56,15,064<br />

Investment in equity shares 3,00,00,000<br />

5,40,00,000<br />

Loans and advances given /<br />

(repaid), net 5,07,17,053 (1,53,49,521)<br />

Reimbursement of expenses 11,32,31,433<br />

5,14,17,344<br />

Advance for investments 2,00,00,000<br />

Balance at year end 5,48,07,483<br />

40,90,430<br />

7 <strong>Karvy</strong> Financial Services Limited<br />

(Subsidiary company) Trading in securities 31,35,48,725<br />

Interest on advances received<br />

/ (paid), net 19,76,83,848<br />

93,68,33,765<br />

1,66,81,918<br />

Investment in equity shares - 10,00,00,000<br />

Loans and advances given /<br />

(repaid), net (36,88,60,618)<br />

49,84,48,195<br />

Reimbursement of expenses 7,48,10,253<br />

1,35,06,051<br />

Balance at year end 2,03,486 36,90,64,104<br />

Trade payables / (receivables) 95,59,345 89,10,600<br />

22

8<br />

<strong>Karvy</strong> Forex & Currencies<br />

Private Limited<br />

(Subsidiary company) Investment in equity shares - 1,75,000<br />

Loans and advances given /<br />

(repaid), net<br />

82,840 1,41,983<br />

Reimbursement of expenses 79,934 1,25,219<br />

Balance at year end 31,96,163 31,13,323<br />

<strong>Karvy</strong> Realty (India) Limited<br />

(Subsidiary company)<br />

Loans and advances given /<br />

(repaid), net<br />

42,90,750 (50,00,000)<br />

Reimbursement of expenses 47,58,912 6,47,884<br />

Balance at year end 95,61,44,390<br />

95,18,53,640<br />

9 <strong>Karvy</strong> Capital Limited<br />

(Subsidiary company) Trading in securities 28,95,94,049<br />

Interest on advances received<br />

/ (paid), net (3,42,096)<br />

2,45,87,572<br />

-<br />

Investment in equity shares 4,00,00,000<br />

Loans and advances given /<br />

(repaid), net 2,05,17,242<br />

30,00,000<br />

-<br />

Reimbursement of expenses 56,96,678 -<br />

Balance at year end 2,05,17,242<br />

-<br />

Trade payables / (receivables) 1,08,06,504<br />

47,17,218<br />

23

10 <strong>Karvy</strong> Holdings Limited<br />

(Subsidiary company) Investment in equity shares 5,00,000 -<br />

11 <strong>Karvy</strong> Asia Pacific Pte Limited<br />

(Subsidiary company) Investment in equity shares 5,15,73,040<br />

-<br />

12 <strong>Karvy</strong> Inc., USA<br />

(Subsidiary company) Investment in equity shares 1,41,31,750<br />

7,59,96,900<br />

13 Indigo Tx Software Pvt Limited<br />

(Associate)<br />

Interest on advances received<br />

/ (paid), net<br />

- 1,64,548<br />

Loans and advances given /<br />

(repaid), net (5,67,288) (1,44,75,870)<br />

Balance at year end - 5,67,288<br />

14 Mr. M. S. Ramakrishna<br />

(Key Management Personnel) Remuneration paid 40,16,020 40,16,020<br />

15 Ms. Spandana Mulpuri Remuneration paid - 19,538<br />

(Relatives of Key Management<br />

Personnel)<br />

24

8) The Financial Performance of Portfolio Manager (based on audited financial statements)<br />

As at<br />

31st March, 2012<br />

Rs in Lacs<br />

As at<br />

31st March, 2011<br />

Rs in Lacs<br />

As at<br />

31st March, 2010<br />

Rs in Lacs<br />

SOURCES OF FUNDS<br />

Shareholders' Funds 35,248.15 34,865.56 33,827.10<br />

Share Application Money 174.20 174.20 174.20<br />

Loan Funds 56,022.84 23,030.85 3,434.70<br />

Deferred Tax Liability - - -<br />

Total 91,445.19 58,070.61 37,436.00<br />

APPLICATION OF FUNDS<br />

Net Fixed Assets 15,992.06 18,149.00 17,651.43<br />

Stock Exchange Membership Cards 15.75 21.00 26.25<br />

Investments 17,392.55 18,002.92 15,670.02<br />

Current Assets 73,824.32 44,954.71 33,024.30<br />

Less: Current Liabilities and Provisions 15,908.43 23,228.74 28,984.70<br />

Net Current Assets 57,915.89 21,725.97 4,039.60<br />

Deferred Tax Asset 128.94 171.76 48.70<br />

Total 91,445.19 58,070.61 37,436.00<br />

Summarized Financial Statement - Profit and Loss Account<br />

For the year ended<br />

31st March, 2012<br />

Rs. Lacs<br />

For the year<br />

ended<br />

31st March,<br />

2011<br />

Rs. Lacs<br />

For the year ended<br />

31st March, 2010<br />

Rs. Lacs<br />

Total Income 25,658.97 24,105.18 26,415.53<br />

Total Expenses 24,086.71 20,176.86<br />

25

21,200.72<br />

Profit before Depreciation and Tax 1,572.26 2,904.47 6,238.68<br />

Depreciation/Amortisation 1,146.87 1,288.22 1,392.88<br />

Profit before Tax 425.39 1,616.24 4,845.79<br />

Provision for Tax 42.81 (577.77) 1,625.75<br />

Profit After Tax 382.58 1,038.47 3,220.04<br />

9) Portfolio Management performance of Portfolio Manager, for the last three years , and<br />

in case of discretionary Portfolio Manager disclosure of performance indicators calculated<br />

using weighted average method in terms of Regulation 14 of the SEBI (Portfolio Managers)<br />

Regulations, 1993. Find below the Performance of the Portfolio Manager calculated using<br />

weighted average Method for the three financial years 2009-10, 2010-11, 2011-12 and<br />

upto December 31, 2012.<br />

Portfolio performance is a percentage, net of all fees and charges levied by the Portfolio<br />

Manager<br />

Returns%<br />

Period<br />

01.04.2012-<br />

31.12.2012<br />

01.04.2011-<br />

31.03.2012<br />

01.04.2010-<br />

31.03.2011<br />

01.04.2009-<br />

31.03.2010<br />

Discretionary PMS- Resident<br />

Portfolio<br />

Performance (%)<br />

Benchmark<br />

Performance (%)<br />

K Energetic 6 -32.49 -41.26 6.96<br />

CNX Midcap 5.81 -5.11 -16.92 11.52<br />

Portfolio<br />

Performance (%)<br />

Benchmark<br />

Performance (%)<br />

K Aggressive 12.49 -0.06 -28.94 35.87<br />

CNX Midcap 8.21 -7.49 -1.53 109.61<br />

26

Portfolio<br />

Performance (%)<br />

K Sensible 0.37 -14.62 -27.5 10.97<br />

Benchmark<br />

Performance (%)<br />

S & P CNX<br />

Nifty<br />

7.59 -11.25 13.01 31.65<br />

Portfolio<br />

Performance (%)<br />

Alpha 16.58 -12.06 -2.84 N.A.<br />

Benchmark<br />

Performance (%)<br />

S&P CNX<br />

Nifty<br />

10.67 -2.49 8.17 N.A.<br />

Portfolio<br />

Performance (%)<br />

Alpha Plus 10.02 3.72 N.A. N.A<br />

Benchmark<br />

Performance (%)<br />

S&P CNX<br />

Nifty<br />

19.26 -1.48 N.A N.A<br />

Portfolio<br />

Performance (%)<br />

Delta 11.24 -3.68 0.69 N.A.<br />

Benchmark<br />

Performance (%)<br />

BSE 200<br />

Index<br />

11.11 -4.83 7.33 N.A.<br />

Portfolio<br />

Performance (%)<br />

Omega 10.5 -3.58 -3.04 N.A.<br />

Benchmark<br />

Performance (%)<br />

BSE 200<br />

Index<br />

16.02 -5.97 0.74 N.A.<br />

Portfolio<br />

Performance (%)<br />

Benchmark<br />

Performance (%)<br />

Gamma 18.34 37.53 N.A. N.A.<br />

CNX Midcap 18.55 45.28 N.A. N.A.<br />

Portfolio<br />

Performance (%)<br />

Theta NA N.A N.A. N.A.<br />

Benchmark<br />

Performance (%)<br />

Crisil<br />

Composite<br />

Bond Index<br />

NA N.A N.A. N.A.<br />

27

Portfolio<br />

Performance (%)<br />

Benchmark<br />

Performance (%)<br />

PSI -17.67 N.A N.A. N.A.<br />

S&P CNX 500 18.75 N.A N.A. N.A.<br />

Discretionary PMS - Non Resident<br />

Portfolio<br />

Performance (%) K Sensible 15.01 -9.74 N.A. N.A.<br />

Benchmark<br />

Performance (%)<br />

S&P CNX<br />

Nifty<br />

11.51 -9.23 N.A. N.A.<br />

Portfolio<br />

Performance (%) Delta 13.35 -1.6 N.A. N.A.<br />

Benchmark<br />

Performance (%)<br />

BSE 200<br />

Index<br />

12.49 -3.26 N.A. N.A.<br />

Portfolio<br />

Performance (%)<br />

Benchmark<br />

Performance (%)<br />

Alpha 16.53 -10.51 N.A. N.A.<br />

S&P CNX<br />

Nifty<br />

11.51 -6.64 N.A. N.A.<br />

Portfolio<br />

Performance (%)<br />

Benchmark<br />

Performance (%)<br />

Alpha Plus 16.25 -0.9 N.A. N.A.<br />

S&P CNX<br />

Nifty<br />

11.51 4.89 N.A. N.A.<br />

Portfolio<br />

Performance (%) Omega 11.05 -3.4 N.A. N.A.<br />

Benchmark<br />

Performance (%)<br />

BSE 200<br />

Index<br />

13.11 -9.13 N.A. N.A.<br />

Non Discretionary PMS- Resident<br />

Portfolio<br />

Performance (%)<br />

K Series 4.37 -19.56 -17.48 10.25<br />

28

Portfolio<br />

Performance (%)<br />

Structured<br />

Products<br />

4.8 -3.86 -2.5 N.A.<br />

Portfolio<br />

Performance (%) Optima 16.63 4.94 N.A. N.A.<br />

Portfolio<br />

Performance (%) Alpha 16.44 N.A. N.A. N.A.<br />

Portfolio<br />

Performance (%) Omega N.A N.A N.A. N.A.<br />

Non Discretionary PMS- Non Resident<br />

Portfolio<br />

Performance (%)<br />

Optima 8.68 -1.98 N.A. N.A.<br />

Note:<br />

Dates of inception of the below discretionary Portfolio Management strategies are as<br />

follows:<br />

Delta : November 23, 2010 ; Omega: December 22, 2010 & PSI: April, 30 , 2012<br />

Date of inception of Structured Products offered as part of Non Discretionary Portfolio<br />

Management services is as follows:<br />

G-11: July 12, 2010 ; G-16: September 13, 2010 ; G-17: October 1, 2010<br />

Portfolio Management performance of Resident Individual and Non Resident Indian were<br />

clubbed till March 31, 2011. However, from April 1, 2011, the same has been shown<br />

separately.<br />

10) Nature of Expenses<br />

The following are the general costs and expenses to be borne by the Client availing the<br />

services by the Portfolio Manager. However, the exact nature of expenses relating to each<br />

of the following services is annexed to the Portfolio Management Agreement in respect of<br />

each of the services provided.<br />

(i) Portfolio Management and Advisory Fees<br />

This fee relates to the portfolio management services offered by Portfolio Manager<br />

(including advisory services) to the clients. The fee may be a Fixed Charge on the quantum<br />

of the funds being managed (or) charges linked to portfolio return (or) combination of both.<br />

For details kindly refer the annexure to this Risk <strong>Disclosure</strong> <strong>Document</strong>.<br />

29

(ii) Premature Redemption Charges<br />

If the redemption is done prematurely at the option of the client, the Portfolio Manager will<br />

levy the Premature Redemption Charges. For details kindly refer the annexure to this Risk<br />

<strong>Disclosure</strong> <strong>Document</strong>.<br />

(iii) Custodian/Depository Participant fee<br />

The charges relating to opening and operation of demat accounts, custody and transfer<br />

charges for shares, bonds and units, dematerialization and rematerialization, pledge and<br />

unpledged, etc. will be as per the actual charged by the Depository Participant/Custodian.<br />

For details kindly refer the annexure to this Risk <strong>Disclosure</strong> <strong>Document</strong>.<br />

(iv) Registrar and transfer agent fee<br />

Charges payable to the Registrar and Share Transfer Agents in connection with effecting<br />

transfer of securities and bonds, units, etc. including stamp charges, cost of affidavits, notary<br />

charges, postage/courier charges and other related charges will be recovered on actual. For<br />

details kindly refer the annexure to this Risk <strong>Disclosure</strong> <strong>Document</strong>.<br />

(v) Placement fee :<br />

A Placement fee not exceeding 3% on the investment value will be charged in some of the<br />

strategies over and above the fixed management fee and performance fee. For details kindly<br />

refer the annexure to this Risk <strong>Disclosure</strong> <strong>Document</strong>.<br />

(vi) Brokerage and transaction cost<br />

The Brokerage and other charges like Service tax, Stamp duty, Security Transaction<br />

Tax, SEBI Fees, Bank charges, Turnover tax, Foreign tax and other charges (if any), as per the<br />

rates existing from time to time, will be charged on actual. For details kindly refer the<br />

annexure to this Risk <strong>Disclosure</strong> <strong>Document</strong>.<br />

The investment by Portfolio Manager will be done through <strong>Karvy</strong> Stock Broking Limited<br />

{Stock Broker} or through any SEBI Registered stock broker only and would as per the rates<br />

negotiated between Portfolio Manager and the broker. The charges relating to brokerage as<br />

per the related party transactions charged by <strong>Karvy</strong> Stock Broking Limited or through any<br />

SEBI Registered stock broker will be recovered on actual by the Portfolio Manager<br />

(vii) Securities Lending and Borrowing Charges<br />

If utilized, the charges pertaining to lending of securities, cost of borrowing including interest<br />

and costs associated with transfer of securities connected with lending and borrowing<br />

transfer operations, Depository Participant Charges, Share Transfer Agent Charges, etc.<br />

would be recovered on actual. For details kindly refer the annexure to this Risk <strong>Disclosure</strong><br />

<strong>Document</strong>.<br />

30

(viii) Certification Charges or Professional Charges<br />

Any charges payable for outsourced professional services like accounting, taxation, auditing,<br />

and any legal services, notarizations, etc., incurred on behalf of the Client by the Portfolio<br />

Manager, will be charged from the client on actual. For details kindly refer the annexure to<br />

this Risk <strong>Disclosure</strong> <strong>Document</strong>.<br />

(ix) Incidental Expenses<br />

Charges in connection with day to day operations like courier expenses, stamp duty, service<br />

tax, postal, telegraphic expenses, opening and operation of bank and demat accounts or any<br />

other out of pocket expenses incurred by the Portfolio Manager, on behalf of the client,<br />

would be recovered from the client. For details kindly refer the annexure to this Risk<br />

<strong>Disclosure</strong> <strong>Document</strong>.<br />

Note: For clients who have opened their PMS account with <strong>Karvy</strong> Stock Broking Limited prior<br />

to August 1, 2012, the performance fee will be computed on a High Watermark Principle<br />

over the life of the Investment at the end of every financial year on financial year basis.<br />

However, for clients who have opened their PMS accounts on or after August 1, 2012, the<br />

performance fees will be charged on completion of 12 months from account opening date<br />

(anniversary basis) and not financial year basis.<br />

11) Taxation<br />

General<br />

It may be noted that the information given hereinafter is only for general information<br />

purposes and is based on the advice received by the Portfolio Manager regarding the law<br />

and practice currently in force in India and the Investors should be aware that the relevant<br />

fiscal rules or their interpretation may change or it may not be acceptable to the tax<br />

authorities. As is the case with any interpretation of any law, there can be no assurance that<br />

the tax position or the proposed tax position prevailing at the time of an investment in the<br />

strategy/plan/option will be accepted by the tax authorities or will continue to be accepted<br />

by them indefinitely.<br />

Further statements with regard to tax benefits mentioned herein below are mere<br />

expressions of opinion and are not representations of the Portfolio Manager to induce any<br />

investor to invest whether directly from the Portfolio Manager or indirectly from any other<br />

persons by the secondary market operations. In view of the above, and since the individual<br />

nature of tax consequences may differ in each case on its merits and facts, each Investor is<br />

advised to consult his / her or its own professional tax advisor with respect to the specific tax<br />

implications arising out of its participation in the PMS strategy/plan/option, as an investor.<br />

In view of the above, it is advised that the investors appropriately consult their investment /<br />

tax advisors in this regard.<br />

31

Portfolio Manager cannot be held responsible for assisting or completing the fulfillment of<br />

the client’s tax obligations.<br />

Income arising from purchase and sale of securities under Portfolio Management Services<br />

can give rise to business income or capital gains in the hands of the Client. The issue of<br />

characterization of income is relevant as the tax computation and rates differ in either of the<br />

two situations. The said issue is essentially a question of fact and depends on whether the<br />

shares are held as business trading assets or on capital account. Based on judicial decisions,<br />

the following factors need to be considered while determining the nature of assets as above:<br />

a. Motive for the purchase of securities<br />

b. Frequency of transactions<br />

c. Length of period of holding of the securities<br />

d. Treatment of the securities and profit or loss on their sale in the accounts of the assessee<br />

and disclosure in notes thereto<br />

e. Source of funds out of which the securities were acquired - borrowed or own<br />

f. Existence of an objects clause permitting trading in securities – relevant only in the case of<br />

corporate.<br />

g. Circumstances responsible for the sale of securities<br />

h. Acquisition of the securities -from primary market or secondary market Infrastructure and<br />

set - up employed for undertaking the securities transactions by the client<br />

Any single factor discussed above in isolation cannot be conclusive to determine the exact<br />

nature of the shares. All factors and principles need to be construed harmoniously.<br />

Investors may refer to CBDT instruction no. 1827 dated August 31, 1989 read with CBDT<br />

Circular no. 4 dated June 15, 2007 for further guidance on the matter.<br />

Tax implications under the Income Tax Act, 1961 ("IT Act") arise in the hands of the Clients<br />

(resident as well as the non-resident) under both the scenarios, viz:<br />

a. Securities in the Portfolio held as business asset; and<br />

b. Securities in the Portfolio held on capital account.<br />

Additionally, non-residents (including Flls) are entitled to be governed by the applicable<br />

Double Tax Avoidance Agreement ("DTAA), which lndia has entered into with the country of<br />

residence of the non-resident, if that is more beneficial. The same would have to be<br />