Celebrating Giving - Allina Health

Celebrating Giving - Allina Health

Celebrating Giving - Allina Health

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCIAL REPORTS<br />

- 32 -<br />

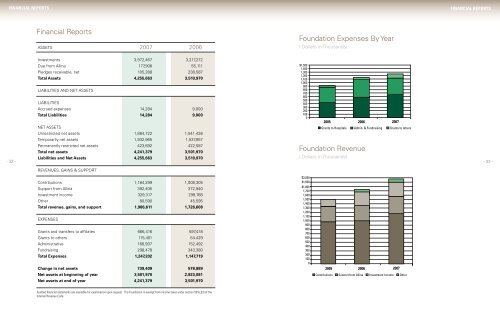

Financial Reports<br />

ASSETS<br />

Investments 3,972,467 3,217,272<br />

Due from <strong>Allina</strong> 177,908 55,111<br />

Pledges receivable, net 105,288 238,587<br />

Total Assets 4,255,663 3,510,970<br />

LIABILITIES AND NET ASSETS<br />

LIABILITIES<br />

Accrued expenses 14,284 9,000<br />

Total Liabilities 14,284 9,000<br />

NET ASSETS<br />

Unrestricted net assets 1,884,722 1,541,426<br />

Temporarily net assets 1,932,965 1,537,957<br />

Permanently restricted net assets 423,692 422,587<br />

Total net assets 4,241,379 3,501,970<br />

Liabilities and Net Assets 4,255,663 3,510,970<br />

REVENUES, GAINS & SUPPORT<br />

Contributions 1,184,299 1,008,305<br />

Support from <strong>Allina</strong> 392,405 372,940<br />

Investment income 329,317 299,768<br />

Other 80,590 45,595<br />

Total revenue, gains, and support 1,986,611 1,726,608<br />

EXPENSES<br />

2007 2006<br />

Grants and transfers to affiliates 666,416 597,418<br />

Grants to others 115,401 54,429<br />

Administrative 166,907 152,492<br />

Fundraising 298,478 343,380<br />

Total Expenses 1,247,202 1,147,719<br />

Change in net assets 739,409 578,889<br />

Net assets at beginning of year 3,501,970 2,923,081<br />

Net assets at end of year 4,241,379 3,501,970<br />

Audited financial statements are available for examination upon request. The Foundation is exempt from income taxes under section 501(c)(3) of the<br />

Internal Revenue Code.<br />

Foundation Expenses By Year<br />

( Dollars in Thousands)<br />

Foundation Revenue<br />

( Dollars in Thousands)<br />

FINANCIAL REPORTS<br />

- 33 -