balance sheet as at 30th june, 2010 revenue account for the period ...

balance sheet as at 30th june, 2010 revenue account for the period ...

balance sheet as at 30th june, 2010 revenue account for the period ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

BALANCE SHEET AS AT 30TH JUNE, <strong>2010</strong><br />

REVENUE ACCOUNT FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

PROFIT & LOSS ACCOUNT FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

Current Period<br />

01.04.10-30.06.10<br />

As <strong>at</strong> 30.06.10<br />

Opening 01.04.10<br />

L<strong>as</strong>t Period Closing 31.03.10

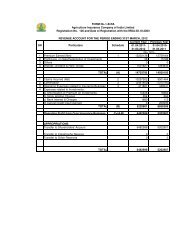

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

REGISTRATION NO. 126<br />

DATE OF REGISTRATION WITH IRDA: OCTOBER 30, 2003<br />

NL1<br />

REVENUE ACCOUNT FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

CROP INSURANCE BUSINESS<br />

Sl.<br />

No.<br />

PARTICULARS<br />

Schedule<br />

For <strong>the</strong> quarter<br />

up to <strong>the</strong> Quarter<br />

Correspodning<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong> Quarter<br />

of <strong>the</strong> preceding<br />

year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1 Premium Earned (Net) NL4 1414848 1414848 1303692 1303692<br />

2 Profit/Loss on Sale/Redemption of Investments 2125 2125 0 0<br />

3 O<strong>the</strong>rs 0 0 0 0<br />

4 Interest, Dividend & Rent -Gross 275217 275217 286418 286418<br />

TOTAL (A) 1692190 1692190 1590110 1590110<br />

1 Claims Incurred (Net) NL5 761060 761060 771049 771049<br />

2 Commission NL6 (12744) (12744) (4123) (4123)<br />

3 Oper<strong>at</strong>ing Expenses rel<strong>at</strong>ed to Insurance Business NL7 35553 35553 4<strong>2010</strong> 4<strong>2010</strong><br />

4 Expenses rel<strong>at</strong>ed to Investments :<br />

a) Amortiz<strong>at</strong>ion of Premium on Investments 215 215 0 0<br />

b) Stock Holding Charges 109 109 67 67<br />

c) Bank Interest & Charges 51 51 1 1<br />

0<br />

TOTAL (B) 784244 784244 809004 809004<br />

Oper<strong>at</strong>ing Profit from Crop Insurance Business C=(A-B) 907946 907946 781106 781106<br />

0<br />

APPROPRIATIONS 0<br />

Transfer to Shareholders' Account 907946 907946 781106 781106<br />

Transfer to C<strong>at</strong><strong>as</strong>trophe Reserve 0 0 0 0<br />

Transfer to O<strong>the</strong>r Reserves 0 0 0 0<br />

TOTAL 907946 907946 781106 781106

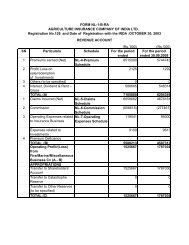

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

REGISTRATION NO. 126<br />

DATE OF REGISTRATION WITH IRDA: OCTOBER 30, 2003<br />

NL2<br />

PROFIT & LOSS ACCOUNT FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

CROP INSURANCE BUSINESS<br />

Sl. No. PARTICULARS Schedule<br />

For <strong>the</strong> quarter<br />

up to <strong>the</strong> Quarter<br />

Correspodning quarter of<br />

<strong>the</strong> preceeding year<br />

Up to <strong>the</strong> Quarter<br />

of <strong>the</strong> preceding<br />

year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1. OPERATING PROFIT/(LOSS)<br />

Crop Insurance Business 907946 907946 781106 781106<br />

0<br />

2. INCOME FROM INVESTMENTS 0<br />

a) Interest,Dividend & Rent-Gross 111366 111366 133902 133902<br />

b) Profit on Sale of Investments 860 860 0 0<br />

. 0<br />

3. OTHER INCOME<br />

a) Miscellaneous Receipts 313 313 338 338<br />

b) Profit on Sale of Assets 44 44 27 27<br />

c) Prior Period Income 0 0<br />

TOTAL (A) 1020528 1020528 1020528 1020528<br />

4. PROVISIONS (o<strong>the</strong>r than Tax<strong>at</strong>ion)<br />

a) Dimunition in <strong>the</strong> value of Investments 0 0 0 0<br />

b) Provision <strong>for</strong> Doubtful Debts 0 0 0 0<br />

c) Provision <strong>for</strong> Premium Defalc<strong>at</strong>ion 0 0 0 0<br />

d) Provision on Standard Assets 0 0 0 0<br />

e) Provision <strong>for</strong> difference in Cenv<strong>at</strong> Input Credit 0 0<br />

0<br />

5. OTHER EXPENSES<br />

a) Expenses o<strong>the</strong>r than those rel<strong>at</strong>ed to insurance business 0 0 0 0<br />

b) Amortis<strong>at</strong>ion of Premium on Investments 138 138 0 0<br />

c) Stock Holding Charges 69 69 31 31<br />

d) Bank Interest & Charges 32 32 0 0<br />

e) Loss on Sale of Assets 0 0 0 0<br />

f) Preliminary Expenses Written off 0 0 0 0<br />

g) Prior Period Expenses 0 0 0 0<br />

TOTAL (B) 239 239 31 31<br />

PROFIT BEFORE TAX (C=A-B) 1020290 1020290 1020497 1020497<br />

PROVISION FOR TAXATION<br />

a) Income Tax (Current Year) 346899 346899 0 0<br />

b) Income Tax (pertaining to earlier years) 0 0<br />

c) Wealth Tax 0 0<br />

d) Fringe Benefit Tax 0 0<br />

e) Deferred Tax 0 0<br />

TOTAL (D) 346899 346899 0 0<br />

PROFIT AFTER TAX AVAILABLE FOR APPROPRIATION<br />

(E=C-D) 673391 673391 1020497 1020497<br />

APPROPRIATIONS<br />

a) Interim Dividend paid during <strong>the</strong> year 0 0 0 0<br />

b) Proposed Final Dividend 0 0 0 0<br />

c) Dividend Distribution Tax 0 0 0 0<br />

d) Transfer to General Reserve 0 0 915342 915342<br />

TOTAL 0 0 915342 915342<br />

0<br />

PROFIT AFTER TAX & APPROPRIATIONS 673391 673391 0 0<br />

Add: Balance of Profit/(Loss) b/f from l<strong>as</strong>t year 0 0 0 0<br />

BALANCE C/F TO BALANCE SHEET 673391 673391 0 0<br />

B<strong>as</strong>ic & Diluted Earning per Share 3.37 3.37 4.58 4.58<br />

Number of Equity Shares 200000 200000 200000 200000<br />

Nominal Value per Share Rs.10/- Rs.10/- Rs.10/- Rs.10/-

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

REGISTRATION NO. 126<br />

DATE OF REGISTRATION WITH IRDA: OCTOBER 30, 2003<br />

NL3<br />

BALANCE SHEET AS AT 30TH JUNE, <strong>2010</strong><br />

CROP INSURANCE BUSINESS<br />

Sl. No. PARTICULARS Schedule<br />

For <strong>the</strong> quarter<br />

up to <strong>the</strong> Quarter<br />

Correspodning<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong> Quarter of <strong>the</strong><br />

preceding year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

SOURCES OF FUNDS<br />

Share Capital NL8 2000000 2000000 2000000 2000000<br />

Reserves & Surplus NL10 6331161 6331161 6239088 6239088<br />

Fair Value Change Account 0 0 0 0<br />

Borrowings NL11 0 0 0 0<br />

TOTAL 8331161 8331161 8239088 8239088<br />

APPLICATION OF FUNDS<br />

Investments NL12 15604471 15604471 9723399 9723399<br />

Loans NL13 12699 12699 13892 13892<br />

Fixed Assets NL14 297693 297693 46112 46112<br />

Deferred Tax Asset 27675 27675 39239 39239<br />

Current Assets:<br />

C<strong>as</strong>h & Bank Balances NL15 9703857 9703857 12367909 12367909<br />

Advances & O<strong>the</strong>r Assets NL16 3667713 3667713 1803647 1803647<br />

Sub - Total (A) 13371569 13371569 14171556 14171556<br />

Current Liabilities NL17 14508008 14508008 11476296 11476296<br />

Provisions NL18 6474938 6474938 4278814 4278814<br />

Sub - Total (B) 20982946 20982946 15755110 15755110<br />

Net Current Assets (C) = (A) - (B) (7611377) (7611377) (1583554) (1583554)<br />

Miscellaneous Expenditure<br />

NL19<br />

(to <strong>the</strong> extent not written off or adjusted) 0 0 0 0<br />

0 0<br />

Debit Balance in Profit and Loss Account 0 0 0 0<br />

TOTAL 8331161 8331161 8239088 8239088<br />

Contingent Liabilities<br />

Claims, o<strong>the</strong>r than against Policies, not<br />

acknowledged <strong>as</strong> debts by <strong>the</strong> Company 0 0 0 0

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL4 : PREMIUM EARNED (NET)<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

up to <strong>the</strong> Quarter<br />

Correspodning<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong> Quarter of<br />

<strong>the</strong> preceding year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

Premium from Direct Business written 1482237 1482237 1315102 1315102.22<br />

Add: Premium on Reinsurance Accepted 0 0 0 0.00<br />

Less: Premium on Reinsurance Ceded 67390 67390 11410 11410.24<br />

Net Premium 1414848 1414848 1303692 1303692<br />

Adjustment <strong>for</strong> change in Reserve <strong>for</strong> Unexpired Risks 0 0 0 0.00<br />

TOTAL PREMIUM EARNED (NET) 1414848 1414848 1303692 1303692

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL5 : CLAIMS INCURRED (NET)<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Correspodning<br />

quarter of <strong>the</strong><br />

preceeding year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

Up to <strong>the</strong> Quarter of <strong>the</strong><br />

preceding year<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

Claims Paid - Direct 1298078 1298078 900599 900599<br />

Add: Reinsurance Accepted 0 0 0 0<br />

Less: Reinsurance Ceded 157216 157216 7672 7672<br />

Net Claims paid 1140862 1140862 892927 892927<br />

Add: Claims Outstanding <strong>at</strong> <strong>the</strong> end of <strong>the</strong> Current <strong>period</strong> 13363889 13363889 7779752 7779752<br />

Add: Reinsurance Accepted 0 0 0 0<br />

Less: Reinsurance Ceded 1161639 1161639 324640 324640<br />

Net Claims Outstanding <strong>at</strong> <strong>the</strong> end of Current <strong>period</strong> 12202251 12202251 7455112 7455112<br />

Less: Claims Outstanding <strong>at</strong> <strong>the</strong> end of <strong>the</strong> Previous Year 13836948 13836948 8067004 8067004<br />

Add: Reinsurance Accepted 0 0 0 0<br />

Less: Reinsurance Ceded 1254895 1254895 490014 490014<br />

Net Claims Outstanding <strong>at</strong> <strong>the</strong> end of <strong>the</strong> Previous Year 12582053 12582053 7576990 7576990<br />

Gross Incurred Claims 825020 825020 613347 613347<br />

Add: Reinsurance Accepted 0 0 0 0<br />

Less: Reinsurance Ceded 63959 63959 (157701) -157701<br />

NET CLAIMS INCURRED 761060 761060 771049 771049

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL6 : COMMISSION<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Corresponding<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong><br />

Quarter of <strong>the</strong><br />

preceding<br />

year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

Commission Paid - Direct 504 504 (1928) (1928)<br />

Add: Reinsurance Accepted 0 0 0 0<br />

Less: Commission on Reinsurance Ceded 13248 13248 2194 2194<br />

NET COMMISSION (12744) (12744) (4123) (4123)

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL7 : OPERATING EXPENSES RELATED TO INSURANCE BUSINESS<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Corresponding Up to <strong>the</strong><br />

quarter of <strong>the</strong> Quarter of <strong>the</strong><br />

preceeding year preceding year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1 Employees' Remuner<strong>at</strong>ion & Welfare benefits 16721 16721 16708 16708<br />

2 Travel, Conveyance and Vehicle running expenses 2050 2050 2370 2370<br />

3 Training Expenses 2 2 29 29<br />

4 Rent, R<strong>at</strong>es & Taxes 4605 4605 3678 3678<br />

5 Repairs 881 881 1198 1198<br />

6 Printing & St<strong>at</strong>ionery 459 459 628 628<br />

7 Communic<strong>at</strong>ion 522 522 538 538<br />

8 Legal & Professional charges 1004 1004 2287 2287<br />

9 Auditor's fees, expenses etc.<br />

a) <strong>as</strong> Auditor (29) (29) (10) -10<br />

b) <strong>as</strong> Advisor or in any o<strong>the</strong>r capacity, in respect of<br />

(i) Tax<strong>at</strong>ion m<strong>at</strong>ters 0 0 0 0<br />

(ii) Insurance m<strong>at</strong>ters 0 0 0 0<br />

(iii) Management Services 0 0 0 0<br />

c) in any o<strong>the</strong>r capacity 0 0 0 0<br />

10 Advertisement & Publicity 493 493 289 289<br />

11 Research & Development Expenses (75) (75) 706 706<br />

12 Fees & Subscription to St<strong>at</strong>utory Authorities 6722 6722 11528 11528<br />

13 Interest & Bank Charges 15 15 29 29<br />

0 0<br />

14 Depreci<strong>at</strong>ion 0 0 0 0<br />

15 O<strong>the</strong>rs 2183 2183 2033 2033<br />

TOTAL 35553 35553 4<strong>2010</strong> 4<strong>2010</strong>

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL8 : SHARE CAPITAL<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Corresponding<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong> Quarter of<br />

<strong>the</strong> preceding year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1 Authorised Capital<br />

150 crore Equity Shares of Rs.10/- each 15000000 15000000 15000000 15000000<br />

2 Issued Capital<br />

20 crore Equity Shares of Rs.10/- each 2000000 2000000 2000000 2000000<br />

3 Subscribed Capital<br />

20 crore Equity Shares of Rs.10/- each 2000000 2000000 2000000 2000000<br />

4 Called-up & Paid-up Capital<br />

20 crore Equity Shares of Rs.10/- each 2000000 2000000 2000000 2000000<br />

Less: Preliminary Expenses 0 0 0 0<br />

TOTAL 2000000 2000000 2000000 2000000

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

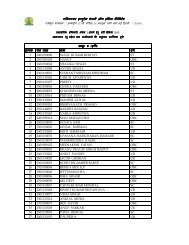

NL9 : PATTERN OF SHAREHOLDING (AS CERTIFIED BY THE MANAGEMENT)<br />

Sl. No.<br />

Shareholders<br />

For <strong>the</strong> quarter <strong>as</strong> on 30.06.<strong>2010</strong><br />

Up to <strong>the</strong> Quarter <strong>as</strong> on 30.06.<strong>2010</strong><br />

Corresponding Period of preceding year<br />

01.04.09-30.06.09<br />

Up to <strong>the</strong> Quarter of <strong>the</strong> preceding<br />

year <strong>as</strong> on 30.06.<strong>2010</strong><br />

Number of % of Number of % of Number of % of Number of % of<br />

Shares ('000) Holding Shares ('000) Holding Shares ('000) Holding Shares ('000) Holding<br />

A. PROMOTERS - INDIAN<br />

1 General Insurance Corpor<strong>at</strong>ion of India 70000 35% 70000 35% 70000 35% 70000 35%<br />

2 N<strong>at</strong>ional Agriculture Bank <strong>for</strong> Rural<br />

Development 60000 30% 60000 30% 60000 30% 60000 30%<br />

3 N<strong>at</strong>ional Insurance Company Ltd.<br />

& its nominee 17500 8.75% 17500 8.75% 17500 8.75% 17500 8.75%<br />

4 The Oriental Insurance Company Ltd. 17500 8.75% 17500 8.75% 17500 8.75% 17500 8.75%<br />

5 United India Insurance Company Ltd. 17500 8.75% 17500 8.75% 17500 8.75% 17500 8.75%<br />

6 The New India Assurance Company Ltd.<br />

& its nominee 17500 8.75% 17500 8.75% 17500 8.75% 17500 8.75%<br />

TOTAL: 200000 100% 200000 100% 200000 100% 200000 100%<br />

B. PROMOTERS - FOREIGN NIL NIL NIL NIL NIL NIL NIL NIL<br />

TOTAL 200000 100% 200000 100% 200000 100% 200000 100%

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL10 : RESERVES & SURPLUS<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

01.04.10-30.06.10<br />

(Rs. '000)<br />

Up to <strong>the</strong> Quarter<br />

As on 30.06.<strong>2010</strong><br />

(Rs. '000)<br />

Corresponding quarter<br />

of <strong>the</strong> preceeding year<br />

01.04.10-30.06.10<br />

(Rs. '000)<br />

Up to <strong>the</strong> Quarter of <strong>the</strong><br />

preceding year<br />

As on 30.06.<strong>2010</strong><br />

(Rs. '000)<br />

1 Capital Reserve 0 0 0 0 0 0<br />

2 Capital Redemption Reserve 0 0 0 0 0 0<br />

3 Share Premium 0 0 0 0 0 0<br />

4 General Reserve 0 0<br />

Opening Balance 5657770 5657770 0 5323746 5323746 0<br />

Less:Charge on <strong>account</strong> of transitional<br />

provisions under Accounting Standard 15 0 0 0 0 0 0<br />

Add: Profit transferred during <strong>the</strong> year 0 5657770 0 5657770 915342 6239088 915342 6239088<br />

5 C<strong>at</strong><strong>as</strong>trophe Reserve 0 0 0 0 0 0<br />

6 O<strong>the</strong>r Reserves 0 0 0 0 0 0<br />

Balance of Profit in Profit & Loss Account 673391 0 673391 0 0 0<br />

0<br />

TOTAL 6331161 6331161 6239088 0 6239088

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL11 : BORROWINGS<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Corresponding<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong> Quarter of<br />

<strong>the</strong> preceding year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1 Debentures & Bonds 0 0 0 0<br />

2 Banks (Secured against Deposits) 0 0 0 0<br />

3 Financial Institutions 0 0 0 0<br />

4 O<strong>the</strong>rs 0 0 0 0<br />

TOTAL 0 0 0 0

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SL<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL12 : INVESTMENTS<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Corresponding<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong><br />

Quarter of <strong>the</strong><br />

preceding year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

A. LONG TERM INVESTMENTS<br />

1 Government Securities and<br />

Govt. Guaranteed Bonds including Tre<strong>as</strong>ury Bills 6893558 6893558 6085089 6085089<br />

2 O<strong>the</strong>r Approved Securities - Housing Sector Bonds 1480509 1480509 1110078 1110078<br />

3 O<strong>the</strong>r Investments:<br />

a) Shares<br />

(i) Equity 348416 348416 69987 69987<br />

(ii) Preference 0 0 0 0<br />

b) Mutual Funds 0 0 0 0<br />

c) Deriv<strong>at</strong>ive Instruments 0 0 0 0<br />

d) Debentures/Bonds 350000 350000 0 0<br />

e) O<strong>the</strong>r Securities 0 0 0 0<br />

f) Subsidiaries 0 0 0 0<br />

Investment in Properties - Real Est<strong>at</strong>e 0 0 0 0<br />

4 Investments in Infr<strong>as</strong>tructure & Social Sector 3823217 3823217 2138446 2138446<br />

5 O<strong>the</strong>r than Approved Securities - Tier II Bonds 120000 120000 120000 120000<br />

Sub - Total (A) 13015700 13015700 13015699 13015699<br />

B. SHORT TERM INVESTMENTS<br />

1 Government Securities and<br />

Govt. Guaranteed Bonds including Tre<strong>as</strong>ury Bills 682971 682971 0 0<br />

2 O<strong>the</strong>r Approved Securities - Housing Sector Bonds 375776 375776 0 0<br />

3 O<strong>the</strong>r Investments:<br />

a) Shares:<br />

(i) Equity 0 0 0 0<br />

(ii) Preference 0 0 0 0<br />

b) Mutual Funds 1380000 1380000 199800 199800<br />

c) Deriv<strong>at</strong>ive Instruments 0 0 0 0<br />

d) Debentures/Bonds 0 0 0 0<br />

e) O<strong>the</strong>r Securities 0 0 0 0<br />

f) Subsidiaries 0 0 0 0<br />

g) Investment in Properties - Real Est<strong>at</strong>e 0 0 0 0<br />

4 Investments in Infr<strong>as</strong>tructure & Social Sector 150024 150024 0 0<br />

5 O<strong>the</strong>r than Approved Securities 0 0 0 0<br />

Sub - Total (B) 2588771 2588771 199800 199800<br />

GRAND TOTAL (A+B)<br />

15604471 15604471 13215499 13215499

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL13 : LOANS<br />

SL<br />

PARTICULARS<br />

Up to <strong>the</strong><br />

For <strong>the</strong> quarter<br />

Corresponding Quarter of<br />

Up to <strong>the</strong><br />

quarter of <strong>the</strong> <strong>the</strong><br />

Quarter<br />

preceeding year preceding<br />

year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.20<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1 SECURITY-WISE CLASSIFICATION<br />

A. Secured:<br />

a) On mortgage of Property:<br />

(i) In India 0 0 0 0<br />

(ii) Outside India 0 0 0 0<br />

b) On Shares, Bonds, Government Securities 0 0 0 0<br />

c) O<strong>the</strong>rs 0 0<br />

(i) Loans to Staff 12699 12699 13892 13892<br />

B. Unsecured 0 0 0 0<br />

TOTAL 12699 12699 13892 13892<br />

2 BORROWER-WISE CLASSIFICATION<br />

a) Central & St<strong>at</strong>e Governments 0 0 0 0<br />

b) Banks & Financial Institutions 0 0 0 0<br />

Subsidiaries 0 0 0 0<br />

d) Industrial Undertakings 0 0 0 0<br />

e) O<strong>the</strong>rs(Loans to Staff) 12699 12699 13892 13892<br />

TOTAL 12699 12699 13892 13892<br />

3 PERFORMANCE-WISE CLASSIFICATION<br />

a) Loans cl<strong>as</strong>sified <strong>as</strong> Standard:<br />

(i) In India 12699 12699 13892 13892<br />

(ii) Outside India 0 0 0 0<br />

b) Non-Per<strong>for</strong>ming Loans, less provisions:<br />

(i) In India 0 0 0 0<br />

(ii) Outside India 0 0 0 0<br />

TOTAL 12699 12699 13892 13892<br />

4 MATURITY-WISE CLASSIFICATION<br />

a) Short Term 0 0 0 0<br />

b) Long Term 12699 12699 13892 13892<br />

TOTAL<br />

12699 12699 13892 13892

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL15 : CASH AND BANK BALANCES<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong><br />

Quarter<br />

Corresponding<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong><br />

Quarter of <strong>the</strong><br />

preceding<br />

year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1 C<strong>as</strong>h (including Cheques,Drafts & Stamps) 62 62 64 64<br />

2 Bank Balances<br />

a) Deposit Account<br />

(i) Short term (due within 12 months) 9512235 9512235 10931723 10931723<br />

(ii) O<strong>the</strong>rs<br />

b) Current Accounts 175669 175669 1421885 1421885<br />

c) O<strong>the</strong>rs (Remittances in Transit) 0 0 3450 3450<br />

0 0<br />

3 Money <strong>at</strong> Call and Short Notice<br />

a) With Banks 0 0 0 0<br />

b) With O<strong>the</strong>r Institutions 0 0 0 0<br />

4 O<strong>the</strong>rs 15891 15891 10786 10786<br />

TOTAL 9703857 9703857 12367909 12367909

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL16 : ADVANCES AND OTHER ASSETS<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Corresponding quarter<br />

of <strong>the</strong> preceeding year<br />

Up to <strong>the</strong> Quarter<br />

of <strong>the</strong> preceding<br />

year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

A. ADVANCES<br />

1 Reserve Deposits with Ceding Companies 0 0 0 0<br />

2 Applic<strong>at</strong>ion Money <strong>for</strong> Investments 0 0 0 0<br />

3 Pre-payments 0 0 4 4<br />

4 Advances to Officers & Staff 3067 3067 1308 1308<br />

5 Advance Tax Paid & Taxes Deducted <strong>at</strong> Source<br />

(Net of Provision <strong>for</strong> Tax<strong>at</strong>ion) 521268 521268 141668 141668<br />

6 O<strong>the</strong>rs:<br />

a) Advance Rent paid 32 32 38 38<br />

b) Sundry Advances 89 89 173 173<br />

Sub - Total (A) 524456 524456 524455 524455<br />

B. OTHER ASSETS<br />

1 Income accrued on investments 793049 793049 964598 964598<br />

2 Outstanding Premium 0 0 0 0<br />

3 Agents' Balances 0 0 0 0<br />

4 Service Tax on Reinsurance Premium 0 0 0 0<br />

5 Due from o<strong>the</strong>r entities carrying on Insurance 97979 97979 440235 440235<br />

Business (including reinsurers)<br />

6 Due from subsidiaries/holding company 0 0 0<br />

7 Deposit with Reserve Bank of India<br />

(Pursuant to Section 7 of Insurance Act, 1938) 101404 101404 102015 102015<br />

8 O<strong>the</strong>rs:<br />

a) Sundry Deposits 25962 25962 31311 31311<br />

b) Advance against Capital Assets 2597 2597 0<br />

c) Short Collection of Premium 18727 18727 13879 13879<br />

d) Premium Receivable 0 0 0 0<br />

e) O<strong>the</strong>rs (Adhoc payment to Govt. of India) 2000000 2000000 0 0<br />

f) Government (Centre/St<strong>at</strong>es/Uts/Coffee Board)<br />

i) Sundry Debtors 19836 19836 13859 13859<br />

ii) Cenv<strong>at</strong> Credit Receivable 83703 83703 94560 94560<br />

Sub - Total (B) 3143257 3143257 1660457 1660457<br />

GRAND TOTAL (A+B)<br />

3667713 3667713 2184912 2184912

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL17 : CURRENT LIABILITIES<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Corresponding<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong><br />

Quarter of <strong>the</strong><br />

preceding<br />

year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1 Agents Balances 0 0 0 0<br />

2 Balance Due to o<strong>the</strong>r Insurance Companies 0 0 0 0<br />

3 Deposits held on Reinsurance Ceded 0 0 0 0<br />

4 Premium received in advance 0 0 0 0<br />

5 Unalloc<strong>at</strong>ed Premium 0 0 0 0<br />

6 Sundry Creditors 284014 284014 478830 478830<br />

7 Due to Subsidiary/Holding Company 0 0 0 0<br />

8 Claims Outstanding 12202251 12202251 7779752 7779752<br />

9 Due to Officers/Directors 0 0 0 0<br />

10 OTHERS:<br />

a) Excess Collection of Premium 88827 88827 95890 95890<br />

b) Provision <strong>for</strong> Outstanding Expenses 62315 62315 5258 5258<br />

c) Earnest Money Deposit 2740 2740 3084 3084<br />

d) Government (Centre/St<strong>at</strong>es/Uts/Coffee Board) 1852321 1852321 3103565 3103565<br />

e) Pension Contribution – New Employees 15542 15542 9917 9917<br />

TOTAL<br />

14508008 14508008 11476296 11476296

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL18 : PROVISIONS<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong> quarter<br />

Up to <strong>the</strong> Quarter<br />

Corresponding<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong> Quarter<br />

of <strong>the</strong> preceding<br />

year<br />

01.04.10-30.06.10 As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1. Reserve <strong>for</strong> Unexpired Risk 6342538 6342538 3882629 3882628.92<br />

2. For Tax<strong>at</strong>ion (Net of Advance Tax & TDS) 0 0 0 0.00<br />

3. For Proposed Dividend 0 0 200000 200000.00<br />

4. For Dividend Distribution Tax 0 0 33990 33990.00<br />

5. O<strong>the</strong>rs:<br />

i) Provision <strong>for</strong> Retirement Benefits 47251 47251 102677 102677.50<br />

ii) Provision <strong>for</strong> Doubtful Debts 13597 13597 9961 9960.95<br />

iii) Provision <strong>for</strong> Premium Defalc<strong>at</strong>ion 18733 18733 12503 12502.56<br />

iv) Provision on Standard Assets 52819 52819 37054 37054.40<br />

TOTAL<br />

6474938 6474938 4278814 4278814

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Regd. Office: 13th FLOOR, "AMBADEEP", 14 K. G. MARG, NEW DELHI - 110 001<br />

SCHEDULES FORMING PART OF FINANCIAL STATEMENTS<br />

UNAUDITED STATEMENTS FOR THE PERIOD ENDED 30TH JUNE, <strong>2010</strong><br />

NL 19 : MISCELLANEOUS EXPENDITURE (To <strong>the</strong> extent not written off)<br />

SL<br />

PARTICULARS<br />

For <strong>the</strong><br />

quarter<br />

Up to <strong>the</strong><br />

Quarter<br />

Corresponding<br />

quarter of <strong>the</strong><br />

preceeding year<br />

Up to <strong>the</strong><br />

Quarter of <strong>the</strong><br />

preceding year<br />

01.04.10-30.06.10As on 30.06.<strong>2010</strong> 01.04.09-30.06.09 As on 30.06.2009<br />

(Rs. '000) (Rs. '000) (Rs. '000) (Rs. '000)<br />

1. Discount allowed in issue of shares 0 0 0 0<br />

0<br />

2 Research & Development Expenses 0 0 0 0<br />

0<br />

3 Preliminary Expenses 0 0 0 0<br />

0<br />

4 o<strong>the</strong>rs 0 0 0 0<br />

TOTAL 0 0 0 0

NL21<br />

IRDA Periodic Disclosures<br />

Sl.No.<br />

FORM NL-21<br />

Particular<br />

PERIODIC DISCLOSURES<br />

Reserves <strong>for</strong><br />

unexpired<br />

risks<br />

St<strong>at</strong>ement of Liabilities<br />

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

St<strong>at</strong>ement of Liabilities<br />

As At 30.06.<strong>2010</strong><br />

Reserve <strong>for</strong><br />

Outstanding<br />

Claims<br />

IBNR Reserves<br />

Total Reserves<br />

Reserves <strong>for</strong><br />

unexpired risks<br />

Reserve <strong>for</strong><br />

Outstanding Claims<br />

(Rs in Lakhs)<br />

As <strong>at</strong> 30.06.2009<br />

IBNR<br />

Reserves<br />

Total<br />

Reserves<br />

1 Fire<br />

2 Marine<br />

a Marine Cargo<br />

b Marine Hull<br />

3 Miscellaneous<br />

a Motor<br />

b Engineering<br />

c Avi<strong>at</strong>ion<br />

d Liabilities<br />

e O<strong>the</strong>rs (Crop Insurance) 63425.38 77414.82 44607.69 185447.89 38826.29 41195.00 36399.00 116420.00<br />

4 Health Insurance<br />

5 Total Liabilities 63425.38 77414.82 44607.69 185447.89 38826.29 41195.00 36399.00 116420.00<br />

Page 20 of 38

NL22<br />

IRDA Periodic Disclosures<br />

FORM NL-22<br />

Geographical Distribution of Business<br />

PERIODIC DISCLOSURES<br />

Insurer: Agriculture Insurance Company of India Ltd., New Delhi D<strong>at</strong>e: 13.08.<strong>2010</strong><br />

GROSS DIRECT PREMIUM UNDERWRITTEN FOR THE FIRST QUARTER: OF <strong>2010</strong>-11<br />

(Rs in Lakhs)<br />

STATES<br />

For<br />

<strong>the</strong><br />

qtr<br />

Overse<strong>as</strong><br />

Motor Own Motor Third Liability Personal Medical medical<br />

Fire Marine (Cargo) Marine (Hull) Engineering Damage Party insurance Accident Insurance Insurance Crop Insurance<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr For <strong>the</strong> qtr Upto <strong>the</strong> qtr<br />

Andhra Pradesh 990.31 990.31<br />

Arunachal Pradesh NA NA<br />

Assam 130.68 130.68<br />

Bihar 995.59 995.59<br />

Chh<strong>at</strong>tisgarh 226.93 226.93<br />

Goa 0.00 0.00<br />

Gujar<strong>at</strong> 4756.90 4756.90<br />

Haryana 116.54 116.54<br />

Himachal Pradesh 50.69 50.69<br />

Jammu & K<strong>as</strong>hmir 3.29 3.29<br />

Jharkhand 29.90 29.90<br />

Karn<strong>at</strong>aka 64.19 64.19<br />

Kerala 128.49 128.49<br />

Madhya Pradesh 725.89 725.89<br />

Mahar<strong>as</strong>thra 1.92 1.92<br />

Manipur 0.00 0.00<br />

Meghalaya 43.37 43.37<br />

Mizoram 0.00 0.00<br />

Nagaland NA NA<br />

Orissa 294.14 294.14<br />

Punjab 0.00 0.00<br />

Raj<strong>as</strong>than 274.49 274.49<br />

Sikkim 0.03 0.03<br />

Tamil Nadu 478.15 478.15<br />

Tripura 1.85 1.85<br />

Uttar Pradesh 2346.08 2346.08<br />

Uttrakhand 147.94 147.94<br />

West Bengal 3002.46 3002.46<br />

Andaman & Nicobar Is. 0.00 0.00<br />

Chandigarh NA NA<br />

Dadra & Nagra Haveli NA NA<br />

Daman & Diu NA NA<br />

Delhi NA NA<br />

Lakshadweep NA NA<br />

Puducherry 3.20 3.20<br />

Total 14813.03 14813.03<br />

All O<strong>the</strong>r<br />

Miscellaneous<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

Grand Total<br />

For <strong>the</strong><br />

qtr<br />

Upto<br />

<strong>the</strong> qtr<br />

Page 21 of 38

Insurer:<br />

FORM NL-23<br />

Agriculture Insurance Company of India Ltd.<br />

Reinsurance Risk Concentr<strong>at</strong>ion<br />

(Rs in Lakhs)<br />

S.No.<br />

Reinsurance Placements<br />

No. of<br />

reinsurers<br />

Premium ceded to reinsurers<br />

Proportional<br />

Non-<br />

Proportional<br />

Facult<strong>at</strong>ive<br />

Premium ceded<br />

to reinsurers /<br />

Total<br />

reinsurance<br />

premium ceded<br />

(%)<br />

1 No. of Reinsurers with r<strong>at</strong>ing of AAA and above NIL<br />

2 No. of Reinsurers with r<strong>at</strong>ing AA but less than AAA 1.00 26.00 3.80<br />

3 No. of Reinsurers with r<strong>at</strong>ing A but less than AA 6.00 229.00 33.90<br />

4 No. of Reinsurers with r<strong>at</strong>ing BBB but less than A<br />

5 No. of Reinsurers with r<strong>at</strong>ing less than BBB<br />

6 No. of Indian Reinsurers (GIC & GIPSA Cos) 5.00 419.00 62.30<br />

Total 12.00 674.00 100.00

FORM NL-24 Ageing of Claims<br />

AGRICULTURE INSURANCE CO. OF INDIA LTD.<br />

AGEING OF CLAIMS<br />

LINE OF BUSINESS<br />

1 Month<br />

1 - 3<br />

Months<br />

No. of Claims Paid<br />

3 - 6<br />

Months<br />

6 Months -<br />

1 Year<br />

> 1 Year<br />

Total No. of<br />

Claims Paid<br />

Total Amount<br />

of Claims Paid<br />

(Rs. in Lakhs)<br />

No. Of Farmers<br />

NAIS 0 255098 168422 159673 66801 649994 49951.42<br />

Non-NAIS 0 2149 564050 0 174 566373 12673.00

S.No.<br />

FORM NL-25 Quarterly claims d<strong>at</strong>a <strong>for</strong> Non-Life<br />

AGRICULTURE INSURANCE CO. OF INDIA LTD.<br />

CLAIMS DATA - Ist Quarter ( April,<strong>2010</strong> to June,<strong>2010</strong>)<br />

Claims Experience<br />

CROP INSURANCE<br />

No. of Farmers<br />

1 CLAIMS O/S AT THE BEGINNING OF THE QUARTER 1241055<br />

2 CLAIMS REPORTED DURING THE QUARTER 6119412<br />

3 CLAIMS SETTLED DURING THE QUARTER 1216367<br />

4 CLAIMS REPUDIATED DURING THE QUARTER 0<br />

5 CLAIMS CLOSED DURING THE QUARTER 0<br />

6 CLAIMS O/S AT END OF THE QUARTER 6144100<br />

LESS THAN 3 MONTHS 5644542<br />

3 MONTHS TO 6 MONTHS 189395<br />

6 MONTHS TO 1 YEAR 308379<br />

1 YEAR AND ABOVE 1784

FORM NL-26 - CLAIMS INFORMATION - KG Table I<br />

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Solvency <strong>for</strong> <strong>the</strong> quarter ended 30.06.<strong>2010</strong><br />

Required Solvency Margin B<strong>as</strong>ed on net premium and net incurred claims<br />

Item<br />

No.<br />

Gross<br />

Premium<br />

PREMIUM<br />

Net<br />

Premium<br />

Gross<br />

incurred claim<br />

Net<br />

incurred<br />

(Rs. in Lacs)<br />

Description<br />

RSM-1 RSM-2 RSM<br />

1 Fire<br />

2 Marine Cargo<br />

3 Marine Hull<br />

4 Motor<br />

5 Engineering<br />

6 Avi<strong>at</strong>ion<br />

7 Laibilities<br />

8 O<strong>the</strong>rs:Crop Ins. 15311.03 127962.33 119725.50 104480.97 25592.47 31344.29 31344.29<br />

9 Health<br />

Total 15311.03 127962.33 119725.50 104480.97 25592.47 31344.29 31344.29

NL27<br />

IRDA Periodic Disclosures<br />

FORM NL-27<br />

PERIODIC DISCLOSURES<br />

Offices in<strong>for</strong>m<strong>at</strong>ion <strong>for</strong> Non-Life<br />

Insurer: Agriculture Insurance Company of India Ltd., New Delhi<br />

Sl. No.<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

Office In<strong>for</strong>m<strong>at</strong>ion<br />

No. of offices <strong>at</strong> <strong>the</strong> beginning of <strong>the</strong> year<br />

No. of branches approved during <strong>the</strong> year<br />

Out of approvals of<br />

No. of branches opened previous year<br />

during <strong>the</strong> year Out of approvals of this<br />

year<br />

No. of branches closed during <strong>the</strong> year<br />

No of branches <strong>at</strong> <strong>the</strong> end of <strong>the</strong> year<br />

No. of branches approved but not opened<br />

No. of rural branches<br />

No. of urban branches<br />

Number<br />

18<br />

0<br />

0<br />

0<br />

0<br />

18<br />

NA<br />

NA<br />

18<br />

The above figures includes 1 Head Office <strong>at</strong> Delhi and 17 Regional Offices.<br />

Page 26 of 38

FORM NL-28-STATEMENT OF ASSETS - 3B<br />

AGRICULTURE INSUARNCE COMPANY OF INDIA LIMITED, CODE NO.126<br />

St<strong>at</strong>ement <strong>as</strong> on: 30TH JUNE, <strong>2010</strong><br />

St<strong>at</strong>ement of Investment Assets (General Insurer, Re-insurers)<br />

(Business within India)<br />

Periodicity of Submission: Quarterly<br />

Rs. In Lakhs<br />

SN PARTICULARS SCH AMOUNT<br />

1 Investments 8 156044.71<br />

2 Loans 9 126.99<br />

3 Fixed Assets 10 2976.93<br />

4 Current Assets<br />

a. C<strong>as</strong>h & Bank Balance 11 97038.57<br />

b. Advances & O<strong>the</strong>r Assets 12 36677.13<br />

5 Current Liabilities<br />

a. Current Liabilities 13 145080.08<br />

b. Provisions 14 64749.38<br />

c. Misc. Exp not Written Off 15 0<br />

d. Debit Balance of P&L A/c<br />

Applic<strong>at</strong>ion of Funds <strong>as</strong> per Balance Sheet (A) 83034.87<br />

Less: O<strong>the</strong>r Assets SCH AMOUNT<br />

1 Loans (if any) 9 126.99<br />

2 Fixed Assets (if any) 10 2976.93<br />

3 C<strong>as</strong>h & Bank Balance (if any) 11 1916.22<br />

4 Advances & O<strong>the</strong>r Assets (if any) 12 35663.09<br />

5 Current Liabilities 13 145080.08<br />

6 Provisions 14 64749.38<br />

7 Misc. Exp not Written Off 15 0<br />

8 Debit Balance of P&L A/c<br />

TOTAL (B) -169146.23<br />

'Investment Assets' As per FORM 3B (A-B) 252181.1<br />

SN 'Investment' represented <strong>as</strong> Reg. % SH PH<br />

Book Value<br />

(SH + PH)<br />

%<br />

Actual<br />

FVC<br />

Amount Total<br />

Balance FRSM+<br />

(a) (b) (c) d = (b+c) (e) (d + e)<br />

1 G. Sec.<br />

Not less than<br />

20%<br />

2153922.47 4794215 69481.37 27.55219 69481.37<br />

2 G. Sec or O<strong>the</strong>r Apporved Sec. (incl. (1) above)<br />

Not less than<br />

30%<br />

2380159.23 5297774 76779.33 30.44613 76779.33<br />

3 Investment subject to Exposure Norms<br />

1.'Housing & Loans to SG <strong>for</strong> Housing and FFE, Infr<strong>as</strong>tructure Investments<br />

Not less than<br />

15%<br />

1807152.75 4022372 58295.25 23.11644 58295.25<br />

Not<br />

2. Approved Investments<br />

exceeding 3306709.56 7360095 106668.05 46.43743 106668.1<br />

55%<br />

3. O<strong>the</strong>r Investments (not exceeding 25%) 323587.31 720242.7 10438.3 10438.3<br />

Total Investment Assets 100% 7817608.85 17400484 252180.93 100 252180.9 0<br />

Market<br />

Value<br />

Certific<strong>at</strong>ion:<br />

Certified th<strong>at</strong> <strong>the</strong> in<strong>for</strong>m<strong>at</strong>ion given herein are correct and complete to <strong>the</strong> best<br />

of my knowledge and belief and nothing h<strong>as</strong> been concealed or suppressed<br />

D<strong>at</strong>e:13.08.<strong>2010</strong><br />

Note: (+) FRMS refers 'Funds representing Solvency Margin'<br />

(*) P<strong>at</strong>tern of Investment will apply only to SH funds representing FRMS<br />

(A) Book Value shall not include funds beyond Solvency Margin<br />

O<strong>the</strong>r Investments' are <strong>as</strong> permitted under Sec 27A(2) and 27B(3)<br />

Sign<strong>at</strong>ure:<br />

Full name:<br />

Design<strong>at</strong>ion:<br />

( M. PARSHAD)<br />

C.E.O.

PERIODIC DISCLOSURES<br />

NL29 - Detail regarding debt securities<br />

Agriculture Insurance Company of Indai Limited<br />

For <strong>the</strong> quarter ending : 30/06/<strong>2010</strong><br />

Detail Regarding debt securities<br />

MARKET VALUE*<br />

Book Value<br />

(Rs in Lakhs)<br />

As <strong>at</strong> ….<br />

<strong>as</strong> % of<br />

total <strong>for</strong><br />

this cl<strong>as</strong>s<br />

<strong>as</strong> <strong>at</strong>…. Of<br />

<strong>the</strong> previous<br />

year<br />

<strong>as</strong> % of<br />

total <strong>for</strong><br />

this cl<strong>as</strong>s<br />

As <strong>at</strong><br />

30.06.<strong>2010</strong><br />

<strong>as</strong> <strong>at</strong> 30.06.2009<br />

<strong>as</strong> % of total<br />

Of <strong>the</strong> previous<br />

<strong>for</strong> this cl<strong>as</strong>s<br />

year<br />

<strong>as</strong> % of total<br />

<strong>for</strong> this cl<strong>as</strong>s<br />

Break down by credit r<strong>at</strong>ing<br />

AAA r<strong>at</strong>ed 139269.0804 99.63834626 95556.27 100<br />

AA or better 505.5 0.361653742<br />

R<strong>at</strong>ed below AA but above A<br />

R<strong>at</strong>ed below A but above B<br />

Any o<strong>the</strong>r<br />

139774.5804 100 95556.27 100<br />

BREAKDOWN BY RESIDUAL MATURITY<br />

Up to 1 year 5015.2 3.588063008 13591.25 14.22329482<br />

more than 1 yearand upto 3years 16589.67 11.86887487 13903.51 14.5500761<br />

More than 3years and up to 7years 52567.06 37.60845499 33581.13 35.14278027<br />

More than 7 years and up to 10 years 45788.73 32.75898236 21159.56 22.14356002<br />

above 10 years 19813.92 14.17562478 13320.82 13.9402888<br />

139774.58 100 95556.27 100<br />

Breakdown by type of <strong>the</strong> issurer<br />

a. Central Government 69481.37 49.70958954 59096.12 61.84431435<br />

b. St<strong>at</strong>e Government 7297.96 5.221235506 2774.92 2.903964334<br />

c.Corpor<strong>at</strong>e Securities 62995.25 45.06917495 33685.23 35.25172132<br />

139774.58 100 95556.27 100<br />

*All securities are considered to be on <strong>the</strong> b<strong>as</strong>i of 'Held to M<strong>at</strong>urity', hence only Book Value is given.<br />

Note<br />

1. In c<strong>as</strong>e of a debt instrument is r<strong>at</strong>ed by more than one agency, <strong>the</strong>n <strong>the</strong> lowest r<strong>at</strong>ing will be taken <strong>for</strong> <strong>the</strong> purpose of cl<strong>as</strong>sific<strong>at</strong>ion.<br />

2. Market value of <strong>the</strong> securities will be in accordnace with <strong>the</strong> valu<strong>at</strong>ion method specified by <strong>the</strong> Authority under Accounting/ Investment regul<strong>at</strong>ions.

FORM NL-30<br />

PERIODIC DISCLOSURES<br />

Analytical R<strong>at</strong>ios<br />

Sl.No<br />

.<br />

AGRICULTURE INSURANCE CO. OF INDIA LTD.<br />

Particular For <strong>the</strong> quarter up to <strong>the</strong> Quarter<br />

Correspodning quarter of <strong>the</strong><br />

preceeding year<br />

up to <strong>the</strong> Quarter of <strong>the</strong><br />

prceeding year<br />

1 Gross Premium Growth R<strong>at</strong>e 12.71 12.71 141.67 141.67<br />

2 Gross Premium to shareholders' fund r<strong>at</strong>io 0.18 0.18 0.16 0.16<br />

3 Growth r<strong>at</strong>e of shareholders'fund 1.12 1.12 48.43 48.43<br />

4 Net Retention R<strong>at</strong>io 0.95 0.95 0.99 0.99<br />

5 Net Commission R<strong>at</strong>io -0.38 -0.38 -0.13 -0.13<br />

6 Expense of Management to Gross Direct Premium R<strong>at</strong>io 0.02 0.02 0.03 0.03<br />

7 Combined R<strong>at</strong>io 0.58 0.58 0.50 0.50<br />

8 Technical Reserves to net premium r<strong>at</strong>io 13.11 13.11 8.95 8.95<br />

9 Underwriting <strong>balance</strong> r<strong>at</strong>io 0.64 0.64 0.60 0.60<br />

10 Oper<strong>at</strong>iong Profit R<strong>at</strong>io 0.72 0.72 0.70 0.70<br />

11 Liquid Assets to liabilities r<strong>at</strong>io 0.66 0.66 1.08 1.08<br />

12 Net earning r<strong>at</strong>io 0.48 0.48 0.70 0.70<br />

13 return on net worth r<strong>at</strong>io 0.08 0.08 0.11 0.11<br />

Available Solvency argin R<strong>at</strong>io to Required Solvency Margin<br />

14<br />

1.64 1.64 2.09 2.09<br />

R<strong>at</strong>io<br />

15 NPA R<strong>at</strong>io (NPA--NIL) NIL NIL NIL NIL<br />

Equity Holding P<strong>at</strong>tern <strong>for</strong> Non-Life Insurers<br />

Analytical R<strong>at</strong>ios <strong>for</strong> Non-Life companies<br />

Gross NPA R<strong>at</strong>io NIL NIL NIL NIL<br />

Net NPA R<strong>at</strong>io NIL NIL NIL NIL<br />

1 (a) No. of shares 200000000 200000000 200000000 200000000<br />

2 (b) Percentage of indian shareholding 100% 100% 100% 100%<br />

3<br />

( c) %of Government holding (in c<strong>as</strong>e of public sector insurance<br />

companies)<br />

Nil Nil Nil Nil<br />

4<br />

(a) B<strong>as</strong>ic and diluted EPS be<strong>for</strong>e extraordinary items (net of tax<br />

expense) <strong>for</strong> <strong>the</strong> <strong>period</strong> (not to be annualized)<br />

3.37 3.37 4.58 4.58<br />

5<br />

(b) B<strong>as</strong>ic and diluted EPS after extraordinary items (net of tax<br />

expense) <strong>for</strong> <strong>the</strong> <strong>period</strong> (not to be annualized)<br />

3.37 3.37 4.58 4.58<br />

6 (iv) Book value per share (Rs) 10 10 10 10

NL-31<br />

IRDA Periodic Disclosures<br />

FORM NL-31 : Rel<strong>at</strong>ed Party Transactions<br />

Insurer: Agriculture Insruance Company of India Ltd.<br />

(Rs in Lakhs)<br />

Rel<strong>at</strong>ed Party Transactions<br />

Sl.No.<br />

1 General Insurance Corpn of India 292<br />

3 New India Assurance co 72<br />

4 Oriental Ins. Co. Shareholders Reinsurance<br />

72<br />

5 N<strong>at</strong>ional Insurance Co. 33<br />

6 United India Ins. Co. 72<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

Name of <strong>the</strong> Rel<strong>at</strong>ed Party<br />

PERIODIC DISCLOSURES<br />

N<strong>at</strong>ure of Rel<strong>at</strong>ionship<br />

with <strong>the</strong> Company<br />

Description of<br />

Transactions /<br />

C<strong>at</strong>egories<br />

Consider<strong>at</strong>ion<br />

paid<br />

Page 30 of 38

NL32<br />

IRDA Periodic Disclosures<br />

PERIODIC DISCLOSURES<br />

FORM NL-32 Products In<strong>for</strong>m<strong>at</strong>ion<br />

Insurer: Agriculture Insurance Company of India Ltd. Ist Qtr (<strong>2010</strong>-11)<br />

Products In<strong>for</strong>m<strong>at</strong>ion<br />

List below <strong>the</strong> products and/or add-ons introduced during <strong>the</strong> <strong>period</strong><br />

Sl. No. Name of Product Co. Ref. No. IRDA Ref.no. Cl<strong>as</strong>s of Business*<br />

D<strong>at</strong>e of<br />

C<strong>at</strong>egory<br />

filing of<br />

of product<br />

Product<br />

D<strong>at</strong>e IRDA<br />

confirmed<br />

filing/<br />

approval<br />

1 Cardamom Plants & Yield Insurance AIC/R&D/35 IRDA/NL/AIC/P/Misc/V-I/093/08-09 Misc. (crop) Insurance 13.2.10 23.4.10<br />

Page 31 of 38

FORM NL-33 - SOLVENCY MARGIN - KGII<br />

AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED<br />

Solvency <strong>for</strong> <strong>the</strong> Quarter ended on 30.06.<strong>2010</strong><br />

Available Solvency Margin and Solvency R<strong>at</strong>io<br />

(Rs. in Lacs)<br />

Item Description Notes No. Amount<br />

(1) (2) (3) (4)<br />

1 Available Assets in Policyholders’ Funds (adjusted value 1 197893.04<br />

of Assets <strong>as</strong> mentioned in Form IRDA-Assets-AA):<br />

Deduct:<br />

2 Liabilities (reserves <strong>as</strong> mentioned in Form HG) 2 185447.89<br />

3 O<strong>the</strong>r Liabilities (o<strong>the</strong>r liabilities in respect of 2 19411.48<br />

Policyholders’ Fund <strong>as</strong> mentioned in Balance Sheet)<br />

4 Excess in Policyholders’ Funds (1-2-3) -6966.33<br />

5 Available Assets in Shareholders’ Funds (value of 3 88902.53<br />

Assets <strong>as</strong> mentioned in Form IRDA-Assets-AA):<br />

Deduct:<br />

6 O<strong>the</strong>r Liabilities (o<strong>the</strong>r liabilities in respect of 2 4970.11<br />

Shareholders’ Fund <strong>as</strong> mentioned in Balance Sheet)<br />

7 Excess in Shareholders’ Funds (5-6) 83932.42<br />

8 Total Available Solvency Margin [ASM] (4+7) 76966.09<br />

9 Total Required Solvency Margin [RSM] 31344.29<br />

10 Solvency R<strong>at</strong>io (Total ASM/Total RSM) 2.46

FORM NL-34<br />

PERIODIC DISCLOSURES<br />

: Board of Directors & Key Person<br />

Insurer: Agriculture Insurance Company of India Limited<br />

BOD and Key Person in<strong>for</strong>m<strong>at</strong>ion<br />

Sl. No. Name of person Role/design<strong>at</strong>ion<br />

Details of change in <strong>the</strong> <strong>period</strong><br />

Board of Directors<br />

1 Shri M. Parshad Chairman-cum-Managing Director<br />

2 Shri Tarun Bajaj Director<br />

3 Shri R. K. Tiwari Director<br />

4 Shri Mukesh Khullar Director<br />

5 Shri K. N. Bhandari Director<br />

6 Smt. Bhagyam Ramani Director<br />

7 Shri S. K. Mitra Director<br />

8 Shri I. S. Phukela Director<br />

9 Shri S. K. Chanana Director<br />

10 Shri P. C. James Director<br />

Key Persons<br />

1 Shri R. P. Samal General Manager<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11<br />

2 Shri S. Chidambaram Appointed Actuary No Change during <strong>the</strong> first quarter of <strong>2010</strong>-11

FORM NL-35-NON PERFORMING ASSETS-7A<br />

Company Name & Code: AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED, CODE NO.126<br />

St<strong>at</strong>ement <strong>as</strong> on: 30TH JUNE, <strong>2010</strong><br />

Details of Investment Portfolio<br />

Periodicity of Submission : Quarterly<br />

COI<br />

Company<br />

Name<br />

Instrume<br />

nt Type<br />

Interest<br />

R<strong>at</strong>e<br />

Total O/s<br />

(Book<br />

Value)<br />

Default<br />

Principal<br />

(Book<br />

Value)<br />

Default<br />

Interest<br />

(Book<br />

Value)<br />

Principal<br />

Due from<br />

Interest<br />

Due from<br />

Deferred<br />

Principal<br />

Deferred<br />

Interest<br />

Rolled<br />

Over?<br />

H<strong>as</strong> <strong>the</strong>re<br />

been any<br />

Principal<br />

Waiver?<br />

Cl<strong>as</strong>sifica<br />

tion<br />

Provision<br />

(%)<br />

Provision<br />

(Rs)<br />

%<br />

H<strong>as</strong> <strong>the</strong>re<br />

been<br />

revision?<br />

Amount<br />

Board<br />

Approval<br />

Ref<br />

NIL<br />

CERTIFICATION<br />

Certified th<strong>at</strong> <strong>the</strong> in<strong>for</strong>m<strong>at</strong>ion given herein are correct and complete to <strong>the</strong> best of my knowledge and belief and nothing h<strong>as</strong> been concealed or suppressed.<br />

D<strong>at</strong>e: 13.08.<strong>2010</strong> Sign<strong>at</strong>ure<br />

Full Name & Design<strong>at</strong>ion<br />

Note:<br />

A. C<strong>at</strong>egory of Investmet (COI) shall be <strong>as</strong> per INV/GLN/001/2003-04<br />

B. FORM 7A shall be submitted in respect of each 'fund'.<br />

C. Cl<strong>as</strong>sific<strong>at</strong>ion shall be <strong>as</strong> per F&A-Circulars-169-Jan-07 Dt.24-01-07.<br />

(M. PARSHAD)<br />

C.E.O.

Insurer: Agriculture Insurance Company of India Ltd.<br />

PERIODIC DISCLOSURES<br />

FORM Quarterly NL-38 Business Returns across line of Business<br />

Quarterly Business Returns across line of Business<br />

(Rs in Lakhs)<br />

Current Quarter<br />

Same Quarter previous year<br />

upto <strong>the</strong> <strong>period</strong><br />

same <strong>period</strong> of <strong>the</strong> previos year<br />

Sl.No.<br />

Line of Business<br />

Premium No. of Policies Premium No. of Policies Premium No. of Policies Premium No. of Policies<br />

1 Fire 0 0<br />

2 Cargo & Hull 0 0<br />

3 Motor TP 0 0<br />

4 Motor OD 0 0<br />

5 Engineering 0 0<br />

6 Workmen's Compens<strong>at</strong>ion 0 0<br />

7 Employer's Liability 0 0<br />

8 Avi<strong>at</strong>ion 0 0<br />

9 Personal Accident 0 0<br />

10 Health 0 0<br />

11 O<strong>the</strong>rs*Crop Insurance 14813.03 83833 13117.7 52065 14813.03 83833 13117.7 52065

FORM NL-39<br />

Rural & Social Oblig<strong>at</strong>ions (Quarterly Returns)<br />

PERIODIC DISCLOSURES<br />

Insurer: Agriculture Insurance Company of india Ltd., New Delhi<br />

Rural & Social Oblig<strong>at</strong>ions (Quarterly Returns)<br />

(Rs in Lakhs)<br />

Sl.No. Line of Business Particular<br />

1 Fire<br />

2 Cargo & Hull<br />

3 Motor TP<br />

4 Motor OD<br />

5 Engineering<br />

6 Workmen's Compens<strong>at</strong>ion<br />

7 Employer's Liability<br />

8 Avi<strong>at</strong>ion<br />

9 Personal Accident<br />

10 Health<br />

11 O<strong>the</strong>rs*Crop Insurance<br />

No. of Policies<br />

Issued<br />

*any o<strong>the</strong>r segment contributing more than 5% needs to be shown separ<strong>at</strong>ely<br />

Note-Entire AIC premium is Rural & Social<br />

Premium<br />

Collected<br />

Sum Assured<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural<br />

Social<br />

Rural 83833 14813.03 500954.2<br />

Social

FORM NL-40 Business Acquisition through different channels<br />

Insurer: Agriculture Insurance Company of India Ltd.<br />

Sl.No.<br />

Channels<br />

PERIODIC DISCLOSURES<br />

Current Quarter<br />

No. of<br />

Policies<br />

No. of Policies<br />

(Rs in Lakhs)<br />

1 Individual agents<br />

2 Corpor<strong>at</strong>e Agents-Banks 55848 14140.86 48391 12823.37 55848 14140.86 48391 12823.37<br />

3 Corpor<strong>at</strong>e Agents -O<strong>the</strong>rs 172 2.78 172 2.78<br />

4 Brokers 399 75.27 706 49.32 399 75.27 706 49.32<br />

5 Micro Agents 26492 528.98 2261 18.94 26492 528.98 2261 18.94<br />

6 Direct Business 1094 67.92 535 223.29 1094 67.92 535 223.29<br />

Total (A) 83833 14813.03 52065 13117.7 83833 14813.03 52065 13117.7<br />

1 Referral (B) 0 0 0 0 0 0 0 0<br />

Grand Total (A+B) 83833 14813.03 52065 13117.7 83833 14813.03 52065 13117.7<br />

Note:<br />

1. Premium means amount of premium received from business acquired by <strong>the</strong> source<br />

2. No of Policies stand <strong>for</strong> no. of policies sold<br />

Business Acquisition through different channels<br />

Premium<br />

Same quarter Previous<br />

Year<br />

Premium<br />

Up to <strong>the</strong> <strong>period</strong><br />

No. of<br />

Policies<br />

Premium<br />

Same <strong>period</strong> of <strong>the</strong> previous<br />

year<br />

No. of Policies<br />

Premium

FORM NL-41<br />

GREIVANCE DISPOSAL<br />

PERIODIC DISCLOSURES<br />

Agriculture Insurance Company of India Limited<br />

D<strong>at</strong>e: 13.08.10<br />

Sl<br />

No.<br />

Particulars<br />

Opening<br />

Balance<br />

Additions<br />

Complaints Resolved<br />

Complaints<br />

Pending<br />

Fully Accepted Partial Accepted Rejected<br />

1 Complaints made by customers<br />

a) Sales Rel<strong>at</strong>ed NIL NIL NIL NIL NIL NIL<br />

b) Policy Administr<strong>at</strong>ion Rel<strong>at</strong>ed NIL NIL NIL NIL NIL NIL<br />

c) Insurance Policy Coverage rel<strong>at</strong>ed NIL NIL NIL NIL NIL NIL<br />

d) Claims rel<strong>at</strong>ed NIL 92 NIL NIL 92 (outside <strong>the</strong> scope<br />

of <strong>the</strong> scheme i.e<br />

NAIS)<br />

NIL<br />

e) o<strong>the</strong>rs NIL NIL NIL NIL NIL NIL<br />

Total Number NIL 92 NIL NIL 92 NIL<br />

2 Dur<strong>at</strong>ion wise Pending St<strong>at</strong>us<br />

Complaints<br />

made by<br />

customers<br />

Complaints<br />

made by<br />

intermediaries<br />

Total<br />

a) Less than 15 days NA NA NA<br />

b) Gre<strong>at</strong>er than 15 days NA NA NA<br />

Total Number NA NA NA