3rd quater - Agriculture Insurance Company of India Ltd.

3rd quater - Agriculture Insurance Company of India Ltd.

3rd quater - Agriculture Insurance Company of India Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

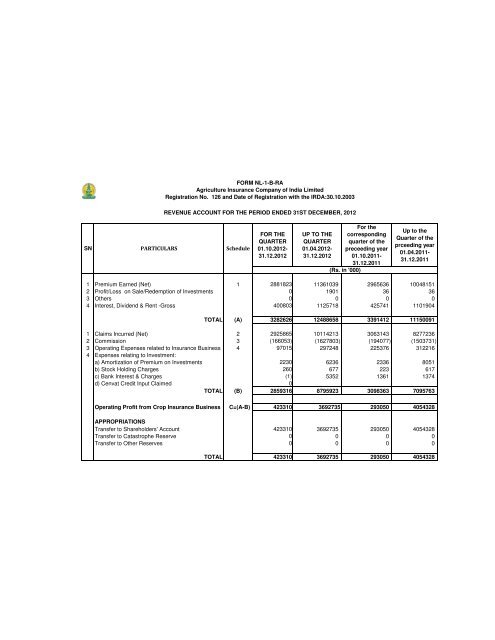

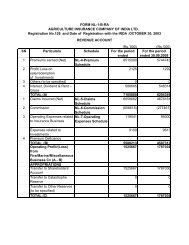

FORM NL-1-B-RA<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003REVENUE ACCOUNT FOR THE PERIOD ENDED 31ST DECEMBER, 2012SNPARTICULARSScheduleFOR THEQUARTER01.10.2012-31.12.2012UP TO THEQUARTER01.04.2012-31.12.2012For thecorrespondingquarter <strong>of</strong> thepreceeding year01.10.2011-31.12.2011(Rs. in '000)Up to theQuarter <strong>of</strong> theprceeding year01.04.2011-31.12.20111 Premium Earned (Net) 1 2881823 11361039 2965636 100481512 Pr<strong>of</strong>it/Loss on Sale/Redemption <strong>of</strong> Investments 0 1901 36 363 Others 0 0 0 04 Interest, Dividend & Rent -Gross 400803 1125718 425741 1101904TOTAL (A) 3282626 12488658 3391412 111500911 Claims Incurred (Net) 2 2925865 10114213 3063143 82772362 Commission 3 (166053) (1627803) (194077) (1503731)3 Operating Expenses related to <strong>Insurance</strong> Business 4 97015 297248 225376 3122164 Expenses relating to Investment:a) Amortization <strong>of</strong> Premium on Investments 2230 6236 2336 8051b) Stock Holding Charges 260 677 223 617c) Bank Interest & Charges (1) 5352 1361 1374d) Cenvat Credit Input Claimed 0TOTAL (B) 2859316 8795923 3098363 7095763Operating Pr<strong>of</strong>it from Crop <strong>Insurance</strong> Business C=(A-B) 423310 3692735 293050 4054328APPROPRIATIONSTransfer to Shareholders' Account 423310 3692735 293050 4054328Transfer to Catastrophe Reserve 0 0 0 0Transfer to Other Reserves 0 0 0 0TOTAL 423310 3692735 293050 4054328

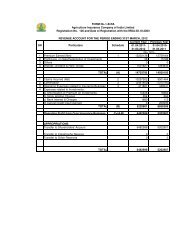

FORM NL-2-B-PL<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003PROFIT AND LOSS ACCOUNT FOR THE PERIOD ENDED 31ST DECEMBER, 2012SN PARTICULARS ScheduleFOR THEQUARTER01.10.2012-31.12.2012UP TO THEQUARTER01.04.2012-31.12.2012(Rs. in '000)For thecorrespondingquarter <strong>of</strong> thepreceeding year01.10.2011-31.12.2011Up to the Quarter<strong>of</strong> the prceedingyear01.04.2011-31.12.20111. OPERATING PROFIT/(LOSS)Crop <strong>Insurance</strong> Business 423310 3692735 293050 40543282. INCOME FROM INVESTMENTSa) Interest,Dividend & Rent-Gross 349801 982471 265857 688092b) Pr<strong>of</strong>it on Sale <strong>of</strong> Investments 0 1659 22 223. OTHER INCOMEa) Miscellaneous Receipts 1129 3581 222 45222b) Pr<strong>of</strong>it on Sale <strong>of</strong> Assets 0 0 54 64TOTAL (A) 774240 4680446 559205 47877284. PROVISIONS (other than Taxation)a) Dimunition in the value <strong>of</strong> Investments 0 0 0 0b) Provision for Doubtful Debts 0 0 0 0c) Provision on Standard Assets 3896 9689 4491 120955. OTHER EXPENSESa Expenses other than those related to insurance business 0 0 0 0b Amortisation <strong>of</strong> Premium on Investments 1947 5443 1459 5028c Stock Holding Charges 227 591 140 385d Bank Interest & Charges -2 4670 850 858e Loss on Sale <strong>of</strong> Assets 2 27 0 0f Preliminary Expenses Written <strong>of</strong>f 0 0 0 0g Prior Period Expenses 110 259 0 0TOTAL (B) 6180 20679 6939 18366PROFIT BEFORE TAX (C=A-B) 768060 4659767 552266 4769362PROVISION FOR TAXATIONa) Income Tax (Current Year) 249197 1511861 179182 1547420b) Income Tax (pertaining to earlier years) 1385 1385 2450c) Wealth Tax 17 17 0 0d) Fringe Benefit Tax 0 0 0 0e) Deferred Tax 0 0 0 0TOTAL (D) 250599 1513263 179182 1549870PROFIT AFTER TAX AVAILABLE FOR APPROPRIATION (E=C-D) 517461 3146504 373084 3219492APPROPRIATIONSa) Interim Dividend paid during the year 0 0 0 0b) Proposed Final Dividend 0 0 0 0c) Dividend Distribution Tax 0 0 0 0d) Transfer to General Reserve 0 0 0 0TOTALPROFIT AFTER TAX & APPROPRIATIONS 517461 3146504 373084 3219492Add: Balance <strong>of</strong> Pr<strong>of</strong>it/(Loss) b/f from last year 0 0 0 0BALANCE C/F TO BALANCE SHEET 517461 3146504 373084 3219492Basic Earning per Share 16.00 16.10Diluted Earning per ShareNumber <strong>of</strong> Equity Shares 200000000 200000000 200000000 200000000Nominal Value per Share Rs.10/- Rs.10/- Rs.10/- Rs.10/-

FORM NL-3-B-BS<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA: 30.10.2003BALANCE SHEET FOR THE PERIOD ENDED 31ST DECEMBER, 2012SN PARTICULARS ScheduleCurrent Period Previous Period01.04.12-31.12.12 01.04.11-31.12.11(Rs. in '000)SOURCES OF FUNDS1 Share Capital 5 2000000 20000002 Reserves & Surplus 6 17105518 124477753 Fair Value Change Account (24910) (68750)4 Borrowings 7 0 330000TOTAL 19080608 14709025APPLICATION OF FUNDS1 Investments 8 21631914 186314152 Loans 9 17480 127383 Fixed Assets 10 188169 2143174 Deferred Tax Asset 31029 193525 Current Assets:6 Cash & Bank Balances 11 10975760 133549727 Advances & Other Assets 12 10241632 3707603Sub - Total (A) 21217392 170625758 Current Liabilities 13 15993275 138948129 Provisions 14 8012101 7336560Sub - Total (B) 24005376 2123137210 Net Current Assets (C) = (A) - (B) (2787984) (4168797)11 Miscellaneous Expenditure(to the extent not written <strong>of</strong>f or adjusted) 0 0TOTAL 19080608 14709025Contingent LiabilitiesClaims, other than against Policies, notacknowledged as debts by the <strong>Company</strong> 0 0

FORM NL-4<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003PREMIUM SCHEDULE FOR THE PERIOD ENDED 31ST DECEMBER, 2012PARTICULARSFOR THEQUARTER01.10.2012-31.12.2012UP TO THEQUARTER01.04.2012-31.12.2012(Rs. in '000)For thecorrespondingquarter <strong>of</strong> thepreceeding year01.10.2011-31.12.2011Up to theQuarter <strong>of</strong> theprceeding year01.04.2011-31.12.2011Premium from Direct Business written 4317741 22919009 3543546 18008079Add: Premium on Reinsurance Accepted 0 0 0 0Less: Premium on Reinsurance Ceded 1267558 10716065 830084 7488945Net Premium 3050183 12202944 2713463 10519134Adjustment for change in Reserve for Unexpired Risks (168360) (841905) 252173 (470983)TOTAL PREMIUM EARNED (NET) 2881823 11361039 2965636 10048151

FORM NL-5<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003CLAIMS INCURRED [NET] FOR THE PERIOD ENDED 31ST DECEMBER, 2012PARTICULARSFOR THEQUARTER01.10.2012-31.12.2012UP TO THEQUARTER01.04.2012-31.12.2012For thecorrespondingquarter <strong>of</strong> thepreceeding year01.10.2011-31.12.2011Up to theQuarter <strong>of</strong> theprceeding year01.04.2011-31.12.2011(Rs. in '000)Claims Paid - Direct 2985638 14290111 4416262 12142029Add: Reinsurance Accepted 0 0 0 0Less: Reinsurance Ceded 1456443 5978690 777918 2442335Net Claims paid 1529195 8311421 3638344 9699694Add: Claims Outstanding at the end <strong>of</strong> the Current period 137376 23357379 (1002370) 15901186Add: Reinsurance Accepted 0 0 0 0Less: Reinsurance Ceded (1259293) 10054222 (427168) 5759395Net Claims Outstanding at the end <strong>of</strong> Current period 1396670 13303158 (575201) 10141791Less: Claims Outstanding at the end <strong>of</strong> the Previous Year 0 21856196 0 15605975Add: Reinsurance Accepted 0 0 0 0Less: Reinsurance Ceded 0 10355830 0 4041726Net Claims Outstanding at the end <strong>of</strong> the Previous Year 0 11500365 0 11564249Gross Incurred Claims 3123015 15791295 3413892 12437240Add: Reinsurance Accepted 0 0 0 0Less: Reinsurance Ceded 197150 5677082 350749 4160004NET CLAIMS INCURRED 2925865 10114213 3063143 8277236

RRSII – REUSII• Calculation <strong>of</strong> REUSII: similar to RNSII,but in Step 1 calculate relative to EU25values• RRSII = φ * RNSII + (1- φ) ) * REUSIIWhere φ is the weight <strong>of</strong> the national component7

FORM NL-10<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003RESERVES AND SURPLUS FOR THE PERIOD ENDED 31ST DECEMBER, 2012Current Period Previous PeriodSNPARTICULARS01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)1 Capital Reserve 0 02 Capital Redemption Reserve 0 03 Share Premium 0 04 General ReserveOpening Balance 13959014 9228283Less:Charge on account <strong>of</strong> transitionalprovisions under Accounting Standard 15 0 0Add: Pr<strong>of</strong>it transferred during the year 0 13959014 0 92282835 Catastrophe Reserve 0 06 Other Reserves 0 0Balance <strong>of</strong> Pr<strong>of</strong>it in Pr<strong>of</strong>it & Loss Account 3146504 3219493TOTAL 17105518 12447776

FORM NL-11<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SNBORROWINGS FOR THE PERIOD ENDED 31ST DECEMBER, 2012Current PeriodPrevious PeriodPARTICULARS01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)1 Debentures & Bonds 0 02 Banks (Secured against Deposits) 0 3300003 Financial Institutions 0 04 Others 0 0TOTAL 0 330000

FORM NL-12<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SNINVESTMENTS FOR THE PERIOD ENDED 31ST DECEMBER, 2012Current Period Previous PeriodPARTICULARS01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)A. LONG TERM INVESTMENTS1 Government Securities andGovt. Guaranteed Bonds including Treasury Bills 10874317 93623212 Other Approved Securities - Housing Sector Bonds 3227983 24971143 Other Investments:a) Shares(i) Equity 348101 300812(ii) Preference 0 0b) Mutual Funds 0 0c) Derivative Instruments 0 0d) Debentures/Bonds 1149095 550000e) Other Securities-Tier II Bonds 120000 120000f) Subsidiaries 0 0Investment in Properties - Real Estate 0 04 Investments in Infrastructure & Social Sector 4600145 43912555 Other than Approved Securities 0 0Sub - Total (A) 20319641 17221503B. SHORT TERM INVESTMENTS1 Government Securities andGovt. Guaranteed Bonds including Treasury Bills 290720 1602802 Other Approved Securities - Housing Sector Bonds 300000 6069113 Other Investments:a) Shares:(i) Equity 0 0(ii) Preference 0 0b) Mutual Funds 112212 7903c) Derivative Instruments 0 0d) Debentures/Bonds 50000 0e) Other Securities (Commercial Papers) 439341 97272f) Subsidiaries 0 0g) Investment in Properties - Real Estate 0 04 Investments in Infrastructure & Social Sector 120000 5375465 Other than Approved Securities 0 0Sub - Total (B) 1312273 1409912GRAND TOTAL (A+B)21631914 18631415

FORM NL-13<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SNLOANS FOR THE PERIOD ENDED 31ST DECEMBER, 2012Current Period Previous PeriodPARTICULARS01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)1 SECURITY-WISE CLASSIFICATIONA. Secured:a) On mortgage <strong>of</strong> Property:(i) In <strong>India</strong> 0 0(ii) Outside <strong>India</strong> 0 0b) On Shares, Bonds, Government Securities 0 0c) Others(i) Loans to Staff 17480 12738B. Unsecured 0 0TOTAL 17480 127382 BORROWER-WISE CLASSIFICATIONa) Central & State Governments 0 0b) Banks & Financial Institutions 0 0Subsidiaries 0 0d) Industrial Undertakings 0 0e) Others(Loans to Staff) 17480 12738TOTAL 17480 127383 PERFORMANCE-WISE CLASSIFICATIONa) Loans classified as Standard:(i) In <strong>India</strong> 17480 12738(ii) Outside <strong>India</strong> 0 0b) Non-Performing Loans, less provisions:(i) In <strong>India</strong> 0 0(ii) Outside <strong>India</strong> 0 0TOTAL 17480 127384 MATURITY-WISE CLASSIFICATIONa) Short Term 0 0b) Long Term 17480 12738TOTAL 17480 12738

FORM NL-14<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003FIXED ASSETS FOR THE PERIOD ENDED 31ST DECEMBER, 2012(Rs. in '000)Cost / Gross BlockDepreciationNet BlockAdd: Less:Sale / As at As atAdditionsParticularsAs atDeductionFor On sale/ Up to As at As atthe01.04.2012 during / Discarded 31.12.2012 01.04.2012 currentadjustment31.12.2012 31.12.2012 31.03.2012the year during the year Year(A)Tangible AssetsBuildings 36614 0 0 36614 12121 919 0 13040 23574 24493Furniture & Fixtures 9381 1330 0 10711 6256 645 0 6900 3811 3125I.T. Equipments 111410 5021 0 116431 62403 2102 0 64505 51926 49007Vehicles 14833 6076 2598 18311 5054 2592 690 6955 11355 9779Office Equipments 5959 328 0 6286 3146 421 0 3567 2719 2813Elec.Equip.& Fittings 5111 1203 0 6314 2515 260 0 2775 3539 2596Leasehold Improvement 7162 0 0 7162 7162 0 0 7162 0 0(B)Intangible AssetsComputer S<strong>of</strong>tware 76590 8169 0 84759 24511 19351 0 43862 40897 52079TOTAL (A) 267060 22127 2598 286590 123168 26290 690 148767 137823 143893Capital Work In Progress 0 0 0 0 0 0 0 0 0 0Capital Work in Progress-Hardware 4453 0 1004 3449 0 0 0 0 3449 4453Capital Work in Progress-S<strong>of</strong>tware 49333 0 2435 46898 0 0 0 0 46898 49333TOTAL (B) 53786 0 3439 50348 0 0 0 0 50348 53786GRAND TOTAL (A)+(B) 320846 22127 6036 336937 123168 26290 690 148767 188170 197679PREVIOUS YEAR 308229 69335 56720 320845 73305 51785 1923 123167 197678 234924

FORM NL-15<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003CASH AND BANK BALANCES FOR THE PERIOD ENDED 31ST DECEMBER, 2012SNPARTICULARSCurrent Period Previous Period01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)1 Cash (including Cheques,Drafts & Stamps) 1970 1312 Bank Balancesa) Deposit Account(i)(a) Short term (due within 12 months) 9299407 12831040(i)(b) Others 1573700(ii) Others-Flexi Deposit 57 431785b)(i) Current Accounts 100243 91909(ii) Others 383 106c) Others (Remittances in Transit) 0 03 Money at Call and Short Noticea) With Banks 0 0b) With Other Institutions 0 04 Others 0 0TOTAL 10975760 13354972

FORM NL-16<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SNADVANCES AND OTHER ASSETS FOR THE PERIOD ENDED 31ST DECEMBER, 2012Current Period Previous PeriodPARTICULARS01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)A. ADVANCES1 Reserve Deposits with Ceding Companies 0 02 Application Money for Investments 0 03 Pre-payments 32291 244654 Advances to Officers & Staff 2178 32495 Advance Tax Paid & Taxes Deducted at Source(Net <strong>of</strong> Provision for Taxation) 0 06 Others:a) Advance Rent paid 5100 75b) Sundry Advances 2191 220Sub - Total (A) 41760 28008B. OTHER ASSETS1 (a) Income accrued on investments 1032744 10753851(b) Income accrued on flexi deposit 0 02 Outstanding Premium 0 03 Agents' Balances 0 04 Due from other entities carrying on <strong>Insurance</strong>Business (including reinsurers) 753316 05 Due from subsidiaries/holding company 0 06 Deposit with Reserve Bank <strong>of</strong> <strong>India</strong>(Pursuant to Section 7 <strong>of</strong> <strong>Insurance</strong> Act, 1938) 100000 1007937 Others:a) Sundry Deposits 33706 31252b) Advance against Capital Assets 337835 13403c) Short Collection <strong>of</strong> Premium 40819 118033d) Premium Receivable 0 0e) Others (Adhoc payment to Govt. <strong>of</strong> <strong>India</strong>) 2000000 0f) Government (Centre/States/Uts/C<strong>of</strong>fee Board) 5859464 2289317g) Sundry Debtors 21924 26417h) Cenvat Credit Receivable 20064 24996Sub - Total (B) 10199872 3679595GRAND TOTAL (A+B)10241632 3707603

FORM NL - 17<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SNCURRENT LIABILITIES FOR THE PERIOD ENDED 31ST DECEMBER, 2012Current Period Previous PeriodPARTICULARS01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)1 Agents Balances 0 02 Balance Due to other <strong>Insurance</strong> Companies 63504 1261193 Deposits held on Reinsurance Ceded 0 04 Premium received in advance 0 05 Unallocated Premium 0 06 Sundry Creditors(a) Cheques issued to insureds, but not encashed 89075 74563(b) Sundry Creditors, other than 6(a) 109431 1424827 Due to Subsidiary/Holding <strong>Company</strong> 0 08 Claims Outstanding(a) Claims settled but not paid 831868 623965(b) Claims Outstanding, other than 8(a) 12471289 95178259 Due to Officers/Directors 0 010 OTHERS:a) Excess Collection <strong>of</strong> Premium: 239627i) Cheques issued but not paid 186266ii) Excess Collection other than 10(a)(i) 78596b) Expenses Payable 254918 179497c) Earnest Money Deposit 1335 2555d) Government (Centre/States/UTs/C<strong>of</strong>fee Board) 1906993 2988178TOTAL 15993275 13894812

FORM NL-18<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SNPROVISIONS FOR THE PERIOD ENDED 31ST DECEMBER, 2012Current Period Previous PeriodPARTICULARS01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)1. Reserve for Unexpired Risk 7627416 68876092. For Taxation (Net <strong>of</strong> Advance Tax & TDS) 182976 2354933. For Proposed Dividend 0 04. For Dividend Distribution Tax 0 05. Others:i) Provision for Retirement Benefits 99579 114874ii) Provision for Doubtful Debts 47 47iii) Provision for Premium Defalcation 18733 18733iv) Provision on Standard Assets 83329 73305v) Provision for Outstanding Expenses 21 6500TOTAL 8012101 7336560

FORM NL-19<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003MISCELLANEOUS EXPENDITURE FOR THE PERIOD ENDED 31ST DECEMBER, 2012(To the extent not written <strong>of</strong>f or adjusted)Schedule Previous PeriodSNPARTICULARS01.04.2012-31.12.2012 01.04.2011-31.12.2011(Rs. in '000)1. Discount allowed in issue <strong>of</strong> shares 0 02 Research & Development Expenses 0 03 Preliminary Expenses 0 04 Others 0 0TOTAL 0 0

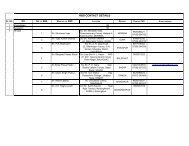

SNDescriptionReserves forUnexpiredRisksReserve forOutstandingClaimsIBNRReservesTotal Reserves(1) (2) (3) (4) (5) (6)(Rs. In lakh)1 Fire NA NA NA NAMarine2 Sub class:Marine CargoMarine HullMiscellaneous3 Sub class:MotorEngineeringAviationLiabilitiesRural insuranceFORM NL-21<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003(Rs. in lakh)STATEMENT OF LIABILITIES FOR THE PERIOD ENDING 31ST DECEMBER 2012NA NA NA NANA NA NA NAOthers (Crop <strong>Insurance</strong>) 76274.16 18946.67 114084.91 209305.744 Health <strong>Insurance</strong> NA NA NA NA5 Total Liabilities 76274.16 18946.67 114084.91 209305.74

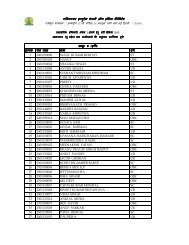

FORM NL-22<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003GROSS DIRECT PREMIUM UNDERWRITTENFOR THE PERIOD ENDED 31ST DECEMBER, 2012STATESFOR THE QUARTER UP TO THE QUARTER01.10.2012-31.12.2012 01.04.2012-31.12.2012(Rs. in Lakh)Andhra Pradesh 9999.68 69769.11Arunachal Pradesh 0.00 0.00Assam 184.90 449.42Bihar 61.52 23843.78Chhattisgarh 916.02 5060.85Goa 0.03 0.06Gujarat 46.76 23324.25Haryana 978.50 1976.05Himachal Pradesh 112.45 221.28Jammu & Kashmir 17.59 0.00Jharkhand 278.69 1878.20Karnataka 1349.36 10361.23Kerala 61.83 403.19Madhya Pradesh 12053.02 23227.41Maharasthra 6914.75 13593.06Manipur 35.28 54.30Meghalaya 3.86 15.86Mizoram 0.00 0.00Nagaland 0.00 0.00Orissa 4126.66 8414.52Punjab 0.00 34.24Rajasthan 93.14 28331.38Sikkim 0.00 0.10Tamil Nadu 1790.92 3282.02Tripura 6.87 12.05Uttar Pradesh 2833.95 7248.61Uttrakhand 39.42 791.30West Bengal 1260.31 6875.43Andaman & Nicobar Is. 6.57 8.15Chandigarh 0.00 0.00Dadra & Nagra Haveli 0.00 0.00Daman & Diu 0.00 0.00Delhi 0.00 0.00Lakshadweep 0.00 0.00Puducherry 5.32 14.24TOTAL 43177.42 229190.10

FORM NL-23<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA: 30.10.2003REINSURANCE RISK CONCENTRATION FOR THE PERIOD ENDING 31ST DECEMBER 2012(Rs. in Lakh)SNReinsurance PlacementsSchedulePremium ceded to reinsurers Premium ceded toProportional Non-Proportional Facultative reinsurers / Total1 No. <strong>of</strong> Reinsurers with rating <strong>of</strong> AAA and above 0 0.00 0.00 0.002 No. <strong>of</strong> Reinsurers with rating AA but less than AAA 3 46665.16 1186.48 44.653 No. <strong>of</strong> Reinsurers with rating A but less than AA 14 16622.85 848.47 16.304 No. <strong>of</strong> Reinsurers with rating BBB but less than A 1 -20.52 47.65 NIL0.035 No. <strong>of</strong> Reinsurres with rating less than BBB 0 0.00 0.00 0.006 No. <strong>of</strong> <strong>India</strong>n Reinsurers 5 41810.57 0.00 39.02Total 23 105078.05 2082.60 100.00

FORM NL-24<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003AGEING OF CLAIMS FOR THE PERIOD ENDED 31ST DECEMBER, 2012No. <strong>of</strong> Claims Paid1 Month Schedule 3 - 6 Months 6 Months - 1Total No. <strong>of</strong> Total Amount <strong>of</strong>LINE OF BUSINESS> 1 Year Claims Paid Claims PaidYearNo. <strong>of</strong> Farmers(Rs. in Lakh)Crop <strong>Insurance</strong> 0 1676727 2723885 152054.00 81998 4634664 142901.11

FORM NL-25<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration With the IRDA:30.10.2003SNCLAIMS DATA FOR THE PERIOD ENDED 31ST DECEMBER, 2012Crop <strong>Insurance</strong>Claims Experience(No. <strong>of</strong> Farmers)1 CLAIMS O/S AT THE BEGINNING OF THE PERIOD 34724092 CLAIMS REPORTED DURING THE PERIOD 77812073 CLAIMS SETTLED DURING THE PERIOD 46259254 CLAIMS REPUDIATED DURING THE PERIOD 1605 CLAIMS CLOSED DURING THE PERIOD 157006 CLAIMS O/S AT END OF THE PERIOD 6611831LESS THAN 3 MONTHS 53650133 MONTHS TO 6 MONTHS 8520886 MONTHS TO 1 YEAR 697901 YEAR AND ABOVE 324940

FORM NL- 26<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003Required Solvency Margin Based on Net Premium and Net Incurred ClaimsFor the period ending 31ST DECEMBER 2012PREMIUMCLAIMSNDescriptionGrossPremiumNetPremiumGrossincurredclaimNet incurredClaimRSM-1RSM-2RSM(Rs in Lakh)1 Fire2 Marine Cargo3 Marine Hull4 Motor5 Engineering6 Aviation7 Laibilities8 Others-Crop <strong>Insurance</strong> 306794.41 152548.32 239601.80 120944.79 42951.22 50316.38 50316.389 HealthTotal 306794.41 152548.32 239601.8 120944.79 42951.22 50316.38 50316.38

FORM NL-27<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003OFFICES INFORMATION FOR THE PERIOD ENDED 31ST DECEMBER, 2012SNOffice InformationNumber12No. <strong>of</strong> <strong>of</strong>fices at the beginning <strong>of</strong> the FY 2012-13No. <strong>of</strong> branches approved during the Year2203 Out <strong>of</strong> approvals <strong>of</strong> previous year0No. <strong>of</strong> branches opened during Year4 Out <strong>of</strong> approvals <strong>of</strong> this year05No. <strong>of</strong> branches closed during the Year 06No <strong>of</strong> branches at the end <strong>of</strong> the Year 227No. <strong>of</strong> branches approved but not opend089No. <strong>of</strong> rural branches 0No. <strong>of</strong> urban branches 22The above figure includes 1 Head Office at Delhi, 17 Regional Office (out <strong>of</strong> which 4 ROs are in Metros), 4 OneMan Offices.

FORM NL-28<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003STATEMENT OF INVESTMENT ASSETS AS AT 31ST DECEMBER 2012SN PARTICULARS SCHEDULE AMOUNT(Rs. in lakh)1 Investments 8 216319.142 Loans 9 174.803 Fixed Assets 10 1881.704 Current Assetsa. Cash & Bank Balance 11 109757.60b. Advances & Other Assets 12 102416.325 Current Liabilitiesa. Current Liabilities 13 159932.75b. Provisions 14 80121.01c. Misc. Exp not Written Off 15 0.00d. Debit Balance <strong>of</strong> P&L A/c 0.00Application <strong>of</strong> Funds as per Balance Sheet (A) 670603.32Less: Other AssetsAMOUNT1 Loans (if any) 9 174.802 Fixed Assets (if any) 10 1881.703 Cash & Bank Balance (if any) 11 1026.534 Advances & Other Assets (if any) 12 101416.325 Current Liabilities 13 159932.756 Provisions 14 80121.017 Misc. Exp not Written Off 15 0.008 Debit Balance <strong>of</strong> P&L A/c 0.00TOTAL (B) 344553.11'Investment Assets' As per FORM 3B (A-B) 326050.21SN 'Investment' represented as Reg. %1 G. Sec.2 G. Sec or Other Apporved Sec. (incl. (1) above)3 Investment subject to Exposure Norms1.'Housing & Loans to SG for Housing and FFE, InfrastructureInvestmentsNot less than20%Not less than30%Not less than15%(Rs. in Lakh)SHBook Value (SH +FVCPH%TotalBalance FRSM +PH)AmountActual(a) (b) (c) d = (b+c) (e) (d + e)36215.37 40642.38 76857.75 23.42 76857.75 75273.0453485.67 60023.81 113509.48 34.59 113509.48 112080.2239286.47 44088.89 83375.36 25.41 83375.36 82163.392. Approved Investments Not exceeding59995.15 67329.03 127324.18 38.80 176.24 127500.42 127537.903. Other Investments (not exceeding 25%) 55%1855.65 2082.49 3938.14 1.20 -427.96 3510.18 3510.18Total Investment Assets 100% 154622.94 173524.22 328147.16 100.00 -251.72 327895.44 325291.69*All securities are considered to be on the basis <strong>of</strong> 'Held to Maturity', hence only Book Value is given.*MarketValue

Particulars As at 31.12.12Break down by credit ratingMarket Valueas % <strong>of</strong> totalAs at 31.12.11for this class(Rs. in Lakh)as % <strong>of</strong> totalfor this classAs at 31.12.12Book Valueas % <strong>of</strong> total forAs at 31.12.11this class(Rs. in Lakh)as % <strong>of</strong> total forthis classAAA rated 215726.92 65.36% 216720.89 65.43 180496.06 98.49AA or better 5615.85 1.70% 5767.50 1.74 2766.14 1.51Rated below AA but above AFORM NL-29<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003DETAIL REGARDING DEBT SECURITIES FOR THE PERIOD ENDING 31ST DECEMBER 2012Rated below A but above BAny other 108731.07 32.94% 108731.07 32.83330073.84 100 107698.4 100 331219.46 100.00 183262.20 100.00Breakdown by residualmaturityUp to 1 year 113572.68 34.41 107698.4 100 113690.26 34.32 13047.37 7.12more than 1 year and upto3years 64225.75 19.4664776.42 19.56 21039.15 11.48More than 3 years and up to7years 68680.31 20.8167695.51 20.44 65352.47 35.66More than 7 years and up to10 years 70728.26 21.4371507.52 21.59 68412.10 37.33above 10 years 12866.84 3.9 13549.75 4.09 15411.11 8.41330073.84 100 107698.4 100 331219.46 100.00 183262.20 100.00Breakdown by type <strong>of</strong> theissurera. Central Government 75273.04 22.80 76824.89 23.19 66117.88 36.08b. State Government 36807.18 11.15 36670.11 11.07 30116.06 16.43c.Corporate Securities 217993.62 66.04 107698.4 100 217724.46 65.73 87028.26 47.49330073.84 100 107698.4 100 331219.46 100.00 183262.20 100.00*All securities are considered to be on the basis <strong>of</strong> 'Held to Maturity', hence only Book Value is given.

FORM NL-30<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003ANALYTICAL RATIOS FOR THE PERIOD ENDING 31ST DECEMBER 2012SNPARTICULARSFor the period01.04.12-31.12.12For the corresponding period01.04.2011-31.12.20111 Gross Direct Premium Growth Rate 27.27% 39.67%[Gross direct premium for the current year divided byGross Premium for the previous year]2 Gross Direct Premium to Net Worth Ratio (In times) 1.20 1.25[Gross Direct Premium for the current year divided byPaid up Capital plus free Reserves]3 Growth Rate <strong>of</strong> Net Worth 32.24% 49.85%[Net Worth as at the current Balance Sheet date divided byNet Worth as at the previous Balance Sheet date]4 Net Retention Ratio 53.24% 58.41%[Net Premium divided by Gross Direct Premium]5 Net Commission Ratio -13.34% -14.30%[Gross Commission Paid net <strong>of</strong> Reinsurance Commission dividedby Net Written Premium]6 Expenses <strong>of</strong> Management to Gross Direct Premium Ratio 1.88% 2.13%[Expenses <strong>of</strong> Management (operating expenss related to insurancebusiness plus direct commissions) divided by Gross Direct Premium]7 Expense <strong>of</strong> Management to Net Written Premium Ratio: 3.53% 3.65%(Expense <strong>of</strong> Management (operating expenses related to insurancebusiness plus direct commissions) divided by Net Written Premium]8 Net Incurred Claims to Net Earned Premium 89.03% 82.38%9 Combined Ratio 86.41% 82.34%[Net Incurred Claims plus Expenses<strong>of</strong> Management (including net commission) divided byNet Written Premium]10 Technical Reserves to Net Premium Ratio (in Times) 1.84 1.69[Reserve for Unexpired Risks plus Premium Deficiency Reserve plusReserve for Outstanding Claims (including IBNR and IBNER)divided by Net Premium] {All on net basis}11 Underwriting Balance Ratio (in Times) 0.23 0.29[Underwriting pr<strong>of</strong>it divided by net premium for the respective class <strong>of</strong> business]12 Operating Pr<strong>of</strong>it Ratio 32.61% 40.45%[Underwriting Pr<strong>of</strong>it/ Loss plus Investment income divided by Net Premium]13 Liquid Assets to Liabilities Ratio 58.71% 86.70%[Liquid Assets (Short Term Investments (Schedule 8) plus Short Term Loans(Schedule 9) plus Cash & Bank Balance (Schedule 11) <strong>of</strong> the insurer divided byPolicyholders' liabilities (to be discharged within 12 months) (claims outstanding(Schedule 13) plus Reserve for Unexpired Risk and Premium Deficiency(Schedule 14)]14 Net Earnings Ratio 25.78% 30.61%[Pr<strong>of</strong>it after Tax divided by Net Premium]15 Return on Net Worth 16.47% 22.28%[Pr<strong>of</strong>it after Tax divided by Net Worth]16 Available Solvency Margin Ratio to Required Solvency Margin Ratio 3.18 3.21[Ratio <strong>of</strong> Available Solvency Margin (ASM) at the end <strong>of</strong> the Quarter to theRequired Solvency Margin (RSM) required to be maintained as perregulations.)17 NPA Ratio 0 0Gross NPA Ratio 0 0Net NPA Ratio 0 0Note: The Ratios for the period ending 31.12.2011 have been recalculated as per the Master Circular No. IRDA/F&I/CIR/F&A/231/10/2012 dated 05.10.2012.Equity Holding Pattern for Non-Life Insurers1 (a) No. <strong>of</strong> shares2 (b) Percentage <strong>of</strong> shareholding (<strong>India</strong>n / Foreign)3 ( c) %<strong>of</strong> Government holding (in case <strong>of</strong> public sector insurance companies)(a) Basic and diluted EPS before extraordinary items (net <strong>of</strong> tax expense) for the period4(not to be annualized)(b) Basic and diluted EPS after extraordinary items (net <strong>of</strong> tax expense) for the period5(not to be annualized)6 (iv) Book value per share (Rs)16200000000100%100%16.1Rs. 10/- per share

FORM NL-31Agiculture <strong>Insurance</strong> Co.<strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003RELATED PARTY TRANSACTIONS FROM 01.04.2012 TO 31.12.2012SN Name <strong>of</strong> the Related Party ScheduleDescription <strong>of</strong>Transactions /Consideration paid(Rs. in Lakh)1 General <strong>Insurance</strong> Corporation <strong>of</strong> <strong>India</strong> Limited 20846.002 The New <strong>India</strong> Assurance <strong>Company</strong> Limited 3935.713 National <strong>Insurance</strong> <strong>Company</strong> Limited Shareholder Reinsurance3935.714 The Oriental <strong>Insurance</strong> <strong>Company</strong> Limited 3935.715 United <strong>India</strong> <strong>Insurance</strong> <strong>Company</strong> Limited 4265.71

FORM NL-32<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003PRODUCTS INFORMATION AS ON 31ST DECEMBER 2012List below the products and/or add-ons introduced during the periodSN Name <strong>of</strong> Product Schedule IRDA Ref.no.Class <strong>of</strong>Business*Category<strong>of</strong> productDate <strong>of</strong> Filing <strong>of</strong> ProductDate IRDAconfirmed filing/approval1 Index Plus <strong>Insurance</strong>2 Loyalty discount based crop insurance3<strong>Insurance</strong> <strong>of</strong> farmers adopting innovativetechnologyLetter. Dt.25.07.2012Misc. (Crop)<strong>Insurance</strong>These are research products notfully developed and informedIRDA vide our lt. dt. 25.07.2012

FORM NL-33<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SOLVENCY FOR THE YEAR ENDING 31ST DECEMBER 2012AVAILABLE SOLVENCY MARGIN AND SOLVENCY RATIOSNDescriptionNotesNo.Amount for periodending 31.12.2012(Rs. In Lakh)(1) (2) (3) (4)1 Available Assets in Policyholders' Funds: 1 188804.45Deduct:2 Liabilities 2 209305.743 Other Liabilities 2 2648.624 Excess in Policyholders' funds (01 - 02 - 03) (23149.91)5 Available Assets in Shareholders Funds: 3 212895.69Deduct:6 Other Liabilities <strong>of</strong> Shareholders' fund 2 28099.417 Excess in Shareholders' funds: (05 -06) 184796.288 Total ASM (04+07) 161646.379 Total RSM 50316.3810 SOLVENCY RATIO (TOTAL ASM/ TOTAL RSM) 3.21

FORM NL-34<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003For the quarter ending 31st December, 2012SN Name <strong>of</strong> person ScheduleBoard <strong>of</strong> Directors1 Shri P. J. Joseph Chairman-cum-Managing Director2 Shri Milind A. Kharat Officiating Chairman-cum-Managing Director3 Shri R. K. Tiwari Director4 Shri Mukesh Khullar Director5 Shri K. N. Bhandari Director6 Shri Shashank Saksena Director7 Shri P K Bhagat Director8 Shri S. K. Mitra Director9 Shri R. K. Deka Director10 Shri S. K. Chanana Director11 Shri Kuldeep Singh Director12 Shri Gopal Naik Director13 Shri Ramabhadran Director14 Shri S. Surenther DirectorKey Persons1 Shri S. Chidambaram Appointed ActuaryBoard <strong>of</strong> Directors and Key Person informationDetails <strong>of</strong> change in the periodJoined as CMD on 18.10.2012.Ceased to Hold <strong>of</strong>fice w.e.f. 18.10.2012.No Change during the reported period <strong>of</strong> Financial Year 2012-13No Change during the reported period <strong>of</strong> Financial Year 2012-13No Change during the reported period <strong>of</strong> Financial Year 2012-13No Change during the reported period <strong>of</strong> Financial Year 2012-13No Change during the reported period <strong>of</strong> Financial Year 2012-13Ceased to hold <strong>of</strong>fice w.e.f. 30.11.2012.Ceased to hold <strong>of</strong>fice w.e.f. 27.11.2012.No Change during the reported period <strong>of</strong> Financial Year 2012-13No Change during the reported period <strong>of</strong> Financial Year 2012-13No Change during the reported period <strong>of</strong> Financial Year 2012-13Joined on 27.11.2012.Joined on 27.11.2012.No Change during the reported period <strong>of</strong> Financial Year 2012-13

FORM NL-35<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003NON PERFORMING ASSETS-7A (AS ON 31ST DECEMBER 2012)COI <strong>Company</strong> Name Instrument Type%Interest RateHas therebeenrevision?Total O/s(Book Value)DefaultPrincipal(Book Value)DefaultInterest (BookValue)PrincipalDue fromInterest DuefromDeferredPrincipalDeferredInterestRolledOver?Has there been anyPrincipal Waiver?AmountBoardApproval RefClassificationProvision(%)Provision(Rs)NIL

FORM NL-37<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> Of india LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SN Name <strong>of</strong> the Security Schedule AmountA. During the Quarter ¹DOWN GRADING OF INVESTMENT STATEMENT AS ON 31ST DECEMBER 2012Date <strong>of</strong>PurchaseRatingAgencyOriginalGradeCurrentGrade(Amount Rs in lakh)Date <strong>of</strong>RemarksDowngradeB. As on Date ²NIL

FORM NL-38<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003ANNUAL BUSINESS RETURNS ACROSS LINE OF BUSINESS AS ON 31ST DECEMBER 2012(Rs. in Lakh)For the periodUpto the period Corresponding Quarter <strong>of</strong> Previous Year Upto the period <strong>of</strong> Previous YearSN Line <strong>of</strong> Business01.10.2012 - 31.12.2012 01.04.2012-31.12.201201.10.2011 - 31.12.201101.04.2011-31.12.2011Premium No. <strong>of</strong> Policies Premium No. <strong>of</strong> Policies Premium No. <strong>of</strong> Policies Premium No. <strong>of</strong> Policies1 Fire 0 0 0 0 0 0 0 02 Cargo & Hull 0 0 0 0 0 0 0 03 Motor TP 0 0 0 0 0 0 0 04 Motor OD 0 0 0 0 0 0 0 05 Engineering 0 0 0 0 0 0 0 06 Workmen's Compensation 0 0 0 0 0 0 0 07 Employer's Liability 0 0 0 0 0 0 0 08 Aviation 0 0 0 0 0 0 0 09 Personal Accident 0 0 0 0 0 0 0 010 Health 0 0 0 0 0 0 0 011 Others* Crop <strong>Insurance</strong> 43177 161933 229190 508182 35435 313414 180080 609543

SN Line <strong>of</strong> Business Schedule1 Fire2 Cargo & Hull3 Motor TP4Motor OD5 Engineering6 Workmen's Compensation7 Employer's Liability8 Aviation9 Personal Accident10 Health11 Others*Crop <strong>Insurance</strong>FORM NL-39<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003RURAL AND SOCIAL OBLIGATION AS ON 31ST DECEMBER 2012No. <strong>of</strong> PoliciesIssuedPremiumCollectedSum AssuredRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRural 508182 229190 4819510Social* any other segment contributing more than 5% needs to be shown separatlyNote-Entire AIC premium is Rural and Social(Rs. in Lakh)

FORM NL-40<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003SNChannelsBusiness Acquisition through Different ChannelsFor the period ending 31st December, 2012 (Rs. In Lakh)For the quarter01.10.2012-31.12.2012No. <strong>of</strong> PoliciesPremiumCorresponding quarter <strong>of</strong> theprevious year01.10.2011-31.12.2011No. <strong>of</strong> PoliciesPremiumUp to the period01.04.2012-31.12.2012No. <strong>of</strong>PoliciesPremiumCorresponding period <strong>of</strong>the previous year01.04.2011-31.12.2011No. <strong>of</strong>PoliciesPremium1 Individual agents 0 0 0 0 0 0 0 02 Corporate Agents-Banks 0 0 0 0 0 0 0 03 Corporate Agents -Others 0 0 0 0 0 0 04 Brokers 691 32 36 1 2169 172 2207 2045 Micro Agents 3403 38 13664 420 10679 199 20155 8996 Direct Business 1313 168 494 109 4119 893 7719 5277 Others 156527 42939 299220 34905 491215 227926 579462 178451Total (A) 161933 43177 313414 35435 508182 229190 609543 1800801 Referral (B) 0 0 0 0 0 0Grand Total (A+B)161933 43177 313414 35435 508182 229190 609543 180080

FORM NL-41 Grievance DisposalInsurer -<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> LimitedRegistration No. 126 and Date <strong>of</strong> Registration with the IRDA:30.10.2003GRIEVANCE DISPOSAL STATEMENT AS on 31.12.2012SNParticularsOpening Balance as onbeing <strong>of</strong> the quarterComplaints Resolved/setteled during the quarterAdditions during thequarterPartialFully AcceptedRejectedAcceptedComplaints Pending at theend <strong>of</strong> the quarterTotal Complaints registerdupto the quarter during thefinancial year1 Complaints made by customersa) Death claims Nil Nil Nil Nil Nil Nil Nilb) Claim Nil 11 Nil Nil 11 Nil 19c) Policy Related Nil Nil Nil Nil Nil Nil 1d) premium Nil Nil Nil Nil Nil Nil Nile) Refund Nil Nil Nil Nil Nil Nil Nilf) Coverage Nil Nil Nil Nil Nil Nil Nilg) Cover Note related Nil Nil Nil Nil Nil Nil Nilh) Products Nil Nil Nil Nil Nil Nil Nili) others Nil Nil Nil Nil Nil Nil 2Total Number NIL 11 NIL NIL 11 NIL 222 Total No. <strong>of</strong> Policies during Previous year NA3 Total No. <strong>of</strong> Claims during Previous year NA4 Total No. <strong>of</strong> Policies during Current year NA5 Total No. <strong>of</strong> Claims during Current year NA6Total No. <strong>of</strong> Policy Complaints (current year) per10,000/-policies (current year)NA78Total No. <strong>of</strong> Claims Complaints (Current year ) per10,000/-claims registered (current year)Duration wise Pending StatusNAComplaints made bythe CustomerComplaints madeby intermediariesa) up to 7 days Nil Nil Nilb) 7- 15 days Nil Nil Nilc) 15 - 30days Nil Nil Nild) 30-90 days Nil Nil Nile) 90 days & beyond Nil Nil NilTotal Number NIL NIL NILTotal