1st Half Year 2010-11 - Agriculture Insurance Company of India Ltd.

1st Half Year 2010-11 - Agriculture Insurance Company of India Ltd.

1st Half Year 2010-11 - Agriculture Insurance Company of India Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

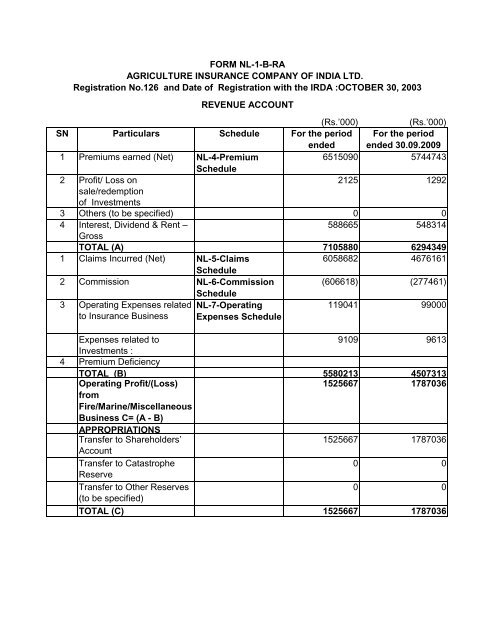

FORM NL-1-B-RAAGRICULTURE INSURANCE COMPANY OF INDIA LTD.Registration No.126 and Date <strong>of</strong> Registration with the IRDA :OCTOBER 30, 2003REVENUE ACCOUNT(Rs.’000)(Rs.’000)SN Particulars Schedule For the periodendedFor the periodended 30.09.20091 Premiums earned (Net) NL-4-Premium6515090 5744743Schedule2 Pr<strong>of</strong>it/ Loss on2125 1292sale/redemption<strong>of</strong> Investments3 Others (to be specified) 0 04 Interest, Dividend & Rent –588665 548314GrossTOTAL (A) 7105880 62943491 Claims Incurred (Net) NL-5-Claims6058682 4676161Schedule2 Commission NL-6-Commission (606618) (277461)Schedule3 Operating Expenses related NL-7-Operating<strong>11</strong>9041 99000to <strong>Insurance</strong> Business Expenses ScheduleExpenses related to9109 9613Investments :4 Premium DeficiencyTOTAL (B) 5580213 4507313Operating Pr<strong>of</strong>it/(Loss)1525667 1787036fromFire/Marine/MiscellaneousBusiness C= (A - B)APPROPRIATIONSTransfer to Shareholders’1525667 1787036AccountTransfer to Catastrophe0 0ReserveTransfer to Other Reserves0 0(to be specified)TOTAL (C) 1525667 1787036

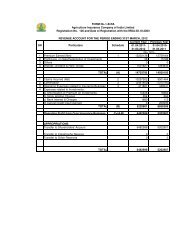

FORM NL-2-B-PLAGRICULTURE INSURANCE COMPANY OF INDIA LTD.Registration No.126 and Date <strong>of</strong> Registration with the IRDA:OCTOBER 30, 2003PROFIT AND LOSS ACCOUNT(Rs.’000)SNParticularsScheduleFor the periodended30.09.<strong>2010</strong>For theperiod ended30.09.20091 OPERATING PROFIT/(LOSS)(a) Fire <strong>Insurance</strong>(b) Marine <strong>Insurance</strong>(c ) Miscellaneous <strong>Insurance</strong> (Crop1525667 1787036insurance Business)2 INCOME FROM INVESTMENTS(a) Interest, Dividend & Rent – Gross 238201 336053(b) Pr<strong>of</strong>it on sale <strong>of</strong> investments 860 792Less: Loss on sale <strong>of</strong> investments3 OTHER INCOME (To be specified)a) Miscellaneous Receipts <strong>11</strong>91 789b) Pr<strong>of</strong>it on Sale <strong>of</strong> Assets 163 27c) Prior Period Income 0 0TOTAL (A) 1766082 21246974 PROVISIONS (Other than taxation)(a) For diminution in the value <strong>of</strong> investments 0 0(b) For doubtful debts (13550) 1008<strong>11</strong>(c) Others:i) Provision for Premium Defalcation 0 0ii) Provision on Standard Assets 4913 174605 OTHER EXPENSES(a) Expenses other than those related to0 0<strong>Insurance</strong> Business(b) Bad debts written <strong>of</strong>f(c) Others :i) Amortisation <strong>of</strong> Premium on Investments 5608 5761ii) Stock Holding Charges 181 127iii) Bank Interest & Charges 33 3iv) Loss on Sale <strong>of</strong> Assets 0 0v) Preliminary Expenses Written <strong>of</strong>f 0 0vi) Prior Period Expenses 0 0TOTAL (B) (2815) 124162Pr<strong>of</strong>it Before Tax 1768897 2000535Provision for Taxation 587583 1231555APPROPRIATIONS(a) Interim dividends paid during the year 0 0(b) Proposed final dividend 0 0(c) Dividend distribution tax 0 0(d) Transfer to any Reserves or Other0 0AccountsBalance <strong>of</strong> pr<strong>of</strong>it/ loss brought forward from0 0last yearBalance carried forward to Balance Sheet <strong>11</strong>81314 768981

(Rs.’000) (Rs.’000)SOURCES OF FUNDS SCHEDULE As at As at30.09.<strong>2010</strong> 30.09.2009SHARE CAPITAL NL-8-Share Capital Schedule 2000000 2000000SHARE APPLICATION MONEYPENDING ALLOTMENTFORM NL-3-B-BSAGRICULTURE INSURANCE COMPANY OF INDIA LTD.Registration No.126 and Date <strong>of</strong> Registration with the IRDA:OCTOBER 30, 2003BALANCE SHEETRESERVES AND SURPLUSNL-10-Reserves and SurplusSchedule6839084 6092725FAIR VALUE CHANGE ACCOUNT 108504 0BORROWINGS NL-<strong>11</strong>-Borrowings Schedule 0 0TOTAL 8947588 8092725APPLICATION OF FUNDSINVESTMENTS NL-12-Investment Schedule 16405196 14150243LOANS NL-13-Loans Schedule 13227 13625FIXED ASSETS NL-14-Fixed Assets Schedule 362471 45825DEFERRED TAX ASSET 27675 32486CURRENT ASSETSCash and Bank BalancesAdvances and Other AssetsNL-15-Cash and bank balanceScheduleNL-16-Advancxes and OtherAssets Schedule<strong>11</strong>337368 102179253618438 866419Sub-Total (A) 14955806 <strong>11</strong>084344CURRENT LIABILITIESNL-17-Current LiabilitiesSchedule164449<strong>11</strong> <strong>11</strong>171439PROVISIONS NL-18-Provisions Schedule 6371876 6062359DEFERRED TAX LIABILITYSub-Total (B) 22816787 17233798NET CURRENT ASSETS (C) = (A - B) (7860981) (6149454)MISCELLANEOUS EXPENDITURE (tothe extent not written <strong>of</strong>f or adjusted)DEBIT BALANCE IN PROFIT AND LOSSACCOUNTNL-19-MiscellaneousExpenditure Schedule0 00 0TOTAL 8947588 8092725CONTINGENT LIABILITIESParticulars As at As at(Rs.’000) (Rs.’000)1 Partly paid-up investments 0 02 Claims, other than against policies, notacknowledged as debts by the company0 03 Underwriting commitments outstanding (in0 0respect <strong>of</strong> shares and securities)4 Guarantees given by or on behalf <strong>of</strong> the0 0<strong>Company</strong>5 Statutory demands/ liabilities in dispute,0 0not provided for6 Reinsurance obligations to the extent not0 0provided for in accounts7 Others (to be specified) 0 0TOTAL

FORM NL-4-PREMIUM SCHEDULEPREMIUM EARNED [NET]ParticularsFor the periodended 30.09.<strong>2010</strong>For the periodended30.09.2009(Rs.’000) (Rs.’000)Premium from direct business9530778 8103774writtenService TaxAdjustment for change in reservefor unexpired risksGross Earned Premium 9530778 8103774Add: Premium on reinsurance215 0acceptedLess : Premium on reinsuranceceded3171634 1432952Net Premium 6359359 6670821Adjustment for change in reserve155731 (926078)for unexpired risksPremium Earned (Net) 6515090 5744743

FORM NL-5 - CLAIMS SCHEDULECLAIMS INCURRED [NET]ParticularsFor the periodended 30.09.<strong>2010</strong>For the periodended 30.09.2009(Rs.’000)( (Rs.’000)Claims paidR8665625 3063674Direct claims* 8665625 3063674Add Claims Outstanding at the 13573308 <strong>11</strong>462380end <strong>of</strong> the yearLess Claims Outstanding at13836948 8067004the beginning <strong>of</strong> the yearGross Incurred Claims 8401985 6459050Add :Re-insurance accepted0 0to direct claimsLess :Re-insurance Ceded toclaims paid2343303 1782889Total Claims Incurred 6058682 4676161* includes Rs. 200 Crores paid to Central Government for the payment <strong>of</strong>

FORM NL-6-COMMISSION SCHEDULECOMMISSIONParticularsFor the periodended30.09.<strong>2010</strong>For the periodended30.09.2009(Rs.’000) (Rs.’000)Commission paidDirect 27386 (205)Add: Re-insurance Accepted 43 0Less: Commission on Reinsurance634047 277255CededNet Commission (606618) (277461)Break-up <strong>of</strong> the expenses(Gross) incurred to procurebusiness to be furnished asper details indicated below:Agents 648 326Brokers 3161 (530)Corporate Agency 23577 0Referral 0 0Others (pl. specify) 0 0TOTAL (B) 27386 (205)

FORM NL-7-OPERATING EXPENSES SCHEDULEOPERATING EXPENSES RELATED TO INSURANCE BUSINESSParticularsFor the periodended30.09.<strong>2010</strong>For the periodended30.09.2009(Rs.’000) (Rs.’000)1 Employees’ remuneration &66785 40630welfare benefits2 Travel, conveyance and6159 6099vehicle running expenses3 Training expenses 66 1254 Rents, rates & taxes 13705 100335 Repairs 3622 31246 Printing & stationery 1770 19637 Communication 2005 18448 Legal & pr<strong>of</strong>essional charges 9081 80729 Auditors' fees, expenses etc(a) as auditor 352 264(b) as adviser or in any other0 0capacity, in respect <strong>of</strong>(i) Taxation matters 0 0(ii) <strong>Insurance</strong> matters 0 0(iii) Management services;0 0and(c) in any other capacity 0 010 Advertisement and publicity <strong>11</strong>89 2282<strong>11</strong> Interest & Bank Charges 39 5<strong>11</strong>2 Others (to be specified) <strong>11</strong>6<strong>11</strong> 2139013 Depreciation 2657 3121TOTAL <strong>11</strong>9041 99000

FORM NL-8-SHARE CAPITAL SCHEDULESHARE CAPITALSNParticularsAs at As at30.09.<strong>2010</strong> 30.09.2009(Rs.’000). (Rs.’000).1 Authorised Capital150 crore Equity Shares <strong>of</strong> Rs.10/- each 15000000 150000002 Issued Capital20 crore Equity Shares <strong>of</strong> Rs.10/- each 2000000 20000003 Subscribed Capital20 crore Equity Shares <strong>of</strong> Rs.10/- each 2000000 20000004 Called-up Capital20 crore Equity Shares <strong>of</strong> Rs.10/- each 2000000 2000000Less : Calls unpaidAdd : Equity Shares forfeited (Amount originally paid up)Less : Par Value <strong>of</strong> Equity Shares bought backLess : Preliminary Expenses 0 0Expenses including commission or brokerage on 0 0Underwriting or subscription <strong>of</strong> sharesTOTAL 2000000 2000000

FORM NL-9-PATTERN OF SHAREHOLDING SCHEDULESHARE CAPITALPATTERN OF SHAREHOLDING[As certified by the Management]ShareholderAs at 30.09.<strong>2010</strong>As at 30.09.2009Promoters<strong>India</strong>nNumber <strong>of</strong>Shares(Rs.’000).% <strong>of</strong>HoldingNumber <strong>of</strong>Shares(Rs.’000).% <strong>of</strong>HoldingGeneral <strong>Insurance</strong> Corporation <strong>of</strong> <strong>India</strong> 70000 35% 70000 35%National <strong>Agriculture</strong> Bank for RuralDevelopmentNational <strong>Insurance</strong> <strong>Company</strong> <strong>Ltd</strong>.& itsnominee60000 30% 60000 30%17500 8.75% 17500 8.75%The Oriental <strong>Insurance</strong> <strong>Company</strong> <strong>Ltd</strong>. 17500 8.75% 17500 8.75%United <strong>India</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>Ltd</strong>. 17500 8.75% 17500 8.75%The New <strong>India</strong> Assurance <strong>Company</strong> <strong>Ltd</strong>. &its nominee17500 8.75% 17500 8.75%Foreign NIL NIL NIL NILOthersTOTAL 200000 100% 200000 100%

FORM NL-10-RESERVE AND SURPLUS SCHEDULERESERVES AND SURPLUSSN Particulars As at30.09.<strong>2010</strong>As at30.09.2009(Rs.’000). (Rs.’000).1 Capital Reserve 0 02 Capital Redemption Reserve 0 03 Share Premium 0 04General Reserves 5657770 5323746Less: Debit balance in Pr<strong>of</strong>it and Loss AccountLess: Amount utilized for Buy-back5 Catastrophe Reserve 0 06 Other Reserves (to be specified) 0 07 Balance <strong>of</strong> Pr<strong>of</strong>it in Pr<strong>of</strong>it & Loss Account <strong>11</strong>81314 768980TOTAL 6839084 6092725

FORM NL-12-INVESTMENT SCHEDULEINVESTMENTSN Particulars As at 30.09.<strong>2010</strong> As at 30.09.2009(Rs.’000). (Rs.’000).LONG TERM INVESTMENTS1 Government securities and7614134 7813058Government guaranteed bondsincluding Treasury Bills2 Other Approved Securities 2355523 15526363 Other Investments( a) Shares(aa) Equity 453596 73291(bb) Preference 0 0( b) Mutual Funds 0 0(c) Derivative Instruments 0 0(d) Debentures/ Bonds 350000 0(e) Other Securities (to be0 0specified)(f) Subsidiaries 0 0(g) Investment Properties-Real0 0Estate4 Investments in Infrastructure and3892273 4041258Social Sector5 Other than Approved Investments 120000 120000SHORT TERM INVESTMENTS1 Government securities and0 0Government guaranteed bondsincluding Treasury Bills2 Other Approved Securities 0 03 Other Investments(a) Shares(aa) Equity 0 0(bb) Preference 0 0(b) Mutual Funds 1619670 550000(a) Derivative Instruments 0 0(b) Debentures/ Bonds 0 0(c) Other Securities (to be specified) 0 0(d) Subsidiaries 0 0(e) Investment Properties-Real0 0Estate4 Investments in Infrastructure and0 0Social Sector5 Other than Approved Investments 0 0TOTAL 16405196 14150243

FORM NL-13-LOANS SCHEDULELOANSSN Particulars As at 30.09.<strong>2010</strong> As at 30.09.2009(Rs.’000). (Rs.’000).1 SECURITY-WISE CLASSIFICATIONSecured(a) On mortgage <strong>of</strong> property(aa) In <strong>India</strong> 0 0(bb) Outside <strong>India</strong> 0 0(b) On Shares, Bonds, Govt. Securities 0 0(c) Others (to be specified)(i) Loans to Staff 13227 13625Unsecured 0 0TOTAL 13227 136252 BORROWER-WISE CLASSIFICATION(a) Central and State Governments 0 0(b) Banks and Financial Institutions 0 0(c) Subsidiaries 0 0(d) Industrial Undertakings 0 0(e) Others (to be specified) 13227 13625TOTAL 13227 136253 PERFORMANCE-WISECLASSIFICATION(a) Loans classified as standard(aa) In <strong>India</strong> 13227 13625(bb) Outside <strong>India</strong> 0 0(b) Non-performing loans less provisions(aa) In <strong>India</strong> 0 0(bb) Outside <strong>India</strong> 0 0TOTAL 13227 136254 MATURITY-WISE CLASSIFICATION(a) Short Term 0 0(b) Long Term 13227 13625TOTAL 13227 13625

ParticularsGoodwillIntangibles (specify)FORM NL-14-FIXED ASSETS SCHEDULEFIXED ASSETSCost/ Gross BlockDepreciationOpening Additions Deductions Closing Up toLast <strong>Year</strong>For ThePeriodOn Sales/AdjustmentsTo Date(Rs.’000)Net BlockAs at As at30.09.<strong>2010</strong> 30.09.2009Land-FreeholdLeasehold Property 9693 0 2531 7162 7668 253 759 7162 0 2025Buildings 36614 0 0 36614 9475 679 0 10154 26460 27139Furniture & Fittings 9044 24 20 9048 4835 388 15 5208 3840 4209Information12<strong>11</strong>4 554 0 12668 8381 833 0 9213 3455 3734TechnologyEquipmentVehicles 9056 1720 1669 9107 5096 621 1369 4347 4759 3960Office Equipment 4877 <strong>11</strong>8 0 4996 2<strong>11</strong>1 221 0 2332 2664 2766Others (Specify 4057 581 0 4638 1835 232 0 2067 2571 2221nature)Computer S<strong>of</strong>tware 509 0 509 509 0 0 509 0 0TOTAL 85965 2998 4221 84742 39912 3226 2144 40993 43749 46054Work in progress 248333 70389 0 318722 0 0 0 0 318722 248333Grand Total 334298 73387 4221 403464 39912 3226 2144 40993 362471 294387PREVIOUS YEAR 76221 6401 3873 78748 26873 6681 1027 32526 46222 49348

FORM NL-15-CASH AND BANK BALANCE SCHEDULECASH AND BANK BALANCESSN Particulars For the periodended 30.09.<strong>2010</strong>For the periodended 30.09.2009(Rs.’000) (Rs.’000)1 Cash (including cheques, drafts6476 42and stamps)2 Bank Balances(a) Deposit Accounts(aa) Short-term (due within 128482300 9839631months)(bb) Others(b) Current Accounts 2848592 366419(c) Others (to be specified) 0 03 Money at Call and Short Notice(a) With Banks 0 0(b) With other Institutions 0 04 Others (to be specified) 0 <strong>11</strong>833TOTAL <strong>11</strong>337368 10217925Balances with non-scheduledbanks included in 2 and 3above0 0

FORM NL-16-ADVANCES AND OTHER ASSETS SCHEDULEADVANCES AND OTHER ASSETSSN Particulars As at30.09.<strong>2010</strong>As at30.09.2009(Rs.’000). (Rs.’000).ADVANCES1 Reserve deposits with ceding0 0companies2 Application money for0 0investments3 Prepayments 5172 49844 Advances1678 1274to Directors/Officers5 Advance tax paid and taxes 700693 0deducted at source (Net <strong>of</strong>provision for taxation)6 Others (to be specified)Advance Rent paid 24 17Sundry Advances 1298 1319TOTAL (A) 708866 7594OTHER ASSETS1 Income accrued oninvestments641407 5840802 Outstanding Premiums 0 03 Agents’ Balances 0 04 Foreign Agencies Balances5 Due from other entitiescarrying on insurance business33388 12673(including reinsurers)6 Due from subsidiaries/ holding 0 07 Deposit with Reserve Bank <strong>of</strong> 101098 101709<strong>India</strong>[Pursuant to section 7 <strong>of</strong><strong>Insurance</strong> Act, 1938]8 Others (to be specified)a) Sundry Deposits 24698 20893b) Advance against Capital4597 1397Assetsc) Short Collection <strong>of</strong> Premium 64253 50149d) Premium Receivable 0 0e) Others (Adhoc payment to0 0Govt. <strong>of</strong> <strong>India</strong>)f) Government1934730 914520(Centre/States/Uts/C<strong>of</strong>feeBoard)g) Sundry Debtors 20090 13491h) Cenvat Credit Receivable 85312 74433TOTAL (B) 2909573 1773345TOTAL (A+B) 3618438 1780939

FORM NL-17-CURRENT LIABILITIES SCHEDULECURRENT LIABILITIESSParticularsAs at As at 30.09.2009N30.09.<strong>2010</strong>(Rs.’000). (Rs.’000).1 Agents’ Balances 0 02 Balances due to other insurance2373543 0companies3 Deposits held on re-insurance ceded 0 04 Premiums received in advance 0 <strong>11</strong>65 Unallocated Premium 0 06 Sundry creditors 309215 1444657 Due to subsidiaries/ holding company 0 08 Claims Outstanding 10658233 93342589 Due to Officers/ Directors 0 010 Others (to be specified)a) Excess Collection <strong>of</strong> Premium 190382 139226b) Provision for Outstanding Expenses 136998 9746c) Earnest Money Deposit 2760 3244d) Government (Centre/States/Uts/C<strong>of</strong>fee 2773781 2423519Board)e) Pension Contribution – New Employees 0 10559TOTAL 164449<strong>11</strong> 12065132

FORM NL-18-PROVISIONS SCHEDULEPROVISIONSSN Particulars As at As at 30.09.200930.09.<strong>2010</strong>(Rs.’000). (Rs.’000).1 Reserve for Unexpired Risk 6186807 48087072 For taxation (less advance tax0 916009paid and taxes deducted atsource)3 For proposed dividends 0 700004 For dividend distribution tax 0 339905 Others (to be specified)Provision for Retirement49846 55864BenefitsProvision for Doubtful Debts 47 <strong>11</strong>0772Provision for Premium18733 12503DefalcationProvision on Standard Assets 57732 54515Provision for Arrears (due to587<strong>11</strong> 20827wage revision)6 Reserve for Premium Deficiency 0TOTAL 6371876 6083186

FORM NL-19 MISC EXPENDITURE SCHEDULEMISCELLANEOUS EXPENDITURE(To the extent not written <strong>of</strong>f or adjusted)SN Particulars As at30.09.<strong>2010</strong>As at30.09.2009(Rs.’000). (Rs.’000).1 Discount Allowed in issue <strong>of</strong>shares/ debentures0 00 02 Others (to be specified) 0 0TOTAL 0 0

PERIODIC DISCLOSURESAGRICULTURE INSURANCE COMPANY OF INDIA LTDFORM NL 21 - STATEMENT OF LIABLITES FOR THE HALF YEAR ENDED 30.09.<strong>2010</strong>As At 30.09.<strong>2010</strong>As At 30.09.2009(Rs in Lakhs)SNParticularReserves forunexpiredrisksReserve forOutstandingClaimsIBNRReservesTotalReservesReserves forunexpiredrisksReserve forOutstandingClaimsIBNRReservesTotalReserves1 Fire2 Marinea Marine Cargob Marine Hull3 Miscellaneousa Motorb Engineeringc Aviationd Liabilitiese Others4 Health <strong>Insurance</strong>Crop <strong>Insurance</strong> 61868 54724 51859 168450 48087 33549 59794 141430Total Liabilities 61868 54724 51859 168450 48087 33549 59794 141430

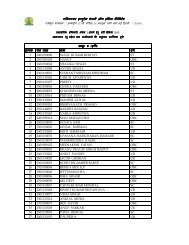

FORM NL-22Geographical Distribution <strong>of</strong> BusinessPERIODIC DISCLOSURESInsurer: <strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> <strong>Ltd</strong>., New DelhiGROSS DIRECT PREMIUM UNDERWRITTEN FROM APRIL TO SEPTEMBER <strong>2010</strong>STATESFortheqtrUptotheqtrFortheqtrUptotheqtrFortheqtrUptotheqtrFortheqtrUptotheqtrFortheqtrUptotheqtrFortheqtrUptotheqtrLiabilityinsuranceFor Uptothe theqtr qtrPersonalAccidentFor Uptothe theqtr qtrMedical<strong>Insurance</strong>For Uptothe theqtr qtrOverseasmedical<strong>Insurance</strong>For Uptothe theqtr qtr(Rs in Lakhs)Crop<strong>Insurance</strong>1.4.<strong>2010</strong> to30.9.<strong>2010</strong>Andhra Pradesh 10226.42Arunachal PradeshAssam 165.04Bihar 8390.56Chhattisgarh 2221.18Goa 2.79Gujarat 12170.96Haryana 449.28Himachal Pradesh 72.61Jammu & Kashmir 7.94Jharkhand 894.82Karnataka 2494.76Kerala 387.36Madhya Pradesh 8105.38Maharasthra 13878.01Manipur 0.00Meghalaya 44.22Mizoram 0.00NagalandOrissa 4590.90Punjab 0.00Rajasthan 22201.43Sikkim 0.03Tamil Nadu 1097.63Tripura 3.17Uttar Pradesh 3859.74Uttrakhand 5<strong>11</strong>.39West Bengal 3637.03Andaman & Nicobar Is. 0.00ChandigarhDadra & Nagra HaveliDaman & DiuDelhiLakshadweepFireMarine(Cargo)Marine(Hull)Engineerin Motor Own Motor Thirdg Damage PartyPuducherry 4.96Total 95417.61NANANANANANANAAll OtherMiscellaneousFortheqtrUptotheqtrGrandTotalFortheqtrUptotheqtrPage 21 <strong>of</strong> 40

Form Nl 23 - Reinsurance Risk ConcentrationAGRICULTURE INSURANCE CO. OF INDIA LTD.(Rs in Lakhs)Reinsurance Risk Concentration for the half year ended 30.09.<strong>2010</strong>Premium ceded to reinsurersSNReinsurance PlacementsNo. <strong>of</strong>reinsurersProportionalNon-ProportionalFacultativePremium ceded toreinsurers / Totalreinsurancepremium ceded (%)1 No. <strong>of</strong> Reinsurers with rating <strong>of</strong> AAA and above NIL2 No. <strong>of</strong> Reinsurers with rating AA but less than AAA 1 1468 4.633 No. <strong>of</strong> Reinsurers with rating A but less than AA 6 <strong>11</strong>889 353 38.604 No. <strong>of</strong> Reinsurers with rating BBB but less than A 0.005 No. <strong>of</strong> Reinsurers with rating less than BBB 0.006 No. <strong>of</strong> <strong>India</strong>n Reinsurers (GIC & GIPSA Cos) 5 17918 88 56.77Total 12 31275 441 100.00

FORM NL-24 Ageing <strong>of</strong> ClaimsAGRICULTURE INSURANCE CO. OF INDIA LTD.Ageing <strong>of</strong> Claims for the half year ended 30.09.<strong>2010</strong>LINE OF BUSINESSNo. <strong>of</strong> Claims Paid1 Month 1 - 3 Months 3 - 6 Months 6 Months - 1<strong>Year</strong>No. <strong>of</strong> No. <strong>of</strong> No. <strong>of</strong> No. <strong>of</strong>Farmers Farmers Farmers Farmers> 1 <strong>Year</strong>No. <strong>of</strong>FarmersTotal No. <strong>of</strong>Claims PaidNo. <strong>of</strong>FarmersTotalAmount <strong>of</strong>Claims Paid(Rs. inLakhs)Crop <strong>Insurance</strong> 0 264441 3430940 2494926 227128 6417435 357243.08

FORM NL-25 claims data for the half year ended 30.09.<strong>2010</strong>AGRICULTURE INSURANCE CO. OF INDIA LTD.CLAIMS DATA - HALF YEARLY (APRIL,<strong>2010</strong> to SEPTEMBER,<strong>2010</strong>)CROP INSURANCESNClaims ExperienceNo. <strong>of</strong> Claims(No. <strong>of</strong> Farmers)1 CLAIMS O/S AT THE BEGINNING OF THE PERIOD 12410552 CLAIMS REPORTED DURING THE PERIOD 87056733 CLAIMS SETTLED DURING THE PERIOD 64174354 CLAIMS REPUDIATED DURING THE PERIOD 05 CLAIMS CLOSED DURING THE PERIOD 06 CLAIMS O/S AT END OF THE PERIOD 3529293LESS THAN 3 MONTHS 6419693 MONTHS TO 6 MONTHS 2276 MONTHS TO 1 YEAR 28790961 YEAR AND ABOVE 8001

FORM NL-26 - CLAIMS INFORMATION - KG Table IAGRICULTURE INSURANCE COMPANY OF INDIA LTDSOLVENCY AS AT 30.09.<strong>2010</strong>REQUIRED SOLVENCY MARGIN BASED ON NET PREMIUM AND NET INCURRED CLAIMSPREMIUMCLAIMS(Rs. in Lacs)Item No.DescriptionGrossPremiumNet PremiumGrossincurred claimNet incurredClaimRSM-1RSM-21 Fire2 Marine Cargo3 Marine Hull4 Motor5 Engineering6 Aviation7 Laibilities8 Others9 HealthCrop <strong>Insurance</strong> 166310 123736 129540 101026 24747 30308 30308Total 166310 123736 129540 101026 24747 30308 30308

PERIODIC DISCLOSURESForm Nl 27 - Offices information for Non-Life<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> <strong>Ltd</strong>., New DelhiFROM APRIL TO SEPTEMBER <strong>2010</strong>SN123456789Office InformationNo. <strong>of</strong> <strong>of</strong>fices at the beginning <strong>of</strong> the yearNo. <strong>of</strong> branches approved during the yearNo. <strong>of</strong> branches openedduring the yearOut <strong>of</strong> approvals <strong>of</strong>previous yearOut <strong>of</strong> approvals <strong>of</strong>this yearNo. <strong>of</strong> branches closed during the yearNo <strong>of</strong> branches at the end <strong>of</strong> the yearNo. <strong>of</strong> branches approved but not opendNo. <strong>of</strong> rural branchesNo. <strong>of</strong> urban branchesNumber18000018nana18The above figures includes 1 Head Office at Delhi and 17 Regional Offices.

FORM NL-28-STATEMENT OF ASSETS - 3B<strong>Company</strong> Name & Code:Statement as on:Statement <strong>of</strong> Investment Assets (General Insurer, Re-insurers)(Business within <strong>India</strong>)AGRICULTURE INSUARNCE COMPANY OF INDIA LIMITED, CODE NO.12630TH SEPTEMBER, <strong>2010</strong>Rs. In LakhsNo PARTICULARS SCH AMOUNT1 Investments 8 164051.962 Loans 9 132.273 Fixed Assets 10 3624.714 Current Assetsa. Cash & Bank Balance <strong>11</strong> <strong>11</strong>3373.68b. Advances & Other Assets 12 36184.385 Current Liabilitiesa. Current Liabilities 13 164449.<strong>11</strong>b. Provisions 14 63718.76c. Misc. Exp not Written Off 15 0.00d. Debit Balance <strong>of</strong> P&L A/cApplication <strong>of</strong> Funds as per Balance Sheet (A) 89199.13Less: Other Assets SCH AMOUNT1 Loans (if any) 9 132.272 Fixed Assets (if any) 10 3624.713 Cash & Bank Balance (if any) <strong>11</strong> 28550.684 Advances & Other Assets (if any) 12 35173.405 Current Liabilities 13 164449.<strong>11</strong>6 Provisions 14 63718.767 Misc. Exp not Written Off 15 0.008 Debit Balance <strong>of</strong> P&L A/cTOTAL (B) -160686.81'Investment Assets' As per FORM 3B (A-B) 249885.94No 'Investment' represented as Reg. %SHBook ValueFVCPH%Total *MarketBalance FRSM +(SH + PH) AmountActualValue(a) (b) (c) d = (b+c) (e) (d + e)1 G. Sec. Not less than 20% 23582.33 45777.46 69359.79 27.88 69359.792 G. Sec or Other Apporved Sec. (incl. (1) above) Not less than 30% 26231.79 50920.54 77152.33 31.01 77152.333 Investment subject to Exposure Norms 0.001.'Housing & Loans to SG for Housing and FFE, Infrastructure Investments Not less than 15% 21242.51 41235.45 62477.96 25.<strong>11</strong> 62477.962. Approved Investments 37<strong>11</strong>8.01 72052.60 109170.61 43.88 1085.04 <strong>11</strong>0255.65Not exceeding 55%3. Other Investments (not exceeding 25%)Total Investment Assets 100% 84592.31 164208.59 248800.90 100.00 249885.94 -*All securities are considered to be on the basis <strong>of</strong> 'Held to Maturity', hence only Book Value is given.Certification:Certified that the information given herein are correct and complete to the best<strong>of</strong> my knowledge and belief and nothing has been concealed or suppressedDate:

PERIODIC DISCLOSURESForm NL 29 - Detail regarding debt securities<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> Limited(Rs in Lakhs)Break down by creditratingAs at 31.03.10as % <strong>of</strong> totalfor this classas at…. Of theprevious yearas % <strong>of</strong> totalfor this classAs at 30.09.10as % <strong>of</strong> totalfor this classas at 30.09.09Of theprevious yearas % <strong>of</strong> totalfor this classAAA rated 143825.15 99.65 136286.62 100.00AA or better 505.14 0.35Rated below AA butabove ARated below A but aboveBAny otherBREAKDOWN BYRESIDUALMATURITY144330.29 100.00 136286.62 100.00Up to 1 year 9240.48 6.40 14071.23 10.32more than 1 yearand upto3yearsMore than 3years and upto 7yearsMore than 7 years and upto 10 years19001.20 13.17 20<strong>11</strong>4.81 14.7650567.22 35.04 40590.87 29.7845722.02 31.68 4<strong>11</strong>29.71 30.18above 10 years 19799.37 13.72 20380.00 14.95Breakdown by type <strong>of</strong>the issurerDetail Regarding debt securitiesMARKET VALUE*144330.29 100.00 136286.62 100.00a. Central Government 69359.79 48.06 71848.16 52.72b. State Government 7792.54 5.40 7299.52 5.36c.Corporate Securities 67177.96 46.54 57138.94 41.93*All securities are considered to be on the basi <strong>of</strong> 'Held to Maturity', hence only Book Value is given.Book Value144330.29 100.00 136286.62 100.00

PERIODIC DISCLOSURESFORM NL-30 ANALYTICAL RATIOSAGRICULTURE INSURANCE COMPANY OF INDIA LTDANALYTICAL RATIOS FOR NON-LIFE INSURANCE COMPANIESSN Particular Sep-10 Sep-091 Gross Premium Growth Rate <strong>11</strong>7.61 208.582 Gross Premium to shareholders' fund ratio 107.83 100.143 Growth rate <strong>of</strong> shareholders'fund 109.22 <strong>11</strong>5.214 Net Retention Ratio 66.72 82.315 Net Commission Ratio -9.54 -3.426Expense <strong>of</strong> Management to Gross DirectPremium Ratio1.54 1.227 Combined Ratio 65.10 58.928 Technical Reserves to net premium ratio 264.89 212.019 Underwriting balance ratio 12.40 32.5810 Operationg Pr<strong>of</strong>it Ratio 25.44 45.86<strong>11</strong> Liquid Assets to liabilities ratio 132.72 155.4512 Net earning ratio 18.58 <strong>11</strong>.5313 return on net worth ratio 13.36 9.5014Available Solvency argin Ratio to RequiredSolvency Margin Ratio2.68 4.5415 NPA RatioFig in (%)Gross NPA Ratio NA NANet NPA Ratio NA NAEquity Holding Pattern for Non-Life Insurers(Rs. in Lacs)1 (a) No. <strong>of</strong> shares 2000 20002(b) Percentage <strong>of</strong> shareholding (<strong>India</strong>n /Foreign)3( c) %<strong>of</strong> Government holding (in case <strong>of</strong> publicsector insurance companies)4(a) Basic and diluted EPS before extraordinaryitems (net <strong>of</strong> tax expense) for the period (notto be annualized)5(b) Basic and diluted EPS after extraordinaryitems (net <strong>of</strong> tax expense) for the period (not 12.58 3.84to be annualized)6 (iv) Book value per share (Rs) Rs.10/- Rs.10/-

PERIODIC DISCLOSURESForm NL31: Related Party TransactionsAGRICULTURE INSURANCE COMPANY OF INDIA LTD.Related Party Transactions for the half year ended 30.09.<strong>2010</strong>(Rs in Lakhs)SNName <strong>of</strong> the Related PartyNature <strong>of</strong>Relationshipwith the<strong>Company</strong>Description <strong>of</strong>Transactions /CategoriesConsiderationpaid1 General <strong>Insurance</strong> Corpn <strong>of</strong> <strong>India</strong> 324331503 New <strong>India</strong> Assurance Co 79462434 National <strong>Insurance</strong> Co.Shareholders Reinsurance72422555 Oriental Ins. Co. 79462436 United <strong>India</strong> Ins. Co. 3267108*including the premium flow through Assocaites/ Group companies as an agent

PERIODIC DISCLOSURESAGRICULTURE INSURANCE COMPANY OF INDIA LTD.Fom 32: Products InformationProducts Information for the half year ended 30.09.<strong>2010</strong>List below the products and/or add-ons introduced during the periodSN Name <strong>of</strong> Product Co. Ref. No. IRDA Ref.no. Class <strong>of</strong> Business*Category <strong>of</strong>productDate <strong>of</strong> filing<strong>of</strong> ProductDate IRDAconfirmedfiling/approval1Cardamom Plants & Yield<strong>Insurance</strong>AIC/R&D/35IRDA/NL/AIC/P/Misc/V-I/093/08-09Misc.(crop)<strong>Insurance</strong>13.2.10 23.4.10

SNFORM NL-33 - SOLVENCY MARGIN - KGIITABLE - IIAGRICULTURE INSURANCE COMPANY OF INDIA LTD.SOLVENCY AS AT 30.09.<strong>2010</strong>AVAILABLE SOLVENCY MARGIN AND SOLVENCY MARGIN(Rs. in Lacs)NotesDescriptionAmountNo.(1) (2) (3) (4)1 Available Assets in Policyholders’ Funds (adjusted value 203013<strong>of</strong> Assets as mentioned in Form IRDA-Assets-AA):Deduct:2 Liabilities (reserves as mentioned in Form HG) 1684503 Other Liabilities (other liabilities in respect <strong>of</strong> 53377Policyholders’ Fund as mentioned in Balance Sheet) (18815)4 Excess in Policyholders’ Funds (1-2-3)5 Available Assets in Shareholders’ Funds (value <strong>of</strong> 106527Assets as mentioned in Form IRDA-Assets-AA):Deduct:6 Other Liabilities (other liabilities in respect <strong>of</strong> 6340Shareholders’ Fund as mentioned in Balance Sheet)7 Excess in Shareholders’ Funds (5-6) 1001868 Total Available Solvency Margin [ASM] (4+7) 813729 Total Required Solvency Margin [RSM] 3030810 Solvency Ratio (Total ASM/Total RSM) 2.68

FORM NL-34<strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> Limited: Board <strong>of</strong> Directors & Key PersonFor the period from 01.04.<strong>2010</strong> to 30.09.<strong>2010</strong>NL 34 : BOD and Key Person informationSl. No. Name <strong>of</strong> person Role/designationDetails <strong>of</strong> change in the periodBoard <strong>of</strong> Directors1 Shri M. Parshad Chairman-cum-Managing Director2 Shri Tarun Bajaj Director3 Shri R. K. Tiwari Director4 Shri Mukesh Khullar Director5 Shri K. N. Bhandari Director6 Smt. Bhagyam Ramani Director7 Shri S. K. Mitra Director8 Shri I. S. Phukela Director9 Shri S. K. Chanana Director10 Shri P. C. James DirectorKey Persons1 Shri R. P. Samal General Manager2 Shri S. Chidambaram Appointed ActuaryNo Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>No Change during the first half year <strong>of</strong> <strong>2010</strong>-<strong>11</strong>

FORM NL-35-NON PERFORMING ASSETS-7A<strong>Company</strong> Name &Code:AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED, CODE NO.126Statement as on:30TH SEPTEMBER, <strong>2010</strong>Details <strong>of</strong> Investment PortfolioCOI<strong>Company</strong>NameInstrument TypeInterest Rate%Has therebeenrevision?Total O/s(BookValue)DefaultPrincipal(BookValue)DefaultInterest(BookValue)PrincipalDue fromInterestDue fromDeferredPrincipalDeferredInterestRolledOver?Has there been anyPrincipal Waiver?AmountBoardApprovalRefClassificationProvision(%)Provision(Rs)NILCERTIFICATIONCertified that the information given herein are correct and complete to the best <strong>of</strong> my knowledge and belief and nothing has been concealed or suppressed.Date:

FORM NL-36-YIELD ON INVESTMENTS 1<strong>Company</strong> Name & Code:AGRICULTURE INSUANCE COMPANY OF INDIA LIMITED, CODE NO.126Statement as on:30TH SEPTEMBER, <strong>2010</strong>Statement <strong>of</strong> Investment and Income on InvestmentCurrent Quarter<strong>Year</strong> to DateRs. LakhsPrevious <strong>Year</strong>NoCategory <strong>of</strong> InvestmentCategoryCodeInvestment (Rs.)BookValueMarketValue*IncomeonInvestment (Rs.)Gross Net YieldYield (%)¹ (%)²Investment (Rs.)BookValueA1 Central Government Securities CGSB 0.00 0.00 0.00 0.00 1979.40 72.89 8.20 5.41 15334.50 129.72 6.80 4.49A4 Deposit u/s 7 <strong>of</strong> <strong>Insurance</strong> Act, CDSS 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00B1 State Government Bonds SGGB 496.00 5.57 8.19 5.41 496.00 5.57 8.19 5.41 4523.37 52.59 7.98 5.27C5 Bonds/ Debentures Issued by HTHD 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00C6 Bonds/ Debentures Issued by NHB HTDN 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00MarketValueIncomeonInvestment (Rs.)Gross Net YieldYield (%)¹ (%)²Investment (Rs.)BookValueMarketValueIncomeonInvestment (Rs.)GrossYield (%)¹Net Yield(%)²C7D2D5Bonds/ Debentures issued byAuthority constituted under anyHousing/ Building Schemeapproved by Central/ State/ anyAuthority or Body constituted byInfrastructure/ Social Sector-PSU-Debenture BondsInfrastructure/ Social Sector-PSU-Debenture Bonds (Tax Free)HTDA 5000.00 40.29 8.37 5.53 8993.20 207.22 8.50 5.61 5996.16 <strong>11</strong>0.14 8.91 5.88IPTD 0.00 0.00 0.00 0.00 5526.65 189.72 8.46 5.58 19556.22 155.86 8.44 5.57IPFD 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00E1E2E6PSU (Approved Investment) -Equity shares QuotedEAEQ 39.95 20.00 0.00 0.00 434.42 22.34 0.00 0.00 33.04 18.15 0.00 0.00Corporate Securities (ApprovedEACE 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00 0.00Investment) - Equity shares QuotedCorporate Securities - Bonds(Taxable)EPBT 3500.00 139.19 8.42 5.56 3500.00 139.19 8.42 5.56 0.00 0.00 0.00 0.00Deposits - Deposit with Scheduled 18441.70 152.16 7.56 4.99 50668.70 <strong>11</strong>13.76 7.03 4.64 65793.81 1304.21 7.30 4.82E16ECDBMibor Deposit <strong>11</strong>272.00 <strong>11</strong>.72 6.50 4.29 <strong>11</strong>6<strong>11</strong>.50 <strong>11</strong>.72 6.50 4.29 35312.00 23.74 4.25 2.81F9 Liquid Fund - MUTUAL FUND OMLF 462<strong>11</strong>.50 69.06 6.45 6.45 75454.00 160.35 6.15 6.15 52381.00 127.74 3.75 3.75TOTAL 84961.15 437.99 6.90 5.75 158663.87 1922.76 6.74 5.44 198930.10 1922.15 5.96 4.27*All securities are considered to be on the basis <strong>of</strong> 'Held to Maturity', hence only Book Value is given.CERTIFICATIONCertified that the information given herein are correct and complete to the best <strong>of</strong> my knowledge and belief and nothing has been concealed or suppressed.

FORM NL-37-DOWN GRADING OF INVESTMENT-2<strong>Company</strong> Name & Code: AGRICULTURE INSURANCE COMPANY OF INDIA LIMITED,Statement as on:30TH SEPTEMBER, <strong>2010</strong>Statement <strong>of</strong> Down Graded InvestmentsCODE NO.126Rs. LakhsNoName <strong>of</strong> theSecurityCOIAmountDate <strong>of</strong>PurchaseRating AgencyOriginalGradeCurrentGradeDate <strong>of</strong>DowngradeRemarksA. During the Quarter ¹B. As on Date ²NILCERTIFICATIONCertified that the information given herein are correct and complete to the best <strong>of</strong> myknowledge and belief and nothing has been concealed or suppressed.

PERIODIC DISCLOSURESForm NL 38 - Business Returns across line <strong>of</strong> Business from April, <strong>2010</strong> to September, <strong>2010</strong><strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> <strong>Ltd</strong>., New Delhi(Rs in Lakhs)SNLine <strong>of</strong> BusinessCurrent <strong>Half</strong> <strong>Year</strong>Previous <strong>Half</strong> yearPremium No. <strong>of</strong> Policies Premium No. <strong>of</strong> Policies1 Fire NA NA NA NA2 Cargo & Hull NA NA NA NA3 Motor TP NA NA NA NA4 Motor OD NA NA NA NA5 Engineering NA NA NA NA6 Workmen's Compensation NA NA NA NA7 Employer's Liability NA NA NA NA8 Aviation NA NA NA NA9 Personal Accident NA NA NA NA10 Health NA NA NA NA<strong>11</strong> Others*Crop <strong>Insurance</strong> 95418 270169 8<strong>11</strong>77 233714

SN Line <strong>of</strong> Business Particular1 Fire8 Aviation10 HealthPERIODIC DISCLOSURESForm Nl 39 - Rural & Social Obligations from April <strong>2010</strong> to September,<strong>2010</strong>2 Cargo & Hull3 Motor TP4 Motor OD5 Engineering6 Workmen's Compensation7 Employer's Liability9 Personal Accident<strong>11</strong> Others*Crop <strong>Insurance</strong>Rural & Social Obligations*any other segment contributing more than 5% needs to be shown separatelyNote-Entire AIC premium is Rural & SocialNo. <strong>of</strong> PoliciesIssuedPremiumCollected(Rs in Lakhs)Sum AssuredRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRuralSocialRural 270169 95418 2354954Social

PERIODIC DISCLOSURESForm NL 40 : Business Acquisition through different channels from April, <strong>2010</strong> to September, <strong>2010</strong><strong>Agriculture</strong> <strong>Insurance</strong> <strong>Company</strong> <strong>of</strong> <strong>India</strong> <strong>Ltd</strong>., New Delhi(Rs in Lakhs)Business Acquisition through different channelsSNChannelsApril to Sep'<strong>2010</strong>April to Sep'2009No. <strong>of</strong> Policies Premium No. <strong>of</strong> Policies Premium1 Individual agents 0 0 0 02 Corporate Agents-Banks 209555 94015 206991 774693 Corporate Agents -Others 0 0 3743 634 Brokers 18163 486 13408 4785 Micro Agents 39921 829 6493 7736 Direct Business 2530 88 3079 2394Total (A) 270169 95418 233714 8<strong>11</strong>771 Referral (B) 0 0 0 0Grand Total (A+B) 270169 95418 233714 8<strong>11</strong>77

SN1 Complaints made by customersPERIODIC DISCLOSURESFORM NL 41 - GRIEVANCE DISPOSAL FOR THE PERIOD APRIL, <strong>2010</strong> TO SEPTEMBER, <strong>2010</strong>ParticularsOpeningBalance *AdditionsFullyAcceptedComplaints ResolvedPartial AcceptedRejecteda) Sales Related 0 0 0 0 0 0b) Policy Administration Related 0 0 0 0 0 0c) <strong>Insurance</strong> Policy Coverage related 0 202 0 0 202 0d) Claims related 0 0 0 0 0 0e) others 0 0 0 0 0 0d) Total Number 0 202 0 0 202 0ComplaintsPending2 Duration wise Pending StatusComplaintsmade bycustomersComplaints madeby intermediariesTotala) Less than 15 days 0 0 0b) Greater than 15 days 0 0 0Total Number 0 0 0* Opening balance should tally with the closing balance <strong>of</strong> the previous financial year.