Investment Performance Reports - New York State Deferred ...

Investment Performance Reports - New York State Deferred ...

Investment Performance Reports - New York State Deferred ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

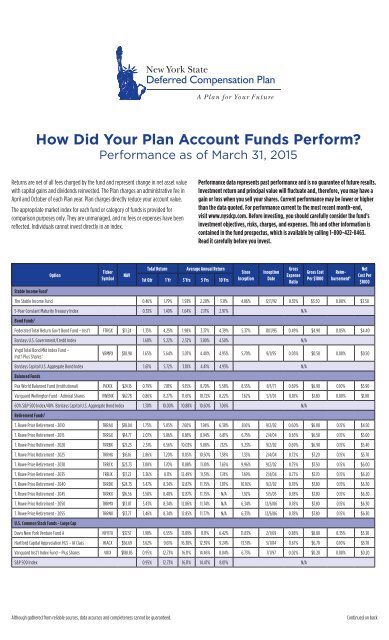

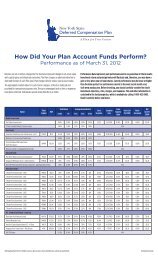

How Did Your Plan Account Funds Perform?<br />

<strong>Performance</strong> as of March 31, 2015<br />

Returns are net of all fees charged by the fund and represent change in net asset value<br />

with capital gains and dividends reinvested. The Plan charges an administrative fee in<br />

April and October of each Plan year. Plan charges directly reduce your account value.<br />

The appropriate market index for each fund or category of funds is provided for<br />

comparison purposes only. They are unmanaged, and no fees or expenses have been<br />

reflected. Individuals cannot invest directly in an index.<br />

<strong>Performance</strong> data represents past performance and is no guarantee of future results.<br />

<strong>Investment</strong> return and principal value will fluctuate and, therefore, you may have a<br />

gain or loss when you sell your shares. Current performance may be lower or higher<br />

than the data quoted. For performance current to the most recent month-end,<br />

visit www.nysdcp.com. Before investing, you should carefully consider the fund’s<br />

investment objectives, risks, charges, and expenses. This and other information is<br />

contained in the fund prospectus, which is available by calling 1-800-422-8463.<br />

Read it carefully before you invest.<br />

Stable Income Fund 1<br />

Option<br />

Ticker<br />

Symbol<br />

NAV<br />

Total Return<br />

Average Annual Return<br />

1st Qtr 1 Yr 3 Yrs 5 Yrs 10 Yrs<br />

Since<br />

Inception<br />

Inception<br />

Date<br />

Gross<br />

Expense<br />

Ratio<br />

Gross Cost<br />

Per $1000<br />

Reimbursement<br />

6<br />

The Stable Income Fund 0.46% 1.79% 1.93% 2.20% 3.11% 4.86% 12/1/92 0.35% $3.50 0.00% $3.50<br />

5-Year Constant Maturity Treasury Index 0.33% 1.40% 1.64% 2.17% 2.97% N/A<br />

Bond Funds 2<br />

Federated Total Return Gov’t Bond Fund – Inst’l FTRGX $11.24 1.35% 4.25% 1.98% 3.37% 4.39% 5.37% 10/1/95 0.49% $4.90 0.05% $4.40<br />

Barclays U.S. Government/Credit Index 1.60% 5.22% 2.32% 3.80% 4.50% N/A<br />

Vngd Total Bond Mkt Index Fund –<br />

Inst’l Plus Shares^<br />

VBMPX $10.98 1.65% 5.64% 3.07% 4.40% 4.95% 5.70% 9/1/95 0.05% $0.50 0.00% $0.50<br />

Barclays Capital U.S. Aggregate Bond Index 1.61% 5.72% 3.10% 4.41% 4.93% N/A<br />

Balanced Funds<br />

Pax World Balanced Fund (Institutional) PAXIX $24.16 0.79% 7.81% 9.15% 8.70% 5.58% 8.55% 8/1/71 0.69% $6.90 0.10% $5.90<br />

Vanguard Wellington Fund - Admiral Shares VWENX $67.78 0.86% 8.27% 11.61% 10.72% 8.22% 7.62% 5/1/01 0.18% $1.80 0.00% $1.80<br />

60% S&P 500 Index/40% Barclays Capital U.S. Aggregate Bond Index 1.30% 10.00% 10.88% 10.60% 7.06% N/A<br />

Retirement Funds 3<br />

T. Rowe Price Retirement - 2010 TRRAX $18.04 1.75% 5.05% 7.60% 7.94% 6.38% 8.16% 9/2/02 0.60% $6.00 0.15% $4.50<br />

T. Rowe Price Retirement - 2015 TRRGX $14.77 2.07% 5.86% 8.88% 8.94% 6.81% 6.75% 2/4/04 0.65% $6.50 0.15% $5.00<br />

T. Rowe Price Retirement - 2020 TRRBX $21.23 2.51% 6.56% 10.03% 9.80% 7.12% 9.23% 9/2/02 0.69% $6.90 0.15% $5.40<br />

T. Rowe Price Retirement - 2025 TRRHX $16.16 2.86% 7.20% 11.05% 10.50% 7.38% 7.35% 2/4/04 0.72% $7.20 0.15% $5.70<br />

T. Rowe Price Retirement - 2030 TRRCX $23.73 3.08% 7.70% 11.88% 11.10% 7.65% 9.96% 9/2/02 0.75% $7.50 0.15% $6.00<br />

T. Rowe Price Retirement - 2035 TRRJX $17.22 3.36% 8.11% 12.49% 11.51% 7.74% 7.69% 2/4/04 0.77% $7.70 0.15% $6.20<br />

T. Rowe Price Retirement - 2040 TRRDX $24.75 3.47% 8.34% 12.87% 11.75% 7.87% 10.16% 9/2/02 0.78% $7.80 0.15% $6.30<br />

T. Rowe Price Retirement - 2045 TRRKX $16.56 3.50% 8.40% 12.87% 11.75% N/A 7.92% 5/5/05 0.78% $7.80 0.15% $6.30<br />

T. Rowe Price Retirement - 2050 TRRMX $13.87 3.43% 8.34% 12.86% 11.74% N/A 6.34% 12/6/06 0.78% $7.80 0.15% $6.30<br />

T. Rowe Price Retirement - 2055 TRRNX $13.77 3.46% 8.34% 12.85% 11.77% N/A 6.33% 12/6/06 0.78% $7.80 0.15% $6.30<br />

U.S. Common Stock Funds - Large Cap<br />

Davis <strong>New</strong> <strong>York</strong> Venture Fund A NYVTX $37.57 1.98% 6.55% 13.89% 11.11% 6.42% 11.83% 2/1/69 0.88% $8.80 0.35% $5.30<br />

Hartford Capital Appreciation HLS – IA Class HIACX $56.69 3.62% 9.61% 16.38% 12.39% 9.24% 13.51% 5/1/84 0.67% $6.70 0.10% $5.70<br />

Vanguard Inst’l Index Fund – Plus Shares VIIIX $188.85 0.95% 12.73% 16.11% 14.46% 8.04% 6.73% 7/1/97 0.02% $0.20 0.00% $0.20<br />

S&P 500 Index 0.95% 12.73% 16.11% 14.47% 8.01% N/A<br />

Net<br />

Cost Per<br />

$1000<br />

Although gathered from reliable sources, data accuracy and completeness cannot be guaranteed.<br />

Continued on back

Option<br />

Ticker<br />

Symbol<br />

NAV<br />

Total Return<br />

Average Annual Return<br />

1st Qtr 1 Yr 3 Yrs 5 Yrs 10 Yrs<br />

Since<br />

Inception<br />

Inception<br />

Date<br />

Gross<br />

Expense<br />

Ratio<br />

Gross Cost<br />

Per $1000<br />

Reimbursement<br />

6<br />

Net<br />

Cost Per<br />

$1000<br />

U.S. Common Stock Funds - Large Cap<br />

Fidelity OTC Portfolio FOCPX $83.40 4.83% 18.43% 19.32% 17.62% 12.84% 13.58% 12/31/84 0.76% $7.60 0.25% $5.10<br />

Principal Large Cap Growth Fund – Inst’l Shares PGLIX $11.24 3.98% 15.42% 15.48% 13.88% 8.60% 3.12% 3/1/01 0.64% $6.40 0.10% $5.40<br />

Vanguard PRIMECAP Fund – Admiral Shares VPMAX $108.97 2.27% 15.68% 21.11% 16.01% 10.90% 10.04% 11/12/01 0.36% $3.60 0.00% $3.60<br />

Russell 1000 Growth Index 3.84% 16.09% 16.34% 15.63% 9.36% N/A<br />

T. Rowe Price Equity Income Fund PRFDX $32.35 -1.03% 4.71% 13.31% 11.67% 6.78% 11.05% 10/1/85 0.67% $6.70 0.10% $5.70<br />

Russell 1000 Value Index -0.72% 9.33% 16.44% 13.75% 7.21% N/A<br />

U.S. Common Stock Funds - Mid Cap<br />

Vanguard Mid Cap Index Fund – Inst’l Plus Shares^ VMCPX $173.77 4.30% 14.91% 17.96% N/A N/A 15.65% 12/01/10 0.06% $0.60 0.00% $0.60<br />

Russell Midcap Index 3.95% 13.68% 18.10% 16.16% 10.02% N/A<br />

Vanguard Capital Opportunity Fund – Adm Shares VHCAX $126.92 4.25% 17.76% 23.49% 15.79% 11.35% 10.93% 11/1/01 0.41% $4.10 0.00% $4.10<br />

Russell Midcap Growth Index 5.38% 15.56% 17.41% 16.43% 10.19% N/A<br />

Perkins Mid Cap Value Fund – N Class (Janus)** JDPNX $19.98 0.15% 7.03% 11.52% 10.08% 8.23% 12.17% 8/1/98 0.52% $5.20 0.00% $5.20<br />

Russell Midcap Value Index 2.42% 11.70% 18.60% 15.84% 9.61% N/A<br />

U.S. Common Stock Funds - Small Cap 4<br />

Vanguard Small Cap Index Fund –Inst’l Plus Shares VSCPX $168.95 4.81% 9.85% 17.61% N/A N/A 14.76% 12/1/10 0.06% $0.60 0.00% $0.60<br />

WF Advantage Small Cap Value Fd – Inst’l Class* WFSVX $28.29 -2.75% -6.95% 7.64% 7.03% 7.20% 11.75% 12/1/97 0.92% $9.20 0.10% $8.20<br />

Russell 2000 Index 4.32% 8.21% 16.27% 14.57% 8.82% N/A<br />

Columbia Acorn USA Fund – Class Z AUSAX $32.62 5.12% 8.22% 13.90% 13.54% 8.16% 10.96% 9/1/96 1.07% $10.70 0.25% $8.20<br />

Russell 2000 Growth Index 6.63% 12.06% 17.74% 16.58% 10.02% N/A<br />

Federated Clover Small Value Fund - Inst’l Shares # VSFIX $25.25 1.36% 4.66% 13.93% 12.12% 8.47% 11.45% 2/1/96 1.19% $11.90 0.10% $10.90<br />

Russell 2000 Value Index 1.98% 4.43% 14.79% 12.54% 7.53% N/A<br />

International Stock Funds - Established Markets 5<br />

International Equity Fund - Active Portfolio $9.40 4.77% 1.01% 9.02% 4.91% N/A -0.79% 6/7/07 0.60% $6.00 0.00% $6.00<br />

International Equity Fund - Index Portfolio $10.04 4.99% -1.01% 8.88% 5.93% N/A 0.05% 6/7/07 0.20% $2.00 0.00% $2.00<br />

Morgan Stanley EAFE Index 4.88% -0.92% 9.02% 6.16% 4.95% N/A<br />

International Stock Funds - Emerging Markets 5<br />

MSIF Emerging Markets Portfolio – Inst’l Shares MGEMX $22.83 3.16% -0.93% 1.32% 2.27% 8.07% 8.16% 9/1/92 1.51% $15.10 0.10% $14.10<br />

Morgan Stanley EMF Index 2.24% 0.44% 0.31% 1.75% 8.48% N/A<br />

1<br />

The annualized net blended interest rate for the Stable Income Fund for the quarter January 1, 2015,<br />

through March 31, 2015, was approximately 1.90%. The Board anticipates (but does not guarantee)<br />

that the annualized blended interest rate for the Stable Income Fund will not be less than 1.93%,<br />

net of all fees, for amounts in the Stable Income Fund from April 1, 2015, through June 30, 2015. Current<br />

contracts within the Stable Income Fund include contracts with BlackRock, Earnest Partners, Goldman<br />

Sachs Asset Management, Jennison, MacKay Shields, ING, Babson.<br />

2<br />

Bond funds have the same interest rate, inflation and credit risks that are associated with the<br />

underlying bonds owned by the fund.<br />

3<br />

Retirement Funds, also known as target date or target maturity funds, are asset allocation funds that<br />

are based on a targeted date as to when an investor plans to begin to withdraw money. These funds<br />

use a strategy that reallocates equity exposure to a higher percentage of fixed investments over time.<br />

As a result, the funds become more conservative over time as you approach retirement. It’s important<br />

to remember that no strategy can assure a profit or prevent a loss in a declining market. The principal<br />

value of the fund(s) is not guaranteed at any time, including at the target date. There is no guarantee<br />

that Retirement funds will provide enough income for retirement<br />

4<br />

Small cap stocks have higher risks than stocks of larger, more established companies and have<br />

significant short-term price volatility.<br />

5<br />

International investing involves additional risks, including: currency fluctuations, political instability and<br />

foreign regulations.<br />

6<br />

Mutual fund reimbursements are contractual.<br />

* Historical returns previous to 07/31/2007, excluding the “Since Inception” figure, are for the Investor<br />

shares. The inception date for Investor shares is 12/31/1997.<br />

^ Historical returns previous to 02/05/2010, excluding the “Since Inception” figure, are for the<br />

Institutional shares. The inception date for Institutional shares is 09/18/1995.<br />

#<br />

Historical returns prior to 3/16/2009 are estimates based on the performance of the fund’s oldest<br />

share class, adjusted for fees.<br />

** Historical returns previous to 5/31/2012 reflect the performance of the fund’s T class shares.<br />

Shares of any investment fund available under the Plan are not guaranteed or insured by the federal<br />

government, <strong>New</strong> <strong>York</strong> <strong>State</strong>, or any other employer maintaining the Plan. The annual administrative<br />

fee is a combination of a $20 fixed fee and an asset-based fee (currently 4.0 basis points) levied in two<br />

installments each April and October. The asset-based fee is not levied on accounts below $20,000 or on<br />

account assets that exceed $200,000. Also, the timing of your contributions and other transactions under<br />

the Plan can result in returns greater than or less than these illustrated returns.<br />

Prospectuses are available at www.nysdcp.com or upon request at 1-800-422-8463. If you decide<br />

to direct investment of your contributions to any fund in the future, please read each prospectus<br />

carefully for more information, including investment objectives, management fees, and other<br />

charges and expenses.<br />

Some mutual funds may impose a short term trade fee. Some funds may be subject to a trade<br />

restriction policy. Please read the underlying prospectuses carefully.<br />

This investment performance report gives information which is intended to help participants understand<br />

what investment alternatives are available to them under the Plan. If you need tax or legal advice,<br />

please ask your certified public accountant or lawyer. While we are pleased to help keep you up-to-date<br />

on your retirement account, nothing in this investment performance report can change the terms of the<br />

Plan or any investment contract.<br />

Nationwide <strong>Investment</strong> Services Corporation, Member FINRA.<br />

The <strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Deferred</strong> Compensation Board<br />

Empire <strong>State</strong> Plaza Station<br />

P.O. Box 2103<br />

Albany, NY 12220-2103<br />

Phone: Toll-Free (800) 422-8463<br />

TTY/TDD: Toll-Free (800) 514-2447<br />

Web site: www.nysdcp.com<br />

NRX-0171NY-NY.0415.40