in-service distribution of rollover account - New York State Deferred ...

in-service distribution of rollover account - New York State Deferred ...

in-service distribution of rollover account - New York State Deferred ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

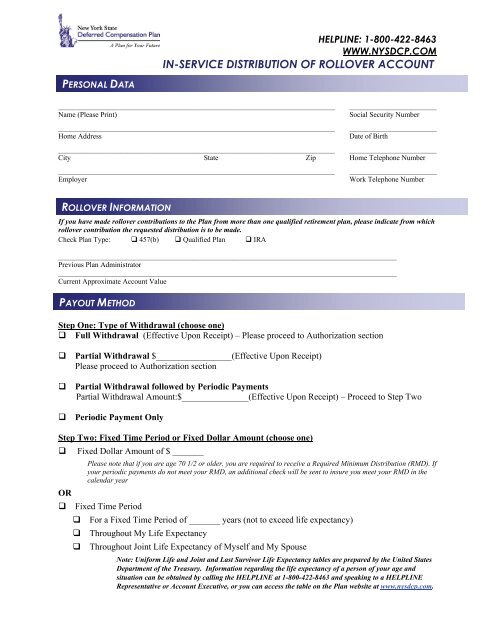

HELPLINE: 1-800-422-8463WWW.NYSDCP.COMIN-SERVICE DISTRIBUTION OF ROLLOVER ACCOUNTPERSONAL DATA____________________________________________________________________________ ________________________Name (Please Pr<strong>in</strong>t)Social Security Number____________________________________________________________________________ ________________________Home AddressDate <strong>of</strong> Birth____________________________________________________________________________ ________________________City <strong>State</strong> Zip Home Telephone Number____________________________________________________________________________ ________________________EmployerWork Telephone NumberROLLOVER INFORMATIONIf you have made <strong>rollover</strong> contributions to the Plan from more than one qualified retirement plan, please <strong>in</strong>dicate from which<strong>rollover</strong> contribution the requested <strong>distribution</strong> is to be made.Check Plan Type: 457(b) Qualified Plan IRA_____________________________________________________________________________________________Previous Plan Adm<strong>in</strong>istrator_____________________________________________________________________________________________Current Approximate Account ValuePAYOUT METHODStep One: Type <strong>of</strong> Withdrawal (choose one) Full Withdrawal (Effective Upon Receipt) – Please proceed to Authorization sectionPartial Withdrawal $_________________(Effective Upon Receipt)Please proceed to Authorization sectionPartial Withdrawal followed by Periodic PaymentsPartial Withdrawal Amount:$_______________(Effective Upon Receipt) – Proceed to Step TwoPeriodic Payment OnlyStep Two: Fixed Time Period or Fixed Dollar Amount (choose one) Fixed Dollar Amount <strong>of</strong> $ _______Please note that if you are age 70 1/2 or older, you are required to receive a Required M<strong>in</strong>imum Distribution (RMD). Ifyour periodic payments do not meet your RMD, an additional check will be sent to <strong>in</strong>sure you meet your RMD <strong>in</strong> thecalendar yearOR Fixed Time Period For a Fixed Time Period <strong>of</strong> _______ years (not to exceed life expectancy) Throughout My Life Expectancy Throughout Jo<strong>in</strong>t Life Expectancy <strong>of</strong> Myself and My SpouseNote: Uniform Life and Jo<strong>in</strong>t and Last Survivor Life Expectancy tables are prepared by the United <strong>State</strong>sDepartment <strong>of</strong> the Treasury. Information regard<strong>in</strong>g the life expectancy <strong>of</strong> a person <strong>of</strong> your age andsituation can be obta<strong>in</strong>ed by call<strong>in</strong>g the HELPLINE at 1-800-422-8463 and speak<strong>in</strong>g to a HELPLINERepresentative or Account Executive, or you can access the table on the Plan website at www.nysdcp.com.

The use <strong>of</strong> the Jo<strong>in</strong>t and Last Survivor Life Expectancy Table is limited to participants whose spouse is morethan ten years younger than the participant and the spouse is the sole beneficiary <strong>of</strong> record. If you haveselected benefit payments based on the Jo<strong>in</strong>t and Last Survivor Life Expectancy Table, please complete thefollow<strong>in</strong>g:___________________________ _________________________ __________________________Spouse’s Name Spouse’s Date <strong>of</strong> Birth Spouse’s Social Security No.Step Three: Frequency (Note: If frequency is not selected, then it will default to a monthly payment)A. Frequency: B. Beg<strong>in</strong> payments <strong>in</strong> _____________(month) to be Monthly received by (select one option below) Quarterly 1 st <strong>of</strong> the month 15 th <strong>of</strong> the month Semi-annually 5 th <strong>of</strong> the month 20 th <strong>of</strong> the month Annually 10 th <strong>of</strong> the month 25 th <strong>of</strong> the month Withdrawals to be made from Stable Option onlyStep Four: Tax Withhold<strong>in</strong>gA. Federal Withhold<strong>in</strong>gFor periodic <strong>distribution</strong>s <strong>of</strong> less than ten years, Lump Sum and Partial Lump Sum <strong>distribution</strong>s, the IRS requiresthe Plan to withhold 20% <strong>of</strong> the <strong>distribution</strong>. If you want the Plan to withhold a greater amount, please <strong>in</strong>dicatethat amount below: Other – please <strong>in</strong>dicate higher percentage amount ________% (must be a whole percentage)For <strong>distribution</strong>s <strong>of</strong> 10 years or longer or to fulfill a Required M<strong>in</strong>imum Distribution, the IRS does notrequire a specific withhold<strong>in</strong>g rate. Please choose a Federal withhold<strong>in</strong>g rate: 10% Default tax withhold<strong>in</strong>g Other – please <strong>in</strong>dicate percentage amount ________% (may be higher or lower than 10%, may be 0%)B. <strong>State</strong> Withhold<strong>in</strong>gThe Plan is not required to withhold for state <strong>in</strong>come tax purposes. If you want a portion <strong>of</strong> your<strong>distribution</strong> withheld for state <strong>in</strong>come taxes, please complete the follow<strong>in</strong>g: Indicate <strong>State</strong> ________ Indicate percentage amount ________%DIRECT DEPOSIT INSTRUCTIONSCheck only one option: Check<strong>in</strong>g Account Sav<strong>in</strong>gs Account_____________________________________________________________ ___________________Bank/Credit Union NameAccount NumberABA NUMBER (First n<strong>in</strong>e digits only) I: /____/____/____/____/____/____/____/____/____/ I:Your ABA number appears at the bottom <strong>of</strong> your checks between the mark<strong>in</strong>gs <strong>in</strong>dicated above.Bank or Credit Union Telephone Number: ( )Note: Direct Deposit is only <strong>of</strong>fered through members <strong>of</strong> the Automatic Clear<strong>in</strong>g House (ACH).Is this <strong>account</strong> associated with a brokerage firm or other <strong>in</strong>vestment firm? Yes NoIf yes, have you confirmed that the ABA and <strong>account</strong> numbers are correct? Yes NoPlease note:You must <strong>in</strong>clude a voided check if your <strong>distribution</strong> is be<strong>in</strong>g sent to your check<strong>in</strong>g <strong>account</strong>.Full withdrawals may not be received by direct deposit.

TRANSFER INFORMATION Transfer Assets to another Qualified Retirement Account(This option is only available to the former spouse <strong>of</strong> a participant)Name <strong>of</strong> Employer or Sponsor:___________________________________________________________________________________Make check payable to:__________________________________________________________________________________________For benefit <strong>of</strong>:________________________________________________________________________________________________(Note: Check will be sent to the Participant address on record with the NYSDCP Adm<strong>in</strong>istrative Service Agency)I acknowledge that the <strong>in</strong>dividual named above is (a) an employee <strong>of</strong> the Employer named below, or (b) the owner <strong>of</strong> atraditional IRA or a conduit IRA at this <strong>in</strong>stitution.We sponsor a plan eligible under Internal Revenue Code 457(b), 401(a),401(k), 403 (b) or an Individual Retirement Account and the plan (sponsor) receives plan-to-plan transfers. Some mutual fundsmay impose a short-term trade fee. Please read the underly<strong>in</strong>g prospectuses carefully.____________________________________________________________________________________Signature <strong>of</strong> Authorized Personnel from Accept<strong>in</strong>g Rollover CompanyAUTHORIZATIONI understand I have a right to receive and review the Special Tax Notice Regard<strong>in</strong>g Plan Payments no less than 30days and no more than 180 days prior to this <strong>distribution</strong>. However, if I elect to receive this <strong>distribution</strong> before theend <strong>of</strong> the 30-day m<strong>in</strong>imum notice period, this election shall constitute a waiver <strong>of</strong> my rights to the 30-day noticerequirement.I attest that the <strong>in</strong>formation provided on this form is true and that I have received and read the Special Taxnotification that the Federal law requires not more than 180 days prior to request<strong>in</strong>g this <strong>distribution</strong>. I have read the<strong>in</strong>structions and understand the requirements. I understand that I may be subject to civil and crim<strong>in</strong>al liability forany false statement on this form or any papers attached to or related to this form or my claim under the Plan.I understand that the <strong>distribution</strong>s <strong>of</strong> assets that were rolled <strong>in</strong> to the Plan from another qualified retirement plan oran IRA may be subject to an early <strong>distribution</strong> tax that would have applied to such plan, unless an exemptionapplies.If I have elected to have my <strong>distribution</strong>s from the Plan be directly deposited, I hereby authorize the Plan’s trustee to<strong>in</strong>itiate such automatic deposits from the Plan to the <strong>account</strong> referenced above with the f<strong>in</strong>ancial <strong>in</strong>stitution namedabove. This authority will rema<strong>in</strong> <strong>in</strong> effect until I have given the Plan written notice that I have term<strong>in</strong>ated theabove referenced <strong>account</strong> or until I have been notified that this deposit <strong>service</strong> has been term<strong>in</strong>ated. I understandthat I must give the Plan sufficient advance notice to allow for process<strong>in</strong>g <strong>of</strong> these <strong>in</strong>structions. If an <strong>in</strong>correctamount should be entered <strong>in</strong>to my <strong>account</strong> by the Plan, I authorize the Plan to direct my bank to make theappropriate credit or debit adjustment.____________________________________________________________Participant Signature______________________DateReturn to:<strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Deferred</strong> Compensation PlanAdm<strong>in</strong>istrative Service Agency, PW-04-08P.O. Box 182797Columbus, OH 43218-2797DC-4214-0111Overnight Address:<strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Deferred</strong> Compensation PlanAdm<strong>in</strong>istrative Service Agency5900 Parkwood Drive, PW-04-08Dubl<strong>in</strong>, Ohio 43016