Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHIEF ExECUTIVE’S REVIEW 31 DECEMBER <strong>2012</strong><br />

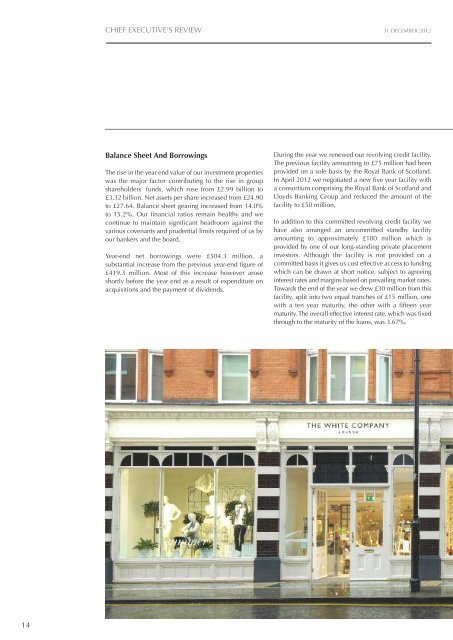

Balance sheet and Borrowings<br />

The rise in the year end value of our investment properties<br />

was the major factor contributing to the rise in group<br />

shareholders’ funds, which rose from £2.99 billion to<br />

£3.32 billion. Net assets per share increased from £24.90<br />

to £27.64. Balance sheet gearing increased from 14.0%<br />

to 15.2%. Our financial ratios remain healthy and we<br />

continue to maintain significant headroom against the<br />

various covenants and prudential limits required of us by<br />

our bankers and the board.<br />

Year-end net borrowings were £504.3 million, a<br />

substantial increase from the previous year-end figure of<br />

£419.3 million. Most of this increase however arose<br />

shortly before the year end as a result of expenditure on<br />

acquisitions and the payment of dividends.<br />

During the year we renewed our revolving credit facility.<br />

The previous facility amounting to £75 million had been<br />

provided on a sole basis by the Royal Bank of Scotland.<br />

In April <strong>2012</strong> we negotiated a new five year facility with<br />

a consortium comprising the Royal Bank of Scotland and<br />

Lloyds Banking Group and reduced the amount of the<br />

facility to £50 million.<br />

In addition to this committed revolving credit facility we<br />

have also arranged an uncommitted standby facility<br />

amounting to approximately £100 million which is<br />

provided by one of our long-standing private placement<br />

investors. Although the facility is not provided on a<br />

committed basis it gives us cost effective access to funding<br />

which can be drawn at short notice, subject to agreeing<br />

interest rates and margins based on prevailing market rates.<br />

Towards the end of the year we drew £30 million from this<br />

facility, split into two equal tranches of £15 million, one<br />

with a ten year maturity, the other with a fifteen year<br />

maturity. The overall effective interest rate, which was fixed<br />

through to the maturity of the loans, was 3.67%.<br />

14