Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

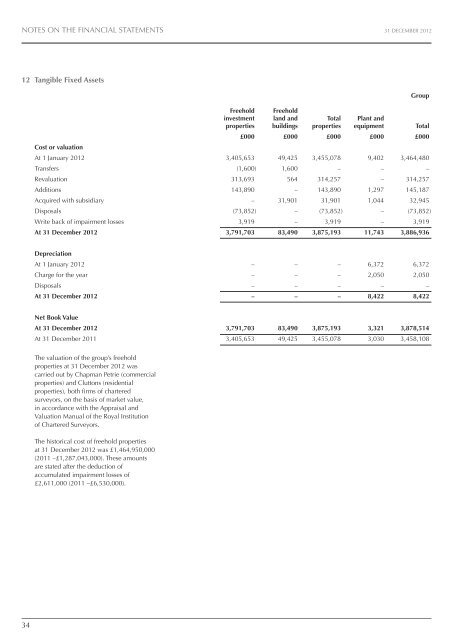

NOTES ON THE FINANCIAL STATEMENTS 31 DECEMBER <strong>2012</strong><br />

12 tangible Fixed assets<br />

Group<br />

Cost or valuation<br />

At 1 January <strong>2012</strong><br />

Transfers<br />

Revaluation<br />

Additions<br />

Acquired with subsidiary<br />

Disposals<br />

Write back of impairment losses<br />

at 31 December <strong>2012</strong><br />

Freehold Freehold<br />

investment land and total Plant and<br />

properties buildings properties equipment total<br />

£000 £000 £000 £000 £000<br />

3,405,653 49,425 3,455,078 9,402 3,464,480<br />

(1,600) 1,600 – – –<br />

313,693 564 314,257 – 314,257<br />

143,890 – 143,890 1,297 145,187<br />

– 31,901 31,901 1,044 32,945<br />

(73,852) – (73,852) – (73,852)<br />

3,919 – 3,919 – 3,919<br />

3,791,703 83,490 3,875,193 11,743 3,886,936<br />

Depreciation<br />

At 1 January <strong>2012</strong><br />

Charge for the year<br />

Disposals<br />

at 31 December <strong>2012</strong><br />

– – – 6,372 6,372<br />

– – – 2,050 2,050<br />

– – – – –<br />

– – – 8,422 8,422<br />

net Book Value<br />

at 31 December <strong>2012</strong><br />

At 31 December 2011<br />

3,791,703 83,490 3,875,193 3,321 3,878,514<br />

3,405,653 49,425 3,455,078 3,030 3,458,108<br />

The valuation of the group’s freehold<br />

properties at 31 December <strong>2012</strong> was<br />

carried out by Chapman Petrie (commercial<br />

properties) and Cluttons (residential<br />

properties), both firms of chartered<br />

surveyors, on the basis of market value,<br />

in accordance with the Appraisal and<br />

Valuation Manual of the Royal Institution<br />

of Chartered Surveyors.<br />

The historical cost of freehold properties<br />

at 31 December <strong>2012</strong> was £1,464,950,000<br />

(2011 –£1,287,043,000). These amounts<br />

are stated after the deduction of<br />

accumulated impairment losses of<br />

£2,611,000 (2011 –£6,530,000).<br />

34