Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan

Annual Report 2012 - Cadogan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

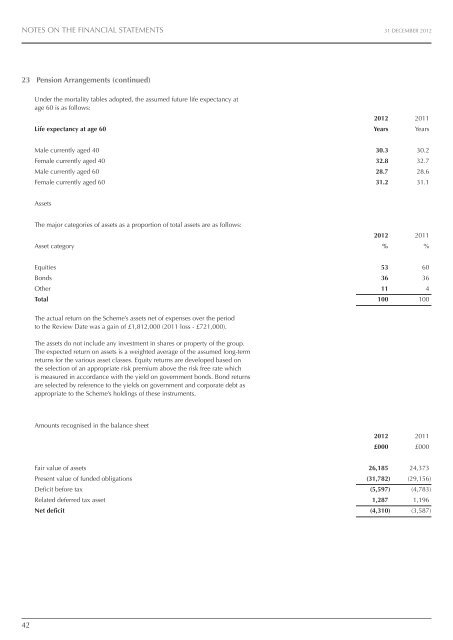

NOTES ON THE FINANCIAL STATEMENTS 31 DECEMBER <strong>2012</strong><br />

23 Pension arrangements (continued)<br />

Under the mortality tables adopted, the assumed future life expectancy at<br />

age 60 is as follows:<br />

life expectancy at age 60<br />

<strong>2012</strong> 2011<br />

Years Years<br />

Male currently aged 40<br />

Female currently aged 40<br />

Male currently aged 60<br />

Female currently aged 60<br />

30.3 30.2<br />

32.8 32.7<br />

28.7 28.6<br />

31.2 31.1<br />

Assets<br />

The major categories of assets as a proportion of total assets are as follows:<br />

Asset category<br />

<strong>2012</strong> 2011<br />

% %<br />

Equities<br />

Bonds<br />

Other<br />

total<br />

53 60<br />

36 36<br />

11 4<br />

100 100<br />

The actual return on the Scheme’s assets net of expenses over the period<br />

to the Review Date was a gain of £1,812,000 (2011 loss - £721,000).<br />

The assets do not include any investment in shares or property of the group.<br />

The expected return on assets is a weighted average of the assumed long-term<br />

returns for the various asset classes. Equity returns are developed based on<br />

the selection of an appropriate risk premium above the risk free rate which<br />

is measured in accordance with the yield on government bonds. Bond returns<br />

are selected by reference to the yields on government and corporate debt as<br />

appropriate to the Scheme’s holdings of these instruments.<br />

Amounts recognised in the balance sheet<br />

<strong>2012</strong> 2011<br />

£000 £000<br />

Fair value of assets<br />

Present value of funded obligations<br />

Deficit before tax<br />

Related deferred tax asset<br />

net deficit<br />

26,185 24,373<br />

(31,782) (29,156)<br />

(5,597) (4,783)<br />

1,287 1,196<br />

(4,310) (3,587)<br />

42