PERA Due Diligence Questionnaire - Public Employees Retirement ...

PERA Due Diligence Questionnaire - Public Employees Retirement ...

PERA Due Diligence Questionnaire - Public Employees Retirement ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

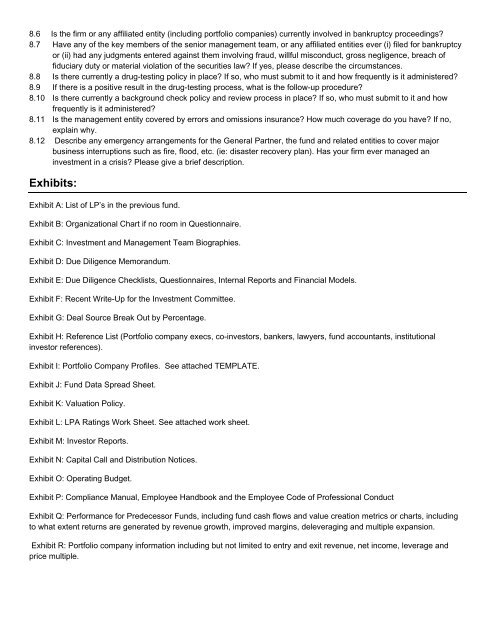

8.6 Is the firm or any affiliated entity (including portfolio companies) currently involved in bankruptcy proceedings?<br />

8.7 Have any of the key members of the senior management team, or any affiliated entities ever (i) filed for bankruptcy<br />

or (ii) had any judgments entered against them involving fraud, willful misconduct, gross negligence, breach of<br />

fiduciary duty or material violation of the securities law? If yes, please describe the circumstances.<br />

8.8 Is there currently a drug-testing policy in place? If so, who must submit to it and how frequently is it administered?<br />

8.9 If there is a positive result in the drug-testing process, what is the follow-up procedure?<br />

8.10 Is there currently a background check policy and review process in place? If so, who must submit to it and how<br />

frequently is it administered?<br />

8.11 Is the management entity covered by errors and omissions insurance? How much coverage do you have? If no,<br />

explain why.<br />

8.12 Describe any emergency arrangements for the General Partner, the fund and related entities to cover major<br />

business interruptions such as fire, flood, etc. (ie: disaster recovery plan). Has your firm ever managed an<br />

investment in a crisis? Please give a brief description.<br />

Exhibits:<br />

Exhibit A: List of LP’s in the previous fund.<br />

Exhibit B: Organizational Chart if no room in <strong>Questionnaire</strong>.<br />

Exhibit C: Investment and Management Team Biographies.<br />

Exhibit D: <strong>Due</strong> <strong>Diligence</strong> Memorandum.<br />

Exhibit E: <strong>Due</strong> <strong>Diligence</strong> Checklists, <strong>Questionnaire</strong>s, Internal Reports and Financial Models.<br />

Exhibit F: Recent Write-Up for the Investment Committee.<br />

Exhibit G: Deal Source Break Out by Percentage.<br />

Exhibit H: Reference List (Portfolio company execs, co-investors, bankers, lawyers, fund accountants, institutional<br />

investor references).<br />

Exhibit I: Portfolio Company Profiles. See attached TEMPLATE.<br />

Exhibit J: Fund Data Spread Sheet.<br />

Exhibit K: Valuation Policy.<br />

Exhibit L: LPA Ratings Work Sheet. See attached work sheet.<br />

Exhibit M: Investor Reports.<br />

Exhibit N: Capital Call and Distribution Notices.<br />

Exhibit O: Operating Budget.<br />

Exhibit P: Compliance Manual, Employee Handbook and the Employee Code of Professional Conduct<br />

Exhibit Q: Performance for Predecessor Funds, including fund cash flows and value creation metrics or charts, including<br />

to what extent returns are generated by revenue growth, improved margins, deleveraging and multiple expansion.<br />

Exhibit R: Portfolio company information including but not limited to entry and exit revenue, net income, leverage and<br />

price multiple.