CHURCHWIDE HEALTHCARE - Pension Fund

CHURCHWIDE HEALTHCARE - Pension Fund

CHURCHWIDE HEALTHCARE - Pension Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

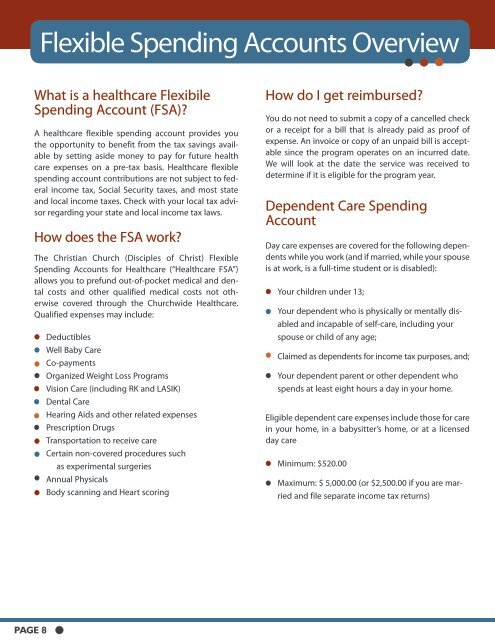

Flexible Spending Accounts Overview<br />

What is a healthcare Flexibile<br />

Spending Account (FSA)?<br />

A healthcare flexible spending account provides you<br />

the opportunity to benefit from the tax savings available<br />

by setting aside money to pay for future health<br />

care expenses on a pre-tax basis. Healthcare flexible<br />

spending account contributions are not subject to federal<br />

income tax, Social Security taxes, and most state<br />

and local income taxes. Check with your local tax advisor<br />

regarding your state and local income tax laws.<br />

How does the FSA work?<br />

The Christian Church (Disciples of Christ) Flexible<br />

Spending Accounts for Healthcare (“Healthcare FSA”)<br />

allows you to prefund out-of-pocket medical and dental<br />

costs and other qualified medical costs not otherwise<br />

covered through the Churchwide Healthcare.<br />

Qualified expenses may include:<br />

Deductibles<br />

Well Baby Care<br />

Co-payments<br />

Organized Weight Loss Programs<br />

Vision Care (including RK and LASIK)<br />

Dental Care<br />

Hearing Aids and other related expenses<br />

Prescription Drugs<br />

Transportation to receive care<br />

Certain non-covered procedures such<br />

as experimental surgeries<br />

Annual Physicals<br />

Body scanning and Heart scoring<br />

How do I get reimbursed?<br />

You do not need to submit a copy of a cancelled check<br />

or a receipt for a bill that is already paid as proof of<br />

expense. An invoice or copy of an unpaid bill is acceptable<br />

since the program operates on an incurred date.<br />

We will look at the date the service was received to<br />

determine if it is eligible for the program year.<br />

Dependent Care Spending<br />

Account<br />

Day care expenses are covered for the following dependents<br />

while you work (and if married, while your spouse<br />

is at work, is a full-time student or is disabled):<br />

Your children under 13;<br />

Your dependent who is physically or mentally disabled<br />

and incapable of self-care, including your<br />

spouse or child of any age;<br />

Claimed as dependents for income tax purposes, and;<br />

Your dependent parent or other dependent who<br />

spends at least eight hours a day in your home.<br />

Eligible dependent care expenses include those for care<br />

in your home, in a babysitter’s home, or at a licensed<br />

day care<br />

Minimum: $520.00<br />

Maximum: $ 5,000.00 (or $2,500.00 if you are married<br />

and file separate income tax returns)<br />

PAGE 8