AIM Italia - Ernesto Mocci - Methorios Capital

AIM Italia - Ernesto Mocci - Methorios Capital

AIM Italia - Ernesto Mocci - Methorios Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

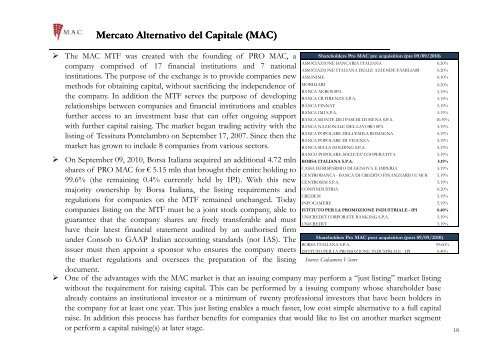

Mercato Alternativo del <strong>Capital</strong>e (MAC)‣ The MAC MTF was created with the founding of PRO MAC, aShareholders Pro MAC pre acquisition (pre 09/09/2010)company comprised of 17 financial institutions and 7 nationalinstitutions. The purpose of the exchange is to provide companies newmethods for obtaining capital, without sacrificing the independence ofthe company. In addition the MTF serves the purpose of developingrelationships between companies and financial institutions and enablesfurther access to an investment base that can offer ongoing supportwith further capital raising. The market began trading activity with thelisting of Tessitura Pontelambro on September 17, 2007. Since then themarket has grown to include 8 companies from various sectors.ASSOCIAZIONE BANCARIA ITALIANA 0.20%ASSOCIAZIONE ITALIANA DELLE AZIENDE FAMILIARI 0.20%ASSONIME 0.10%MOBILIARI 0.20%BANCA AKROS SPA 5.19%BANCA CR FIRENZE S.P.A. 5.19%BANCA FINNAT 5.19%BANCA IMI S.P.A. 5.19%BANCA MONTE DEI PASCHI DI SIENA S.P.A. 10.39%BANCA NAZIONALE DEL LAVORO SPA 5.19%BANCA POPOLARE DELL'EMILA ROMAGNA 5.19%BANCA POPOLARE DI VICENZA 5.19%BANCA SELLA HOLDING S.P.A. 5.19%BANCO POPOLARE SOCIETA' COOPERATIVA 5.19%BORSA ITALIANA S.P.A. 5.19%CASSA DI RISPARMIO DI GENOVA E IMPERIA 5.19%CENTROBANCA - BANCA DI CREDITO FINANZIARIO E MOB 5.19%CENTROSIM S.P.A. 5.19%CONFINDUSTRIA 0.20%CREDEM 5.19%INFOCAMERE 5.19%ISTITUTO PER LA PROMOZIONE INDUSTRIALE - IPI 0.40%UNICREDIT CORPORATE BANKING S.P.A. 5.19%UNICREDIT 5.19%‣ On September 09, 2010, Borsa <strong>Italia</strong>na acquired an additional 4.72 mlnshares of PRO MAC for € 5.15 mln that brought their entire holding to99.6% (the remaining 0.4% currently held by IPI). With this newmajority ownership by Borsa <strong>Italia</strong>na, the listing requirements andregulations for companies on the MTF remained unchanged. Todaycompanies listing on the MTF must be a joint stock company, able toguarantee that the company shares are freely transferable and musthave their latest financial statement audited by an authorised firmShareholders Pro MAC post acquisition (post 09/09/2010)under Consob to GAAP <strong>Italia</strong>n accounting standards (not IAS). TheBORSA ITALIANA S.P.A. 99.60%issuer must then appoint a sponsor who ensures the company meets ISTITUTO PER LA PROMOZIONE INDUSTRIALE - IPI 0.40%the market regulations and oversees the preparation of the listing Source: Cedcamera Visuredocument.‣ One of the advantages with the MAC market is that an issuing company may perform a “just listing” market listingwithout the requirement for raising capital. This can be performed by a issuing company whose shareholder basealready contains ti an institutional investor or a minimum i of twentyt professional investors thatt have been holders inthe company for at least one year. This just listing enables a much faster, low cost simple alternative to a full capitalraise. In addition this process has further benefits for companies that would like to list on another market segmentor perform a capital raising(s) at later stage. 18