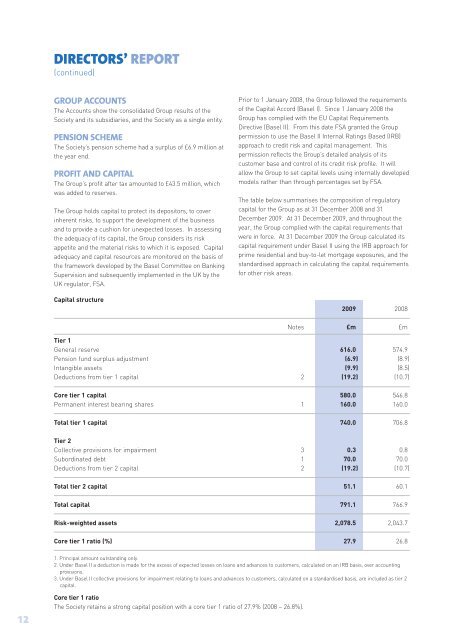

DIRECTORS’ REPORT(continued)GROUP ACCOUNTSThe Accounts show the consolidated Group results of the<strong>Society</strong> <strong>and</strong> its subsidiaries, <strong>and</strong> the <strong>Society</strong> as a single entity.PENSION SCHEMEThe <strong>Society</strong>’s pension scheme had a surplus of £6.9 million atthe year end.PROFIT AND CAPITALThe Group’s profit after tax amounted to £43.5 million, whichwas added to reserves.The Group holds capital to protect its depositors, to coverinherent risks, to support the development of the business<strong>and</strong> to provide a cushion for unexpected losses. In assessingthe adequacy of its capital, the Group considers its riskappetite <strong>and</strong> the material risks to which it is exposed. Capitaladequacy <strong>and</strong> capital resources are monitored on the basis ofthe framework developed by the Basel Committee on BankingSupervision <strong>and</strong> subsequently implemented in the UK by theUK regulator, FSA.Capital structurePrior to 1 January 2008, the Group followed the requirementsof the Capital Accord (Basel I). Since 1 January 2008 theGroup has complied with the EU Capital RequirementsDirective (Basel II). From this date FSA granted the Grouppermission to use the Basel II Internal Ratings Based (IRB)approach to credit risk <strong>and</strong> capital management. Thispermission reflects the Group’s detailed analysis of itscustomer base <strong>and</strong> control of its credit risk profile. It willallow the Group to set capital levels using internally developedmodels rather than through percentages set by FSA.The table below summarises the composition of regulatorycapital for the Group as at 31 December 2008 <strong>and</strong> 31December <strong>2009</strong>. At 31 December <strong>2009</strong>, <strong>and</strong> throughout theyear, the Group complied with the capital requirements thatwere in force. At 31 December <strong>2009</strong> the Group calculated itscapital requirement under Basel II using the IRB approach forprime residential <strong>and</strong> buy-to-let mortgage exposures, <strong>and</strong> thest<strong>and</strong>ardised approach in calculating the capital requirementsfor other risk areas.<strong>2009</strong> 2008Notes £m £mTier 1General reserve 616.0 574.9Pension fund surplus adjustment (6.9) (8.9)Intangible assets (9.9) (8.5)Deductions from tier 1 capital 2 (19.2) (10.7)Core tier 1 capital 580.0 546.8Permanent interest bearing shares 1 160.0 160.0Total tier 1 capital 740.0 706.8Tier 2Collective provisions for impairment 3 0.3 0.8Subordinated debt 1 70.0 70.0Deductions from tier 2 capital 2 (19.2) (10.7)Total tier 2 capital 51.1 60.1Total capital 791.1 766.9Risk-weighted assets 2,078.5 2,043.7Core tier 1 ratio (%) 27.9 26.81. Principal amount outst<strong>and</strong>ing only.2. Under Basel II a deduction is made for the excess of expected losses on loans <strong>and</strong> advances to customers, calculated on an IRB basis, over accountingprovisions.3. Under Basel II collective provisions for impairment relating to loans <strong>and</strong> advances to customers, calculated on a st<strong>and</strong>ardised basis, are included as tier 2capital.12Core tier 1 ratioThe <strong>Society</strong> retains a strong capital position with a core tier 1 ratio of 27.9% (2008 – 26.8%).

ASSETSThe assets of the Group increased by £1,038 million to£18,402 million at 31 December <strong>2009</strong>, representing growth of6.0%.Changes in intangible assets <strong>and</strong> property, plant <strong>and</strong>equipment are detailed in notes 24 <strong>and</strong> 25 to the Accounts.Advances during the year amounted to £2.7 billion,contributing to total loan balances of £14.1 billion,representing growth of 6.8%. At 31 December <strong>2009</strong>, therewere 174 mortgage <strong>accounts</strong> twelve months or more inarrears (2008 - 66). The balances on these <strong>accounts</strong> totalled£22.2 million (2008 - £6.8 million) <strong>and</strong> the value of thesearrears was £1.1 million (2008 - £0.5 million).CREDITOR PAYMENT POLICYThe <strong>Society</strong>’s policy is to agree the terms of payment at thestart of trading with the supplier <strong>and</strong> to pay in accordancewith its contractual <strong>and</strong> other legal obligations.CHARITABLE AND POLITICAL DONATIONSThe <strong>Society</strong> provided for donations of £1.4 million (2008 - £1.8million) to charitable organisations during the year. Thisincluded a provision for £1.3 million (2008 - £1.6 million) toThe Royal British Legion’s Poppy Appeal <strong>and</strong> £50,000 (2008 -£50,000) to the <strong>Coventry</strong> <strong>Building</strong> <strong>Society</strong> CharitableFoundation.The amount donated to The Royal British Legion PoppyAppeal was the result of an ongoing relationship with theLegion for which the <strong>Society</strong> has developed a portfolio ofproducts including fixed rate bonds <strong>and</strong> an easy accesssavings account. In February 2010, a cheque for £1.8 millionwas presented. This brings the total support given to thePoppy Appeal since the launch of the inaugural Poppy Bond inOctober 2008 to £3.4 million. The number of membersholding <strong>accounts</strong> which support the Legion now totals over54,000.No contributions were made for political purposes. However,as a result of the Political Parties, Elections <strong>and</strong> ReferendumsAct 2000, time allowed for employees to carry out civic dutiescan amount to a donation. The <strong>Society</strong> supports a very smallnumber of employees in this way.CORPORATE RESPONSIBILITY,ENVIRONMENTAL AND EMPLOYEE FACTORSStaffThe directors would like to recognise the contribution madeby every member of staff in meeting the expectations of the<strong>Society</strong>’s membership. During the economic downturn <strong>and</strong> inparticular the uncertainty caused by ongoing shocks to thefinancial system, the need for staff to reassure members aswell as deal with their financial requirements has been anadditional priority.The performance of staff in this regard has been exemplary,supported by a commitment to open, timely <strong>and</strong> relevantcommunications across the <strong>Society</strong>.The emphasis on communication was just one aspect thatwas favourably reviewed by independent assessors for theInvestor in People award. This was re-awarded during <strong>2009</strong>,<strong>and</strong> the directors were delighted that the <strong>Society</strong> was placedin the top 100 of the 20,000 organisations assessed.This award emphasises the <strong>Society</strong>’s commitment to its staff.In uncertain times, when many organisations have beenforced to make cutbacks with a corresponding loss of jobs,the directors are particularly pleased that <strong>Coventry</strong> continuesto grow, providing opportunities for both new <strong>and</strong> existingstaff.However, members of staff are under no illusion that theeconomic conditions are harsh <strong>and</strong> that the <strong>Society</strong> mustwork hard to prosper. Their flexibility <strong>and</strong> willingness to takeon additional responsibilities is a fundamental strength of the<strong>Society</strong> <strong>and</strong> one that has been encouraged through training<strong>and</strong> development opportunities over a number of years. Thishas supported improvements in efficiency <strong>and</strong> costeffectivenesswhich has helped protect jobs in the currentdownturn.It was very encouraging that the <strong>Society</strong> should also berecognised in the <strong>Coventry</strong> <strong>and</strong> Warwickshire Employer ofChoice awards, being presented with the top award for itsemployee wellbeing programme <strong>and</strong> highly commended forthe overall employer of choice award. The <strong>Society</strong> willcontinue to invest to provide the right environment <strong>and</strong>opportunities for members of staff to meet their expectations<strong>and</strong> those of the <strong>Society</strong>’s membership.13