Annual report and accounts 2009 (PDF) - Coventry Building Society

Annual report and accounts 2009 (PDF) - Coventry Building Society

Annual report and accounts 2009 (PDF) - Coventry Building Society

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

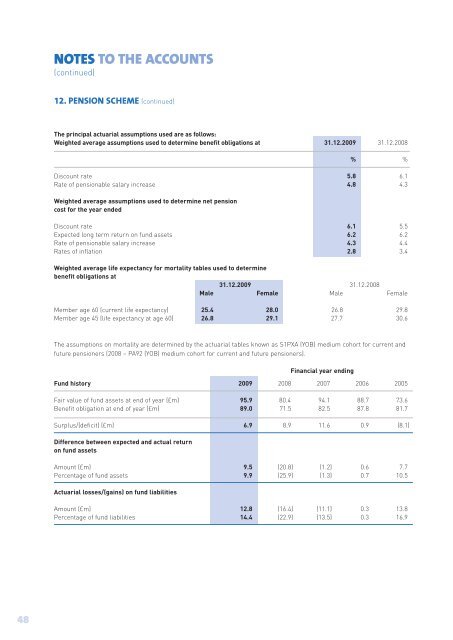

NOTES TO THE ACCOUNTS(continued)12. PENSION SCHEME (continued)The principal actuarial assumptions used are as follows:Weighted average assumptions used to determine benefit obligations at 31.12.<strong>2009</strong> 31.12.2008% %Discount rate 5.8 6.1Rate of pensionable salary increase 4.8 4.3Weighted average assumptions used to determine net pensioncost for the year endedDiscount rate 6.1 5.5Expected long term return on fund assets 6.2 6.2Rate of pensionable salary increase 4.3 4.4Rates of inflation 2.8 3.4Weighted average life expectancy for mortality tables used to determinebenefit obligations at31.12.<strong>2009</strong> 31.12.2008Male Female Male FemaleMember age 60 (current life expectancy) 25.4 28.0 26.8 29.8Member age 45 (life expectancy at age 60) 26.8 29.1 27.7 30.6The assumptions on mortality are determined by the actuarial tables known as S1PXA (YOB) medium cohort for current <strong>and</strong>future pensioners (2008 – PA92 (YOB) medium cohort for current <strong>and</strong> future pensioners).Financial year endingFund history <strong>2009</strong> 2008 2007 2006 2005Fair value of fund assets at end of year (£m) 95.9 80.4 94.1 88.7 73.6Benefit obligation at end of year (£m) 89.0 71.5 82.5 87.8 81.7Surplus/(deficit) (£m) 6.9 8.9 11.6 0.9 (8.1)Difference between expected <strong>and</strong> actual returnon fund assetsAmount (£m) 9.5 (20.8) (1.2) 0.6 7.7Percentage of fund assets 9.9 (25.9) (1.3) 0.7 10.5Actuarial losses/(gains) on fund liabilitiesAmount (£m) 12.8 (16.4) (11.1) 0.3 13.8Percentage of fund liabilities 14.4 (22.9) (13.5) 0.3 16.948