Notes to and forming part of the financial statements for the year ended 30 September 2008 <strong>AWB</strong> LIMITED31. Financial Risk Management Objectives and Policies (continued)(a) Loan credit riskExposure to loan credit risk is managed through regular analysis of the ability of credit customers and borrowers to repay principal and interestin a timely manner, and by changing lending limits where appropriate as the risk profile changes. Exposure to credit risk is also managed byobtaining collateral and corporate and personal guarantees.The ability to repay is assessed and risk rated for individual customers and for a portfolio of customers. An independent credit team is responsiblefor assessing credit information, determining the risk rating for customers, providing approval for limits and for structuring a transaction thatprovides an acceptable risk profile. Customer risk rating profiles and portfolio risk are reviewed regularly. Where collateral is taken, the type andvaluation of collateral is reviewed by credit personnel, and policies for types of acceptable security are set.When a customer loan becomes impaired, it is put under the control of specialist staff who work with the business unit and customer to analysethe issues, determine a collection strategy and, if necessary, manage recourse to collateral.The entity holds collateral in the form of first mortgage securities over rural properties, and fixed or floating charges over livestock and crops.It is not the Group’s policy nor does it have the ability to sell or repledge collateral in the absence of default by a debtor. As at 30 September2008, the Group held collateral over the financial assets that are past due but not impaired and impaired financial assets as detailed in Note 5,with an estimated fair value of $232 million (2007: $377.4 million). The estimated fair value of the collateral is based on the market value of thesecurity held for each individual loan which is reviewed every 3 years. However, for financial assets that are past due and or impaired, it is theGroup’s policy that the valuations of the security held are reviewed and updated at least annually. As such, management believe they represent areasonable estimate of the fair value of collateral held at balance date. During the year the Group took possession of $1.4 million (2007: $nil) ofrural property which is currently being prepared for sale and is expected to fully cover the outstanding debt.The maximum exposure to credit risk on rural loans designated as ‘at fair value through profit or loss’ is $445.9 million (2007: $355.6 million).(b) Commercial trading accountsThe ability and willingness to repay are assessed on major customer accounts in this portfolio in a similar way as for customer loans. However,there is also a large volume of small commercial trading accounts which are assessed, rated and controlled on a portfolio basis. Typically,collateral is not taken on the trading account portfolio, as exposures are smaller than for customer loans and are generally for periods ofbetween 7 and 30 days.(c) Accounts for grain trading and derivative contractsCounterparties in the trading environment are evaluated for credit worthiness as for other portfolios. Open contracts are revalued regularly andthe capacity to repay contracts at today’s market values is assessed. Given the shorter term nature of the obligations, collateral is taken onlyselectively and includes retaining ownership to grain under shipment and letters of credit.(d) Financial Institution credit riskGroup Treasury establishes, reviews and monitors bank and financial institution counterparty credit limits, within Board approved guidelines.A predetermined matrix exists for the approval of counterparty credit limits by the Credit Risk Committee. The size of the credit limit approvedis dependent on the rating given by either Standard and Poor’s and/or Moody’s, and in certain circumstances will be limited by a maximumpercentage of the counterparty’s shareholders’ funds and/or its total assets. Limits exceeding guidelines require Board approval. All counterpartycredit limits are required to be reviewed at least once a year. Group Treasury is required to manage its derivative dealings within certain creditlimits and to administer and manage exposures to ensure that no excessive exposures occur.Management of concentration of riskConcentration of risk is managed at a portfolio level, each month through quality reviews and delinquency and loss reviews. The Groupminimises its concentration of credit risk by undertaking transactions with a large number of customers. The Group is not materially exposed toany individual overseas country or individual customer.Credit quality of financial assets that are neither past due nor impairedSpecific and collective provisions for impairment exist for all loans and advances including trade receivables for balances known or anticipatedto be uncollectible. The risk grading and monitoring systems of the Group are such that credit exposures which are not provided for by animpairment provision are considered to be of high credit quality. Further, the average loan to value ratio of the rural loans and advances portfoliois 39% (2007: 40%), reducing the loss exposure should unanticipated future defaults occur on the rural loan portfolio.The Group has cash, short term deposits and certain derivative contracts with financial institution counterparties. Via the use of limits outlinedabove, as well as the high credit ratings of financial institution counterparties, management assess the credit quality of these financial assets tobe sound. Due to the short term nature of the trading accounts, combined with the credit assessment process, with the exception of those tradereceivables provided for by a specific provision, the credit quality of these financial assets is considered to be sound.Equity price riskThe Group holds equity investments that are classified as available for sale financial assets and are initially measured at fair value with subsequentchanges in fair value recognised directly in equity. On disposal, accumulated fair value changes are recycled to the income statement. Theseinvestments primarily relate to shares and a membership held in the Chicago Mercantile Exchange and a membership held with the Kansas CityBoard of Trade. As at 30 September 2008, it is estimated that a change of 10% in equity prices would result in a charge or credit to consolidatedequity of $0.5 million (2007: $1.2 million).www.awb.com.au 111

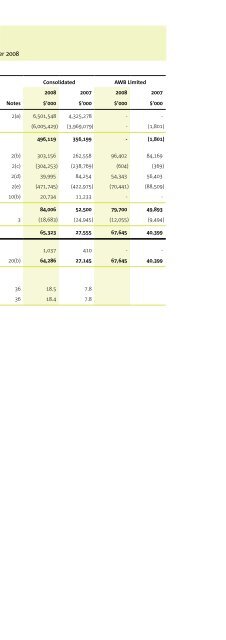

<strong>AWB</strong> LIMITED Notes to and forming part of the financial statements for the year ended 30 September 200832. Derivative Instruments And Fixed Rate Loan Fair Value MovementsDerivatives held for tradingThe Group holds a variety of derivative instruments. As hedge accounting is not applied, all derivative contracts are classified as held for trading,and are recognised at fair value with changes recognised in the income statement as required by AASB 139.The fair value of derivative positions held at 30 September 2008 is as follows:Consolidated<strong>AWB</strong> <strong>Limited</strong>2008 2007 2008 2007$’000 $’000 $’000 $’000Derivative assets 388,123 516,088 - -Derivative liabilities (352,596) (353,702) - -Net fair value position 35,527 162,386 - -Net gains/(losses) taken to profit and loss during the financial year for derivative assets and liabilities classified as held for trading was($5.6 million) (2007: $4.8 million).Fixed rate loansChanges in fair value attributable to:Credit Risk 3,632 500 - -Market Risk (14,831) 3,600 - -(11,199) 4,100 - -Cumulative movements for all fixed rate loans since their inception have been $7.3 million (credit risk $0.4 million and market risk $6.9 million).The effect of changes in fair value on fixed rate loans are largely offset by interest rate swaps which produced an $11.2 million gain(2007: $3.6 million loss).33. Deed of Cross GuaranteePursuant to ASIC Class Order 98/1418 (as amended) dated August 1998, the following wholly-owned subsidiaries are relieved from theCorporations Act 2001 requirements for preparation, audit, and lodgement of financial reports and directors’ reports: <strong>AWB</strong> Finance <strong>Limited</strong>,<strong>AWB</strong> (Australia) <strong>Limited</strong>, <strong>AWB</strong> GrainFlow Pty Ltd, <strong>AWB</strong> Investments <strong>Limited</strong>, Landmark Rural Holdings <strong>Limited</strong>, Landmark (Qld) <strong>Limited</strong> and IAMAAgribusiness Pty Ltd.It is a condition of the Class Order that <strong>AWB</strong> <strong>Limited</strong> and each of the subsidiaries enter into a Deed of Cross Guarantee. The effect of the Deed isthat <strong>AWB</strong> <strong>Limited</strong> guarantees to pay any deficiency in the event of winding up any of the wholly-owned subsidiaries listed below.The subsidiaries that are parties to the Deed are:<strong>AWB</strong> Finance <strong>Limited</strong><strong>AWB</strong> (Australia) <strong>Limited</strong><strong>AWB</strong> GrainFlow Pty Ltd<strong>AWB</strong> Investments <strong>Limited</strong><strong>AWB</strong> Commercial Funding <strong>Limited</strong>Landmark Rural Holdings <strong>Limited</strong>Landmark (Qld) <strong>Limited</strong>IAMA Agribusiness Pty Ltd.112 www.awb.com.au