Annual Report - AWB Limited

Annual Report - AWB Limited

Annual Report - AWB Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

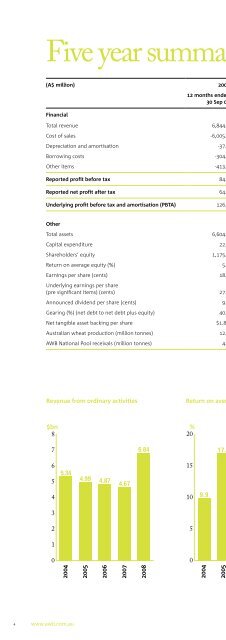

In 2008 <strong>AWB</strong> significantly improved its financial performance,successfully implemented comprehensive governance reform anddeveloped a strategy for future growth.A 137% increase in net profit after tax and significant itemsto $64.3m was the result of hard work in every business by allemployees in Australia and overseas.We were able to achieve this strong result by focusing on what wecould control in the face of unprecedented global commodity andfinancial market volatility, extensive restructuring of the businessand deregulation of Australia’s wheat exportmarketing arrangements.The new Wheat Export Marketing Act 2008 introducedcompetition into bulk wheat export marketing from 1 July2008. The new regulator, Wheat Exports Australia, subsequentlyapproved a number of export licences to domestic andmultinational grain traders.<strong>AWB</strong> <strong>Limited</strong> subsidiaries, <strong>AWB</strong> Harvest Finance <strong>Limited</strong> and <strong>AWB</strong>(Australia) <strong>Limited</strong>, were also accredited, enabling the companyto continue to be a major exporter of Australian wheat. This isan important step as <strong>AWB</strong> has retained many loyal internationalcustomers who want to continue to buy wheat from Australia.The deregulation of wheat marketing reinforced the need toreform <strong>AWB</strong>’s governance arrangements. We needed to replacean out-dated dual shareholder structure and a complexConstitution with a single share structure and a standardcommercial Constitution.After several attempts, 77% of grower shareholders approvedchanges to the Constitution on 3 September 2008 to make thecompany a commercially strong grains marketer under the newwheat marketing arrangements. On behalf of the Board, I wouldlike to thank shareholders for the significant voter turnout and tothank all those who actively supported reform.The majority of the board supported these reforms. Unfortunately,four directors opposed the reforms. Following the successfulshareholder vote, these four directors resigned from the <strong>AWB</strong><strong>Limited</strong> Board.With the adoption of a new commercial Constitution on22 October 2008, Brendan Stewart retired as Chairman of <strong>AWB</strong><strong>Limited</strong>. I would like to recognise Brendan’s strong leadershipon governance reform over several years in very challengingcircumstances.Brendan left a highly focused and commercial <strong>AWB</strong> that is nowwell equipped for the challenges of the future.Following the deregulation of wheat export marketing, oursubsidiary <strong>AWB</strong> International <strong>Limited</strong> will no longer run a NationalPool on behalf of all wheat growers. After the finalisation of the2007-2008 National Pool, the old Single Desk arrangements willeffectively cease to exist.As a result, three directors elected by wheat growers to the Boardof <strong>AWB</strong> International <strong>Limited</strong> resigned as part of the governancereforms implemented on 3 September. I would like to thank <strong>AWB</strong>International Chairman, Ian Donges, and his fellow directors,James Rackham and Wayne Gibson, for their support for <strong>AWB</strong>governance reform and their stewardship of the National Poolon behalf of wheat growers over the last few years.<strong>AWB</strong> has made progress in 2008 on a range of legacy issuesarising from legal actions previously taken against the company.After deregulation of wheat export marketing and companyconstitutional change, <strong>AWB</strong> has been able to consider a rangeof growth options, including potential industry consolidationopportunities.Under a new dividend policy announced during the year, futuredividends will be more closely aligned to annual earnings.The policy aims for a dividend payout ratio of between 40% to65% of Net Profit After Tax and significant items and wheneverpossible, to fully frank all dividends. As part of the 2007-2008 fullyear results announcement, the Board of Directors approved a5 cents per share final dividend payable that took the full yeardividend payable to 9 cents per share fully franked. The DividendReinvestment Plan will continue to be fully underwritten.Finally, in a difficult and watershed year for the company I wouldlike to thank our employees for their hard work and commitmentto the business, and our customers and shareholders for theirsupport.Peter PolsonChairmanDuring his term as Chairman, Brendan put in place a newConstitution, a new Board, a new management team, anda company culture which focuses on the essential businessprinciples of integrity, accountability, teamwork and customerfocus. We now operate within a far stronger risk managementand compliance framework, and have developed a companystrategy to grow and diversify our revenue streams.www.awb.com.au 7